Asset tokenization is the process of fixing a certain amount of rights to something of value in the form of a crypto tokens. Read on, and we’ll break down what can be tokenized in general, how to do it, and what it’s for.

- Types of assets

- Tokenization of fungible assets

- Tokenization of non-fungible assets

- Why tokenize assets at all?

- How does asset tokenization works?

- Choice of representation model

- Modeling

- Deployment of code

- Prerequisites for tokenization

- How to invest in tokenized assets

- Benefits of tokenization from an asset owner’s perspective

- Fair prices (well, most of the time)

- Reduced administrative costs

- Benefits of asset tokenization from an investor perspective

- Increased liquidity

- Shorter lockup periods

- High trustworthiness

- Risks associated with token assets

- The future of digital asset tokenization

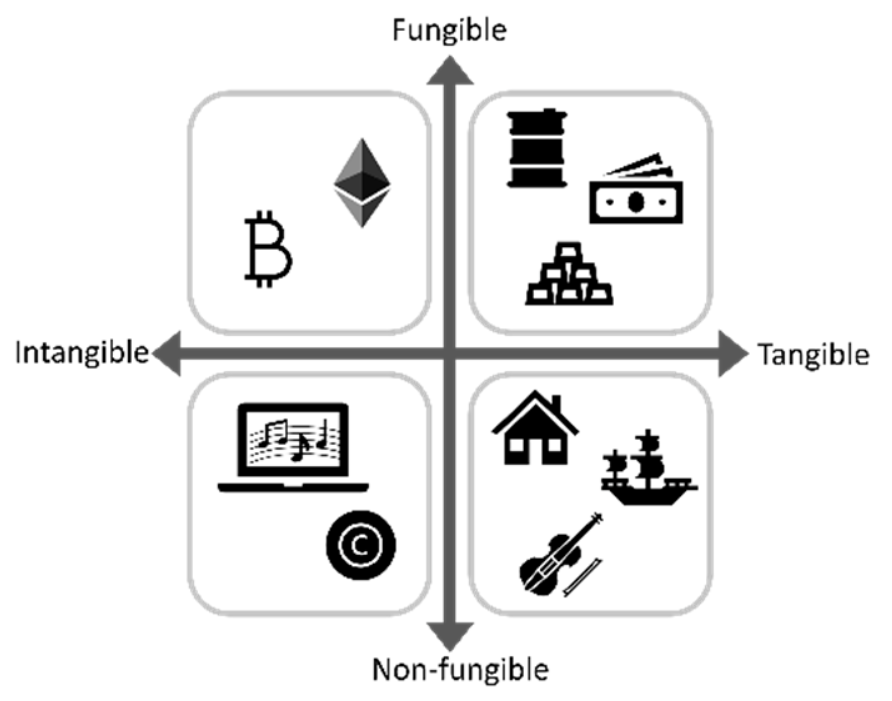

Types of assets

These types of assets can be tokenized:

- Tangible – gold, real estate, art.

- Intangible – voting and ownership rights.

In general, any asset that has value can be turned into a jingling virtual coin.

Just like that.

Tokenization of fungible assets

Assets can be tokenized with two different types of coins – fungible and non-fungible. It all depends on the characteristics. What exactly are they?

Well, let’s get into them. We’ll start with the fungible ones:

- Replaceability – each token has the same value and authenticity. For example, the units of many cryptocurrencies are identical (let’s take the proverbial and famous BTC). This means that one bitcoin has the same value as another. A full equivalence within certain bounds.

- Divisibility – it means that when an item is divided into smaller pieces, they all retain the same value.

Tokenization of non-fungible assets

For fungible assets, everything is clear. But what about the second ones? They are:

- Non-fungible – that is, the opposite of the previous ones. Each such asset is a unique object, so it cannot be exchanged 1:1 with others. You have to do some market research to find out how much each one is actually worth.

- Inseparability – non-exchangeable assets are whole and cannot be divided into smaller pieces. Well, 90% of the time.

- Uniqueness – each such token is completely unique. Even if, for example, this or that NFT image is not particularly different visually, it will still contain non-repeating information and attributes.

Why tokenize assets at all?

There are a number of reasons. First, it’s worth noting that tokenization plays into the hands of diversification.

But it goes way further.

How does asset tokenization works?

The process is carried out by creating a record of ownership of an asset or part of it on the blockchain. The smart contract automatically changes the owner’s data in the registry during the period when the active is both on offer and on sale.

Choice of representation model

The cryptocurrency community has calibrated token standards to represent certain types of assets. Before deciding whether to use a particular yardstick, it is necessary to evaluate the fundamental characteristics of this or that asset.

This means, for example, its fungibility or non-interchangeability. But that’s not all. Confidentiality is also taken into account when making decisions.

Modeling

Before implementing a tokenization model, several aspects should be considered so that it is clear which data will be stored in the chain and which will be stored outside. Factors to consider include:

- Legal constraints.

- Regulatory constraints.

- Level of trust.

- The need for scalability.

Deployment of code

It’s not enough to just let smart contracts do all the work and hope they can handle it.

It’s reasonable enough to check them from time to time. This can be done with the help of third parties. They will certify the code before and during deployment.

Prerequisites for tokenization

- First, clear security policies must be developed.

- Second, the role of financial institutions in the chain must be clarified.

- Third, it’s mandatory to understand which platforms will be integrated (and if they will be integrated at all).

- Finally, it’s needed to remember to follow KYC and AMLD5 principles on an ongoing basis.

