An open position is the existence of a trade that is not currently closed by another one. In other words, it means that a trader is buying an asset, but has not received a response (i.e. a sale).

Understanding an open position

An open position can appear after a purchase (this would be called a long) or after a sale (and this would be called a short).

Example of an open position

Let’s take an example for clarity. Suppose there is an investor X who owns 100 items. He declares that his spot on them is an open one for now. If this very investor is able to sell all of his 100 assets, his position will be considered closed.

Risks

An open position is always a risk. And that risk exists until it will be closed.

The amount of risk is directly proportional to the size of the spot in relation to the size of the account and the holding period. In general, longer periods are riskier because of the unforeseen market events.

How to limit and control them

There is one proven way. By actually closing an open position. This is done either by buying back shares (if it is a short) or by selling the entire position (if it is a long).

However, the risk can also be managed. For example, if the position will be no more than 2% of the total portfolio value.

Diversification is the golden rule. But we will talk about it a little bit below.

How is an open position closed?

You can close a spot in two ways:

- Manually.

- Automatically.

Well, everything is pretty clear with the first. The second one is realized through take-profit orders. Trailing stop or stop-loss orders are intended for protection in case of price movement reversal, which will be described further on.

Diversifying

Diversification is the golden rule. The most important thing to remember is that the spot should not exceed two percent of the total capital. It is also important to diversify positions by asset class and market sector.

It can be information technology, medicine, consumer goods or even government bonds. It is better to cover the whole spectrum at once.

And yes, do not forget about stop-losses. They will help reduce losses and eliminate potential risk. We have an article dedicated to protection orders that you can read here. In it we have explained in detail what they are and how they work.

We have also explained the mechanism of other orders – market orders and limit ones.

Open position and day trading

Day trading is buying and selling assets within one day. It is quite a common practice if you look at it that way.

You see, if you do not close the spot within one day, it will go into the night, when no one can predict in which direction the price will move.

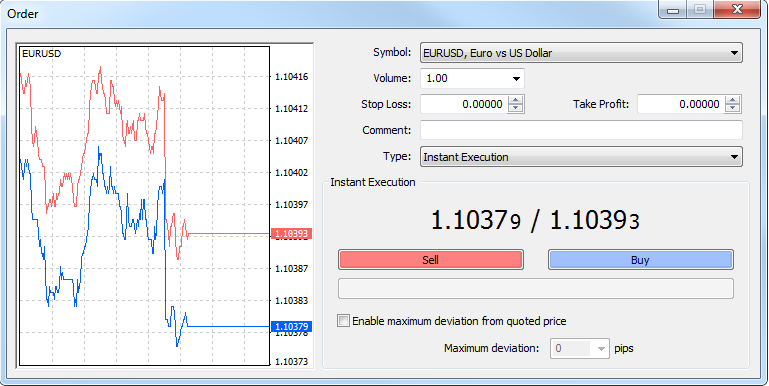

This is what it might look like. Hopefully it’s a little clearer now. By the way, we have prepared separate material on day trading!

Advantages and disadvantages of an open position

Having an open position comes with its own set of advantages and disadvantages. On the positive side, it gives you the opportunity to make a profit on your investment.

Anyway, when you’re diving into the market, it’s really advisable to have multiple positions in different financial instruments. So the key here is going to be management. For example, if you have a long-term investment horizon, a buy-and-hold strategy can help to drastically reduce the risks.