Cryptocurrency inflation is an increase in the overall price level of cryptocurrency assets over time. This means that over time, the purchasing power of cryptocurrency decreases and fewer assets can be bought for the same amount of money.

Cryptocurrency inflation can arise from a variety of reasons:

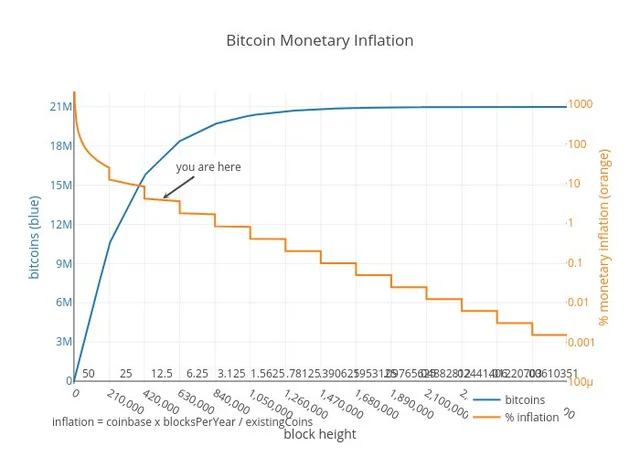

- New coin issuance: Some cryptocurrencies have a predetermined number of coins that will be issued over a certain period. If new coins are constantly being introduced into circulation, this can lead to an increase in the number of coins available and hence inflation.

- Growth in popularity and usage: If a cryptocurrency becomes more common and is used in more transactions, the demand for it can grow. If the supply of coins cannot meet the growing demand, this can lead to higher asset prices and therefore inflation.

- Coin Policies: Different cryptocurrencies may have different coin policies, such as mining rewards or staking. If these policies are not balanced or regulated properly, this can lead to inflation.

Inflation can affect cryptocurrency users and investors. First, it can reduce purchasing power and affect the value of goods and services that can be purchased with cryptocurrency. Second, inflation can impact investment returns. If asset price increases do not meet the inflation rate, investors can suffer losses in the real value of their investments.

Top news

Comments

Subscribe

Login

0 Comments

Oldest