Bitcoin Cash is a very promising cryptocurrency with several benefits. But is it better than Bitcoin itself? Let’s take a look at the history of Bitcoin Cash and review the necessary details.

- Bitcoin Cash (BCH): what it actually is

- The story behind BCH

- Principles of work

- BCH token

- Fundamental Technology of Bitcoin Cash

- Ecosystem

- Ways to buy and use Bitcoin Cash

- The differences between BCH and BTC

- Pros & cons

- What happens with Bitcoin Cash in the future

- Q&A

- Is BCH worth owning?

- Is it right to invest in BCH?

- Bitcoin Cash drawback

Bitcoin Cash (BCH): what it actually is

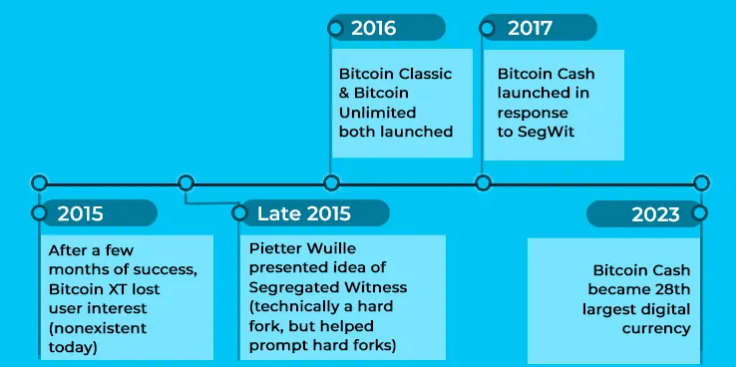

Bitcoin Cash is a replacement for Bitcoin, but not in all aspects. Generally, Bitcoin is supposed to provide fast and cheap transactions which, eventually, didn’t happen. Here’s where Bitcoin Cash enters the room. After the Bitcoin “hard fork” which happened in 2017 the new cryptocurrency was released. “Hard fork” is the event which means a split of a blockchain in two parts. Consequently, the main reason for the launching is a return of decentralization to Bitcoin. Here’s the storyline of hard works:

The story behind BCH

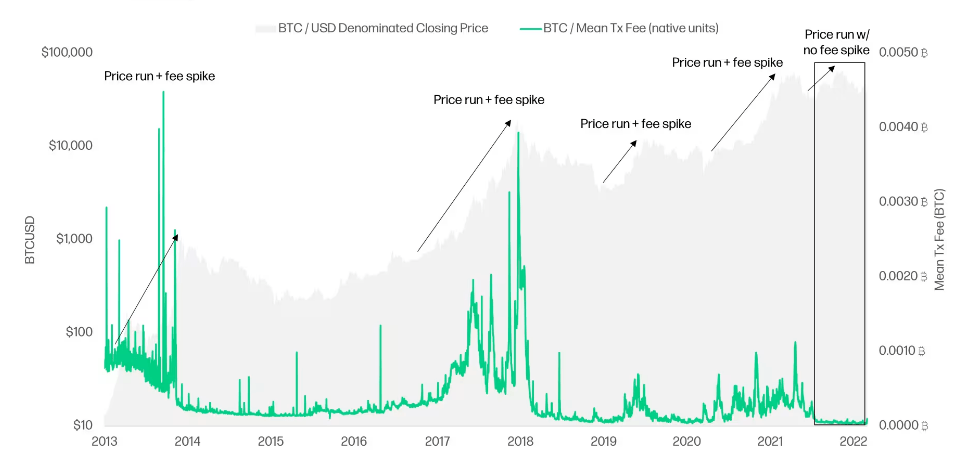

Due to increased popularity of BTC, the blockchain started to fail: the transaction rate slowed down and the demanded fees raised. It happened because of the initial 1 MB block size limitation. The network just couldn’t handle the amount of action and started to slow down in general.

You need to take a look at the chart of the transaction fees below to understand the significance of such jump:

That’s where Bitcoin cash stepped in. The supposed goal of Bitcoin was to provide fast and cheap transactions, but in 2017, developers decided that it is better to be used as an investment. BCH replaced BTC in the payment function and was designed to be a peer-to-peer system and to provide direct and fast transactions.

Principles of work

BCH is based on, relatively, same principles as Bitcoin:

- Validation of transactions and releasing new coins by mining. The supply is limited with the same 21 million coin mark.

