Disclaimer: this article is for informational purposes only and does not constitute a solicitation to fund or to speculate in any form – remember that all investments involve risk.

Margin trading is a transaction that an investor makes on credit: he borrows either money or securities from a broker. This is quite similar to borrowing in the stock market. Today we will have a look at what initial margin is and what maintenance margin is. Read on – it will be interesting.

What is the initial margin?

It is the value of assets multiplied by the risk rate (a thing used to calculate the amount one need to have in his/her account to open or keep an uncovered position – the lower, the larger the position can be – that is, the broker might lend more assets; and vice versa – with a high risk rate, the amount of leverage will be small or none at all). For each of them. If the value of the portfolio (total of free cash and liquid – the, the more you can borrow from a broker for trading) is less than the initial margin, the trader will not be able to trade.

What is the maintenance margin?

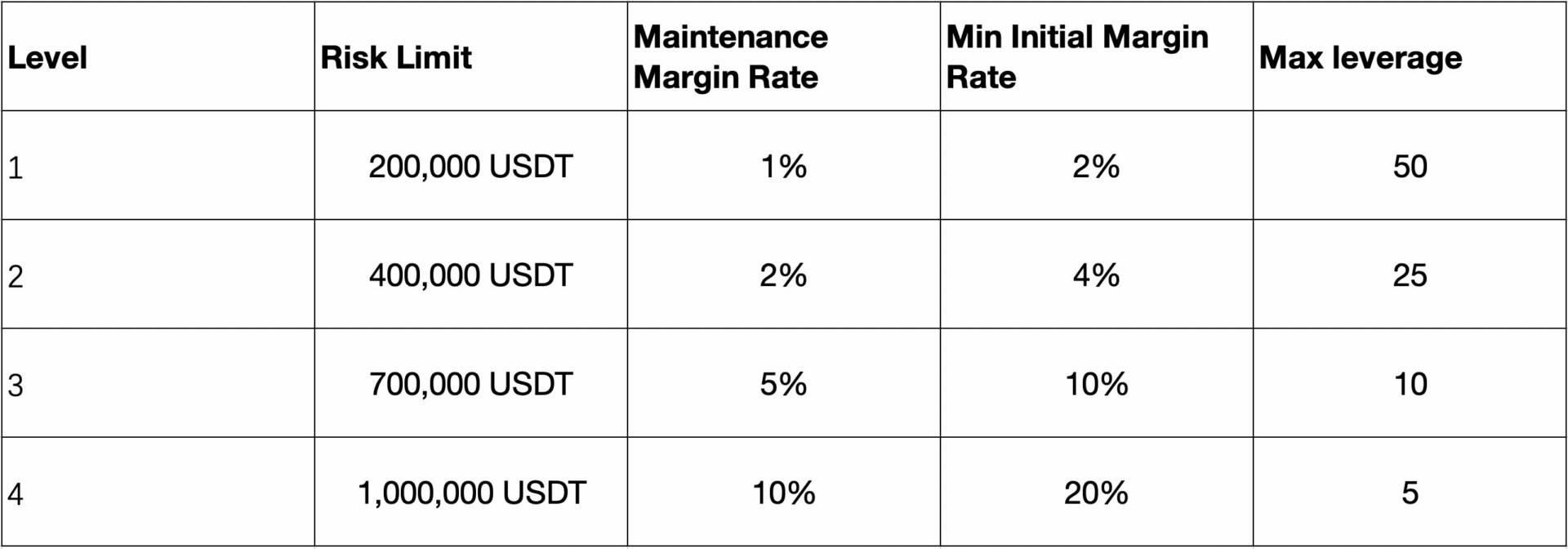

It is the minimum amount of funds required to maintain an open position. This very amount is determined by the risk limit set by market participants: the higher, the lower the maximum leverage.

As a rule, the risk limit of each trading pair uses the minimum amount of maintenance margin.

Initial margin vs maintenance margin: dissimilarities

The main difference between initial margin and maintenance margin is that the former is the amount required to open a trade and the latter is the amount required to maintain it.

The second is also always lower than the first.

The risk limit, MMR, IMR and maximum leverage for a SRM USDT contract on KuCoin (09:00 UTC, April 15, 2022) were like at this picture:

Just an example to better understand the big picture.

Initial margin and maintenance margin – how they work (some real-case scenarios)

Let’s look at one situation. Suppose a trader wants to buy 50 shares of company X at $10 per one, yet he does not have the right amount of money to buy all these securities. However, he may open an account with his broker and purchase the shares with only a certain percentage of the total price.

It will be convenient to assume that this percentage is 50% of the total purchase price, which in this case is equal to $500. It is the amount a trader must have in his account to fulfill the requirement. When an investor makes a deal, he is essentially borrowing the balance of the total cost from the broker, for which he is usually charged a fee.

Maintenance margin is, as we mentioned earlier, a required percentage of the total investment that is less than the initial margin and that the investor must maintain in his trading account to avoid a margin call.

For the example here, let’s imagine John and Bob. Two investors. John bought a wheat futures contract at $4 per bushel, and Bob bought the similar (but he sold it). The exchange set an initial of one thousand dollars and a maintenance of 65%.

