Trading and investing are large fields. And that means that variations and approaches are quite different. In this article we will take a look at day trading, a common tactic that’s nevertheless risky and stressful, even though it comes with a large chunk of advantages.

- What is Day Trading?

- The Basics of Day Trading

- Why Is Day Trading Controversial?

- What Does One Need to Start?

- How Much Money Does One Need to Start?

- Cash vs. Margin Account

- Day Trading Tools

- How to Start Day Trading?

- How to Day Trade?

- Existing Strategies

- What is the Best Time for Day Trading?

- How to Manage the Risks?

- An Example of Day Trading

- The Advantages of Day Trading

- The Disadvantages

- Is Day Trading Profitable?

In our article we will explain the basics of day trading, the controversies around it, its pros and cons, as well as provide risk management tips and explain existing strategies.

What is Day Trading?

Day trading is a tactic that involves a trader buying and selling financial assets, such as stocks, options, or currencies (including crypto), within the same trading day. Day traders aim to profit from short-term price movements and typically close out all their positions by the end of the trading day. This type of trading requires a high level of skill, discipline, and risk management, as well as proper understanding of the market and its dynamics.

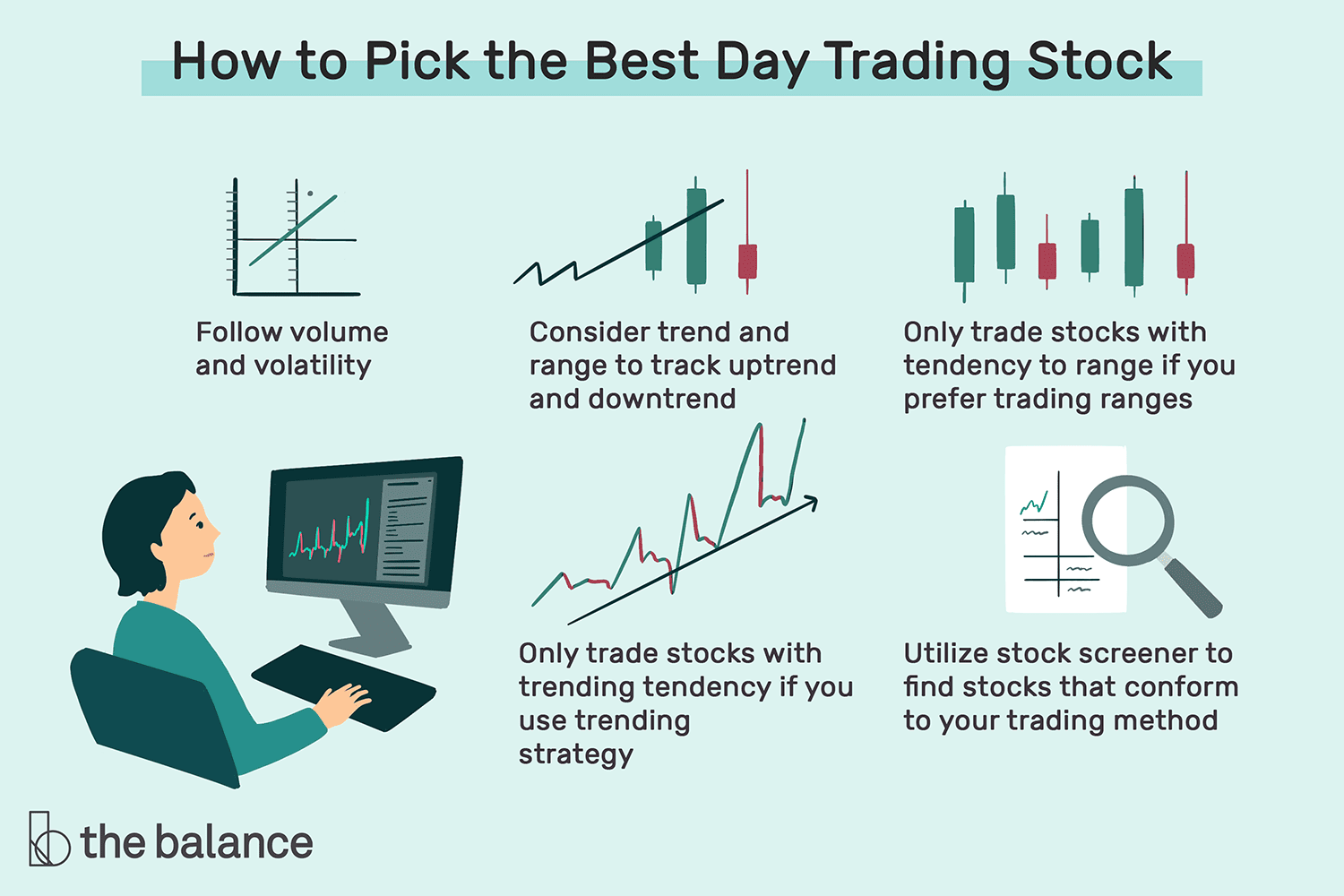

The Pic1 below shows what day trading is.

