It’s very important to analyse a huge list of factors before the start of any trading activities. And for the beginning you need to determine the entry point which is very crucial to potential results of the transaction. Let’s review many ways to identify such points and answer the question: why it is so important.

- Determination of entry & exit timings

- The Golden rule of trade timings

- Layered trade orders

- Efficient guide to choose the optimal trading strategy in Forex

- Methods to discover the best trading entry

- The importance of the trading entry

- Things you need to think about before making a choice

- Determination of the market environment

- Observation for the trend

- Variety of ways to enter the trading

- Efficient tools & methods to enter

- Trend against entries

- Detect the best timing

- Strategies of trading in Forex

- FAQ

- How to enter Forex trading efficiently

- How to discover the best way to enter the trades

- What should beginner do before the entering

- Which important factors must be evaluated before the strategy’s choosing

Determination of entry & exit timings

There is a lot to consider before entering and exiting the trades. The result of the analysis should be effective enough to determine both of these timings. Of course, it’s difficult to predict the exact value of an asset, but there are several ways to minimize the risk, increase the profit and all of that must be executed with no additional emotions.

If you consider entering the trades you should know that there are plenty of ways to enter the market and each of them could fit, but before making a choice, a trader must apply his individual planning and risk management to it.

The Golden rule of trade timings

The main rule of timings in trading: there is no guarantee that you will be certainly sure about the valuation and technical pattern exactly at the same time. Market players can adjust the strategy by observing the technical formation and use it as a fundamental base for the decisions or try to base their moves on a price level.

Layered trade orders

First of all, let’s sort all the necessary rules which we need to remember before diving straight to the trading:

- The overall connection between the cost and an indicator is weak.

- Possible false signals which can occur during the usage of a technical instrument. There is a certain unpredictability which exists within the principles of such indicator’s work.

- Technical divergences. It can be as good as bad, because it can directly happen right at the time when the trader wants to receive a profit.

Bearing all that in mind, a market player should put the price out of the equation. This will indeed help to decrease all the uncertainties during the process.

The timing of trading is very risky and one of the most efficient ways to reduce it is a layered defence line which will stand against potential market changes and possible troubles that are created by such movements. If you want not only to save your money, but to gain an income, there is another way to receive such profit: an attack layered line.

It works the same way as the defense line, but the goal is to withstand trading pressure and not to lose the capital before the exit. The main principle of that tactic is to conduct the owned assets within a layered manner.

It will significantly help to avoid false timings and withstand highly volatile periods. If a trader splits the trading in segments and puts a small part of the whole capital, it reduces the potential risks of huge losses. Then he can add more step-by-step whilst checking the existing trend. In that case, a market player has more chances not to lose, but to profit during the trades.

Efficient guide to choose the optimal trading strategy in Forex

Now you are up to the part when it’s time to choose the optimal strategy in Forex trading with all the necessary factors applied. Let’s review the whole list of them.

Methods to discover the best trading entry

As we already know, there are a lot of ways to enter Forex trading. It’s quite difficult to choose right at the start without any guidance. That’s why you need to prepare yourself and, most importantly, base your choice not only by the statistics, but by the individual trading patterns and the initial goals you want to achieve.

Here’s a plan to make a correct choice:

- Evaluate your capital.

- Create a risk management pattern.

- Prepare the initial trading setup.

After these things are done, you can start to adjust it all-together with an entry strategy which you chose. Further down the article you will learn several ways to enter the trades.

The importance of the trading entry

Even if you’ve a hint or an understanding of the asset’s potential, it will be useless without a good entry strategy. Here’s why it is so crucial to get the best possible timing:

- Minimizing the potential risk.

- Maximizing the possible profit.

- Ability to step away from the human factor and make fully conscious decisions.

- Improved time management pattern.

All of that comes with an effective trading strategy and completes the picture of a successful trading model.

Things you need to think about before making a choice

When you are finally up to the choice, there are several pivotal factors to consider:

- Market analysis. Right at start market players should define existing trends and movement patterns.

- Risk: Wise measuring of risk appetite helps to choose the most preferable strategy.

- Timeframe. Depending on the timeframe, traders can choose the trading strategy, because a different timeframe stands for a different strategy.

- Volatility. A potential market participant must consider its levels before entering the trades. It’s crucial to fit the strategy to the current volatility pattern.

- Trading plan. Existing plans, risk management: all of it must work in synergy with potential trades to achieve positive results in the end.

Determination of the market environment

Applying the knowledge of an existing market sentiment to the tactic is crucial to reach the profit. It all comes to the personal preferences of the desired result and initial capital.

Before making any choices a market player must define:

- Individual requirements for the market structure.

- Ways to trade: only one, multiple or even the whole list of trading strategies. You’re able to execute multiple ones if you spread your focus wisely and have the necessary knowledge and features of each type.

