It’s difficult to make the right call: closing the trade or playing longer. That’s where the exit strategy steps in. Let’s discuss: why it is a valuable component in the whole trading process and how it helps to reduce the influence of the human factor.

- Definition of the Exit Trading strategy

- Importance for Crypto market players

- Human factor behind the decisions to sell and to hold

- Contract-For-Difference(CFD): stop-loss & take-profit

- Risk reward

- Risk tolerance

- Creation of an Exit strategy

- Determining the target

- Identifying the existing market condition

- Detecting right exit points

- Market volatility incorporating

- Exits which are based on timing

- Special exit strategies in crypto trading

- Partial selling

- Usage of technical indicators

- Hedging

- Algorithmic & bot trading

- Sentiment analysis exit

- FAQ

- Reason for the existence of exit strategies

- Useful exit indicator

- Definition of exit in trading

Definition of the Exit Trading strategy

As it comes from the naming, the exit strategy is a tactic, which is used by a crypto trader to sell his holdings. It is a combination of both timing and method of executing the transactions to achieve the profit without huge losses.

Importance for Crypto market players

The crypto market is quite volatile and it’s difficult to predict the exact values. That’s why having a working exit strategy is efficient. Such a plan helps to reduce the human factor behind all important decisions.

Human factor behind the decisions to sell and to hold

It is almost impossible to have no emotional reaction throughout the whole trading process. Market players are afraid of potential losses and can hold too long, which results in much larger losses. It is the reason behind using an exit strategy that is able to put these feelings out of the equation and improve the quality of the trade.

Contract-For-Difference(CFD): stop-loss & take-profit

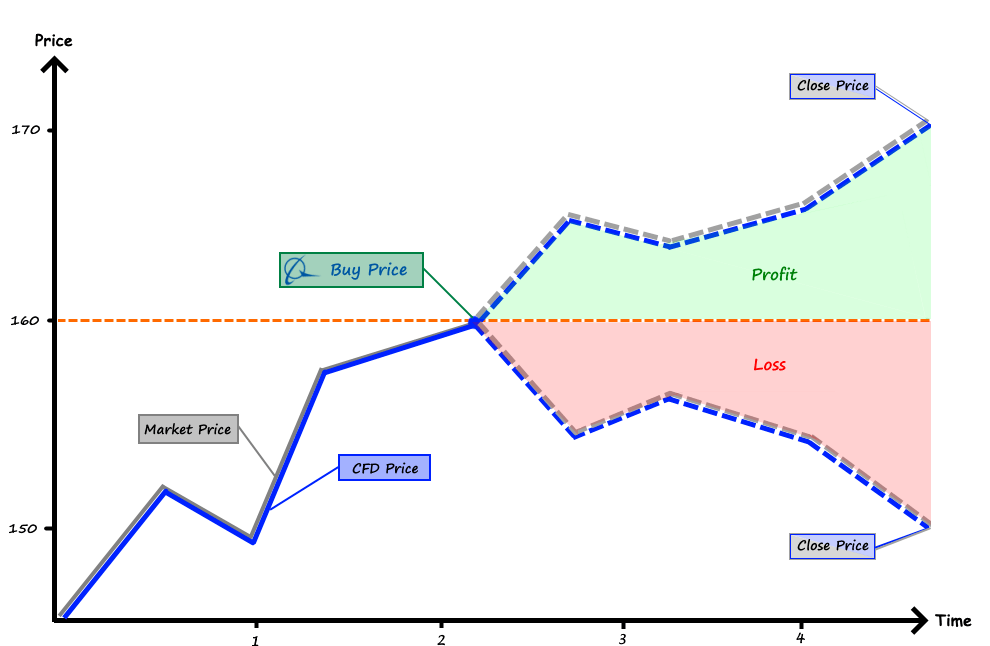

It is crucial to have an exit strategy during a CFD trade, because it backs up the strategy with stop-loss and take-profit orders. Stop-loss orders assist a market player with the ability to identify the exact valuation, when the position becomes a losing one. When the price reaches this point, stop-loss automatically turns into a market order. This kind of saving method is very efficient to avoid possible losses.

