The Bitcoin Halving has strict principles, massive impact and the reasons behind it. Let’s review the tendencies and main information about this process.

- BTC Halving: What is it

- Events during this process

- Is btc halving good

- Inflation

- Demand

- Investing

- Mining

- Consumers

- Why is it so important

- Risks

- Background

- Last halving date

- Future halving date

- Why does halving happen more often than 4 years

- Halving’s graph – impact on valuation

- To invest or not to

- FAQ

- The principals of the bitcoin block halving

- The reason behind the event’s importance

- The amount of previous halvings

- Impact on the valuation

BTC Halving: What is it

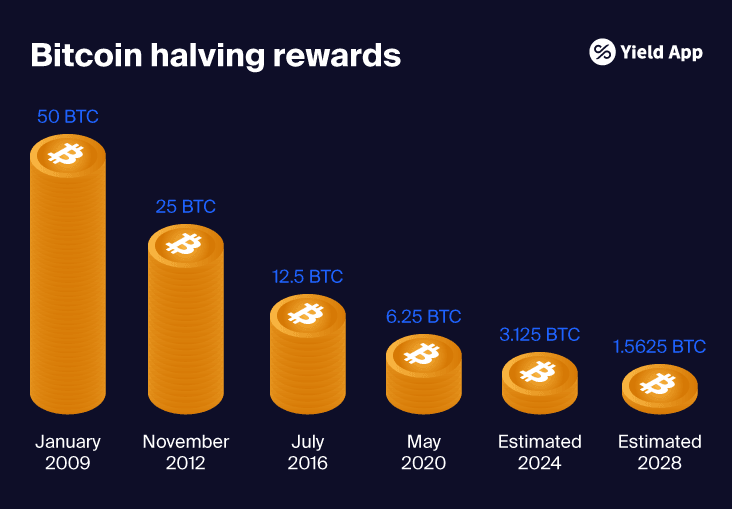

It is a reduction of the block reward by 50 %. This event happens every 4 years. Bitcoin halving decreases the amount of btc which enters the market. It creates a rising deficit tendency and can potentially increase the price. This rise is possible in the sustained market conditions.

Block reward is an income for the validating transactions and mining. Mining is a process of opening a new block. All together, these events are parts of the blockchain’s automatic process.

Miner is a contender for a block reward. His main target is to solve a cryptographic puzzle. The first miner who solves it gets the block reward.

Events during this process

Halving decreases the btc’s block reward by a half (50%). It means that every miner who solved the puzzle first, will have a lower income for the work. This event happens every 210 000 mined blocks. If it is measured in real-time, it is around every 4 years. This event is coded.

Is btc halving good

The process itself is an important event in the market. Let’s dive deeper and discover the overall impact of it: whether it is bad or good.

