There are several dominating forces within the crypto market. Crypto Whales are one of them and the largest ones have a huge impact on a certain currency. Let’s review the definition and scale the influence of this phenomenon.

- Definition

- Impact on market

- Liquidity

- Valuation

- Governance

- The influence on other investors

- Observation for the whales activity

- Meaning of being a crypto whale

- Who owns the most amount of BTC

- Protection mechanism of the anonymity

- Q&A

- Impact on liquidity

- Impact on valuation

- The influence on governance

- The richest BTC billionaires

Definition

A crypto whale is an organisation or a person who holds a lot of certain cryptocurrency. This amount of coins is able to have an impact on the market in many different ways: liquidity, valuations, governance and more. They are monitored by people because every step of such an important participant creates changes.

For instance, It is considered to be such an account if it holds around 10000 BTC or so. It can be less, but it is already an incredible amount of cryptocurrency, especially when you know the price of 1 BTC.

Impact on market

It’s obvious that holders of such a quantity of coins create an impact on several things. Let’s review the most meaningful ones:

- Liquidity.

- Valuation.

- Governance.

Liquidity

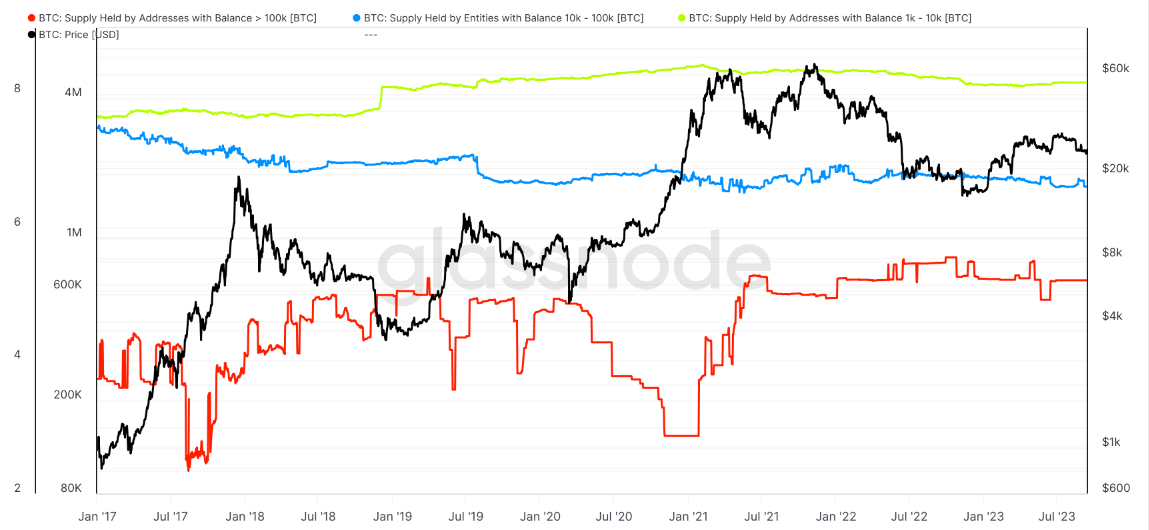

Crypto whales usually are inactive in transactions. It directly affects the liquidity of the coin because they own a significant amount of Bitcoins compared to all circulating BTC. There are holders which reserve more than 15% of the cryptocurrency. It is around 3000000 BTC. Their usual holding is 10000 Bitcoins and more. These accounts have a certain influence, but it’s not as big as other holders have. Other accounts hold nearly 44.49% of BTC circulation. It is around 8.8 million Bitcoins.

These whales have from 10000 BTC to 100000 Bitcoins. Such a quantity creates a hole if it is not used. And as it stands many of these accounts are inactive or rarely active. The impact on liquidity is huge.