In addition, the trailing continues with the valuation. In case the price stands at the same values, the stop-loss value will remain the last relevant level.

The other part which needs to be reviewed is a take-profit. It is an order which shows the best possible time to close a position to gain profit. It is a converse order to stop-loss, because the principle is very similar. When the necessary value is reached it converts to a market order.

Here’s a graph below which shows the CFD trading model:

Despite all that, you need to remember about the volatility: observe and analyse to get the asset with enough space for fluctuations. There are several ways to put the volatility into the equation: technical tools and fundamental factors. It is crucial to consider the volatility, because it plays a big part in the principles of CFD trading’s work.

Risk reward

It is important to get an understanding that the risk is worth taking. That’s why the risk-reward ratio exists. It visualizes the result of a potential trade.

For instance, you buy an asset which costs $100. Then you place the stop-loss order at $ 99.50. The potential growth of this specific asset can reach $101. In that certain case we have several equations:

- $100 – $99.50 = $0.50. It is the risk value per one trade.

- $101 – $100 = $1.00. It is the reward value.

- $0.50 / $1.00 = 0.50. This is the value of RRR. (1:2)

It is considered as an optimal RRR value. 1:1 is highly dangerous to work with.

Risk tolerance

Main principle of risk tolerance lies in the individual ability of a trader to handle a loss. There are several chances of losing emotional control over the situation due to a fear of the possible loss.

When a market player decides to step in, it’s crucial to determine the amount of capital that can be lost during the trades. The usual risk-per trade is estimated around 2% of the whole capital.

With both stop-loss and take-profit orders included, the trade is guarded with several layers of protection from huge losses.

Creation of an Exit strategy

You need to follow several rules to create a working exit strategy which would fit to your individual trading preferences. Let’s learn them step-by-step.

Determining the target

It is crucial to consider your own goals to build an optimal exit strategy. Calculating the capital, measuring the acceptable loss – all of that helps to draw the lines on both sides of the market.

Identifying the existing market condition

You simply can’t ignore the existing market sentiment. It plays a huge role in the outcome – that’s why a trader should use a variety of technical tools and a fundamental analysis which helps to understand and acknowledge the prevailing trends and possible changes of the valuations within the market.

These are the instruments you can use to determine all the necessary intel about the market:

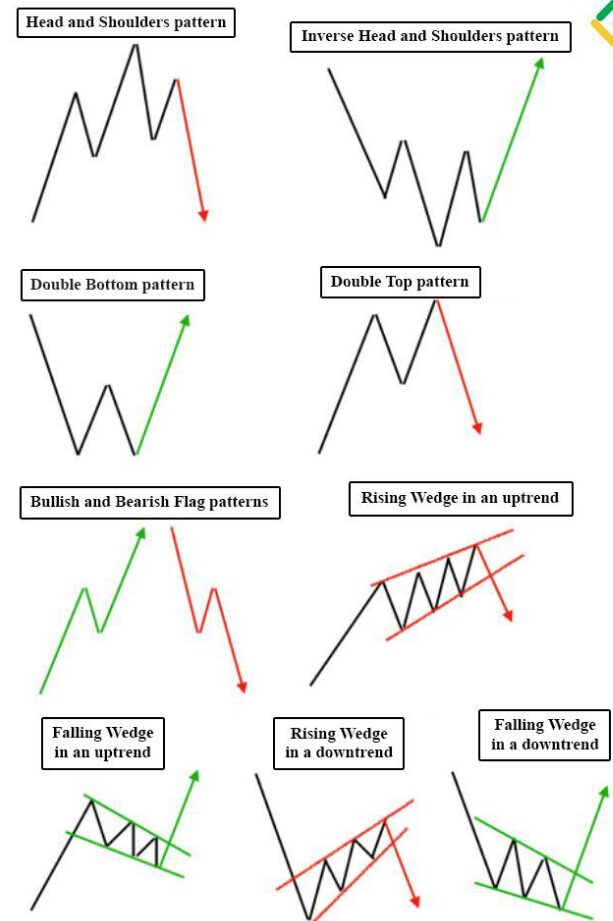

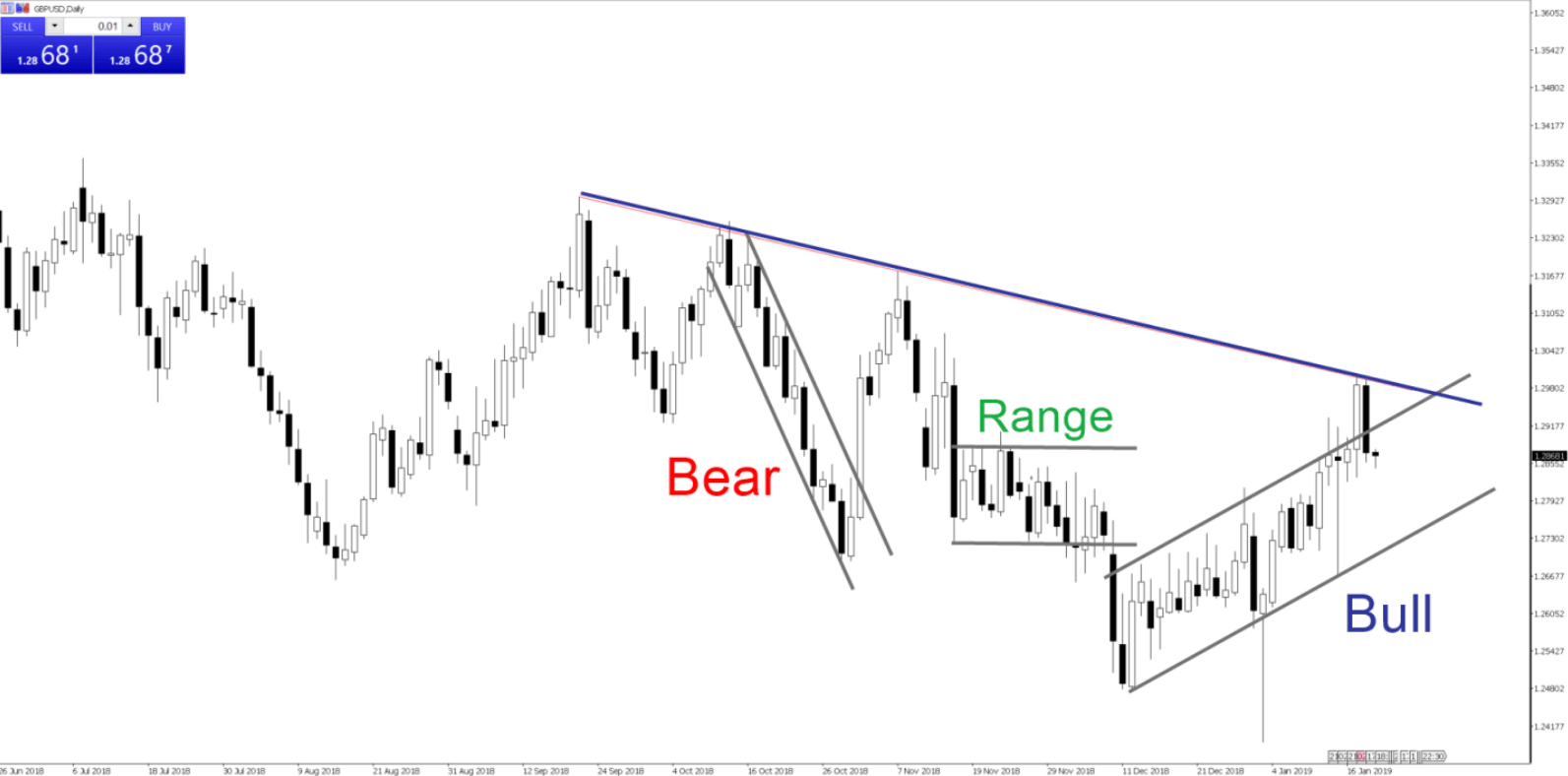

- Technical: chart patterns, indicators and trend lines.