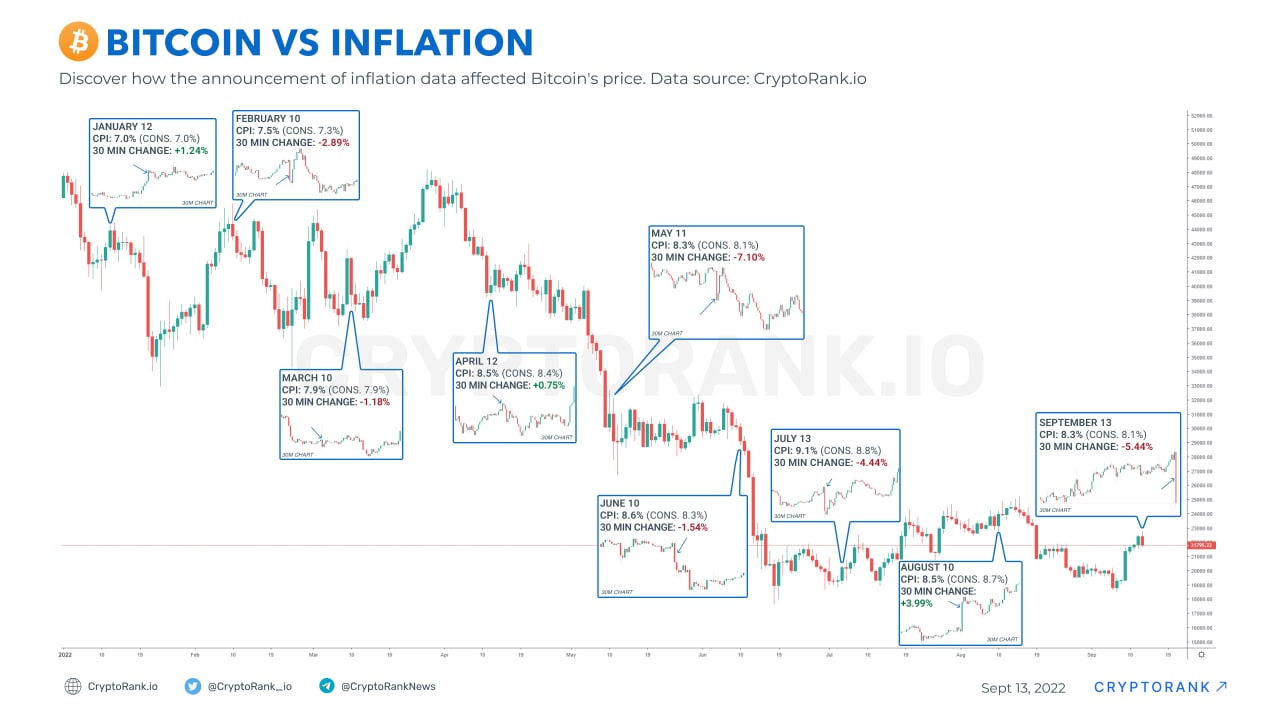

Inflation

Inflation’s reduction is one of the main reasons for this event. It is a process which includes the decrease of the supplies which can be bought with a specific amount of currency at any time.

It interferes with inflation and helps to reduce the effect. It is not a cure from it, of course, but the event can offer a helping hand to a cryptotrader. This event saves people from potential inflation’s losses.

