What is the Initial Coin Offering, how to start such an event and the difficulties of investing choice: let’s answer all these questions.

ICO’s definition

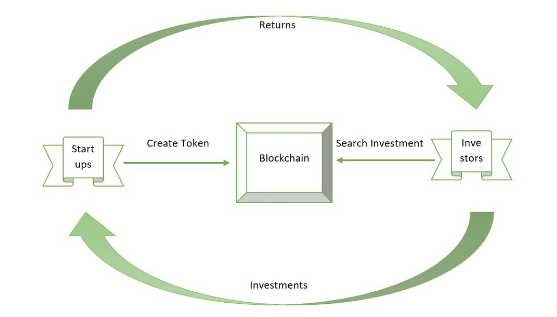

People use certain ways to raise funds in the cryptocurrency field. One of them is ICO. Creators of a potential token or another project should have enough resources for that. It is time for Initial Coin Offering’s execution. People who see potential in such new projects can have several coins for participation in such events. Moreover, they will acquire the new cryptocurrency itself. It can be a start of cooperation with the company because investors will potentially have a share in the project which is considered as an acquired token from the Initial Coin Offering.

Here’ a visualization of an ICO’s working process.

ICO: types

ICO has two types. Let’s review each one:

- Public ICO. It is a free-enter event which provides a possibility for everyone who desires to invest in the project. The example of obvious efficiency is just a basic statistic. The 2017 year showed a seven billion dollar mark of funds which were raised during the event. Despite that fact nowadays the other type of Initial Coin Offering becomes more advisable because of several regulation issues.

- Private ICO. Name speaks for itself. Number of participants is limited. There are certain requirements for the investor who desires to enter the event. Members of the private ICO must be accredited whether it’s a person or a financial organisation.

Principles of ICO’s work

If the project provider decides to launch an Initial Coin Offering, there is a certain order. It declares the date, rules and buying process. Start of an ICO is the start of the investing process.

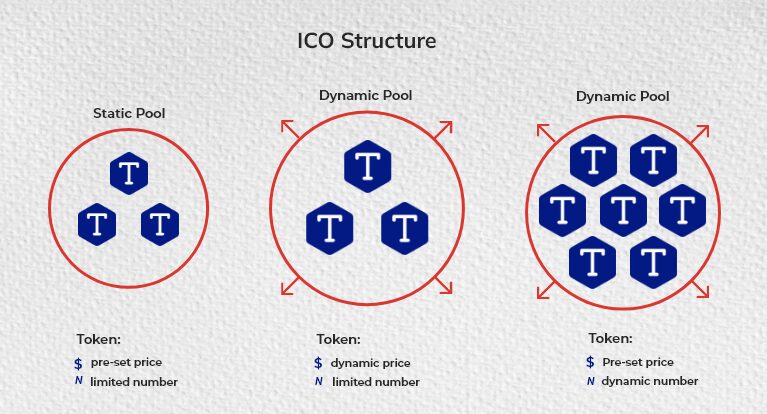

In order to receive the desirable cryptocurrency investors send funds to a specified crypto wallet address and give the information about their own addresses to acquire the chosen cryptocurrency. There are several differences in the number of tokens and its valuations within the process. Let’s review them:

- If both valuation and number of tokens are fixed the provider of the event sets each of them upfront.

- If the number of tokens are fixed and the valuation is changeable the provider of the event sells that number of tokens and declares the valuation based on gained funds during the ICO. If ICO received high support the valuation will grow respectively.

- If the valuation is fixed and number of tokens is changeable the provider of the ICO sells tokens without limitations. Companies sell tokens with a fixed cost up until the event’s ending.

It can be launched by anyone because of the low barrier to entry. It leads the overall filling of the cryptocurrencies flow. Let’s have a look on the Initial Coin Offering’s structure:

Regulations

Such a significant event was quite unexpected by regulators of capital-raising processes. It started a wave of regulations around the world: the countries separated in choices. China and South Korea immediately banned ICO events. On the other hand we have the USA, Canada and several European countries who gave a chance to Initial Coin Offering and started to develop regulations.