Examples of chart patterns:

An instance of trend lines:

- Fundamental: make an observation for economic reports and news, events and the market sentiment itself.

Detecting right exit points

One more key component of the exit strategy is the detection of preferable exit timings. There are several steps you need to do while identifying the right level:

- Detection of support and resistance levels. Use multiple technical tools to identify them. The common ways to exit the trade: near resistance in the long-term positioning, near support in the short-term positioning.

- Trailing stops. This is a dynamic protection of the capital. Such adjustments of the value prevent traders from making poor decisions and maximise the potential profit.

Market volatility incorporating

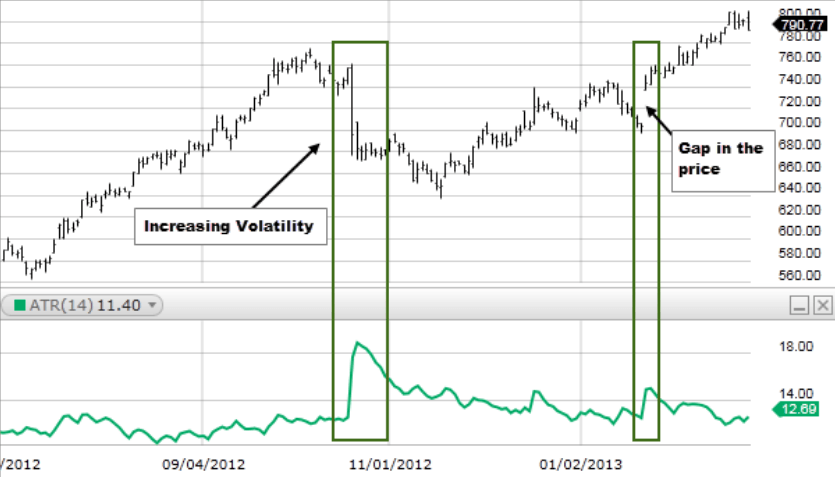

As we already know, the aspect volatility plays an indeed crucial role in the possible price fluctuations. You need to make stop-loss and take-profit levels wider if the trades are executed within the highly volatile market. It will help to prevent a market player from early exits.

The higher ATR values – the higher the volatility is within the observable market. Take a look at the example of ATR usage below:

Exits which are based on timing

If a trader decides to avoid risks he also can base the exit strategy on timing. Such trades will be closed after a curtain calculated period of time. This type of exit doesn’t depend on profit or loss – it just helps to hold the owned asset for a medium amount of time. Moreover, such traders have a decreased impact by overnight risks and weekend gaps.

Special exit strategies in crypto trading

If a trader is qualified enough, he can use certain exit strategies which are more advanced. Such strategies have a more precise and sophisticated way to gain profit and avoid capital losses. It’s a complicated structure of technical analysis. risk management patterns and existing market sentiment. Let’s review them.

Partial selling

It is the process of selling a part of the crypto holdings. The rest of the investments stay within the portfolio. By doing that, market players gain some profit and retain the bigger part as an existing investment. This method of trading has both benefits and drawbacks.

Benefits:

- The granted profit and the ability to stake on a possible growth in the future.

- A wider choice list which helps to decrease the risk.

Drawbacks:

- The cost can skyrocket upwards after such sellings, which results in a reduced overall profit.

- More complicated and detailed observation for the holdings.

This strategy fits in cases where you want to gain the granted reward and believe in a future potential growth of this specific asset.

