Day trading is a fundamental strategy for many stock market users. What is it exactly? Well, in fact, everything here correlates quite strongly with the name. These are literally short-term trades (or their multiple series) with opening and closing within one day.

- The main patterns of day trading (PDT)

- Bull and bear

- Head n Shoulders

- Ascending triangle

- Basic rules of day trading

- Knowledge is power

- ALWAYS save for a rainy day

- Trade at the right hours

- Do not spread yourself thin

- An example of a trader following a trading rule

- Well, I broke the rules of pattern trading. What are the consequences?

- Ways to evade the rules of the patterns

- Bottom line

- FAQ

- Why has my broker marked me as a day trader on patterns?

- What is considered day trading?

- Should I worry about being labeled a day trader by patterns?

- I don’t trade that much anymore, so why does my broker still mark me up?

- I have a little over $25,000. Can I make random day trades?

The main patterns of day trading (PDT)

The most important thing in day trading is to be able to read and understand charts quickly.

And before we start describing some of them, let’s go ahead and clarify that it is more convenient to analyze the price patterns of an asset on a candlestick chart because Japanese ones provide more information: price opening and closing, its movement up and down. It is important not to confuse the analysis of price patterns with the reading of candlestick charts, which is based on the evaluation of the appearance of a single bearish or bullish spike.

As for the patterns themselves, they are cyclical and repetitive. They recur and draw different figures. Based on them you can predict further price movement and open profitable trades, setting clear goals.

The specific patterns can be divided into following.

