The world of cryptocurrency has matured a lot during the last few years, so all of the technicalities related to it might look complex and difficult. After all, the new technologies have improved a lot of things for blockchains: speed, security, and functionality. New assets also emerged during the last few years.

- What is a Digital Asset?

- What Are Cryptocurrencies and Crypto Tokens?

- What Are Cryptocurrencies?

- What Are Cryptocurrency Coins Needed for?

- What Are Crypto Tokens?

- What Are Cryptocurrency Tokens Needed for?

- Types of Crypto Tokens

- Transactional Tokens

- Non-Fungible Tokens (NFT)

- Stablecoins

- Decentralized Finance Tokens (DeFi Tokens)

- Utility Tokens

- Security Tokens

- Governance Tokens

- Wrapped Tokens

- How Cryptocurrency Tokens Work

- Asset Tokenization: What is It and How Does It Work?

- Tokenization Advantages

- Security

- Programmability

- Liquidity

- Token-Related Concerns

- Tokens vs. Currencies: The Difference

- Cryptocurrency and Tokens vs. Fiat

- FAQ

- What is the point of tokens?

- Is Bitcoin a cryptocurrency or a token?

- What is the difference between cryptocurrency and tokens?

- What types of tokens exist on blockchains?

The article below aims to make some things clearer: we will explain what crypto tokens are. We will cover the way they differ from cryptocurrencies and other types of assets, as well as what features they offer. There are many types of them, and we will review each in detail.

What is a Digital Asset?

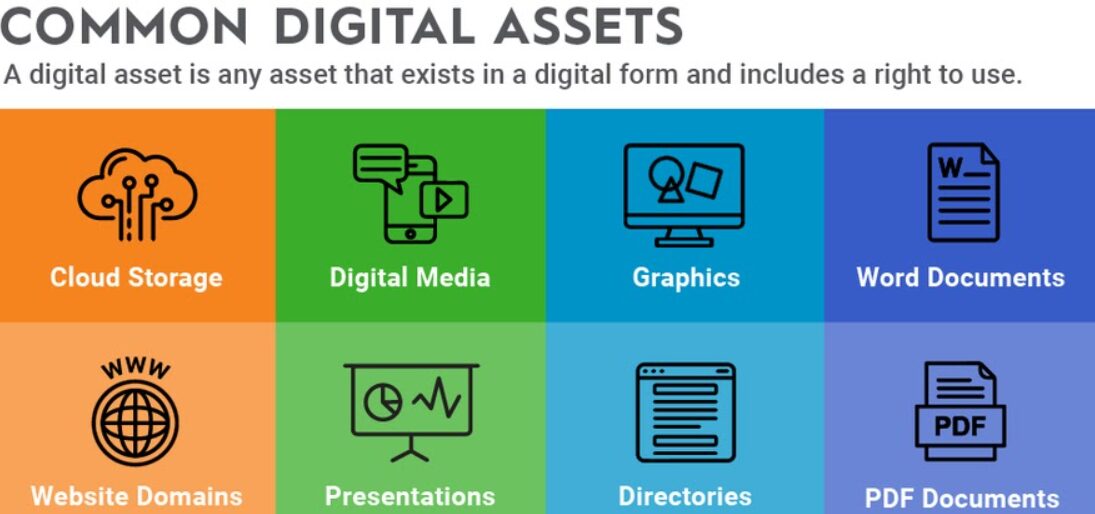

Digital assets are those that exist exclusively in a digital world and have value. It can be any type of file, a piece of art, or media, as well as many other things. Another feature is having distinctly defined ownership rights. The term was rediscovered and took on new meanings after the rise of the crypto world. There are now many new types of assets, such as tokens and cryptocurrencies.

Picture below shows existing types of digital assets.

What Are Cryptocurrencies and Crypto Tokens?

Both cryptocurrencies and tokens are digital assets. But there are plenty of distinct differences about them. The main one is that cryptocurrencies exist natively on a blockchain, while the tokens exist on top of them, but are not essential for blockchains to function. In the next few sections, we will provide detailed definitions for both.

Picture includes some examples of cryptocurrencies and tokens. Check them out!

What Are Cryptocurrencies?

Cryptocurrencies are digital coins. Designed to work independently and fully in the electronic world, they are usually not controlled by a single entity, although exceptions exist. A certain level of cryptography secures their operation, but the quality of it ranges from one coin to another. They exist on blockchains: immutable ledgers that include records of transactions and operations. Cryptocurrencies are essential for their operation.

What Are Cryptocurrency Coins Needed for?

Cryptocurrencies were created as a solution for fast and borderless transactions. Ideally, they should be fully independent from financial institutions and other entities, but there are plenty of exceptions in the modern crypto world. They can also offer a certain level of security, but this, again, depends on the coin. Cryptocurrencies are also valuable as investments and are popular assets for such purposes.

What Are Crypto Tokens?

