The world still needs to learn more about cryptocurrencies and how to integrate it properly into the economic system. It leads us to the number of regulations in each country. Let’s review the situation.

Reasons of cryptocurrency regulations

To understand the initial goal of these regulations, we need to learn the government position about crypto. Internal revenue service of the USA, for example, views crypto as a property. That’s why it charges the familiar with the classic investing, taxes on the income. Conditions of these taxes depend on the duration of deals. If investors gain a fast, short-term profit – the conditions are harsh. On the other hand, long-term deals are met with a softer approach. Holding the security over a year, decreases the amount of taxes.

It leads crypto traders to be more careful with their transactions. Even owners are obligated with maintaining all the records about their positions.

Issues with regulations

Financial Crimes Enforcement Network (USA’s organisation) were not so positive with crypto and did not accept it as a legal tender. Only in 2012 their intentions to use it as a replacement for basic currency. It led to the merger between the crypto and traditional currencies as both valid ones. Money transmitters of each of them are controlled by the Bank Secrecy Act.

Another organisation, The Commodities Futures Trading Commission (CFTC) verified the crypto as a valid way to trade on public derivative markets and created certain regulations. These regulations are meant to surpass illegal activity with crypto by restraining wash trading and prearranged trades. These rules were mandated by laws.

Rules around the globe

When crypto rushed into the market with such intensity, governments around the world decided to step in and create certain rules about usage of new currency. Let’s review them.

USA

In 2022 The United States made a move which led to other regulations. New directive directly helped both organisations: Securities and Exchange Commission (SEC) and CFTC. This move created new opportunities for the future regulations.

The SEC started a full confrontation with Ripple, Coinbase, Binance and etc.

After only one year the organisation lost the trial to Ripple. A district court of appeals made a crucial decision: Ripple’s sale of XRP were assets offerings only in case of selling to institutions. The exchanges transactions did not include. This verdict led to the next move. In November of the same year, the Commission rejected Grayscal’s claim. Grayscal desired to courconvert its Bitcoin ETF trust to an ETF as a BTC holder. Later on, the battle continued. The court ordered another review of Grayscal’s claim. This action entailed the approval of certain requests: January 2024 – first BTC Spot ETFs; July 2024 – First Ethereum Spot ETFs. Overall, the battle continues. New regulations will appear and the counteract will be expected.

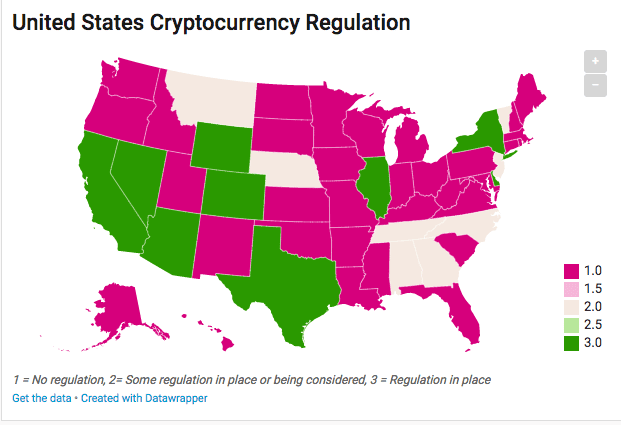

On the picture below you can see the regulation’s situation in the USA.

China

China acted very strictly. The People’s Bank of China forbids all cryptocurrency companies to operate within the country. Main reason: it contributes public financing without any permission.