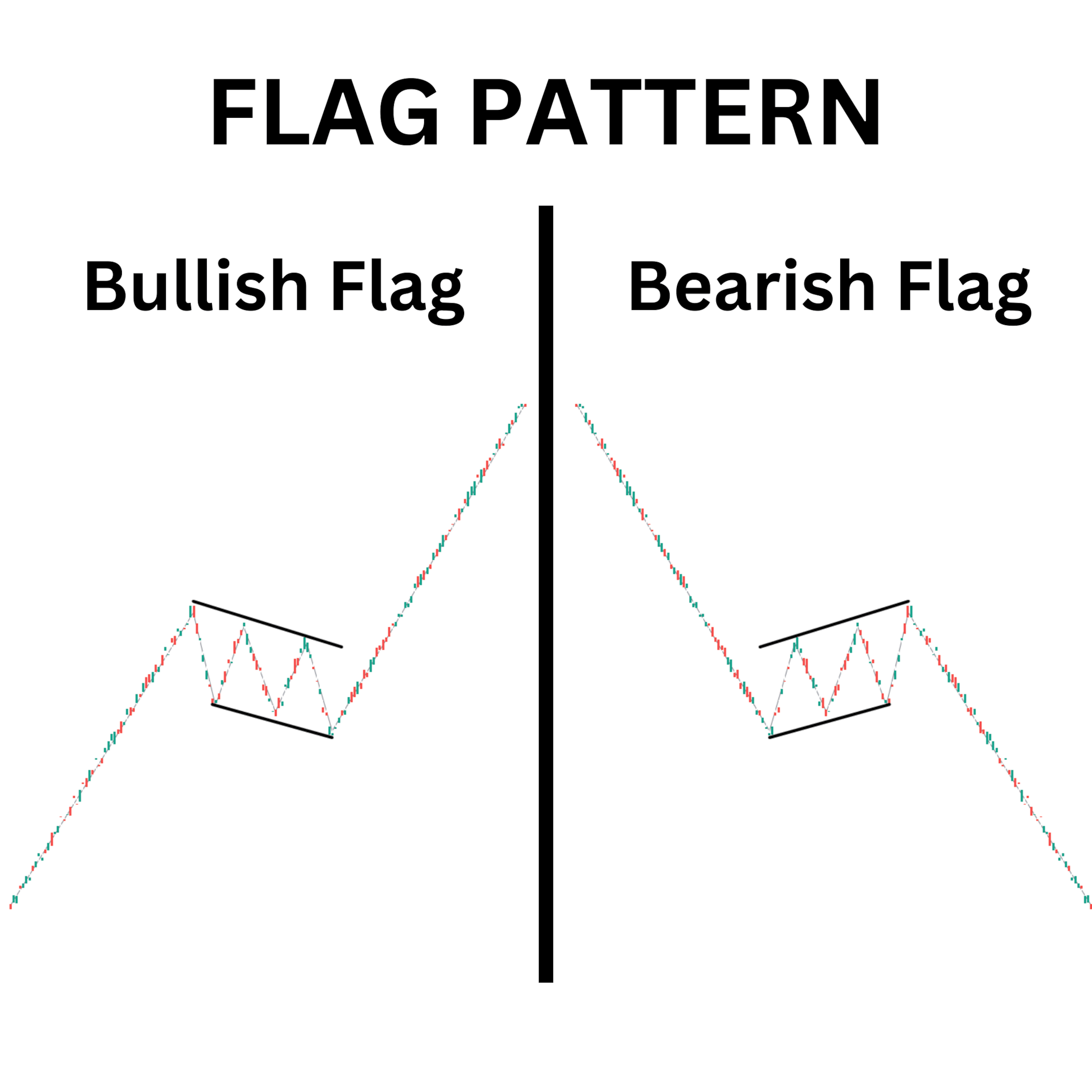

Bull and bear

These are short-term patterns that occur after a rapid price movement. When prices rise quickly, a bullish pattern is observed. Well, or a bull flag as it is often called in the trading community. When prices fall quickly, we see a bearish flag. These “flags” help predict the continuation of the price movement in the same direction.

By the way, we have an article about bull and bear markets. Be sure to read it – you will discover a lot of new things.

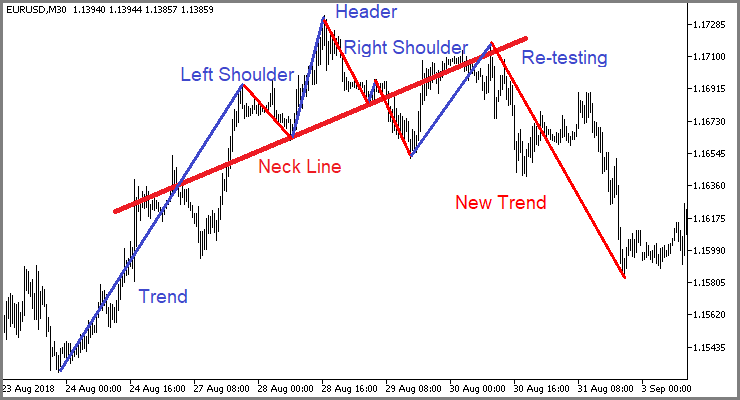

Head n Shoulders

Yes, it sounds exactly like the name of the line of shampoos that will make your hair “flake and free”. But that’s not what we’re talking about. The subject is interesting, but let’s get back to our sheep.

The head-and-shoulders pattern is a long-term pattern that usually appears after a strong run-up in prices. A head is a shape that is formed when prices peak, then fall, rise again but not to the previous peak, and then fall again. This process repeats itself, seemingly forming a head and two shoulders. When prices start to fall again, it can be a signal to sell stocks or cryptoassets.