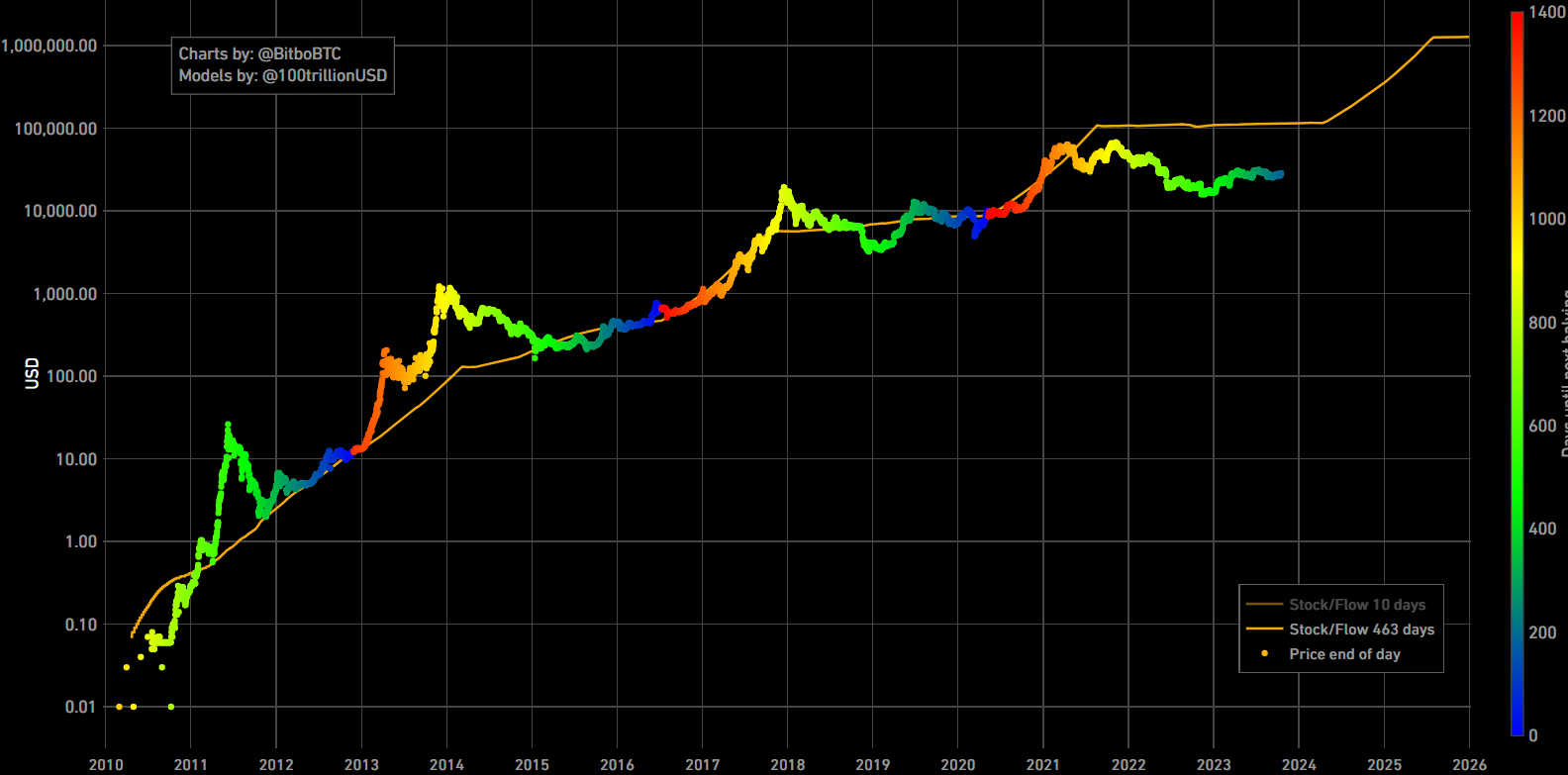

Let’s review the graph below, which visualises the fight for price levels.

Demand

Rising demand is an expectable event after the btc halving. After all, it decreases the flow of new blocks, which lead to the overall demand increase. Checking is simple: follow every previous halving and observe the valuation data. Cost usually increases. It is a benefit for the investors who depend on such changes.

Investing

Even though bitcoin’s initiative was to be a new payment method which helps you to avoid the outsiders from deals, it grew popular in investing. When traders saw the potential in the currency – they rushed in the market, which was quite unexpected at the time. It created a huge demand.

After all, investing could be profitable in the case of bitcoin, especially in the hands of a speculator. This event gives hope to the potential valuation increase which fits in the investing process.

Mining

As it was said before, mining is a process of solving the cryptographic puzzle. People who profit from the mining, miners, are focused on the income from this process. Despite the bitcoin volatility, the currency stays profitable. It remains an interest in mining.

Halving in case of mining is a decrease in block rewards. Big companies need to sustain their ability to compete with each other. It leads to increasing the mining levels by the equipment’s upgrades and a grown capacity. This costs a huge amount of money.

Consumers

Retailers and consumers will be affected by this event. The impact won’t be huge but the price of transactions will be volatile:

- Consumers will be affected by small changes in the cost. It even may remain the same value after the halving.

- Transactions are dependent on the btc’s market valuation, but usually it has the same impact on this way of using the currency.

Why is it so important

This process is important because of its influence on the flow of new coins into the market. It controls the generation of new coins by a sustained time-period. If there was no halving, but a constant decrease of the production – it would lead to future difficulties with gaining new coins.

Risks

The main risk which occurs during the bitcoin halving is a potential volatility in price. Investors should remain attentive and patient. Even though it creates a possible rising, the currency itself is volatile enough.

In the mining segment it means a lot. Huge companies need to constantly improve themselves to remain in their positions. Small miners will have less opportunities to obtain coins which lead to future losses.

Volatility risks: volatility is one of the most common risks associated with cryptocurrency investments. One day your portfolio could be worth thousands of euros, and the next it could drop significantly. For example, Bitcoin has seen price fluctuations of up to 20% in a single day.

