In the modern world of trading, there are many kinds of assets and contracts one can use to buy, sell, and interact with in different ways. Futures are one of them, and in this article we’re planning to research what they are, mainly covering the basics, providing the main information, and even answering the most important questions.

- What Are the Futures?

- Preconditions for Further Futures Evolution

- An Example of a Futures

- What Are Futures Contracts?

- Using Futures

- The Basics of Trading Futures

- Pros and Cons of Trading Futures

- The Risks of Trading Futures

- Choosing a Platform for Trading Futures

- Developing a Plan for Trading Futures

- Contract Specifications

- The Markets for Trading Futures

- How to Trade Futures

- Are Futures Derivatives?

- What Happens if You Hold a Futures Contract Until Its Expiration?

- Frequently Asked Questions (FAQ) for Trading FuturesWhich Assets You Can Trade with Futures?

- What are the Main Pros and Cons of Trading Futures?

- What Are the Things to Consider When Trading Futures?

- What are the Main Things to Include in Your Futures Trading Plan?

What Are the Futures?

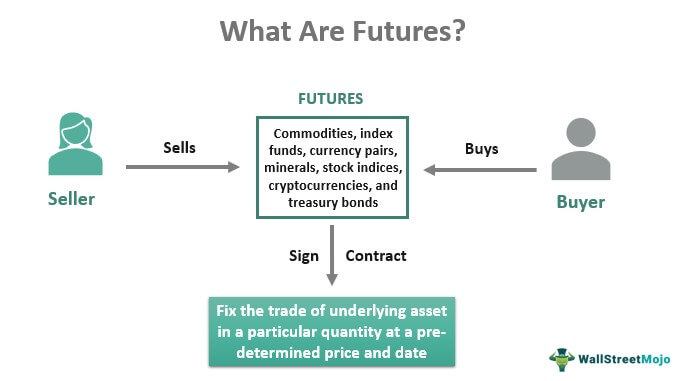

Futures are the type of contract that you have to sell or buy in a certain date. The price is also predetermined. The main trick and caveat is that the trade should be profitable or generally favorable to you.

Otherwise, there are certain risks involved, resulting in losing money for one reason or another. The picture below shows what futures are in a demonstrative manner.

Preconditions for Further Futures Evolution

The futures are quite popular, and there are several reasons to believe that they will only continue to be increasingly common in the world of trading. First things first, they’re a great way for the producers of goods to lock their prices, often in a favorable manner, but sometimes simply to reduce the risks and potential losses. The second thing is that the traders like them since they provide high liquidity and have other strong points. More on that in the «Pros and Cons» section of our article.

An Example of a Futures

We can go on and on describing important things to consider when signing a future contract, listing risks, advantages and disadvantages, as well as tips about choosing a platform. But all of that does not matter for beginners without a demonstrative example.

So let’s take a look at one. The month is August, and a trader thinks one company’s stock will rise after some expected announcements. The end of the fiscal year of the company is based on the calendar, so the trader expects the stock of the company to go up in January. For that reason, he buys the contract that they will buy 100 shares at $50 per share. They also deposit some money into their margin maintenance account, and when the price starts fluctuating near the time the company announces its third quarter results, the broker asks the trader to add more money to it.

The year ends, the company announces its annual financial results, and success means the rise of stock prices. They are now traded at $60 per one, a massive increase for an established company. When it expires, they buy the shares and quickly sell them, resulting in a $1,000 profit (60 x 100 minus 50 x 100), minus the fees.

But if the prediction was incorrect or the trader guessed the time incorrectly, then smaller prices would result in buying shares for more than they’re worth.

What Are Futures Contracts?

The futures contract is just another name for futures. The reason why they’re called such is that technically trading futures is like signing a contract: there is an information about the day when one will buy or sell and at which price. After all, they involve financial obligations. Contracts are usually offered by the producers of an asset or other market players.

Using Futures

Futures allow one to make money by predicting a market trend and price changes. They might not be as straightforward in that matter as simply longing for some assets, but they’re still easy to use, despite being sometimes a bit difficult to understand.

The Basics of Trading Futures

If you’re planning to buy or sell future contracts, then you have to understand how things work. Let’s take a look at the main terms involved in the process of trading such contracts:

- Hedgers. These are people and firms that sell actual assets. They use futures to mitigate the risks and lock the prices, often trying to mitigate the risks this way.

- Speculators. Or simply traders, as we refer to them in this article, are the ones risking money and trying to make a profit by selling or buying assets involved in the futures.

- Future expiration. The last trading day, when the sell or buy happens.

- Volatility. This is a general term that means the variability of prices. The pi c3 below shows high volatility looks on graphs in a fun way.

Pros and Cons of Trading Futures

As would be the case with any contract that one can trade, there are always certain benefits and drawbacks. Futures are not exceptions. They might be popular due to some of the advantages of using them compared to other derivatives, but they still have certain shortcomings.

