There are many things that we can write about the way the futures work. There are many aspects and nuances to the process, but one thing is quite constant: the margin. What is it? It’s a percentage of the contract’s price that one one has to deposit. It is essentially a security deposit that covers potential losses that may occur during the life of the contract.

- The Types of Futures Margin

- Initial Margin

- Maintenance Margin

- Margin Requirements for Futures

- Initial Margin Requirements

- Maintenance Margin Requirements

- Daily Margin

- Margin Requirements Policy

- Daily Trades

- Monthly Delivery Margin

- Marginable Securities

- How the Futures Margin is Calculated

- How Does a Futures Margin Work?

- What Happens During a Futures Margin Call?

- The Difference Between Futures Margin and Regular Margin

- The Advantages of Futures Margin

In this article, we will take a closer look at what the margins are for futures in trading. We will take a look at their types, requirements, related policies, and explain many basic terms. Check this article and get a clearer picture.

The Types of Futures Margin

Margins come in different forms. Let’s take a look at main kinds of them, since they differ in nature, sometimes rather significantly. We will provide the needed information in the next two sections, check them out.

Initial Margin

This is probably the most common type of margin. It acts as a deposit. Let’s take a closer look at it. The initial margin serves as a form of protection for both the trader and the broker. For the trader, it ensures that they have enough funds to cover any potential losses that may arise if the trade moves against them. For the broker, it helps to mitigate the risk of default by the trader.

The picture below shows the general definition of a margin that you have to remember.

Maintenance Margin

Maintenance margin is the amount that one has to keep to continue holding the position. It is usually a certain percentage of the initial one. And a rather significant one: often between 50 and 75%. If the amount drops below a required level due to one reason or another (in most cases, it’s the asset losing value), then the trader might receive a so-called margin call which will require either selling some of the assets or making the margin larger.

The picture below offers a quick view on how the maintenance margin is calculated.

Margin Requirements for Futures

Of course, there will always be requirements for margins. They will depend on many things and, in the case of futures trading, might be very important for the final decision and calculations of the trader. In the next few sections, we will take a look at how they can differ at what the requirements are.

Initial Margin Requirements

These are usually just percentages of the overall sum of the contract. In the case of the futures, such requirements are often relatively low: between 2% and 11% in the vast majority of cases. This is a rather reasonable amount, so it shouldn’t create issues for the traders.

Maintenance Margin Requirements

Maintenance margin should also meet certain requirements. Usually, this also means keeping a certain sum as a deposit. In many cases, it’s 50-60% of the initial amount, but this can vary significantly depending on many factors.

Daily Margin

At the end of a trading day, you can check out the losses, gains, and changes. You can also receive a margin call as the result of such settlement after the process called marking to market.