Some countries have already provided ICO’s with the regulations: Australia, New Zealand, UAE and Hong Kong.

Rules

ICO’s process is very demanding to be performed. There are certain 4 steps of it:

- Target’s marking. First of all, the company must show the initial goal of its project. The identification of targets and the necessary knowledge about the details will guide the potential investor.

- Token’s creation. Since token is a modification of a cryptocurrency which is provided by an independent blockchain, it gives trading opportunities from the start. The Creation process is not that hard because the token is based on the existing cryptocurrency. In that case, specific blockchain platforms provide the process execution.

- Promotion. It’s a usual event during ICO. After all, project holders need to gather investors. The most efficient way to promote is online-based. However, some of the dominant online platforms banned ICO (for example: Google and Facebook).

- Initial offering. After all the preparations it finally starts. The process can be splitted on several stages. Funding can be used in future products. It does not change the fact that participants can choose to have the profit from instant sell of an acquired asset or wait and play the long game hoping the asset to raise in the future.

Your own ICO

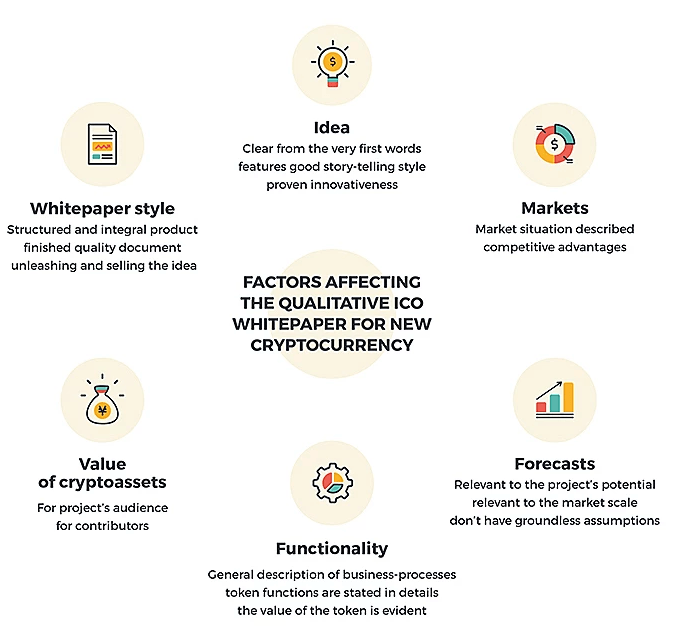

If you decide to start your own Initial Coin Offering there are the same rules applied: date, targets and rules for the sales. Let’s take a look at the details of the process which are necessary for the maximization of positive outcomes:

- A White Paper which provides details of your project.

- A Roadmap which consists of short-term and long-term targets of the project.

- Market research on other Initial Coin Offerings.

- Creating a website.

- Cooperation with social media.

- Promotion.

All of it will provide the investor with a bigger picture which can attract him to your project.

Let’s review several factors which affect on the ICO’s efficiency.

Instances

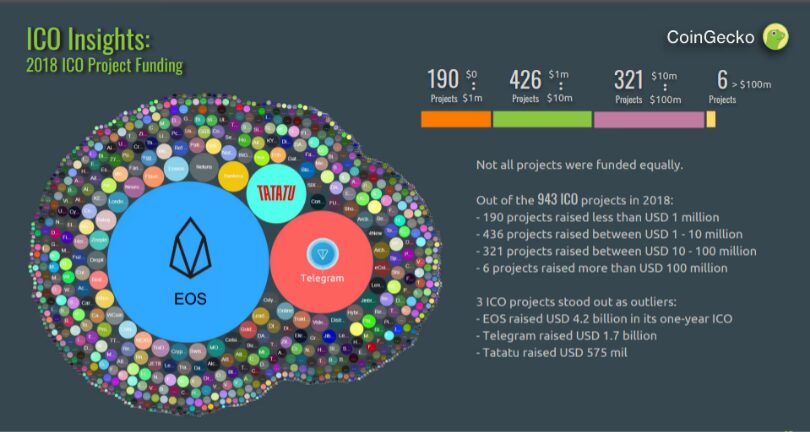

There are several examples of ICOs throughout the last decade:

- Year 2014. Etherium’s ICO which raised nearly $18 million dollars over just 42 days.