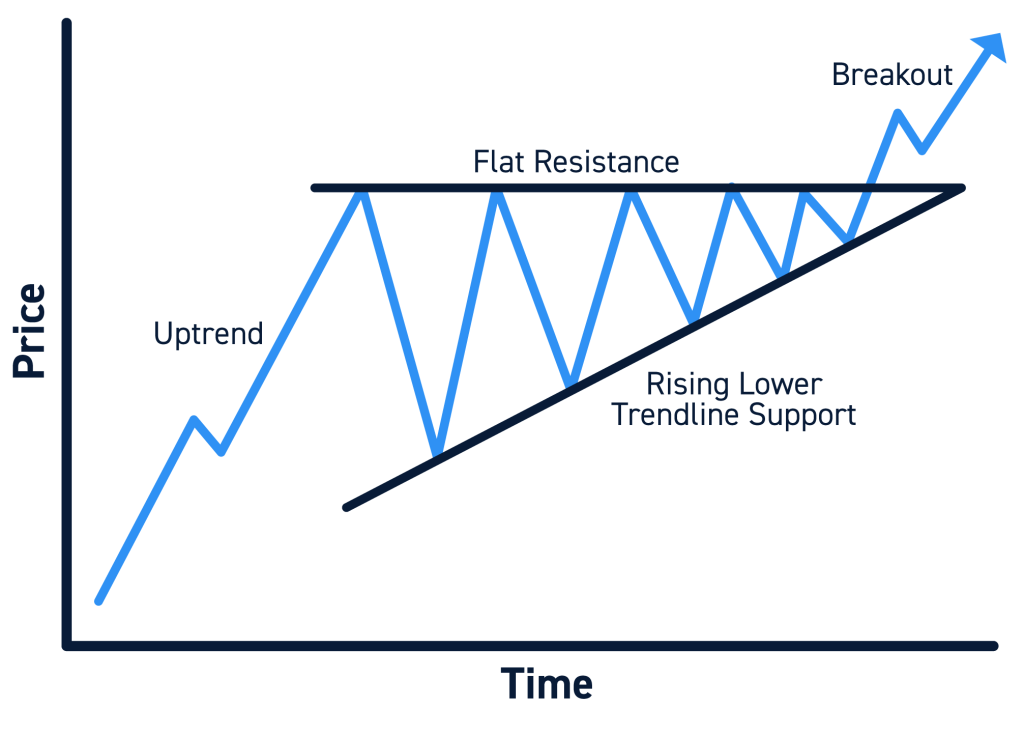

Ascending triangle

The ascending triangle continuation pattern has a clear horizontal resistance line. When it is reached, prices reverse and form an ascending low. After consolidation, the price of the asset breaks through this resistance level and the price continues to rise to the height of the ascending triangle.

For such patterns a stop-loss is quite appropriate. The order is placed at the very bottom.

Basic rules of day trading

You probably won’t believe it, but day traders (like all other traders) have their own behavioral strategies. More precisely, it is an algorithm of actions that must be followed during this type of trading. Kinda unbreakable rules.

Knowledge is power

Make a list of stocks you would like to trade. Keep yourself informed about your chosen companies, their stocks and the general markets. Track business news and note reliable services to find information.

ALWAYS save for a rainy day

Many successful traders risk less than 1-2% of their accounts per trade – keep this percentage in mind and target it. Ideally, your loss should be as little as 0.5% of your total capital for the day.

Trade at the right hours

Day in day trading is when whales and pro traders get their kudos. They place orders ahead of time right after the markets open, which contributes to price volatility. But for them it is not terrible – they successfully use it and make profit.

Do not spread yourself thin

Choose only three or four liquid instruments – no more. Remember that you need to monitor any stock movement almost constantly, so it will be difficult to keep track of several assets at once. Professional traders usually invest large sums of money in several stocks and track their movements, and close the current position before entering another one.

An example of a trader following a trading rule

We have finished with the theory, so let us now move on to practice. Let’s take trading on impulses as a vivid and very illustrative example.

Trading on impulses is about when something happens in the world, everyone starts running in different directions, sprinkling their heads with ashes, but securities grow. Or fall. The most important thing here is to study the news in detail and not to make unnecessary and unnecessary movements.

Actually, all a day trader needs to do is to find a reliable news source and understand the industry. Saw the news – researched – invested – gained – profit.

Well, I broke the rules of pattern trading. What are the consequences?

In this case, you simply risk losing money on your investment. Not necessarily, you can still get lucky, but these patterns were not invented by dummies for nothing.

Ways to evade the rules of the patterns

Basically, you have a couple of options. The first one that comes to mind is to open multiple brokerage accounts. You can do this at:

- Schwab;

- TD Ameritrade;

- Fidelity;

- E-Trade;

- and others.

Each additional account gives you an additional three-day limit for each rolling five-day period.

You can also open an additional account. However, this option is more suitable for those who already have their own capital and those who intend to trade seriously.

Bottom line

PDT is the name of a day trader. Well, to put it in isolation. In this article we have given you some useful tips on how to engage in such trading. If we have missed something, please let us know!

FAQ

Why has my broker marked me as a day trader on patterns?

Because you have probably been trading for four days or more and none of your trades have rolled over to the next day.

What is considered day trading?

Making and closing trades within one day – without carrying them over to the next day.

Should I worry about being labeled a day trader by patterns?

No. You can take it as a fact and even be happy about it. But now you have to trade with a minimum amount of money. It varies a lot from exchange to exchange.

I don’t trade that much anymore, so why does my broker still mark me up?

This could be a mistake. We recommend that you contact your local support team.

I have a little over $25,000. Can I make random day trades?

Yes, of course you can.