Usage of technical indicators

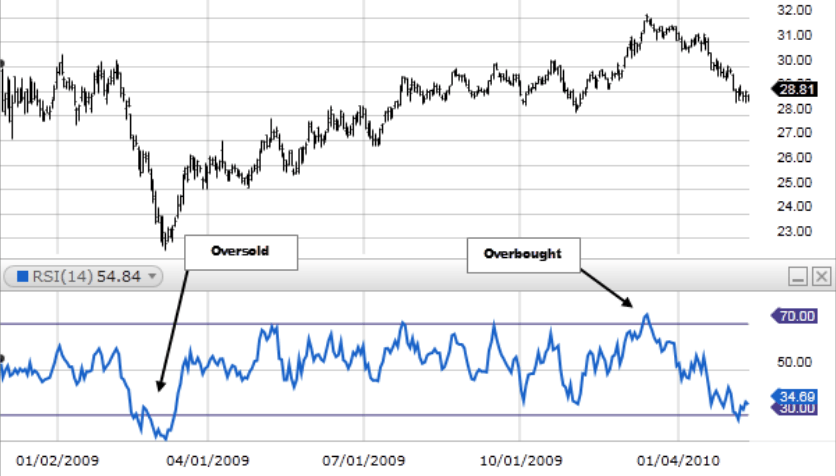

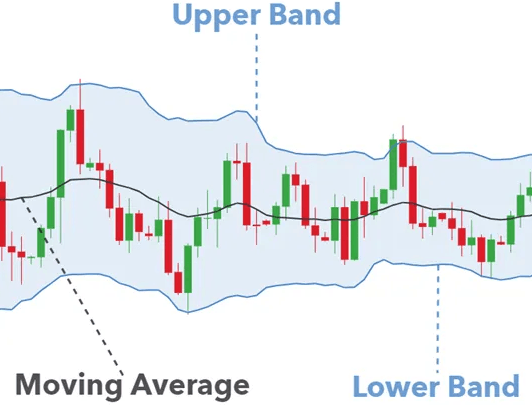

This type of trading suits a trader who has enough knowledge to perform a qualitative technical analysis and trusts this method highly enough to base an exit point on it. The usual list of technical tools involves MACD, RSI and Bollinger Bands which helps to identify an exit point. Take a look at each of them in the pictures below:

MACD:

RSI:

Bollinger Bands:

Let’s review both pros and cons of such a strategy.

Pros:

- It is a trading model which is based purely on the technical aspect of the market.

- Ability to identify early exits which helps to avoid the possible downward movement of the price.

Cons:

- It is a sophisticated method and demands significant knowledge to be used.

- Even with all advantages, this strategy doesn’t have a pure accuracy. There are possibilities of false signals which can mislead to poor trading decisions.

Hedging

It is a smart way to profit from both rising and falling from one asset. It works by the principles of short-selling a related crypto, if the initial asset is rising or buying the derivative crypto in case of the strong downward trend of the initial holding. This method is a profitable one, but has its own disadvantages.

Benefits:

- Protection from possible losses which can occur due to downward moving patterns.

- Ability to gain profit even in case of a declining market.

Drawbacks:

- It is a difficult strategy with many things to estimate.

- Possible scenario where both of the assets will fall which can result in a huge loss.

Algorithmic & bot trading

This method requires a purely technical approach. Traders use computer algorithms or bots to trade. That way of trading is based on a certain predefined factor which can be given by technical tools. The received indications can mean several conditions of the market. Let’s discuss pros and cons of such a method.

Pros:

- Completely puts out a human factor out of the equation.

- Ability to make transactions in a much quicker and efficient way.

Cons:

- The strategy fully depends on the fundamental program of the calculating machine. Few mistakes can result in several losses.

- Constant observation which is required for ensuring that the executed algorithm performs on the necessary level.

Sentiment analysis exit

Market players who chose this kind of strategy observing the data of the social media field, news and e.t.c. Gathered intel helps to understand the existing market sentiment and, consequently, the right timing of exiting. It is an efficient strategy, but has its cons.

Pros:

- Ability to know about the possible market shift before it occurs.

- Gained knowledge about the human psychological factors which impact on the market.

Cons:

- Market sentiment can be highly subjective and it’s difficult to identify the right mood.

- Abrupt shifts in the sentiment may misguide traders.

FAQ

Reason for the existence of exit strategies

Main reason is to simply reduce the potential losses and increase the profit. Such strategies help to clarify the optimal solution in a variety of market situations.

Useful exit indicator

Indicators which contain collaboration between ATR and support/resistance levels are efficient models of technical analysis.

Definition of exit in trading

It is defined as closing the existing trading position. Basically, it means the selling of an asset in case of a long-term position trade and buying-returning process in a short-term one.