Valuation

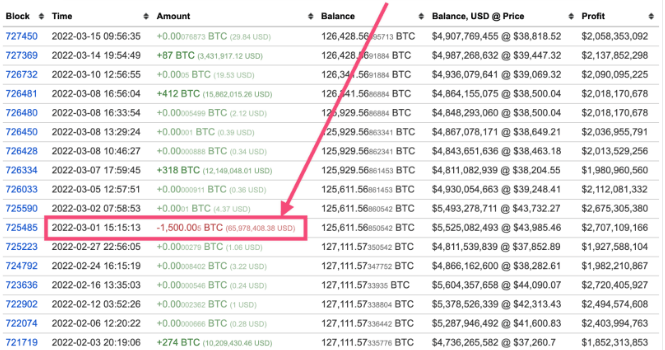

The valuation is undoubtedly affected by that enormous activity. If such crypto holders make a transaction with a large amount of coins, it creates big fluctuations of the price. Let’s take a look at the graph to understand that influence:

Let’s review an instance. If many whales together create a reduction of liquidity and one of them decides to make a transaction on the scale this big – it works as an indicator for other investors.

Usual investors observe the exchange flow mean. If the mean amount of coins per transaction overgrow the 2.0 mark wallet’s owner is going to start dumping the crypto. It should correlate to a large number using the exchange. Let’s take a look at the real-life instance:

However, the valuation is also influenced by the outside indicators of a whale’s potential moves. News or social media can directly affect the price when each one predicts and notifies about such an account’s intentions.

Governance

Certain blockchains provide coin holders with a voting ability. Such votes can directly affect the future of the blockchain and a whale has much bigger influence than a usual investor. In that case they can improve their own situation by making things worse for others. Lowering the decentralization can decrease this certain blockchain’s attractiveness which will badly affect the future valuation of it.

The influence on other investors

Transactions of such wallets, especially when it includes a large amount of crypto, can directly affect the market. Simple example: holder of a large quantity of coins decides to transfer holdings to another wallet and it can be interpreted wrong. The valuation will be affected greatly and other investors can see that as an indicator.

Common investors know about the power of whale’s transactions and observe their addresses.

Observation for the whales activity

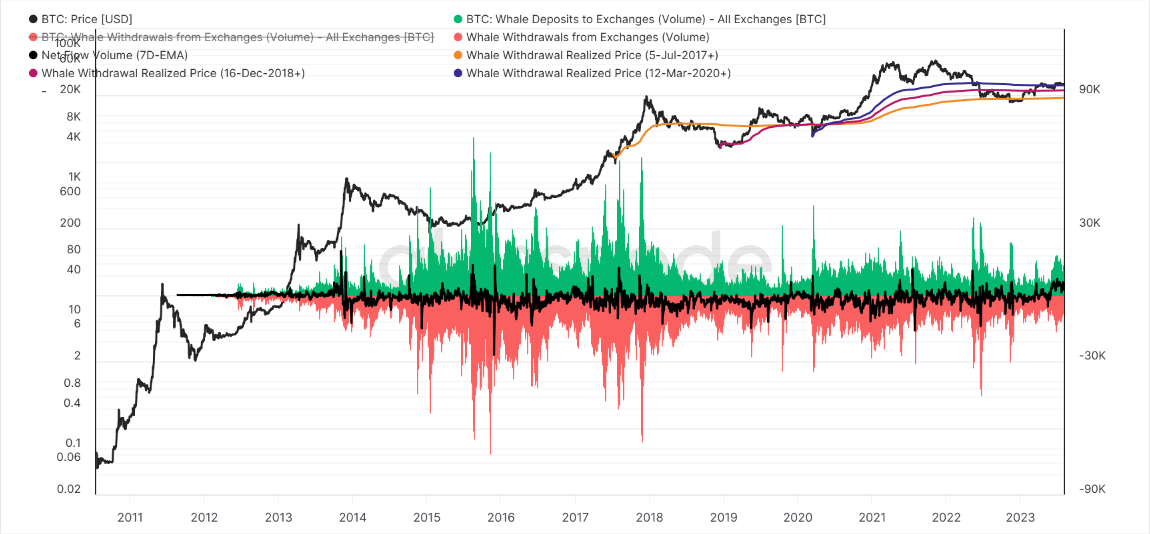

Crypto whales are constantly being watched because of their potential impact on the market. Not only common investors monitor the situation – some platforms are specifically used to follow and notify about their moves. Such close observation helps to understand all the fluctuations and changes and apply this knowledge during investing. Let’s review an example of the observation:

