There are many ways to interact with your cryptocurrency assets. You can swap them, sell them, buy them, or just continue holding the funds and seeing the price changing. Each process has its own nuances and caveats.

- What Does Swapping Crypto Mean?

- How Does a Crypto Swap Work?

- How to Swap Crypto: Three Methods

- Centralized Exchanges

- Decentralized Exchanges

- Over-the-Counter (OTC) Exchanges

- Examples

- How to Exchange Cryptocurrency: a Guide

- When Do You Swap Crypto?

- Is Crypto Swap Taxable?

- How Long Does a Crypto Swap Take?

- How to Make Money by Swapping Crypto?

- Crypto Swap vs Exchanging: A Comparison

- Advantages and Disadvantages

- FAQ

- What is slippage when swapping cryptocurrencies?

- Is crypto swap traceable?

- Is swapping crypto save?

- Can I lose my funds during a swap?

- What are atomic swaps?

- Are cryptocurrency swaps taxable events?

- What cryptocurrencies can I swap?

Our article will focus on swapping crypto. It will include information about the overall process, how it works, the ways to go through it, as well as advantages and disadvantages. The examples and guides will also be included.

What Does Swapping Crypto Mean?

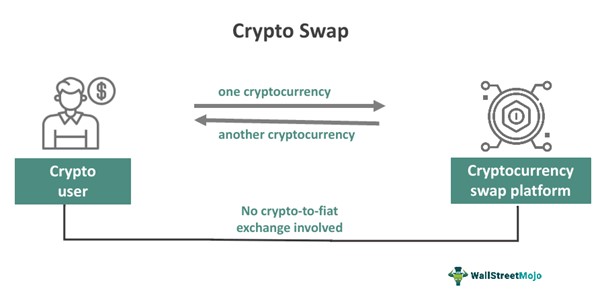

Swapping is similar to trading or exchanging but there are certain differences. The main one is that it is usually a direct peer to peer transaction done on a decentralized exchange. But, technically the process is nearly the same: you exchange the currency you kept for another and hope that the rate is good.

Pic below shows how the process looks in a simplified nature.

How Does a Crypto Swap Work?

You simply exchange one currency for another according to their current prices. There are several ways to do so, as well as certain limitations. In the result, you will get new tokens in your wallet, just make sure that you had enough transaction fees for the operation.

How to Swap Crypto: Three Methods

If you want to make a crypto swap, then there are several ways to approach the process. While the term «swap» usually means using decentralized methods, we will briefly touch on how trading works on centralized exchanges as well. In the next few sections, we will provide all of the needed information about each method.

Centralized Exchanges

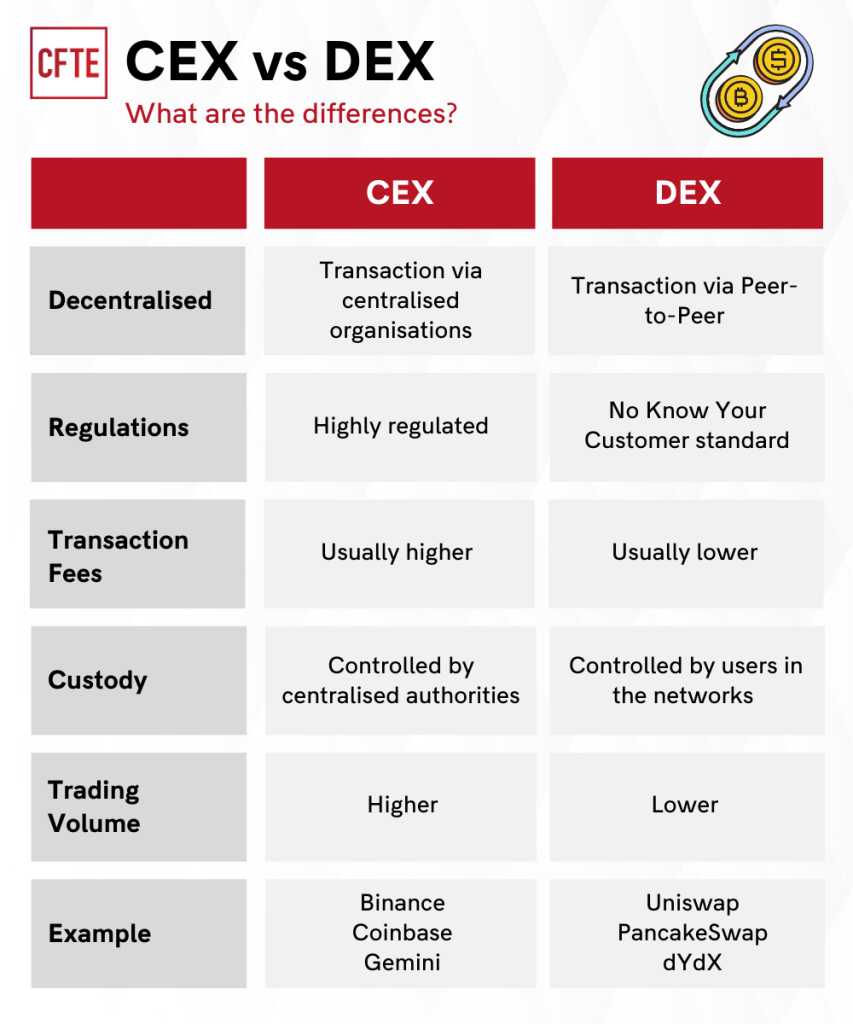

If you are going with a centralized route, then the process is usually called «exchanging» instead of «swapping», but these are just small things that might not matter to some users. Centralized exchanges, also called CEX, are the most common platforms for buying, selling, and trading crypto. They are also the largest: Binance and Coinbase are known by every cryptocurrency owner. The downsides are obvious: your assets are controlled by a certain entity, firm or institution. The advantages are also there: the UI is quite easy to access, there are regulations and guarantees.