- March, 2018. The 1-year ICO of Dragon Coin. The event provided an overwhelming fundraising: four billion dollars.

However on December 11, 2017, Munchee tried to launch ICO which could help them to implement a new cryptocurrency in the company’s app for food ordering. It failed because the SEC announced that event as an unregistered securities offering and cut down the ICO.

Let’s take a look at the diagram of the ICO’s which were performed in 2018 year to understand the amount of funding.

Comparison of ICO & IPO

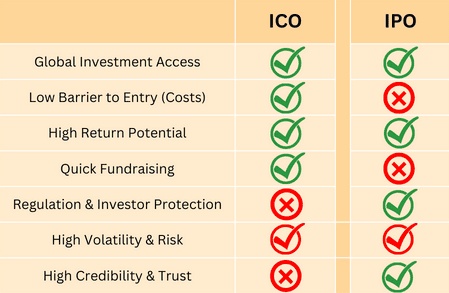

We already know what the ICO is. Let’s review the other way of offering – IPO. IPO is an Initial public offering of new stocks by a private organisation. Both of these events have in common that it is a crowdfunding.

On the other hand we have a huge difference between them. IPO is already a regulated and controlled process of selling security. It requires a registration statement with the SEC which must be approved. This document must hold the information about financial statements and potential risks.

However, ICO and IPO each have their risks. If you choose a safer way to invest, it should be an IPO, because it is already a controlled and regulated event.

To make it simple, let’s review a table.

Benefits & Drawbacks

Let’s have a look at both sides of ICO. Firstly, benefits:

- Highly profitable outcome. Right choice of crypto can lead to a big gain. Especially when there is a discount on tokens during the ICO.

- ICOs are available to everyone because of the absence of any limitations or restrictions on who can enter the event and invest.

- ICO is an efficient and fast event for fundraising.

And now let’s take a look at the dark sides of the story:

- Crypto’s changeability and volatility of the project itself. It can lead to devaluation of the token in the worst case.

- The other side of the absence of any restrictions can be followed by frauds and scams. Even the project itself can be not so prospective and fail under the pressure or just does not perform on the claimed level.

- The lack of knowledge can lead to an instant profit loss. People who want to invest should gain enough information about principles of ICO’s and crypto wallet’s work to have an understanding of the investing process.

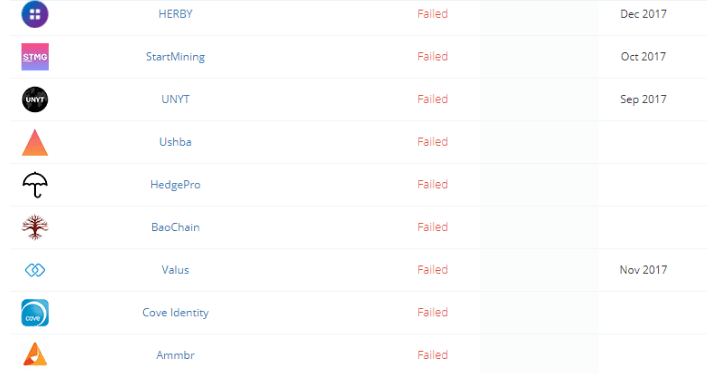

Here is the list of the ICO’s which did not succeed and for your comfort it’s short:

But you should understand one main fact: more than 50% of ICO’s failed, so be wise in the choices you make.

FAQ

ICO’s process – how it works

ICO usually announces its details: details of coin usage, ICO’s targets and risks. ICOs which gathered the trust and proved its efficiency will be supported.

ICO’s definition

It is a fundraising event provided with the company for a crypto project or a blockchain.

ICO & IPO: differences

ICO is a fundraising event for the cryptocurrency projects which are provided by a private company. IPO is a fundraising event for a stock which is created and provided by a company within the law statements.