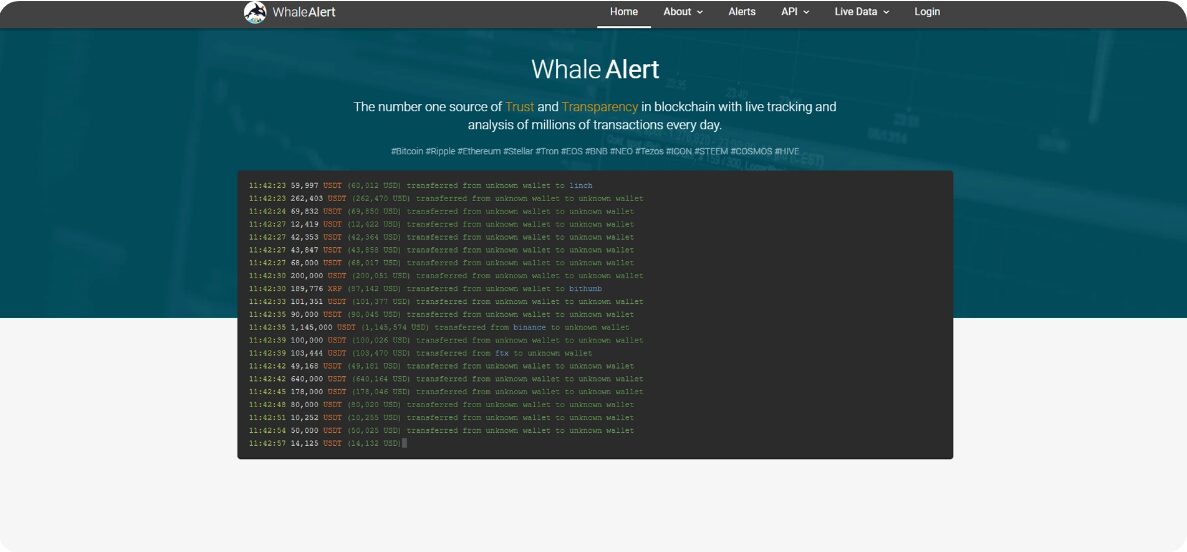

In addition, you can have a look at the Whale Alert website which notify you about their activity:

Meaning of being a crypto whale

IT means having a large quantity of certain cryptocurrency – enough to have an impact on the market. The scale of the influence is directly connected to the amount of holdings.

Who owns the most amount of BTC

It is not discovered who is the owner of this whale account. But one thing we do know is that it’s featured in BTC’s white paper holding 1000000 Bitcoins. Currently, it equals $95.171 billion. The ownership is an open question, but main suggestions are: the group of crypto whales or the creator of Bitcoin himself – Satoshi Nakamoto. If he is the only owner of such a wallet it would make him the largest whale in the world.

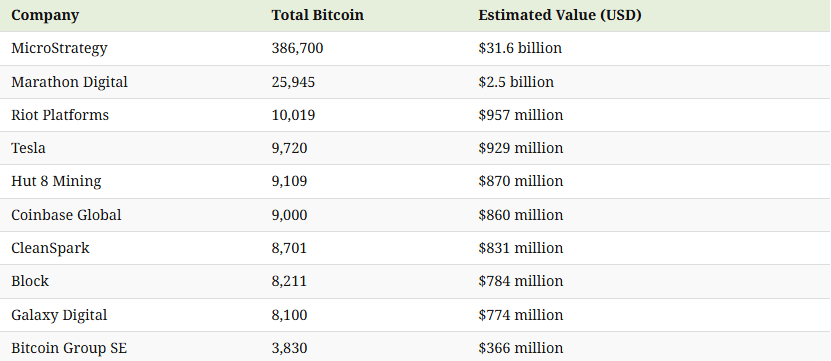

In addition, let’s review the current list of top companies who hold Bitcoins.