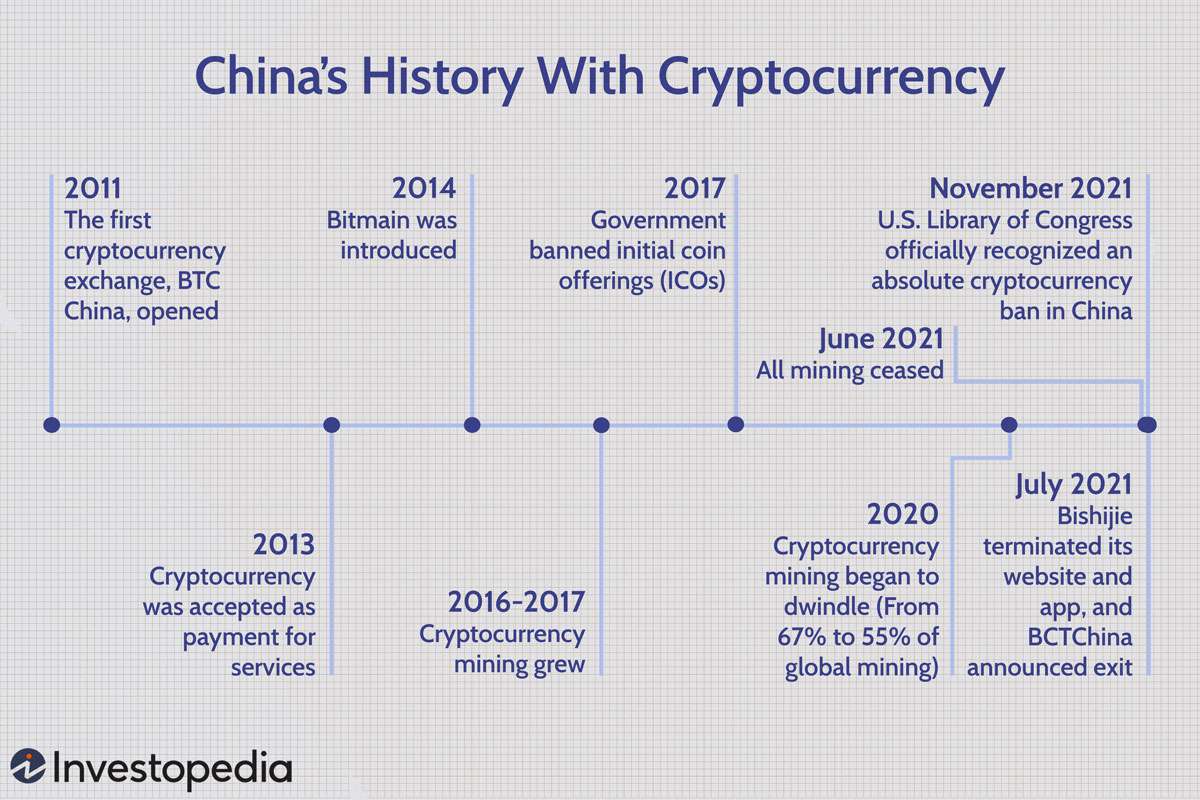

Another block happened in May 2021. BTC mining became illegal. At the last nail to the coffin: total forbiddance of cryptocurrencies in September 2021. Here’s the historical sequence of actions below:

Canada

Despite that Canada does not accept crypto as a legal payment method, it still made a lot of moves in the regulation direction. It was the first country around the world who permitted a BTC ETF. It includes a number of transactions on the Toronto Stock Exchanges.

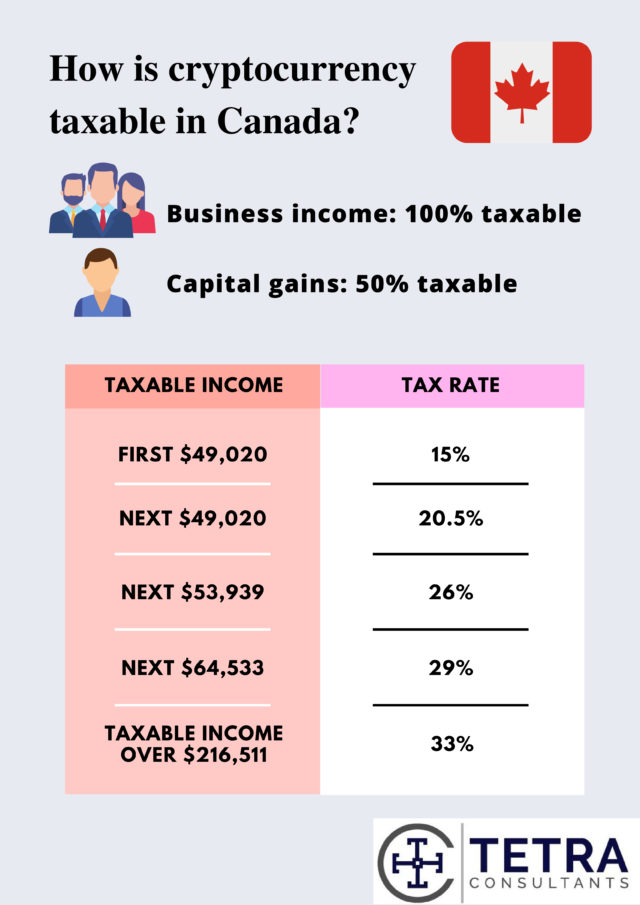

Canada’s taxation of crypto is simple: it is obligated with the taxes as other commodities. That’s why the country refers to crypto organisations as money service businesses.