The Basics of Day Trading

The idea is simple: buy and sell an asset within the course of a day. This means that a trader must be sure that the price will go higher but doesn’t have to think about long-term implications. This is what makes day trading different from classical investing: there’s no need to think about the next day or plan things for the future. Sometimes the whole trade happens in a few seconds. So yes, this is a quick trading that doesn’t revolve around long-term complications.

Why Is Day Trading Controversial?

Differing from traditional investing in many significant ways, day trading has attracted enough controversy. Let’s take a look at the existing reasons.

- Firstly, many often see it as a high-risk and speculative form of trading, as participants can experience significant financial losses if they make poor decisions or do not have a solid trading strategy.

- Secondly, there’s an opinion that such an activity contributes to market volatility. The reason is that day traders sometimes engage in rapid buying and selling and that im[acts the overall market.

Additionally, some critics argue that day trading can become addictive and excessive, which may have a negative impact on the individual’s psychological and financial well-being.

What Does One Need to Start?

Starting to partake in day trading doesn’t require much. The bar is actually quite low, even though it’s generally preferable to have skills in investing and understand the markets.

Having money to spend and being disciplined will go a long way, but even those aren’t prerequisites, one just will have a hard time without such things. Here are the usual steps we recommend to start day trading:

- Learn more about the process. We recommend educating yourself on how the stock market works, learn existing trading strategies, and how to make a technical analysis before getting started. The Internet is full of resources that will help you get started.

- Develop a trading plan. The next step is to make a detailed trading plan that outlines your goals, risk tolerance, and trading strategy. TIdeally, it must include criteria for entering and exiting trades, and risk management rules..

- Practice with a demo account: Various brokers usually provide them. So that will allow you to practice trading with virtual money. This way, you can learn from practice without risking real finances.

- Start small: Once you’re planning to use real money, it’s important to start small and gradually increase your position sizes as you gain experience and confidence.

- Stay informed: Keep up-to-date with market news and developments. Especially, if they’re related to your assets and activities. We also recommend to regularly evaluating and adjusting your trading plan based on your performance and ever-changing market conditions.

- Manage your emotions: Day trading is generally a stressful activity, so it’s important to develop strategies for managing emotions and avoiding impulsive decisions. Some things can help you, such as taking regular breaks, practicing mindfulness techniques, or seeking support from a mentor or trading community. We also strongly recommend avoiding the activity altogether, if your mental state isn’t in the most stable shape.

How Much Money Does One Need to Start?

Actually, day trading doesn’t involve large sums. Although many experts think that the activity is only worth it if you have significant savings: this way you can afford serious risks and potential losses, while also having chances to significantly increase the chances of winning serious sums, since you’re operating with large amounts of money.

Cash vs. Margin Account

When one starts day trading, there’s usually one question that nearly always arises; what account to choose? There are usually two options: cash account or a margin one.

What’s the difference?

- Cash account. This type of account means that you must make all of the transactions with money you have. If there’s not enough of it, one should deposit more into the balance. The great thing is that you can lend out the assets to other traders, for example for short sellers or hedgers.

- Margin account. This one allows the users to borrow an asset. Which opens for a lot of flexibility, but there are usually interest rates and fees involved.

So, which one is better for day trading? The answer is that the margin one. The ability to borrow an asset can be incredibly useful when you’re buying and selling the funds in a short amount of time. Moreover, some platforms and organizations directly prohibit day trading with a cash account.

Day Trading Tools

With day trading, you often must be quite fast. As we already mentioned, in some cases, the whole buy-and-sell process might take less than a minute. If a trader wants to keep up with all of the changes, some assistance would be needed. Thankfully, there are plenty of software solutions to help.

One can group the needed programs into a few sections: charting software, scanning programs, online brokers, and dashboards that show the changes and news in a demonstrative and accessible way.