Observation for the trend

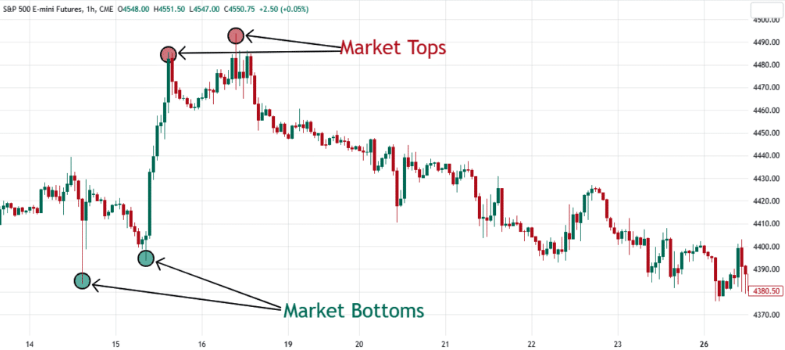

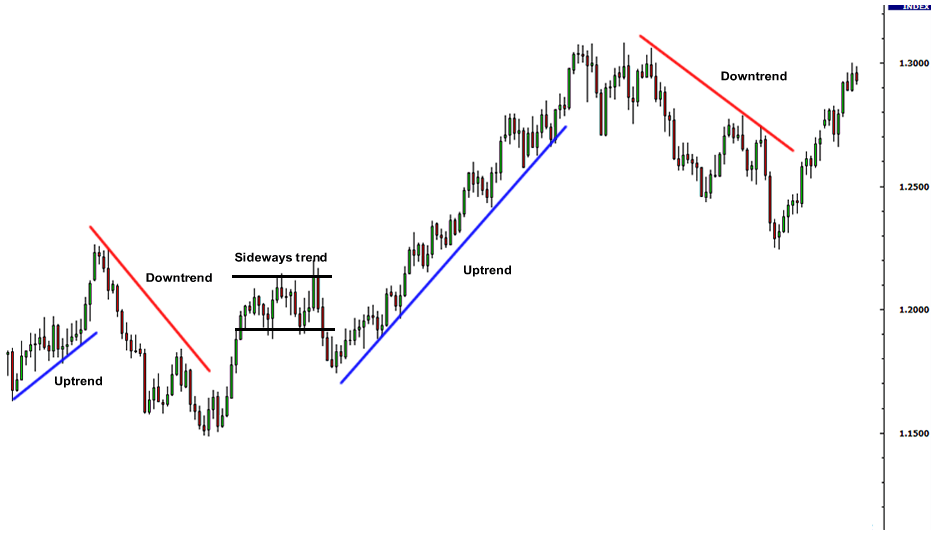

One more key component of the market is an existing trend. The movement direction of the price and its momentum are important before making any potential moves. Base the analysis on the difference between higher highs/higher lows and lower highs/lower lows.

Variety of ways to enter the trading

There are many ways to trade, but in case of Forex entries there are 3 specific types to determine the entrance timing:

- Level picking. Initial choice of entries.

- Wait for the confirmation signals. The valuation should respect a level.

- Momentum entries. Prepare yourself for the breakouts of specific levels.

Efficient tools & methods to enter

Now let’s sort several instruments and patterns which are used for each type of marked players:

- Level pickers. They use: top & bottom; high & low; fibonacci retracement; fibonacci target; trend line bounce; bottom & top of the range and chart pattern bounce. Take a look at several examples of them:

Top & Bottom:

High & low:

Fibonacci retracement:

Trend lines:

- Confirmation traders. Their arsenal: candlestick patterns around the expected support and resistance levels which are defined by usage of multiple technical instruments; indicator confirmations; fractal break in the expected movement direction.

- Momentum breakout traders. They depend on: trend line break; chart pattern break; fractal indicator break; top or bottom break; high or low break.

Trend against entries

It’s a common problem to struggle during the start of trade’s participation. It doesn’t matter what exact tendency you choose to base on. There are several main procedures to follow before making a decision:

- Determine the existing trend & market structure.

- Look out for possibilities.

- Check for filters.

- Define and confirm the entrance timings.

Connect all the dots between each piece of information and make the next move.

Detect the best timing

Each type of entry has benefits and drawbacks which must be considered before the trades. Here’s what you need to know about an early one:

- Fit in the long-term positioning which targets larger swings within the market.

- Easier to choose timings. Tops & bottoms are difficult to be operated with. Fibs stop-loss is the most preferable as an optimal stop-loss position.

- More calm monitoring.

- Higher risk. It must be highly rewarded in order to justify the position.

- Bigger amount of time to execute the trade.

Secondly, let’s take a look on the confirmation one:

- More opportunities to reach the desired levels of the market.

- Chance of confirmation being small. Price may move the same direction.

- Simple process of the stop-loss order determining.