Let’s take a look at the chart of crypto taxation in Canada.

The United Kingdom

This country faced cryptocurrencies by accepting it as a regulated financial tool in October 2022. Another law was created in June 2023 – The Financial Services and Markets bill. It works as an addition to the first regulations.

The United Kingdom required a certain level of reporting. It relates to:

- Know Your Client standards.

- Anti-money laundering.

- Combating the financing of terrorism.

People pay capital gains taxes on any crypto activity’s profit. The amount of taxes depends on certain conditions:

- Person engaging in the crypto transaction.

- The type of crypto activity.

The reporting to the Office of Financial Sanctions Implementation is required for custodian wallets and crypto exchanges. The organisation should be informed about suspicious people who can be a sanctioned person or who broke the law against financial sanctions, respectively.

Japan

Japan met new currency with open arms. This country’s regulations make a point: crypto is a legitimate possession which means that it is under Payment Services Act. New currency’s exchanges must be registered with the Financial Services Agency and abide by AML & CFT obligations.

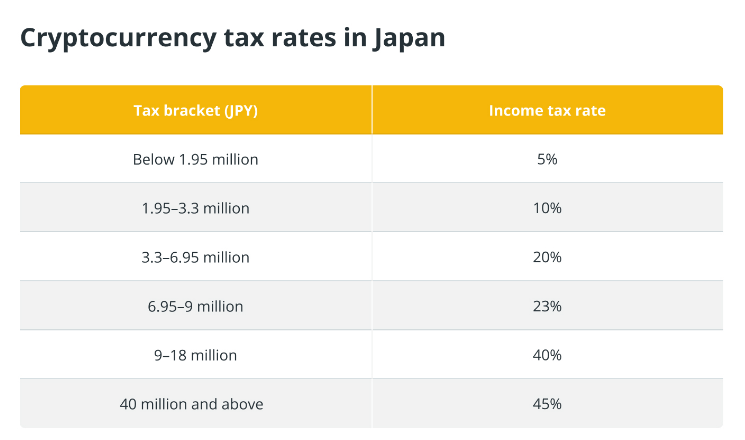

In 2020 the country created the Japanese Virtual Currency Exchange Association: all crypto exchanges became participants. Profit from crypto is obligated with taxes for the sundry income.

Let’s have a look at taxation levels of crypto in Japan:

More regulations applied with time. The government proclaimed in September 2022 that certain rules of transactions will be applied in May 2023. It was put in place to counteract money laundering with cryptocurrency. Therefore, The Act on Prevention of Transfer Of Criminal Proceeds allowed to gather the intel of customers to improve the purity of transactions.

Australia

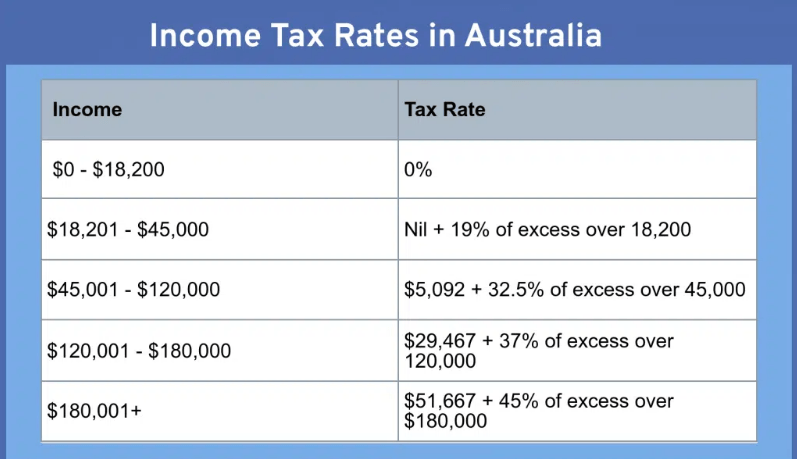

This country adapts the new currency as a legitimate possession. It is obligated to pay capital gains taxes. In addition, exchanges have to register with the Australian Transaction Reports and Analysis Centre. Also it must follow particular rules with AML & CTF. After that has been done, an exchange can operate in Australia. Here’s the taxation chart in Australia:

Let’s continue. The Australian Securities and Investments Commission published several regulations for ICOs in 2019. These rules restricted all privacy cryptocurrencies on the country’s territory. By doing that, Australia banned the possibility of anonymous transactions. The next move was made in 2021. It was announced that the country is going to elaborate a new licensing framework around coins. Moreover, there was a possibility of launching a central bank digital currency.