Background

In 2008 Satoshi Nakamoto, the Bitcoin creator, decided to improve the process of Bitcoin’s obtaining. This cryptocurrency gradually flows into the market – we should give credit to halving.

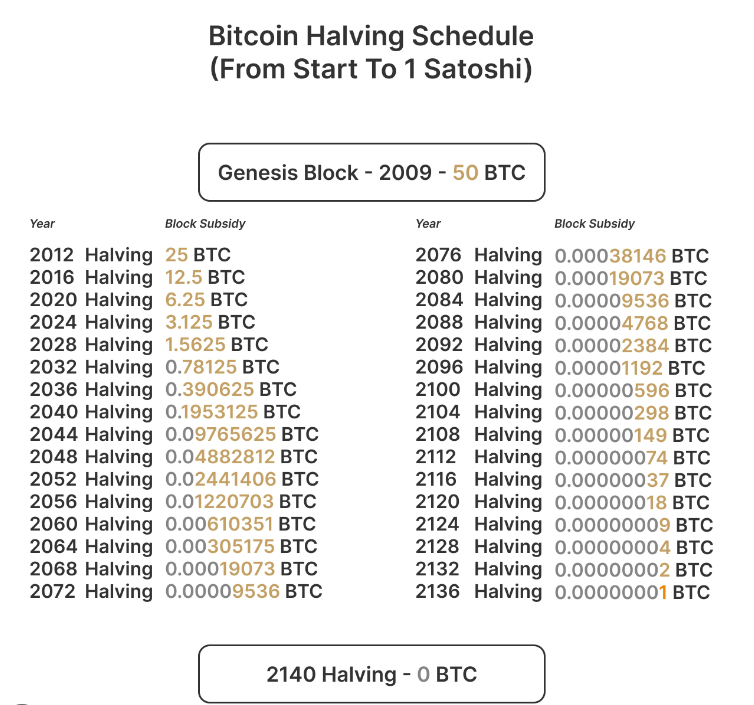

He created the limit of the coin: 21 million pcs. After the limitation, he discovered and executed a predictable scheduled way to release the currency. That is where the 210 000 block system comes from. It is the birth of the halving process.