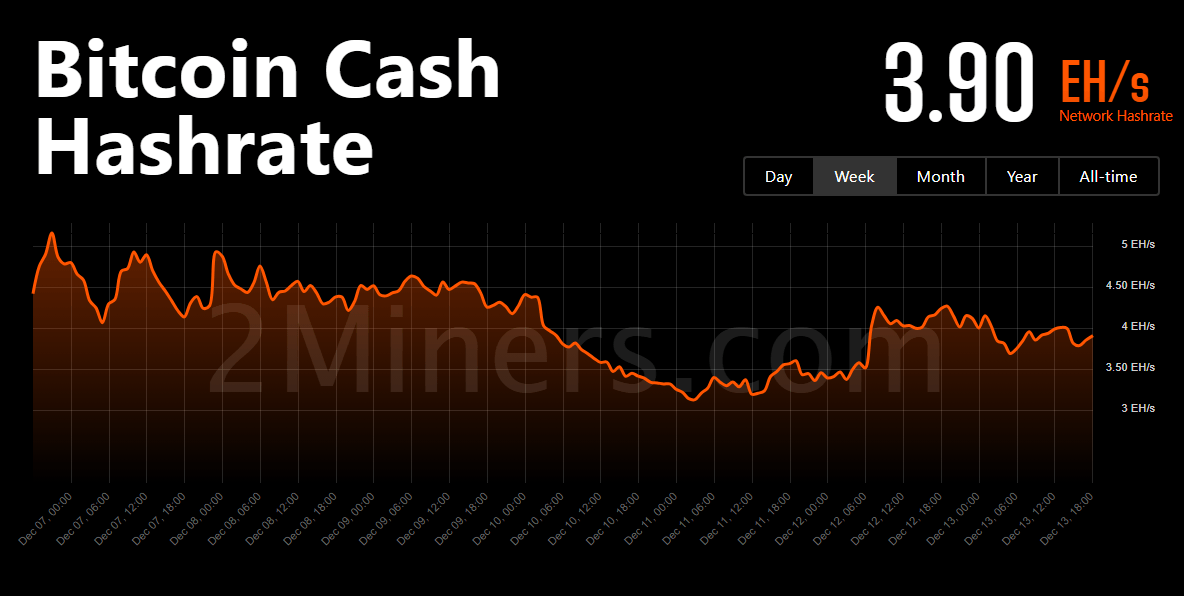

- Proof-of-work consensus mechanism. Miners are obligated to show the evidence of calculations performed to approve transactions. It is the same story with a difficult math equation which needs to be solved to confirm a block. The first miner who does it gets the reward. The picture below shows the current level of BCH hashrate:

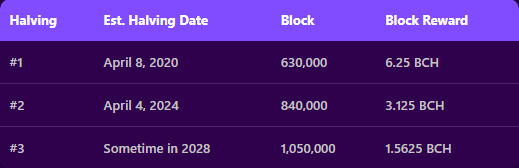

- The halving process which occurs every 210,000 blocks. Here’s the list of previous halvings and a prediction for a future one:

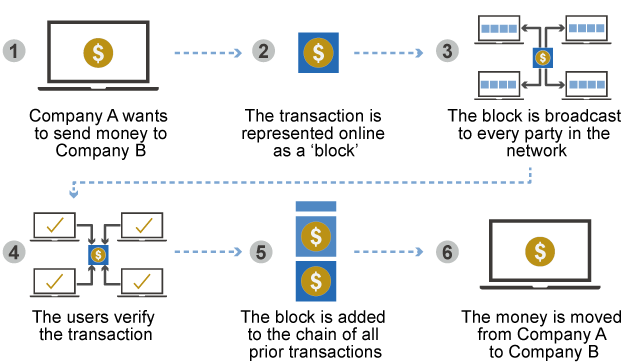

- The constant recording of added transactions in the blockchain. It is a decentralized ledger. Take a look at the principles of its work:

BCH token

It is a digital currency which is used within the BCH network. The BCH token can be operated as an investment and as a payment method. The flow of new tokens is generated by miners. In fact, it has the same limitation of 21 million tokens as Bitcoin and BCH themselves. The block itself is bigger which reduces the amount of funds you need to spend per a single transaction.

The cost of this token highly depends on supply and demand. However, different exchanges and businesses can add this token to the payment method list which increases the support of the token.

Fundamental Technology of Bitcoin Cash

The peer-to-peer concept and the increased size of the block all-together became the solutions of several troubles which ended up with a hard fork in 2017. These features combined are able to provide high quality transactions with a high-rate and lower price for each one.

In the end, it has the limitation of supply: 21 million tokens. After all the mining and reaching the limit, there will be no more new BCH added to the flow.