Singapore

Singapore decided to identify crypto as a property. Despite that it is not a legal payment method The Monetary Authority of Singapore (MAS) approves and controls crypto investing organisations under the Payment Services Act.

It was followed by other rules in 2022. Digital payment token providers were warned: they should not promote their cryptocurrency’ services to the people in the country. Another important establishment happened in August 2023. The MAS shared the plans of a regulating framework. It should control stablecoin flow in the country. Providers met several requirements. The MAS must approve stablecoin. Therefore, stablecoin must have a «MAS-regulated stablecoin» label.

Even though the country met crypto with certain suspicion, long-term income is not obligated with taxation. On the other hand, a company which operates transactions with crypto on a regular basis pays taxes.

South Korea

This country blocked all privacy cryptocurrencies in 2021 as Australia did. There is a certain procedure of a registration with the Korea Financial Intelligence Unit. Every crypto exchange must do it to gain access to operations within the country.

Several rules became intact in 2023. The Act on the Protection of Virtual Asset Users decreed full empowerment of the Financial Services Commission. It was followed by labeling the new currency’s usage: legitimate and illegitimate. This concept is based on the protection of users because crypto providers are obligated to follow the rules of legal activities.

India

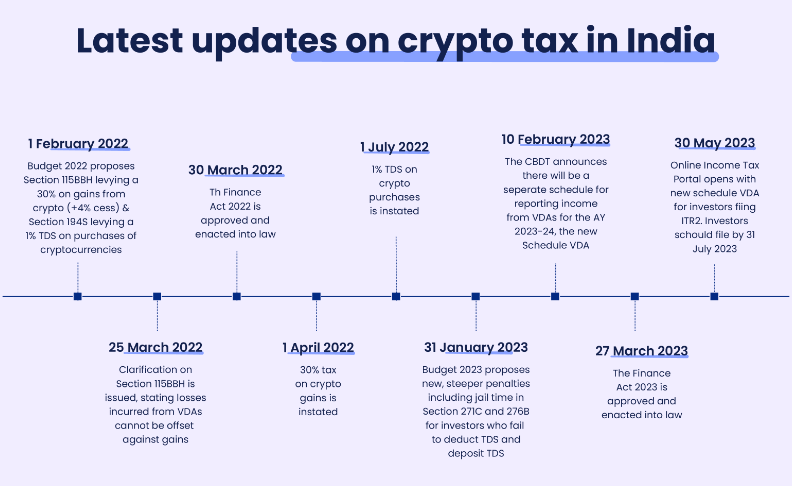

At first, this country stayed in a neutral position with rules of crypto usage. India plans to restrict private coins, but it is still not quite progressed. Although, India established a 30% tax obligation with all cryptocurrency investments. Moreover, the country added a 1% tax subtraction on all crypto trades. Let’s review the historical sequence of taxation in India:

However, it is still a blurry situation. India is still deciding: to ban or to regulate. The Finance Bill of 2022 identified crypto as property and explained all taxation conditions with any income from new currency.

Brazil

Same adaptation story happens in Brazil. BTC is not a legal payment method. Despite that the country moves towards innovations and provides the law which legalizes crypto as a valid payment method. On November 29, 2022, Brazil’s Chamber of Deputies gave a green light to a new regulatory framework which led to legalization.

European Union (EU)

Crypto is under overall legalization in almost every country of the EU. But there are certain individual details with regulations which are directly connected to each government of the EU members. Range of taxation within EU countries measures from 0% to 48%. In the recent past, EU’s 5th and 6th Anti-Money Laundering Directives applied. Both of them cooperate with Know Your Client & Combating the Financing of Terrorism.

The European Commission announced the Markets in Crypto-Assets Regulation in September 2020. It is a framework which improves consumer safety and defines regulations of crypto more specifically. This was followed by the next move in April 2023. Parliament approved certain obligations: providers of the new currency’s services must get an operation license to work legally. This regulation helps in the fight against money laundering and terrorism funding. All-in-all, the consumer became more protected.

Q&A

Is there any regulations of cryptocurrency

There are several regulations of crypto around the globe. Each country has an individual position – it leads to certain regulations in them.

The most friendly state in US with cryptocurrency

For instance, California, Florida and Texas are very friendly states to operate with cryptocurrency.

Rules of crypto trading

Depending on the chosen country, you will face different regulations, but there are general rules which are the same in all of them.