Last halving date

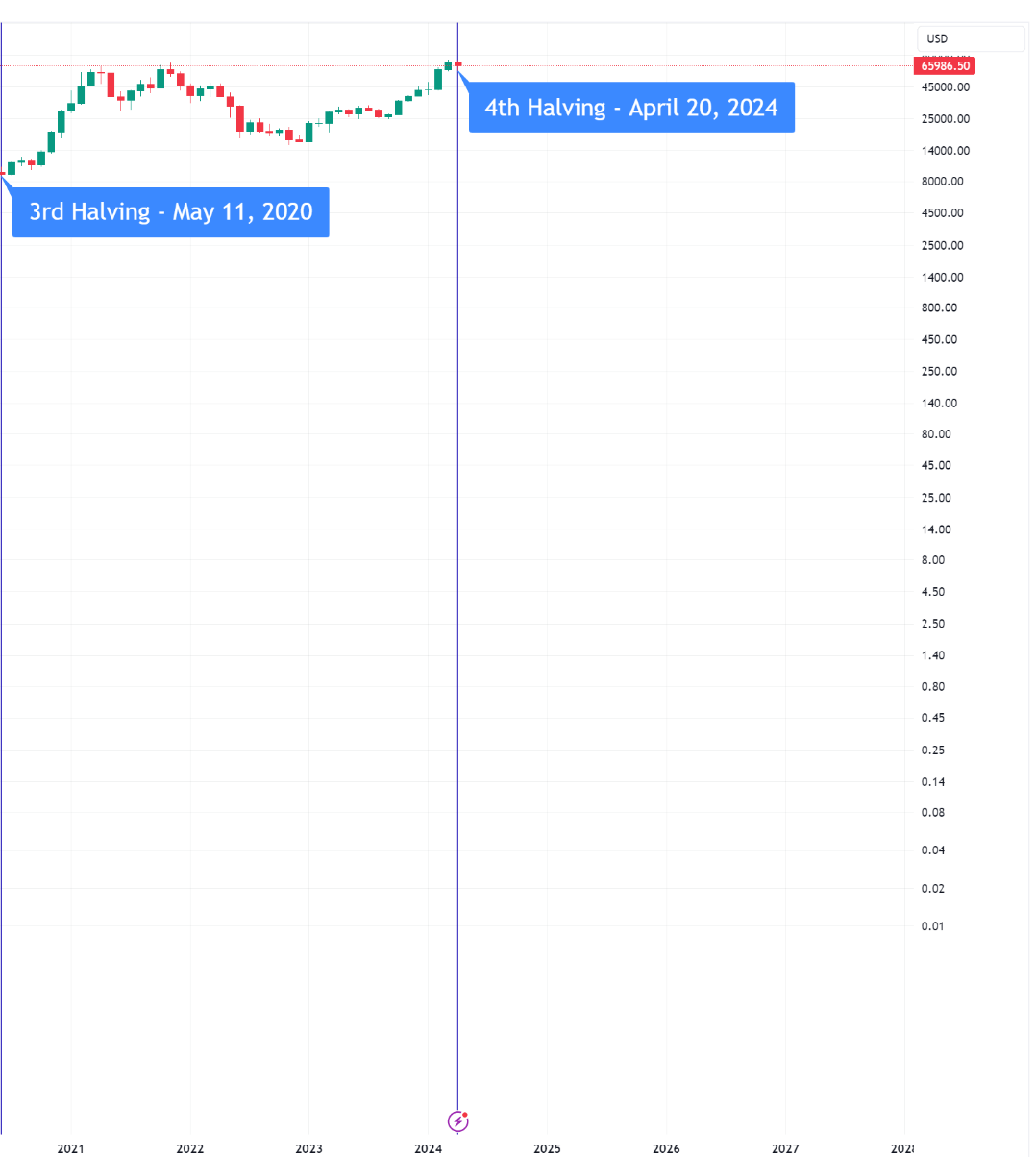

Last halving occurred on April 19th, 2024. On that date, the block reward decreased from 6.25 BTC to 3.125 BTC.

Future halving date

The scheduled time of the next event is around April, 2028. It will reduce from 3.125 BTC to 1.562 BTC.

Why does halving happen more often than 4 years

The main and obvious reason behind this is the 210 000 block’s level. The process occurs only after this level which usually is not in the exact 4 year period. Even though it is not 100% correct, the event is not far away from that time mark.

All of this leads to a blurry event’s date. Slight changes in mining time impacts on the process date. As a result, we do not have a specific date for each halving.

Halving’s graph – impact on valuation

Each bitcoin halving had a huge impact on the currency’s valuation:

- First one. The valuation increased by 9,52% over the next 365 days.

- Second one. The valuation increased by 3,402% over the next 518 days.

- Third one. The valuation increased by 652% over the next 335 days.

As you already got from the statistics, bitcoin halving has a huge influence on the valuation.

To invest or not to

It is an popular opinion to make an investment move with the halving, because of the growth tendency in previous events. Despite that fact the valuation rose slowly during the long time period. And all of this is not a 100% insurance of Bitcoin’s cost increase. That’s why you need to observe the market condition before, during and after the process. Also do not forget about your risk tolerance level. However, investing is quite risky because of the high level of fluctuating and volatility which can create unexpected changes. It can be highly profitable and very risky at the same time.

FAQ

The principals of the bitcoin block halving

This is a process of the block reward decreasing by 50%. It slows down the flow of new coins in the market and raises the demand.

The reason behind the event’s importance

It is a very important event because btc halving controls the amount of coins which enters the market. It balances the system and prevents coin mining from a great reduction in the future.

The amount of previous halvings

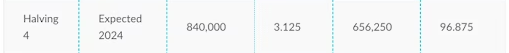

There were 4 halvings already:

- November 28, 2012.

- July 9, 2016.

- May 11, 2020.

- April 19, 2024.

Impact on the valuation

This event surely impacts on the BTC valuation. Previous tendencies showed the cost increase. However, it’s difficult to say that this effect remains the same in future halvings. Despite that fact it will still have an influence on the price.