Margin Requirements Policy

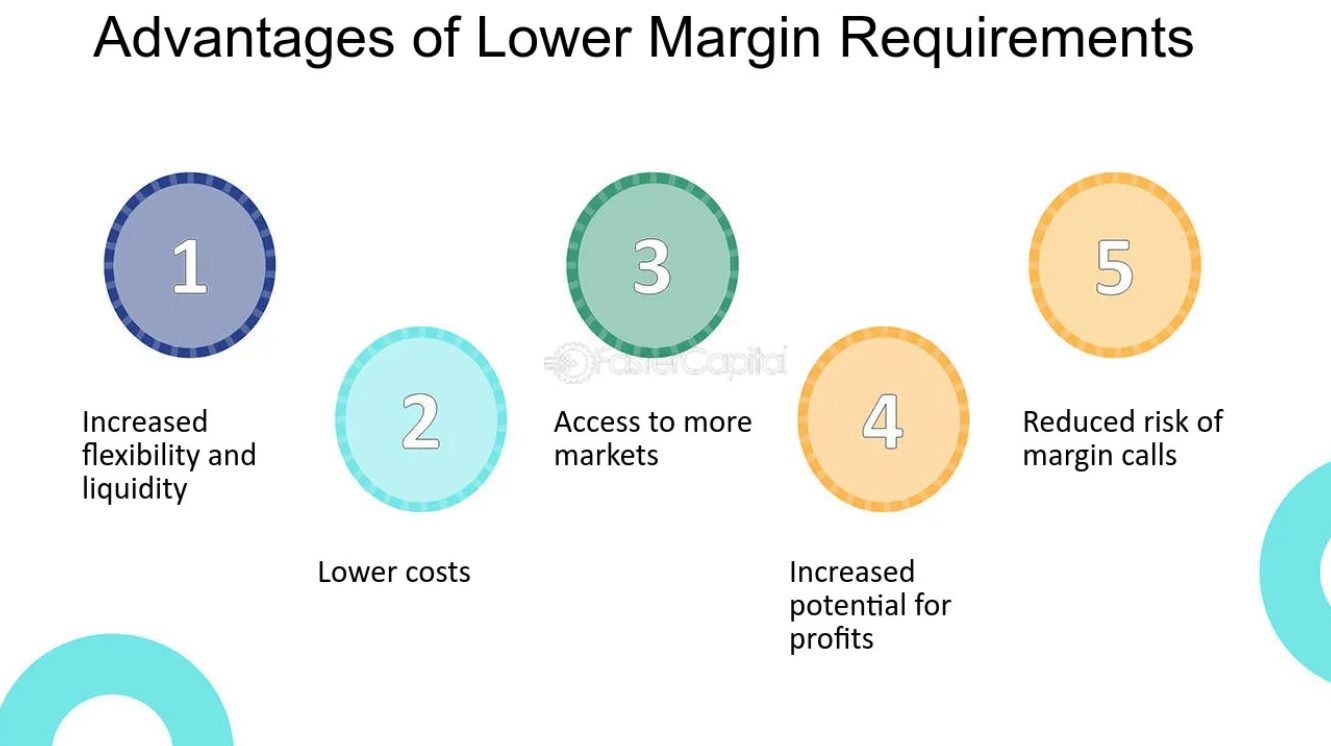

And, of course, there are many differences in how certain brokerages treat futures margins. If the contract is a high-risk one, then the margin has to be much larger. This is usually done to account for potential risks and losses.

The Picture below shows some of the advantages of less strict margin policies, with some being quite obvious.

Daily Trades

The futures contracts are marked-to-market on a daily basis, this means that the gains and losses are calculated at the end of each trading day. Nothing stops you from shorting or longing your futures multiple times within a 24 hours window.

Monthly Delivery Margin

A delivery margin is a specific type of margin that is required for certain futures contracts that have physical delivery of the underlying asset upon expiration.

This can happen on a monthly or annual basis, as well as within any other time frame. This type of margin is also quite common, especially for futures trading.

Marginable Securities

These are any assets that can act as margins and be stored as deposits for the future contracts. They come in different shapes and sizes, but in the case of futures they are often just money. But technically, nothing stops other assets from being stored, including stocks, cryptocurrencies, and other commodities.

How the Futures Margin is Calculated

The formula is incredibly simplistic: just multiple the value of the trade by a margin requirement. Usually, this shouldn’t result in very large amounts.

But, as we have already stated, the size of the margin requirement percentages might vary. The formula usually takes into account the notional value of the futures contract, the current market price, and the volatility of the underlying asset.

How Does a Futures Margin Work?

One is required to deposit a sum and keep it as a secure way to cover losses and possible failures if they appear. It’s very important to maintain them at a level that the brokerage requires which might vary significantly. If everything works successfully in the end, the trader can get their margin back.

What Happens During a Futures Margin Call?

Margin calls happen when the securities’ value is decreased for one reason or another. In this case, there are two possible courses of action to follow: either to add more money into deposit or sell some of the assets they own.

The Difference Between Futures Margin and Regular Margin

The main difference lies in the fact that the futures margin works only for futures contracts. Those are marked-to-market on a daily basis with the gains and losses being settled at the end of each day.

The Advantages of Futures Margin

There are several advantages of futures margin. Below, we will list quite a few of them.

- Leverage. One can control a larger position while having a smaller amount of capital. This increases potential returns but also amplifies the risks of losses.

- Cost efficiency: Futures margin requirements are typically lower than the full value of the contract, making it more cost-effective for traders to enter into futures contracts.

- Risk management: Futures margins are a form of collateral that ensures that traders can meet their financial obligations. It helps protect both the trader and the brokerage from potential losses, so this advantage is rather obvious.

- Liquidity: Futures margin requirements help ensure that there is enough liquidity in the market by preventing traders from taking on excessive risk.

- Speculation: Futures margin allows traders to make predictions of the movements of prices. And moreover, they can do so without making a full investment.

So, there are all advantages of Futures Margin.