Every investor has heard about long and short positions at least once. Let’s overview both terms, explain how each position works, look at the differences between them and analyze the main factors for making a decision.

- What are Shorts?

- Pros and Cons of Shorts

- What are Longs?

- Pros and Cons of Longs

- Key Differences Between Shorts and Longs

- Main Principles and Actions

- Potential Results in Different Market Cases

- Risk Profile and Rewards

- Hedging and Speculation

- The Effect on Portfolio’s Diversification

- Examples of Longs and Shorts

- Factors to Consider When Choosing Longs or Shorts

- An Evaluation of Market Trends and Investors Predictions

- An Analysis of the Company’s Fundamental Parameters and Financial Data

- The Importance of Risk Aversion and Investment Goals During Decision Making

- Combining Longs and Shorts, Is It Possible?

- The Risks of Using Each

- Short or Long: Which One to Choose?

- Frequently Asked Questions (FAQ)

What are Shorts?

«Shorts», or short positions, is when an investor sells an asset expecting its price to drop. To put things simply, the plan is to buy them back at a lower price while keeping «the change» as a gain. While the process might not be quite obvious, it’s actually straightforward in nature: the investor sells it high and buys it again at a low price.

Pros and Cons of Shorts

The short position has its own set of advantages and drawbacks. The main strong point is that it allows investors to make money even in the harshest market conditions. Another thing to consider is that it also makes it possible to take on more risk.

What are Longs?

Long positions are actually something that the majority of traders, including beginners, have an easier time grasping. The reason is that the concept can be explained in just a few words: buying an asset and keeping it in the hope of its price getting higher.

This tactic is actually much more common and requires fewer actions, so it’s not surprising that many traders use it.

Pros and Cons of Longs

Similarly to the shorts, the longs have their own pros and cons. The main thing about the longs in the world of shares is that going with this strategy means that you indeed own the stock and have all of the perks of long-term investing.

There are associated risks, of course. For example, it’s possible to lose all of your funds. In many cases the investor also won’t be able to profit from a falling market by shorting on the same asset.

Key Differences Between Shorts and Longs

While there are many obvious differences between long and short positions and from certain angles both tactics seem to be just opposites of each other, there are many things where the contrasts between the two run much deeper. The following paragraphs will include more detailed information.

Main Principles and Actions

This is where the most obvious differences come into play. Obviously, the shorts mean that the investor expects the price of an asset to go down, while the longs mean betting on it increasing.

Potential Results in Different Market Cases

Each strategy works best with certain market trends. For example, if the market goes sideways or the price of an asset is going to go down, then short selling is a perfect solution. In this case, an investor can profit greatly in a short amount of time. But if they went with the long strategy before such market trends, then the losses would appear. One can wait them out if you’re confident that the market will recover.

Risk Profile and Rewards

It’s always important to assess a risk-reward ratio when going long or selling short. Long-term investments might be considered safer in some cases, but they actually possess significant risks as well, especially if an asset is a stock in a new company.

Hedging and Speculation

Hedging usually means mitigating the risks, while speculation always means a strategy that has the sole purpose of turning a profit. Obviously, longs and shorts can play a role in both. Long hedges are often used by manufacturers as a way to reduce or completely remove price volatility. Also, short hedges are great for the assets that will be sold in the near future.

The Effect on Portfolio’s Diversification

Using both long and short positions is a great way to reduce the risks and diversify one’s portfolio, provided it’s used on different markets. We will cover this in greater detail in the «Combining Longs and Shorts» section at the end of this article.

Examples of Longs and Shorts

While this article has already gone into great details explaining how everything works about both types of positions, having an example would be a good start.

A short position works differently. In a hypothetical situation a trader thinks that a company’s upcoming quarterly results will make the price plummet. He sells 100 shares for $1,200. The predictions come true: after the reports come disappointing the shares start trading at $1,000. The trader buys them back and keeps the change, resulting in the $20,000 gain. Moreover, the trader still has all of the shares.

Factors to Consider When Choosing Longs or Shorts

If one is seriously deciding on their investing strategy, then there are many things to consider. Of course, the preferences exist, but there are many important factors one has to take a look at before going with either shorts or longs.

An Evaluation of Market Trends and Investors Predictions

Likely the most important thing to consider is the market trend. If it’s bullish and everything points to price increasing over the long-term, then you can safely trade long. If the price seems to go down, then short selling would be the solution.

An Analysis of the Company’s Fundamental Parameters and Financial Data

If your asset is a share, then it’s worth looking deeper into the company itself. There are several important financial parameters that can help you predict possible trends. These include ratios and other things.