Ecosystem

Let’s take a look at the parts of the BCH ecosystem:

- Miners. The ones who verify the transaction and add new tokens to the flow.

- Wallet providers. Internal storages of your digital capital. They grant you the ability to send and receive BCH.

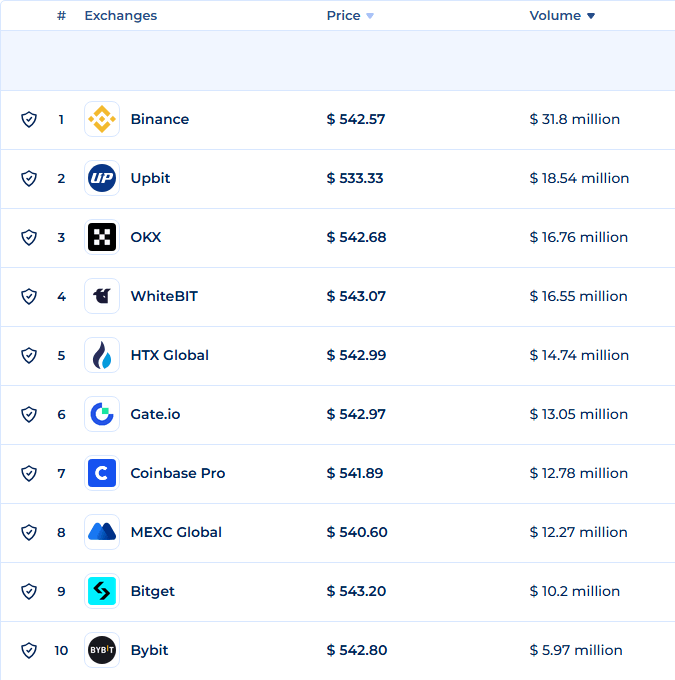

- Exchanges. There are many of them which provide you with the opportunity to buy or sell Bitcoin Cash. The primary exchanges which accept BCH are dependent on supply and demand. The picture below shows the top-10 list of the current exchanges which provide trades with Bitcoin Cash:

- Businesses & brands. There is a continuous adaptation process of Bitcoin Cash as a payment method throughout the companies which helps to improve and expand the ecosystem.

- Community. The general support of those who are interested in the project grants the positive tendencies in the development. Users, investors or the developers themselves have an impact on the ecosystem’s improvements.

Ways to buy and use Bitcoin Cash

You can buy and sell Bitcoin Cash within many exchanges. It is usually required to pass Know Your Customer and Anti-Money Laundering verification.

There are multiple uses of BCH:

- Transferring funds. It is a simple coin which provides you with a fast and direct transaction.

- Payment methods. There are a lot of websites and merchants which can accept BCH as a valid currency for the payment. Although, usually, Bitcoin is preferred to be that method.

The differences between BCH and BTC

The main advantage of Bitcoin Cash against Bitcoin is the speed of transactions by enlarging the block size up to 32 MB. Another difference: BCH doesn’t include Segregated Witness which is supposed to increase the quantity of transactions by taking out specific witness signatures.

Bitcoin Cash increased the size of blocks to have a limit of 32 MB, enabling more transactions to be processed per block. However, BTC is still more popular in payments than its “younger brother” BCH despite its efficiency.

Pros & cons

Now, we need to review all the advantages and disadvantages of BCH. Let’s start with pros:

- Transaction’s high rate.

- Low fees.

- Advanced protection.

- Global reach.

- Limitation of supply grants a resistance to inflation conditions.

And the other side of the medal, cons:

- Volatility.

- Limitation of adoption.

- Considerably, small network size.

What happens with Bitcoin Cash in the future

In the case of this particular coin, there are positive expectations because it is a very functional project which provides solutions to several transaction difficulties. High-rate and cheap price for the asset’s transfers are key factors which directly impact on the future of BCH.

But you have to remember about the competition within the market: Binance Coin is not the only one who provides such services. They all differ in certain aspects. The winner is going to be that project who gives more individual solutions for investors and most useful answers to general questions.

Q&A

Is BCH worth owning?

You need to decide if this currency fits your own trading strategies and risk management. BCH increased hugely in 2024. However, it doesn’t guarantee the inevitable growth in the future.

Is it right to invest in BCH?

Again, it is necessary to check if Binance Coin is suitable for your financial situation because all coins are affected by volatility. Don’t be afraid to ask for advice from a more experienced investor.

Bitcoin Cash drawback

One of the main problems of many crypto projects: small networks. It becomes more vulnerable to attacks. However, it’s a regular problem with all blockchains but a smaller network means an increase of this risk.