Let’s take a look at the benefits that using futures can offer:

- Overall simplicity. While the concept of futures might be a little difficult to grasp for some beginners, overall trading them is an extremely straightforward process. The pricing is also quite simple, compared to some other derivatives.

- High liquidity. The future markets offer high levels of liquidity, so it’s extremely easy to move in or out of one’s position.

- Highly regulated. These markets tend to be transparent and regulated, and while some traders might find the latter point to be a drawback, it actually makes it all much safer.

- Great leverage. Futures can offer much higher leverage compared to regular stocks, but the downside is that it involves greater risks as well.

And of course, trading futures comes with its own drawbacks. Let’s take a deeper look at it:

- Affected by price fluctuations. Of course, it’s true for the majority of assets and their derivatives, but in the case of futures, the position moving against you can result in needing more cash to cover the maintenance margin. The situation is only made worse if you use a lot of leverage.

- Expiration. Once the time comes, one has to sell or buy a future and there’s nothing to do about it. Even if it seems that the market move was predicted correctly, but it happens just a day or two later than the expiration date, the trader will be at loss and can’t postpone it.

- Lack of control. Speaking frankly, futures don’t have any measures that would allow one to deal with some unpredictable events. If something happens that you don’t see coming, you can do nothing to fix it and make your position better, apart from exiting the contract by exchanging it to another similar one.

The Risks of Trading Futures

As is expected in trading, there are risks. Most of them are strongly related to the downsides we mentioned in the «Pros and Cons» section. Let’s take a look at some of them in a greater detail:

- Unpredictable events. If some move happens against your position, there’s nothing you can do about it. There are no ways to mitigate the downfall, since a trader has no control over when and at what price they can sell or buy a future contract. The only time when one can choose them is when agreeing to a contract.

- A price move happens, but a bit later than the trader expected. We already mentioned such a thing in the «Pros and Cons». Imagine a situation where the trader correctly predicted the changes, but an expiration date comes a day or two before. Similarly to the previous points, the total absence of any control leads to the losing position; there’s basically nothing a person can do about postponing the process other than try the rollover tactic, which is when one exits a contract and gets another similar one with an expiration set much later.

Choosing a Platform for Trading Futures

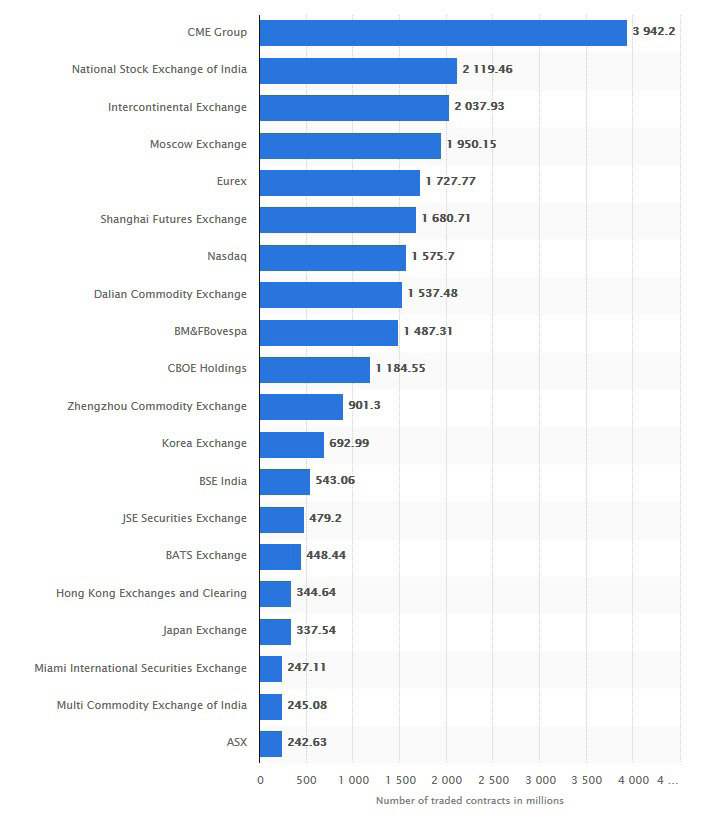

Plenty of exchanges offer futures contracts. It mainly revolves around what assets one is trying to speculate on, but there are other things to consider, so let’s list crucial aspects.

- Traded assets. Different platforms cover different things. If you’re planning to speculate on the price of cryptocurrencies when buying futures, then you have to use crypto exchanges. If an asset you’re interested in is oil or energy, then take a look at places where you can speculate on their price. And of course, there are plenty of exchanges for those interested in the stock market.

- An exchange reputation. Some markets are less regulated than others. And while futures are usually pretty transparent, it’s still important to consider whether you can trust the platform you’re planning to use. For example, if you’re planning to use decentralized cryptocurrency exchanges, then there are zero regulations and the platform’s reputation should be your main factor.