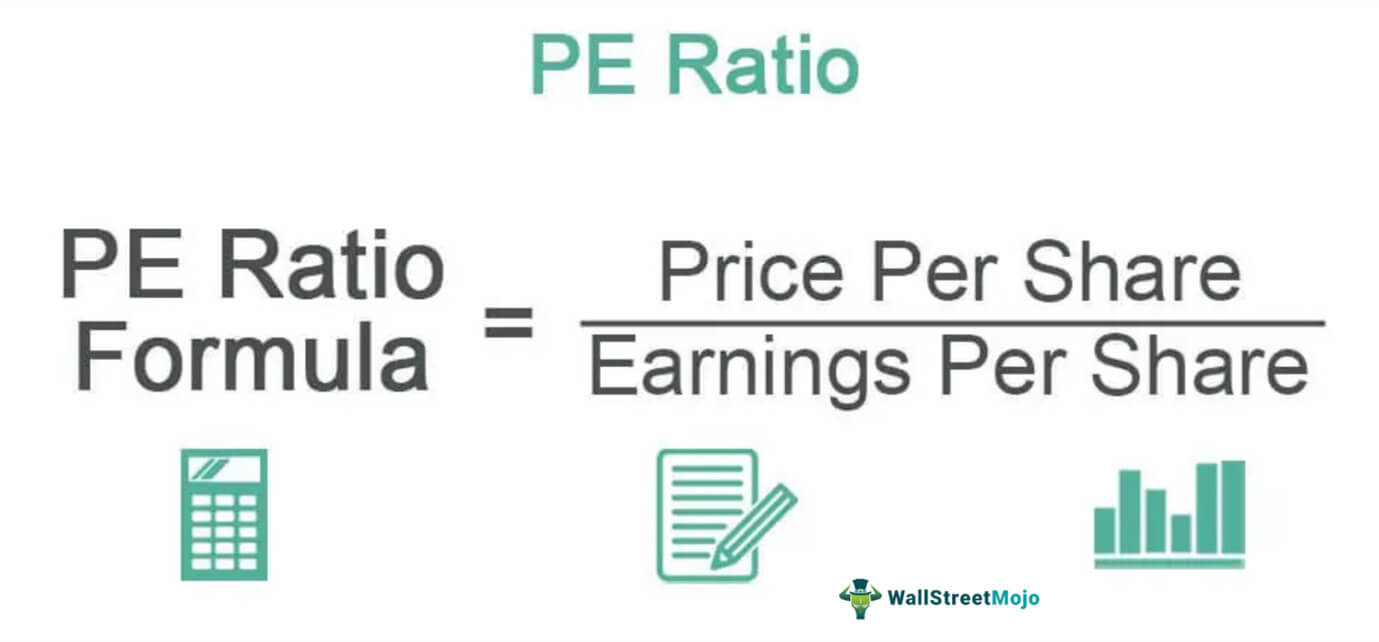

- Price to Earning (P/E). This ratio is one of the most straightforward ways to check whether a company is overvalued. See pic.1.

- Return on Equity (RoE). This one is a clear parameter that shows how good a company is at generating revenue for its investors. This can be very important for those planning to go long.

- Price-to-Book (P/B). This is a direct comparison of any company market capitalization to its book value. Similarly to the Price to Earning parameter, this can make it possible for quick understanding on how under- or overvalued a company is.

- Dividend Yield. A great indicator of returns, this parameter is very crucial to understand for any investor with the plans of going long.

- Debt-to-Equity (D/E). This one shows how much debt a company has. Having it isn’t always bad and the expectations vary greatly depending on the industry, but it’s nevertheless an important ratio to know.

The Importance of Risk Aversion and Investment Goals During Decision Making

Longs and shorts have different risks if things go wrong, but it’s possible to mitigate them. Speaking of the investment goals, going long is always a choice if one plans to actually own a stock. Selling short is a great strategy if ownership isn’t important. Making big profits is possible with both.

Combining Longs and Shorts, Is It Possible?

While our article mainly focuses on the topic of «Long position vs Short position», it’s actually possible to have both short and long positions on different assets. This can act as a great way to diversify your portfolio and mitigate the risk. It is a common practice among investors.

If one plans to have both positions on the same asset, then it’s highly inefficient, similar to having no position at all. Also, depending on the asset, it might be illegal. For example, the National Futures Organization prohibits such behavior on the same market. Of course, the things are less regulated on the cryptocurrency market. But that still doesn’t make that tactic efficient.

The Risks of Using Each

Both short and long positions feature their different sets of possible risks. Let’s take a look at them. With selling short, there’s theoretically a risk to lose more than 100% of the original investments. Another rare phenomena that the traders may encounter is the so-called short squeeze: a rapid increase of price due to a rising number of short sellers (check pic 2.) Overall, the long positions are riskier.

With a market long position, the most obvious risk revolves around the fall in the price of an asset. In some cases, it might go all the way to zero, resulting in catastrophic losses. Some markets might be very unpredictable, so it’s difficult to calculate everything correctly long-term. The Long buy position often involves locking the funds for a significant amount of time, so there’s usually no way to profit from the falling market.

Short or Long: Which One to Choose?

This differs from one case to another. If you think that market conditions are favorable for access to a higher price, then going long is a way to go. It also provides ownership of the stock, which can be important for traders. If the price of an asset seems to be going down or sideways, then it’s possible to profit by selling short.

Frequently Asked Questions (FAQ)

- What’s the importance of long and short positions?

Going long and selling short represent two entirely different tactics on making profits on your investment. Both are popular but are used in entirely different situations, although combining them in one’s portfolio is entirely possible.

- How to open a long or short position?

Opening a long investing position is easy: one either directly invests in an asset or uses derivatives. Opening a short position requires having a margin account.

- Is it possible to have a long and short position at the same time?

Yes, but in some cases it might be inefficient or plainly illegal, if it’s on the same asset. It’s perfectly fine to have both long and short positions on different ones and it is a great way to diversify your portfolio.

- What’s the difference between long and short positions?

A long position involves long-term investment with all of the associated risks, as well as perks of being a stock owner. The short position involves selling the assets and buying them back at a lower price while keeping the remaining funds.

- How to decide between short and long positions?

This depends entirely on a situation. If a trader is bullish and thinks that the price of an asset will go up, then going long is an obvious choice. Selling short is a solution for the situations when the price is likely to go down or sideways.

- What’s an example of a long position?

Investing into an asset after researching it and deciding that it looks like that it will grow means going long. For example, if the data about one company’s finances make it seem like the price will increase, then buying its stock at $100 per share, getting benefits of long-term investment, and a possibility to sell it a year later at $200, resulting in a long sale.