Trading stocks usually happens during a certain time of the day. It’s when the market is open and most of the activity occurs. But there aren’t limitations. There’s the after-hours trading phenomenon: it refers to buying assets (as well as selling them) outside of normal time. It’s not exactly new, although historically it was limited to institutions and investors with higher net worth, but this changed after private trading systems appeared.

- What’s After-Hours Trading?

- How Does After-Hours Trading Work?

- Schedule of After-Hours Trading

- The Factors to Consider

- The Comparison Between Standard and After-Hours Trading

- How Does This Activity Affect Stock Prices?

- The Risks of Extended-Hours Trading

- Examples

- How to Start Trading Out of Hours

- Why Would One Start Extended-Hours Trading?

- Brokers That Offer Extending-Hours Trading

- Pros and Cons of Extended-Hours Trading

- Frequently Asked Questions About Extended-Hours Trading

What’s After-Hours Trading?

The term refers to participating in trading activity after the most active hours are over. While it doesn’t differ much from regular trading, there are some things to know before you try doing it.

There are also two additional terms:

- Pre-market trading. It’s similar to the after-hours one, but it only covers the time before the market starts getting active.

- Extended-hours trading. This term covers any trading that doesn’t happen during the time when the market’s at the peak of its activity. This refers to both after-hours and pre-market. Another way to call it is “out of market trading.”

The picture below shows how one can easily separate these terms.

How Does After-Hours Trading Work?

The overall process is quite similar to regular trading, but you have to consider some things. First, the orders might be placed more slowly than one expects. The second thing to remember is that not all assets are eligible for this activity, and the trading rules for them might differ.

Schedule of After-Hours Trading

In the United States the vast majority of high-volume activity usually happens between 9:30 a.m. and 4 p.m EST. Interacting with any asset outside of this timeframe is called pre-market and after-hours trading. It’s also worth remembering that things might differ for other countries and sometimes even from one market to another.

The Factors to Consider

If you want to trade out of normal hours, you have to remember and be aware of certain things. First, you have to select a broker with a good reputation that makes it possible to trade out of normal hours.

Secondly, you have to be ready for significant price movements caused by some events. Thirdly, you have to keep in mind that not all assets are traded outside of the most active market hours.

The Comparison Between Standard and After-Hours Trading

In essence, this kind of trading doesn’t differ much from a regular one. It features more extreme price movements, so you have to keep this in mind, as it can be both beneficial and risky, depending on the situation. On the other hand, this type of trading offers more convenience and flexibility for some investors, since not all of them can find the time to participate in the activity during the time of highest activity.

How Does This Activity Affect Stock Prices?

This type of trading can have an effect on prices in the usual ways. They can grow after positive news and plummet after negative ones. The movements might be more significant since the market is usually more volatile during this time.

Moreover, the prices can be affected by the events that happen both during and outside the most active trading time.

The Risks of Extended-Hours Trading

It’s to be expected that this type of trading comes with certain risks. Let’s look at some:

- Low liquidity.

- High levels of volatility.

- Bigger spreads.

- Larger price movements.

- Unexpected events can affect the market in more significant ways.

- More widespread technical issues.

Examples

Let’s take a look at a hypothetical example. A company announces its quarterly results, and they’re quite impressive. The company’s stock starts rising from $100 to $110 per share.

The trading activity gets quite high, but the market closes at 4:30 p.m. This doesn’t stop the investors from actively trading an asset, and the next day the asset is traded at $104, which is higher than it was before the announcement but a significant plummet from the initial rise.

How to Start Trading Out of Hours

There are no specific prerequisites, so you can easily participate in the activity. The only thing to consider is that some brokerages don’t offer such an option, so take a look at those that provide it, check the fees, and remember the risks.

Why Would One Start Extended-Hours Trading?

This type of trading comes with its own benefits. The main reason many traders participate in the activity is due to convenience: not everybody prefers interacting with the assets during the most active hours. The others enjoy the ability to react to the changes caused by events that happen outside the period of highest activity on the market. There are also other additional benefits that we will extensively cover later in this article.

Brokers That Offer Extending-Hours Trading

As was mentioned elsewhere in this article, not all brokers allow customers to participate in extended trading. If you’re searching for one, consider the fees, available assets, and, obviously, their reputation. Another thing to keep in mind is that some brokers only provide pre-market activity and don’t feature anything for after-hours traders. And the situation can be fully opposite with another broker. So finding the one that offers both can’t be a bit difficult, but thankfully there’s plenty of them.

The Picture below shows some of the most popular brokerages that let you trade any time you want. Obviously, we still recommend extensively researching them before joining.

Pros and Cons of Extended-Hours Trading

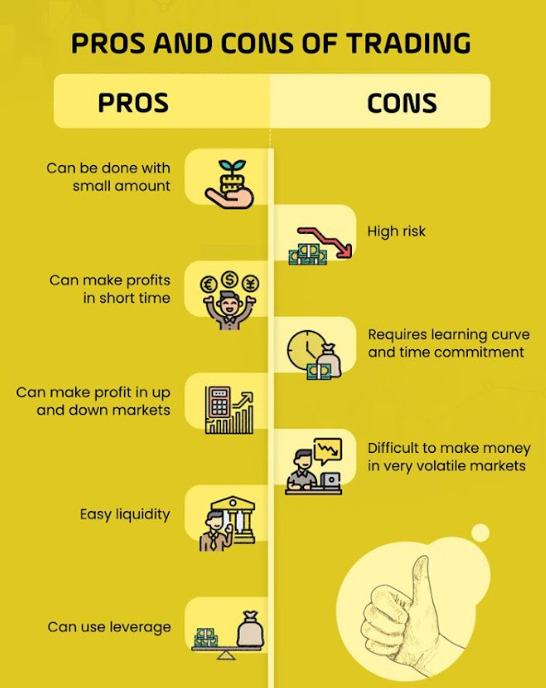

It comes with certain positives and disadvantages. We already explained some of the downsides earlier in the article, but there are also obvious benefits. Now it’s time to check out both pros and downsides in the table below.

| Pros | Cons |

| An ability to buy and sell assets at any time | High volatility |

| More flexibility | Low liquidity |

| The chance to take advantage of significant market movements | Sudden changes that are disadvantageous for one’s position |

| An ability to benefit from the way the market reacts to the events that happen outside of most active hours | Some brokers don’t offer such an option |

While our table lists main existing pros and downsides, you can also take a look at Picture with an alternative table that covers the same information in a slightly different manner.

Frequently Asked Questions About Extended-Hours Trading

- Who Can Trade During Extended Hours?

Everyone can. The activity used to be limited for the investors with high networth and institutional investors but these days are long gone.

- Is the Process the Same as for Regular Trading?

Yes, with the main caveat that you have to find a brokerage that offers this type of trading.

- Why Can Stock Prices Rise During Extended Hours?

Positive events that happen during active market hours and outside of them can affect the movements, causing the stock prices to rise.

- Can One Buy Stocks During Extended Hours?

Yes. If you found a broker who allows trading outside of the usual hours, you can easily buy (and sell) stocks on the market.

- When Does Extended-Hours Trading Time Stop?

Pre-market trading stops at 9:25 a.m. EST. The after-hours activity usually stops at 8 p.m. EST.

- Is It Risky to Trade During Extended Hours?

There are specific risks that are more pronounced compared to regular-hours trading. For example, lower liquidity, higher volatility, and the fact that the market can more significantly and unexpectedly react to news and events.

- Do All Brokerages Allow for Extended-Hours Trading?

No, but plenty of them do.