- Competitive fees. Since the market of futures is quite competitive for hedgers as well, we recommend finding the platforms with lowest fees included.

- The diversity of choices. The more offers you have, then more control you can gain about your choices. Select the contract that suits your needs and demands the most.

To understand how big the market is, take a look at the picture below (pic). It shows the largest derivative exchanges in 2016. So you can expect the market to be even larger in 2023.

Developing a Plan for Trading Futures

If you’re planning to use a certain strategy when trading futures, then there are certain things to keep in mind.

- Market trends. This one is pretty much obvious: analyze the market and check out whether to expect the prices to go higher, lower, or even sideways.

- Make safe moves. Trading is always risky, and futures are even more so, so make sure that you can afford the losses if things go wrong.

- Learn more about spread trading. This strategy is quite popular in the world of futures, since it involves getting two contracts with opposite results. This works as a way to mitigate the risks.

- Learn the difference between going long and short. This is true for all types of trading, futures including.

Contract Specifications

Since futures are contracts, there are many things that cover how, when, and at what cost an asset will be bought or sold. Below is the list of main specifications usually included.

- A type of an asset. Futures can involve different kinds of them: currencies, including crypto ones, interest rates, indices, and nearly anything that’s trading on the market, including metals, stocks, and other things.

- Quantity. You have to agree how much you have to buy or sell.

- Expiration. This is the day when you have to buy or sell futures.

- An agreed price. This is where you will decide at which price you will sell or buy an asset. This is crucial to a successful future trade.

The Markets for Trading Futures

We have already mentioned that you can trade different types of assets. Available markets include cryptocurrencies, regular currencies, grain, energy, oil, materials, metals, stocks, indices, interest rates, and even livestock. And that’s not even the complete list. Technically, you can use futures with any type of asset, although some markets will be less regulated, transparent, and profitable compared to others.

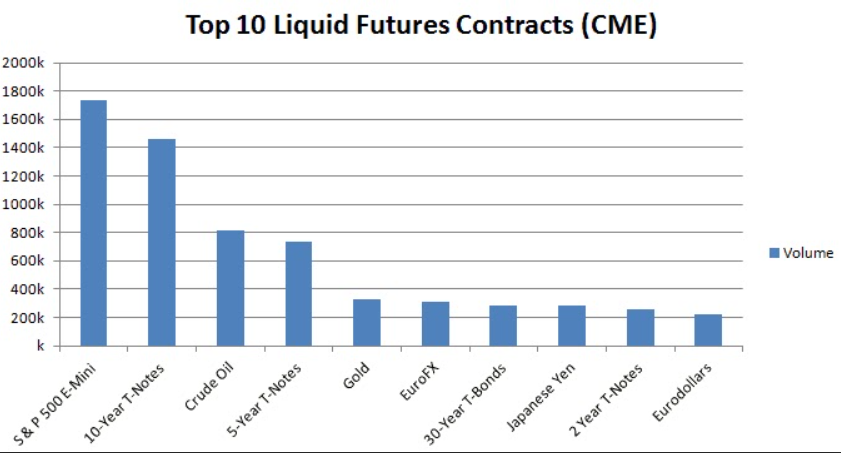

The picture below (pic) shows top popular liquid market contracts. Of course, this is just a small part of the seemingly endless list of assets that you can use for futures.

How to Trade Futures

The process is quite easy, provided one has some experience with trading. The idea is to find an asset you’re interested in and the platform you can trust. If you’re not new to trading, then you likely have an idea where to go and what exchange to use. The next step is to find a broker and then set the conditions or agree to existing ones. All of it is quite simple.

Are Futures Derivatives?

Yes, since they derive their price from another asset. This is quite normal in the world of trading and investing: many entities are actually derivatives, such as options or currency swaps.

What Happens if You Hold a Futures Contract Until Its Expiration?

The answer to this question is surprisingly obvious. If you hold a contract until expiration, then it will be automatically settled. Meaning that the sell or buy will happen. So unless something happens or when the contract, the settlement will happen.

Frequently Asked Questions (FAQ) for Trading Futures

Which Assets You Can Trade with Futures?

Nearly anything, ranging from cryptocurrencies to grain and livestock. Interest rates and stock markets are also included.

What are the Main Pros and Cons of Trading Futures?

The majority of advantages include high liquidity and a relatively straightforward process. The drawbacks include significant risks of losing money and total lack of control over the situation.

What Are the Things to Consider When Trading Futures?

You have to keep in mind the fluctuation of the prices, and possible market trends. You also have to choose the platform wisely, since some are less regulated than others or offer higher fees.

What are the Main Things to Include in Your Futures Trading Plan?

If you’re developing your own strategy of futures trading, then you have to consider market trends and be ready for risks. The future contract usually includes an asset, its quantity, expiration, and the price.