Decentralized Exchanges

Now, it is time to cover the main platforms for swapping crypto: decentralized exchanges.

As you can understand by their name, there is no entity that has control over your funds or any processes you go through with crypto.

They have been steadily growing in popularity during the recent years, and Uniswap and PancakeSwap are among the best known ones. While using decentralized exchanges is generally safe and not so difficult, all risks are on you, so we recommend doing research before trying it.

Pic below shows the differences between centralized and decentralized exchanges.

Over-the-Counter (OTC) Exchanges

And there is another way. There are over-the-counter (OTC) desks that also offer direct swaps of crypto. They are often decentralized in nature. Privacy is their main benefit: investors, especially early adopters, can use them to swap significant amounts of currency without alerting high exchanges. They are rarely used for smaller sums, since exchanges are a more convenient option in such cases.

Examples

You can swap any currency for another and it is often possible to do so without having active pairs on decentralized exchange. Of course, the most common options usually cover popular tokens, such as BTC and ETH. But nothing stops you from doing swaps for any pairs.

How to Exchange Cryptocurrency: a Guide

Now, it is time to move to some practical examples. Below, you can check out a step-by-step guide covering how you can exchange your cryptocurrency. Read it thoroughly!

- Choose a platform. Now you have to find the exchange you want to use to swap your crypto. There are plenty of them, including decentralized ones. Read about their reputation, check the reviews, take a look at the prices and fees.

- Connect your wallet. Simply connect the wallet to the platform. The process is similar for both software and hardware wallets.

- Pick the tokens. Go and find a pair that you are planning to swap. Select these coins. Ensure having enough balance to cover the transaction fees.

- Confirm the transaction. The platform will handle it on its own by using the Automated Market Maker (AMM) process.

- Receive the coins. When everything is completed, you will get new tokens on your balance. All done!

When Do You Swap Crypto?

You can do it anytime you want. There are different possible reasons why you want to do so. For example, to profit by trying to predict the market’s trends. Or you may want to diversify your portfolio. Either way, the process usually does not take long, but we recommend doing your own research before swapping cryptocurrency.

Is Crypto Swap Taxable?

Yes, swapping crypto is a taxable event in the U.S. and many other countries. On the other hand, sending cryptocurrency between your own wallets is not taxable. Make sure you are familiar with all of the implications and report this event.

How Long Does a Crypto Swap Take?

The process is usually quite fast, but it depends on several factors. These include network congestion, liquidity of pairs and the speed of the blockchain. In most cases, the procedure is rather quick: a few minutes will be enough. In some cases it might take up to an hour and, rarely, in times of high congestion or due to technical issues, it might take even longer.

How to Make Money by Swapping Crypto?

It is possible to profit by swapping crypto. To do so, you have to keep several things in mind and use various tactics. First, take advantage of price discrepancies and check out how the prices vary from one platform to another. Obviously, you can also try market speculation, trying to predict downward and upward trends. Finally, the options such as yield farming and staking also exist.

Crypto Swap vs Exchanging: A Comparison

As we have already stated, swaps and trading might be extremely similar in their nature, but there are certain differences. Let us outline them.

- Swaps are decentralized in their nature, so you are going through the process without an intermediary.

- Due to the peer-to-peer design of the transactions involved in swaps, the fees might often be lower than if you were using a traditional exchange.

- Swaps offer a higher level of privacy. This is again due to their decentralized nature. Regular centralized exchanges might involve creating accounts and providing more personal information compared to DEX.

- Regular exchanging might offer more trading pairs.

Advantages and Disadvantages

As you can understand by now, there are different pros and cons of doing cryptocurrency swaps. But what exactly are they? Well, we will try to find it out. Let us start with the advantages:

- Diversification of your portfolio. By swapping, you can get more coins, which is great for investing, since you will not keep «all of your eggs in the same basket».

- Convenience. Swapping is a fast and straightforward process that is easy to go through. In many cases, it is even simpler than a traditional exchange of coins.

- Cost-effectiveness. Some of the offers are financially more advantageous and profitable compared to a regular exchange.

The drawbacks also exist. The list below will include all of the regular disadvantages of swapping:

- Price volatility. The prices of cryptocurrencies are rarely stable, so there is always a chance that it can go down while you are doing a swap.

- Limited liquidity. Some less popular or recently launched coins might not have great liquidity and finding pairs can get more difficult.

- Regulatory concerns. Depending on the jurisdiction and regulations, swapping cryptocurrencies may not be legal or may require additional compliance measures.

FAQ

What is slippage when swapping cryptocurrencies?

Slippage refers to the difference between the expected price of a cryptocurrency trade and the actual price at which the trade is executed. In the context of crypto swaps, slippage can occur when there is a delay between the time a trade is initiated and the time it is completed.

Is crypto swap traceable?

Usually, yes, since many cryptocurrency transactions can be checked out on blockchain by everybody. But sometimes there are exceptions, so it depends on the blockchain one is using.

Is swapping crypto save?

Yes, there are usually several security measures. But we recommend doing your own research to understand whether the exchange you are planning to do your swap at is reliable and can be trusted.

Can I lose my funds during a swap?

In theory, yes. In practice, it does not often happen as long as you take the needed precautions, such as researching a decentralized exchange you are going to use and making sure you know what you are doing.

What are atomic swaps?

Atomic swaps are exchanging currencies from two different blockchains without any centralized intermediary.

Are cryptocurrency swaps taxable events?

Yes. At least in the USA, they are due to the IRS considering them to be two transactions. In other jurisdictions, the situation might differ.

What cryptocurrencies can I swap?

You can swap any currencies.