As a result of the increase in the price of a bushel to $4.1, John earned $500 and Bob lost the same amount. John has $1500 in his account – he doesn’t need to worry anymore. While Bob’s account has $500 – only 50% of the original margin. After such a price change, he receives a margin call requiring him to replenish his account by at least $150.

To avoid calls just check the account status and the value of the portfolio on a regular basis. Also consider using stop orders. With their help you can automatically exit the position and reduce losses if the situation starts taking a bad shape.

And remember about diversification: do not invest all your money in just one asset, but rather spread it over several objects. Then, if one of the securities falls in price, the others will grow – and the yield on them may exceed the losses incurred, which will stabilize the state of your portfolio and prevent a margin call.

Calculating

Let’s dive into math a bit. Let’s talk about how to calculate all this stuff.

Initial one

It is calculated using the following formula:

- IM% = IM account / margin balance x 100%.

- IM = IM account order + IM account position.

Maintenance one

As for the maintenance margin example, the model would be:

- MM% = MM account / margin balance × 100%.

- (account) MM = sum (if short position) .

- (position) MM = [max (MM factor x index price, MM factor x option mark price) + option mark price + lquidation fee rate x index price] x (position size).

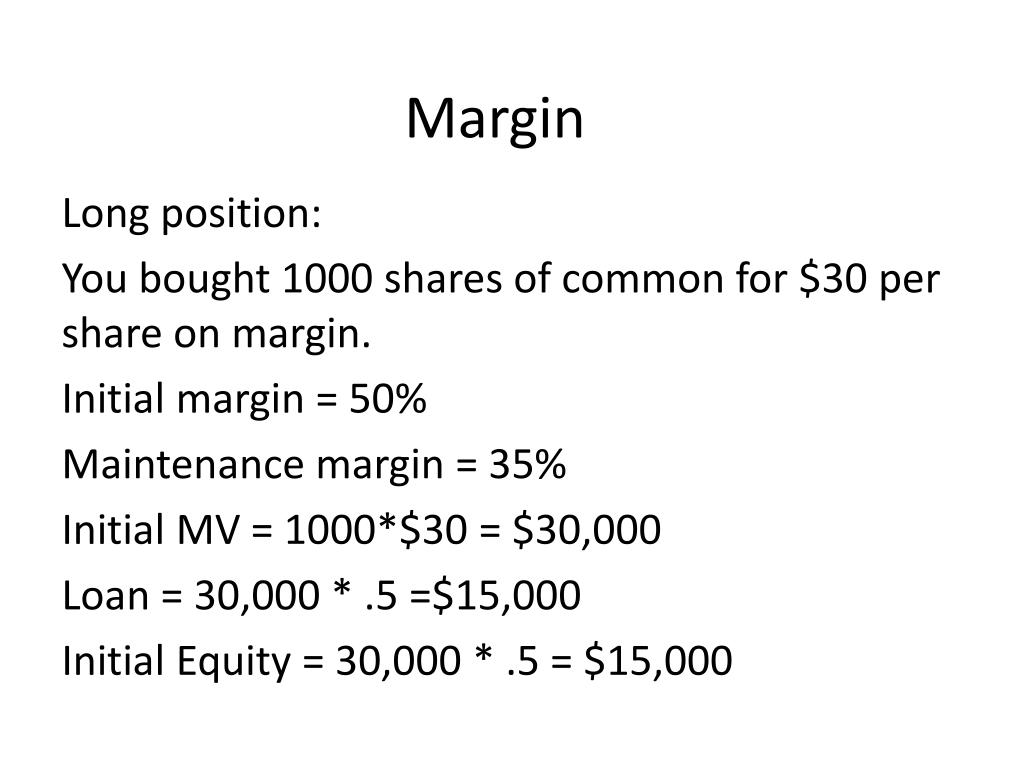

By the way, here is an example of a long position:

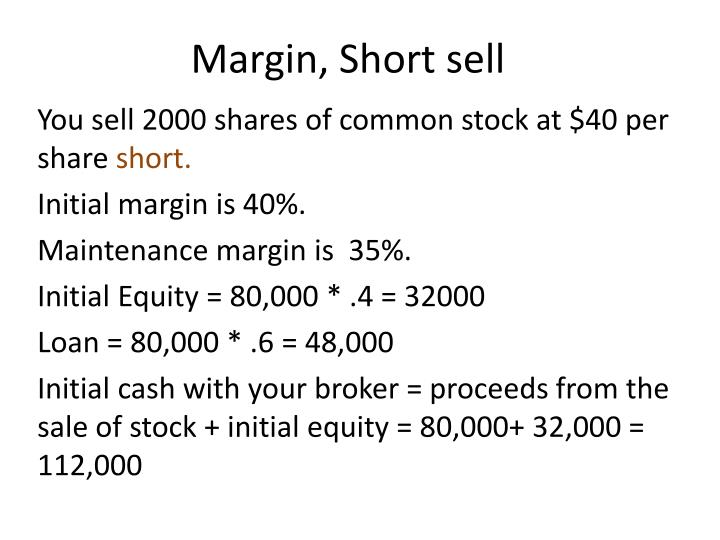

And here’s one for short:

Welp, you can earn pretty much on the stock exchange if you use borrowed funds. But God knows how much money you will owe to the broker in a worst case scenario. Nevertheless, these are the realities of margin trading. We do hope that the article was useful for you.