There are many ways to get more coins if you’re investing in cryptocurrency. Traditional mining is no longer as common as it used to be due to high initial investments and the fact that it’s difficult to pull off successfully in 2024 without large farms. But there are other ways, such as staking, yield farming, and minting.

- What is Stablecoin Yield Farming?

- How Does Farming Stablecoins Work?

- Best Yield Farming Strategies for Stablecoins

- Lending

- Liquidity Provision

- Best Yield Farming Platforms

- What Stablecoin Is the Most Suitable for Yield Farming?

- The Strategies to Maximize the Profits

- RIsk Management in Stablecoins Yield Farming

- Tips for Beginners

- Tips for Experienced Users

- Is Stablecoin Yield Farming Worth It?

And in this article, we will take a look at exactly how exactly yield farming works. And we will focus on stablecoins specifically. After all, it’s the main way to farm more of them. But, of course, there are certain risks and caveats.

What is Stablecoin Yield Farming?

Yield farming is a method of receiving rewards by lending or staking a decentralized asset. Providing liquidity by other means is also possible. The strategy is usually very high-risk, but the returns are significant. It’s also a form of passive income.

It’s possible to farm stablecoins, at least those backed by cryptocurrencies, since they’re mainly decentralized in nature. Moreover, it’s a relatively low-risk method due to the low volatility of stablecoins’ prices.

Picture below shows the meaning of the yield farming term.

How Does Farming Stablecoins Work?

One can deposit stablecoins into liquidity pools on decentralized platforms. The pools are essentially smart contracts that provide liquidity to the market and make decentralized exchanges function. In the return, the investors get nice fees and payments. Stablecoin yield farming works the same way. While the design of most stablecoins make them a low-volatile asset, in turn minimizing the majority of risks of yield farming, some of them might still appear.

The Picture below provides a definition of a stablecoin.

Best Yield Farming Strategies for Stablecoins

And now it’s time to take a look at the exact ways one can approach stablecoin yield farming. Generally, there are two main strategies one can use to generate income this way: either by lending or providing liquidity to the pools. Let’s explore both in the next two sections.

Lending

Stablecoin lending in DeFi works by creating smart contracts between lenders and borrowers. They can use such coins, and a lender will get some interest rates. Lending is a more stable strategy since it has fewer significant risks, but the rewards are smaller compared to liquidity provision, which we’re going to describe in the next section. By combining the stability of lending with the low volatility of stablecoins, you can probably get the safest possible way to farm.