Tokens are similar to cryptocurrencies, but it is important to know how to differentiate them. Essentially, they are digital representations of some other asset and were built on top of existing blockchains. This is one of the key differences between them and cryptocurrencies: the latter are native to blockchains and are essential and fundamental for their operation.

What Are Cryptocurrency Tokens Needed for?

One can use crypto tokens for payments, but they mainly exist to store value and for investment purposes. The developers also often use them to raise funds for their projects, but this is just one of many possible use-cases. Tokenization has its own share of advantages and risks, but we will cover those in detail closer to the end of this article.

Types of Crypto Tokens

As we have already mentioned, the tokens are very versatile and can be used for many different purposes. So, it should not come as a surprise that they come in different forms. In the next few sections, we will provide information on existing types of tokens, with each serving its own purpose.

Transactional Tokens

This type of token works similarly to cryptocurrencies. Its main purposes are selling and purchasing. In this case, they often do not differ much from the majority of cryptocurrencies.

Non-Fungible Tokens (NFT)

NFTs are prime examples of tokenization. They are representations of something such as a piece of art or any other important asset. Cryptography and blockchain are used to secure and prove one’s ownership of such assets.

In Picture below, you can read the definition of NFT.

Stablecoins

This type of tokens are currencies that have their value constantly connected to that of any other currency. Usually, the choice is fiat. For example, USD or Euro, or any other popular currency. These assets usually aim to reach a certain level of stability, while also being a possible great choice for exchanging funds due to a low level of volatility.

Decentralized Finance Tokens (DeFi Tokens)

This type of token is essential for the functioning of decentralized services and platforms. There is a whole world of them that includes many solutions aiming to offer financial functions not related to or governed by any entity.

Utility Tokens

As is obvious from the way they are called, such tokens offer access to specific features. In the majority of cases, the project developers use them during Initial Coin Offering (ICO) to attract new investors. Those get such tokens and use them to access certain functions and can also often exchange them for cryptocurrencies.

Security Tokens

Another example of tokenization, security ones are digital representation of something that exists in the “real” world. For example, it might represent a stock or part of it transferred into an existing blockchain.

Governance Tokens

These ones exist for providing voting rights on blockchain, one of the essential features of technology. This is actually a very common type of token. One such example would be UniSwap.

Wrapped Tokens

These tokens are representations of existing cryptocurrencies. Their main purpose is to allow them to operate on other blockchains. Similar to what we described in the “Stablecoins” section, they have their value pegged to that of another currency.

How Cryptocurrency Tokens Work

A token usually represents something. This can be another currency, an existing object, work of art, or some other types of finances, such as stocks. Cryptographic algorithms and smart contracts secure the information and ownership rights about this asset on the blockchain. As such, tokens can also provide additional features and bring more versatility into the world of crypto.