How to Start Day Trading?

The process isn’t difficult at all. Here are the required steps:

- Open an account on the exchange you’re planning to use. It’s better to start with a demo account to learn all of the needed nuances.

- Set goals and learn about possible tax implications. There’s a lot to unpack, but there’s also plenty of information on the market.

- Choose a broker. This is an important step, so go with a reputable one with good fees.

- Select an asset you’re planning to trade.

How to Day Trade?

The activity is actually perfectly straightforward. Once you join any exchange, you can start trading. Buy the assets you’re thinking will grow in prices in a short time. Sell them if their price increases. Do this several times a day. Learn the nuances of the process and keep your head clear.

You can check out the pic2 below that shows how to day trade. It’s actually that simple.

Existing Strategies

There are many different day trading tactics to use. Make sure the one you choose aligns with your goals and aligns with your risk tolerance, as well as market conditions. Here are some of them:

- Scalping: This tactic entails quick small trades to profit from minor changes in price. When employing this method, the participants usually aim to make a large number of trades in a single day.

- Momentum trading: This strategy involves traders looking stocks or other assets that are going through significant price movements. Then they usually try to make money on the continuation of the trend.

- Range trading: Range traders look for stocks or other assets that are trading within a specific price range. The idea is to buy at the bottom of the range and sell at the highest.

- Breakout trading: Those who use this tactic usually look for stocks or other assets that are breaking out of a previous trading range. They bet on the continuation of this breakout and aim to make profits this way.

- News-based trading: The idea is simple: the traders check and monitor the news continuously and try to predict the trends emerging from significant market events..

- Technical analysis: This involves using technical indicators and chart patterns to find out possible entry and exit points for trades.

What is the Best Time for Day Trading?

The answer depends entirely on the asset you’re trading. But the regular requirement is to trade when the market is most volatile. For stocks it’s usually in the morning. For crypto, the market is active 24/7, but it’s better to trade the currencies when its level of activity is at its highest.

How to Manage the Risks?

We’ve already mentioned several times that the activity is quite risky. So what exactly can one do with such downsides? Well, here are some tips:

- Set stop-loss orders.

- Use proper position sizing.

- Diversify your trades.

- Stay disciplined.

- Continue being informed.

An Example of Day Trading

And now it’s time to provide some examples. Obviously, they will be different for each strategy. Let’s take a look at scalping. A trader checks the charts and believes that one asset will soon go higher in price.

They buy it at $10. In a few minutes, the asset costs $10.5. The trader sells it and gets a small profit of 50 cents. They continue to do so several times a day, sometimes less successfully than expected, and in the end get some money.

The Advantages of Day Trading

There are plenty of reasons why day trading attracts large audiences, and some of them are quite positive. Let’s check out the great things that day trading can offer:

- an ability to make significant profits in a short amount of time;

- some traders argue that the activity can offer a lot of liquidity to the market, although there’s a significant argument against the positivity of this effect;

- day trading can also be a great source of income, providing you have enough money to spend, know the market, and are capable of managing the risks;

- you can transfer some skills involved in day trading into other investment related activities and regular trading.

The Disadvantages

But day trading comes with the negatives, many of them are reasons why the activity is often looked down upon. We already checked some of the reasons in the “Why is Day Trading Controversial?” section. And now let’s check out the main downsides of the activity:

- There’s an opinion that day trades only negatively affect the market, and even the liquidity they bring in only offers the downsides.

- The traders themselves are usually more affected by the market changes compared to long-term investors, and this includes negative changes as well.

- Day trading has potential negative effects on the mental health of its participants, since the activity is quite stressful and risky. Constantly monitoring the prices, charts, and trends won’t do anyone any good.

- Some argue that day trading is quite similar to gambling, making the activity addictive, resulting in less clear thinking from the traders, and all that. These comments usually come from serious investors who hold prejudice against day traders, but on the other hand, looking for a quick profit can sometimes definitely lead to an addiction.

Is Day Trading Profitable?

The answer is yes. Day trading is an activity that can become quite profitable for its participants. Obviously, this requires some strategies and understanding how things work. It’s also easier to make it profitable if you have enough money to spend. Larger sums can lead to higher profits.

It’s also worth noting that day trading is quite stressful. The activity involves regularly monitoring and checking prices, charts, changes, and other stuff. This requires a lot of discipline and clear thinking, otherwise the trader will make the mistakes.