Protection mechanism of the anonymity

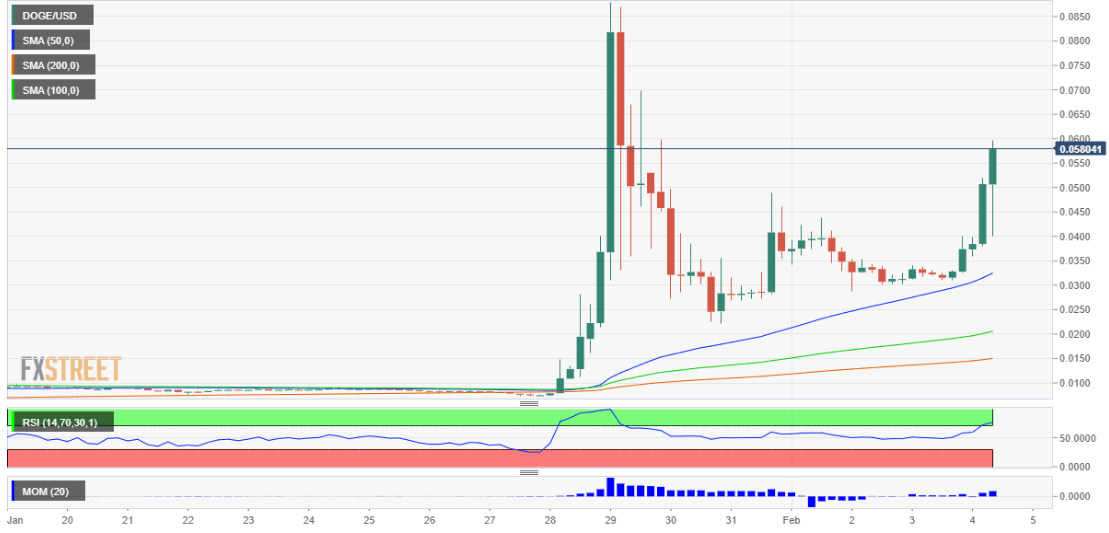

Usually, every crypto investor prefers privacy. Anonymity of their transactions and holdings, especially in cases of such enormous amounts of coin, are very desired for many uncountable reasons. We have a great example: the situation with Elon Musk and Dogecoin. He was accused of increasing the cryptocurrency’s growth by gathering attention to it and selling his holdings after the price rose up. Review the chart of DOGE which observes that period:

This situation led Musk to ensure the anonymity of his crypto transactions and holdings.

Q&A

Impact on liquidity

Whale’s account has a huge influence on the market liquidity. If the wallet holder is inactive the liquidity lowers down due to decreased supply.

Impact on valuation

Every large transaction can change the valuation and the tendency. If a crypto whale starts dumping it can lower the coin price significantly.

The influence on governance

Such account holders can directly influence the future of the blockchain and the currency, because he owns large quantities of cryptocurrency. Several platforms have a voting system which is based on the quantity of currency you have. More coins – more impact.

The richest BTC billionaires

- Changpeng Zhao – $57.4 billion.

- Brian Armstrong – $6.9 billion.

- Michael Saylor – $3.8 billion.

- Chris Larsen – $3.1 billion.

- Jed Caleb – $2.9 billion.

- The Winklevoss Twins – $2.7 billion each.

- Fred Ehrsam – $2.1 billion.

- Tim Draper – $2.0 billion.

- Matthew Roszak – $1.8 billion.

- Joe Lau – $1.5 billion.

- Nikil Viswanathan – $1.5 billion.