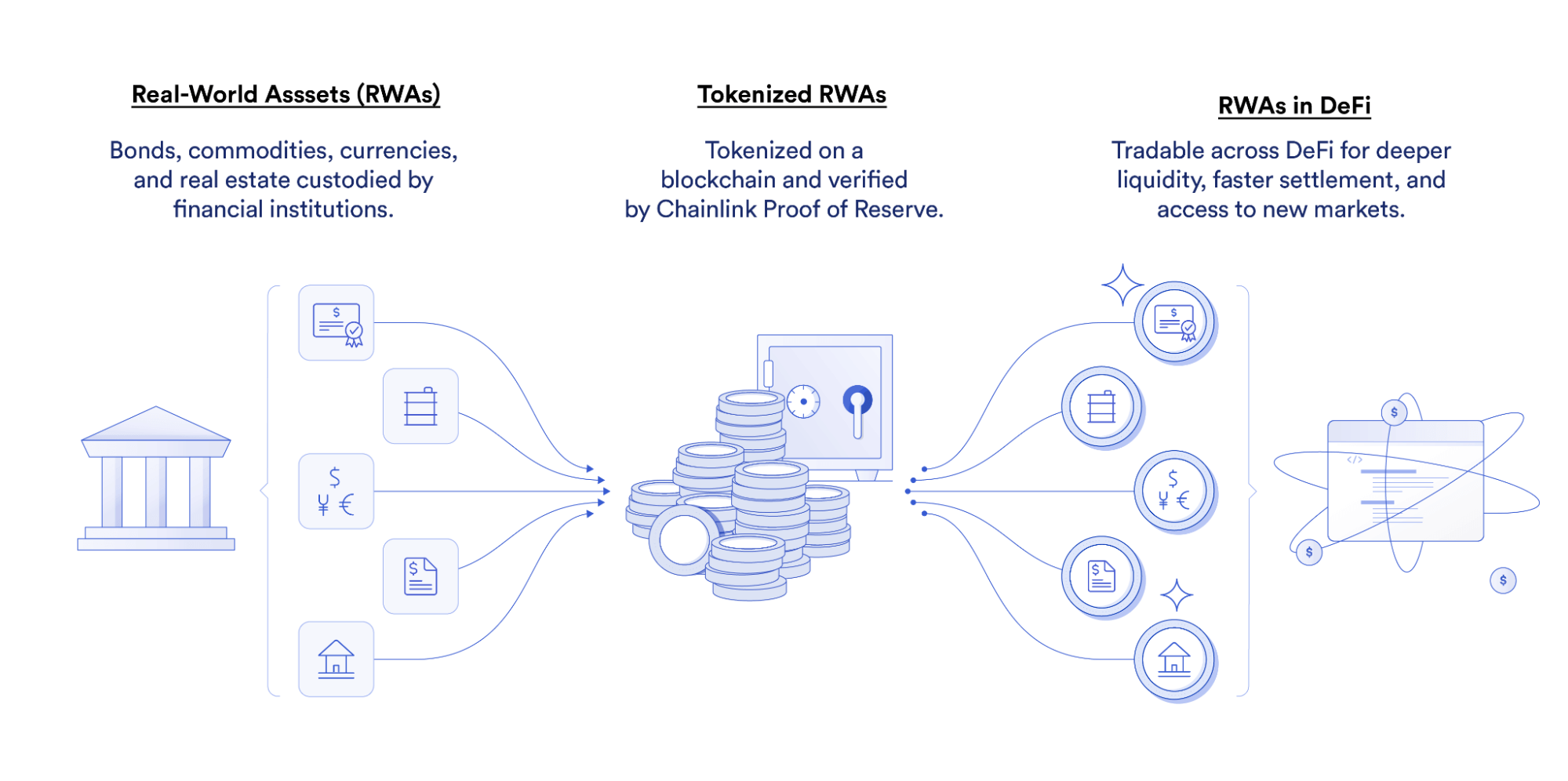

Asset Tokenization: What is It and How Does It Work?

We have already mentioned that it is possible to tokenize an existing asset. This essentially means creating a digital representation of it. So, how exactly is it done? Well, algorithms and various technologies secure ownership rights of an asset in the blockchain. And it is immutable. As a result, a greater level of security is achieved. There are other advantages as well, let us check them out in the next section.

Picture below shows the basics of real-world assets tokenization.

Tokenization Advantages

Tokenization has clear benefits, otherwise it would not gain popularity. Let us take a look at some of them to get a better picture.

Security

Blockchains and smart contracts provide an impressive level of security or add an additional layer of that. There are complex and well-tested cryptographic algorithms and usually a certain level of transparency. Immutability of blockchains is also worth to be noted.

Programmability

Smart contracts provide an impressive level of versatility. You can program them to have certain rules, which will open doors for complex interactions and automation. This can be great for various purposes.

Liquidity

The market is large and includes many instruments. You can easily swap your preferred token to another one, if such a need arises. While it does not matter much in many cases, having such an option is essential for other situations.

Token-Related Concerns

Tokens come with a certain level of disadvantages, difficulties, and risks. Let us take a quick look at them. Some are quite important.

- Regulation. While the token market is regulated in the U.SThis is not true for any country. Moreover, it largely depends on a token. If you are planning to invest into one or tokenize your existing asset, there are things to consider, so we recommend doing a lot of research.

- Certain chances of them being scams. Unfortunately, scams are not rare in the world of crypto. Even under regulation, they often appear and sometimes become successful. If you do not want to run into one, we recommend thoroughly researching the project and the team behind it.

Tokens vs. Currencies: The Difference

We have mentioned several times in this article that there are differences between them. First, cryptocurrencies are native to the blockchain they are operating on. Tokens are not, and they have to use smart contracts to interact with them. As an example, Ethereum (ETH) is a cryptocurrency, while ERC-20 solutions are tokens.

Cryptocurrency and Tokens vs. Fiat

And now it is time to take a look at the differences between the world of crypto and regular currency, also called fiat. First things first, fiat is usually centralized and governed by a single entity. This is usually the central bank of the country. For crypto, it does not have to be the case. While plenty of centralized coins and tokens exist, the decentralized financial options are also vast and impressive in their diversity.

Cryptocurrencies and, of course, tokens can offer a greater level of security. While there are plenty of ways to keep your fiat money safe and the technologies are not lagging behind in this matter, the world of crypto is much more versatile in this aspect, with smart contracts providing impressive levels of security.

FAQ

What is the point of tokens?

Tokens play many roles, bringing a lot of functionality and impressive additional features and technologies to the world of crypto. They can also act as investments and as a secure store of value.

Is Bitcoin a cryptocurrency or a token?

Bitcoin is a cryptocurrency, operating on the blockchain with the same name and being a prime example of it.

What is the difference between cryptocurrency and tokens?

Despite many similarities, there are clear differences. Cryptocurrencies usually exist on blockchains from the start, while the tokens are often built upon them to provide additional functionalities.

What types of tokens exist on blockchains?

There are utility, security, and governance tokens. Stablecoins and Non-Fungible Tokens also exist.