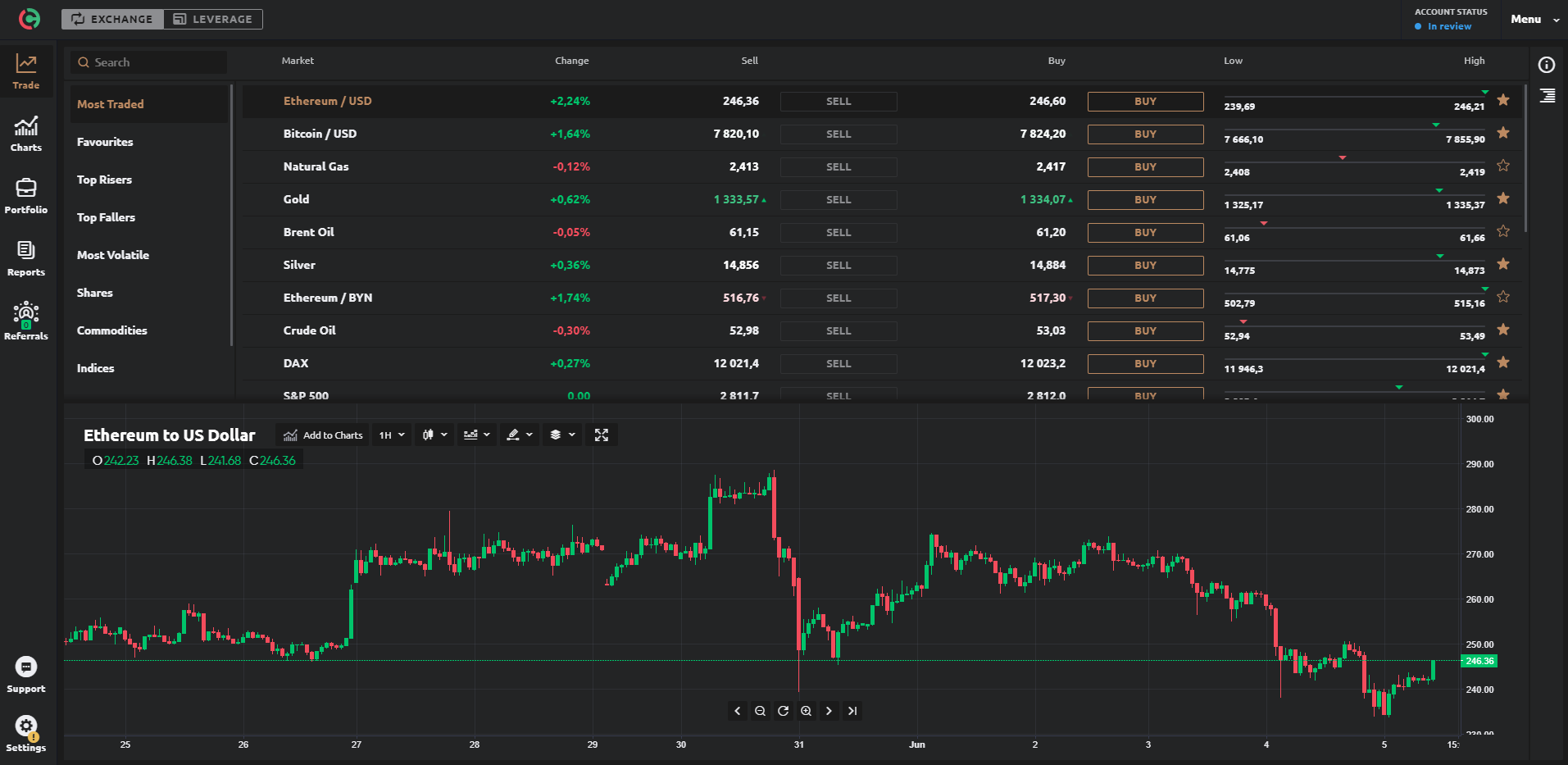

How to invest in tokenized assets

To do so, you need to register on a specific exchange and go through KYC. For example, you can invest on Currency.com – there are over 4 000 different positions. Such a number will be enough even for a sophisticated trader. But you can also look at more localized options like FTX, Bittrex, Bitpanda, etc. There are not so many positions – from 5 to 50 on average, but it’s still okay.

Benefits of tokenization from an asset owner’s perspective

Below are the benefits that owners receive from tokenization.

Fair prices (well, most of the time)

Assets that cannot be easily sold often have an unspecified market value. This improves liquidity because delegated ownership eliminates discounts. This allows to achieve an adequate value education in most cases.

Reduced administrative costs

This process can be simplified by choosing the right method that eliminates intermediaries and the necessity of trustbuilding. This saves time and money while avoiding potential headaches.

Benefits of asset tokenization from an investor perspective

Now let’s discuss the benefits that investors receive from tokenization.

Increased liquidity

Investors can diversify their portfolio by putting small amounts of money into things like real estate.

Shorter lockup periods

Tokenization can shorten the lockup period so investors can easily sell their cryptocurrency. No more waiting years to make a profit. Well, or suffer losses, but that’s a different topic..

High trustworthiness

Since the owner and DID data are stored on the blockchain, the keys (both private and public) form a digital signature to ensure they are valid. This can be used for KYC verification, for example.

Risks associated with token assets

Tokenization is never without risks. Investors can suffer significant losses in the case of illiquid items, as prices can be very volatile and deviate significantly from fair value.

Volatility is a scary thing after all, and it can grow exponentially. For example, due to changes in legislation, cyberattacks and cryptocurrency thefts.

By the way, thefts and cyberattacks are really a very dangerous problem. And it is so because tokenized asset platforms mostly use open source software for development.

And it is very, very vulnerable.

The future of digital asset tokenization

Overall, it can be said that it is quite promising. Analysts predict that by 2030, tokenized assets will grow by more than $15 trillion. This is a huge amount, which proves that people are steadily interested in it.