Liquidity Provision

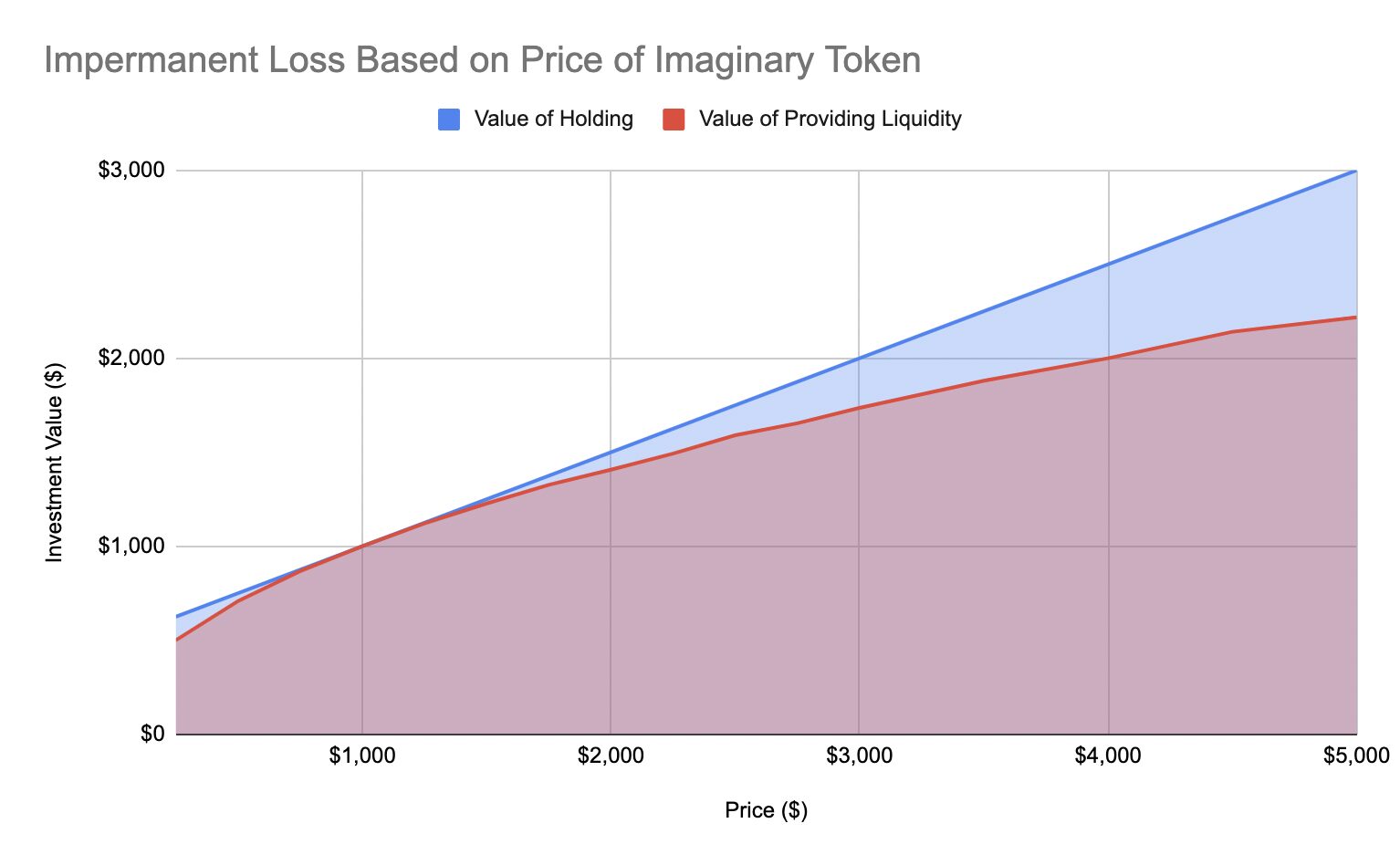

Liquidity provision is another strategy. In essence, it’s very similar to lending, yet there are certain differences. The idea is that you provide two currencies for trading pairs and receive fees from transactions. In DeFi (decentralized finances), it’s usually what makes the exchanges function. There are higher risks associated with providing liquidity, such as impermanent loss.

Best Yield Farming Platforms

There are plenty of decentralized platforms to choose from. When doing your research, you have to keep in mind aspects such as their fees and interest rates, the number of supported assets, and the reputability of the platform.

Here are some platforms:

- Uniswap;

- Pancakeswap.

What Stablecoin Is the Most Suitable for Yield Farming?

These depend on your needs, but two main things to consider are the popularity of the coin and its stability. The former means that there’s always demand, while the latter is great for risk reduction. After all, the main reason why some investors aim to yield farm stablecoins and not other assets is their lower volatility.

Below is the list of best stablecoins on the market that you can use:

- Tether (USDT);

- USD Coin (USDC);

- Dai (DAI);

- FRAX;

- Pax Dollar (USDP).

The Picture below shows the difference between USDT and USDC, the most popular stablecoins on the market.

The Strategies to Maximize the Profits

There are certain tactics you can use to increase your possible profits. Here are some of them:

- Choose a liquidity pool correctly. You need higher yields.

- Diversify your portfolio by looking for more pools and finding other platforms.

- Reinvest your returns.

- Think long-term but don’t forget about short-term results completely. This, of course, depends on the exact strategy you’re using.

RIsk Management in Stablecoins Yield Farming

While stablecoins are low-volatile by design, yield farming them carries lower risks compared to doing the same activity with less stable currencies. This is obvious and to be expected. Nevertheless, plenty of risks still exist. And DeFi comes with its own set of related possible issues. And you have to keep in mind that if you’re providing liquidity, then there’s a risk of impermanent loss.

Below are some recommendations that you can use to make the process safer.

- Think smart when choosing your investment strategy. Lending is generally less risky but has lower returns as well.

- Make sure your coin is definitely stable. The lower volatility, the better.

- Use impermanent loss calculators. They will help you to grasp the concept better, as well as understand the risks clearer.

You can take a look at a Picture that shows how an impermanent loss graph of an imaginary token might look like.

A materialization of the risk of impermanent loss. How it can look like in the scenario when holding an asset would be a more profitable option compared to providing liquidity.

Tips for Beginners

Let’s provide some recommendations that can help some investors that only start trying their hand at stablecoin yield farming.

- Start with the research. Understand the risks and how yield farming and its strategies work. Our article can be a good starting point, but there’s a lot more to uncover.

- Choose only reputable platforms. When selecting a platform, you have to understand what it can offer. Check out whether they support the assets you own, and their interest rates and fees.

- Start small. This is essential advice for any type of investing, especially for those that can get risky quite high. By investing small amounts, you can get a feel of the way yield farming works, understand whether it’s a suitable method for you, and do so without the chance of losing large sums.

Tips for Experienced Users

While experienced investors usually already already know what they’re doing, some things are worth to be said over and over again. Moreover, some tips might be obvious but it’s easy to ignore them or forget about them. Let’s check them out.

- Diversify your portfolio. Using different currencies, liquidity pools, and platforms are always better than keeping eggs in one basket.

- Monitor the investments. Keeping an eye on your liquidity pools is always helpful.

- Understand the risks and continue your research. While this top applies to beginners as well, doing more research and learning is always great even for seasoned investors.

Is Stablecoin Yield Farming Worth It?

Stablecoin yield farming poses certain risks, but the methods of reducing them are well-known. Moreover, it’s still safer and more stable compared to lending or providing liquidity for more volatile coins, due to the way these coins work.