- The reward in relation to risk can be significantly higher in some cases.

Finally, the momentum one:

- Fits for optimising an entry timing and an obvious stop-loss level.

- Market traders with a lot of available time and desire to trade often suits for it.

- Short time window for the trade.

- False signals of breakouts can provoke a mistake.

- The location of the break’s occurrence is one of the main factors in defining the exact entry point and stop-loss levels.

Strategies of trading in Forex

Now we are up to a list of efficient Forex trading strategies:

- Scalping: quick and multiple transactions; profiting from short and minor valuation fluctuations; increasing the profit by scaling up the size of positions.

- Day trading: short-term trades within the same day; the most optimal market has high volatility and liquidity; the principle of profiting from short cost fluctuations; usage of MA and fixed central breakouts can be similar and be an addition to the day trading; consistent trading volume.

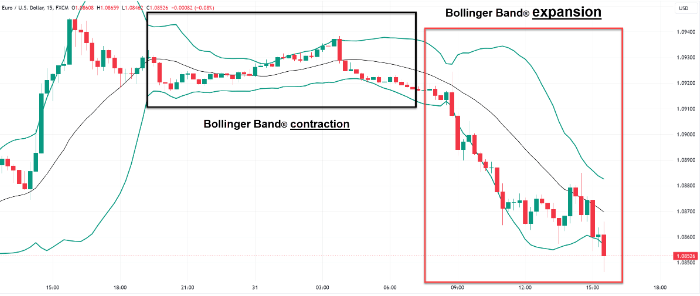

- Swing trading: may be longer than the time window of one day; requires discipline and patience; profiting from large market changes; multiple usage of technical tools (Bollinger Bands and Fibonacci retracement levels, most importantly); following trends and breakouts.

- Bollinger Bands trading: identification of oversold & overbought conditions of an asset; working model of an SMA; detection of the asset’s extremes under the buying/selling pressure, consequently, profiting from it.

Example of Bollinger Bands:

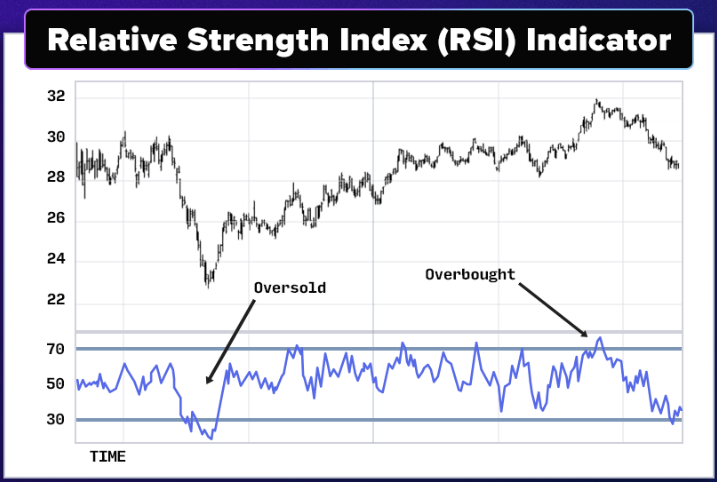

- RSI trading: same principle of detection both oversold/overbought conditions; reducing the risk of being outplayed by possible price fluctuations.

Instance of the RSI:

- Trend Following: profiting from a strong price movement tendency; short-term deals for the downward pattern and long-term for the rising tendency; several technical instruments are used (RSI & OBV, for identifying preferable timings for both starting and ending the trade).

- MACD Divergence trading: fundamental tool – MACD indicator; identifying potential reversals and profitable timings to start the transaction; the main principle: difference between the valuation and the signals of the tool means the inevitable change in the movement direction; stabilizing the risk.

- Seasonal trading: profiting from the repetitive changes in cost which occur on specific time windows of the year; profiting from trends.

- High-Frequency trading: extreme amount of transactions during a short period of time; multiple moves within milliseconds; usage of complex algorithms; profiting from very small price changes; the necessity of having a good enough software to perform.

- Multi-Time Frame Analysis: observation for several time frames to analyse the existing trends to make an efficient decision; compartment between different points of view; profiting from the higher awareness of the existing trend and current market condition.

FAQ

How to enter Forex trading efficiently

There are a lot of different strategies to use for Forex trading and the most efficient one is the one that fits your own plan and risk tolerance.

How to discover the best way to enter the trades

The identification of this point can be executed by several technical instruments: MA, oscillators, trend lines and e.t.c. However, don’t forget to observe the market sentiment.

What should beginner do before the entering

If you are going to enter Forex trading for the first time, there are several main strategies to start with: trend following or to profit from the support/resistance trading.

Which important factors must be evaluated before the strategy’s choosing

You need to remember and apply these key factors to the choice of your potential strategy: evaluate the capital, determine the time you are able to spend, calculate the risks and define the market condition.