To some, trading may seem like a dark backwater. Well, this is partly true. Another topic that confuses many people is market, limit and stop orders.

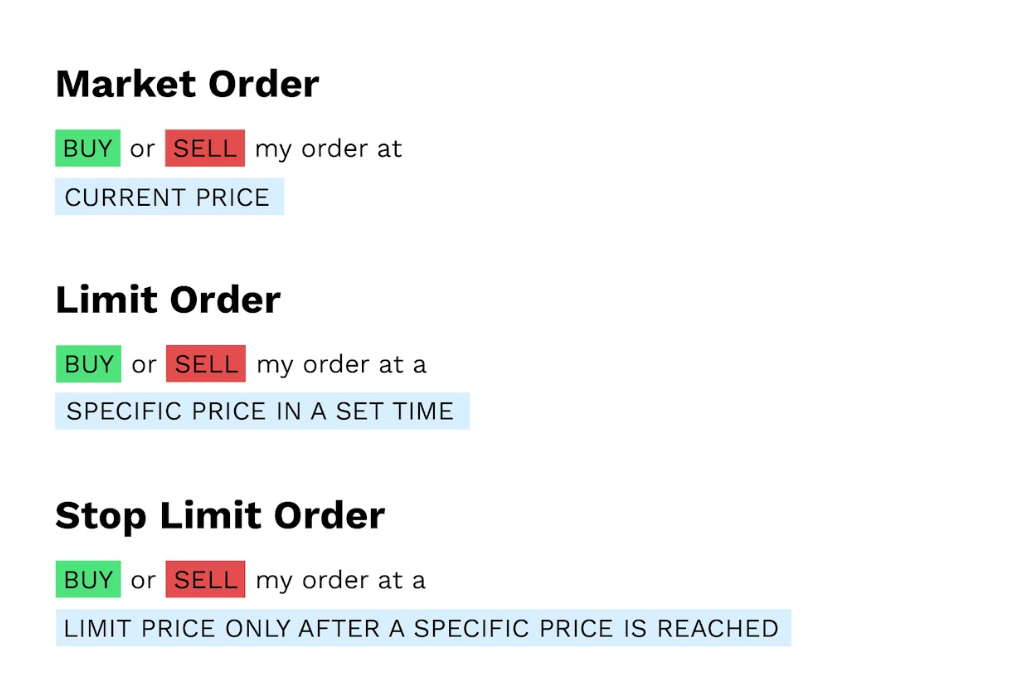

In short, a market order is an instruction to buy or sell an asset immediately at the current price, and a limit order is an instruction to buy or sell when the specified price (above) is reached. Stop orders, by the way, work on the opposite principle from limit orders – they can only be placed at the average price or a lower price.

But that’s for a very, very short time. Read on if you are interested in what all these orders mean, how to work with them and which one is better.

Market Order

A market order allows you to buy or sell an asset immediately and at the best price available. Sounds cool, but there are drawbacks. For example, the fact that you will be charged a certain commission (the one that takes one – usually it is around 1-3%, but it depends a lot on where you trade).

In general, you should use market bets when speed is more important to you than buying or selling at a specific price. They always work because they are prioritized by the service.

Limit Order

The most complex and deepest type of these three “siblings”. It is triggered when a certain market price level is reached. A limit order is executed either at the specified price (as the market price) or at a better price.

On the downside: has a high probability of being rejected. This can happen when the market makes a 180 degrees turn to the other side and the order simply cannot be physically executed.

Limit orders are often used by abusers and whales. It is believed that such traders act more aggressively, as if they are pushing the price in a certain direction. This knowledge is important when analyzing market volume – just keep it in mind.

Stop Order

This is essentially a market sell order that is triggered when a certain price (average or lower) is reached. It is used to protect you from a large loss by closing out a position.

Many people confuse limit orders with stop orders. As mentioned above, they differ in that stops are placed below the median price, while limit orders are placed above it. But that is not the only difference. Interestingly, limit orders are visible to everyone, while stops are usually invisible. This can be useful for some speculative trading tactics.

Other Types of Orders

The above are just the tip of the iceberg. There are actually many more types of orders. They are also subdivided, for example, by expiration date and conditions. More specifically, they are divided into the following categories:

- Day – the most common type. Such orders remain valid until they are executed or the session is closed. Unexecuted orders are simply deleted. If we consider the proportions, options of this type make up about 50% of the total number, or even more.

- Good till Canceled (GTC) – remains active until canceled either by the trader or by the system itself.

- One Cancel the Other (OCO) – a pair of orders, the execution of one of which automatically cancels the other. It combines two types – stop and limit. Extremely useful type, but it is not found everywhere.

- All or None (AON) – an instruction to the broker to either close the lot completely or cancel it. It is not possible to trade partially, as it is in Day. where it is possible to execute even until the proper number is triggered. This one In general, it is better to avoid it, as it can only be useful in some local situations.

- Fill or Kill (FOK) – such lots must be executed immediately. Otherwise, they will be canceled. For example, an order instructs the broker to buy 5 BTC at a price of 65 thousand dollars (yeah, the example is hardly realistic, but it is still useful for clarity). If the entire volume of 5 BTC is not available at the specified price at the current moment, the order will be canceled. Or, as we used to say – “killed”.

Using the Price Orders – A Case Study

For example, you have just invested a certain amount of cryptocurrency (let’s say it is BTC). You did it with the expectation that its price will go up. But if you turn out to be wrong (no big deal, it happens to everyone), a good idea would be to set a sell order to cut your losses if the price starts falling.

To be more specific, let’s use a certain amount as a benchmark. Say you think $350 is normal price for 0.01 you’ve purchased. Thus, you can place a stop order just below that price (in case it doesn’t hold) – $347 or so – and if the decline really starts, you will just sell at that price. Well, in most cases.

There are even full-blown strategies based on the use of one order or another, btw. For instance, a popular use of stops is the breakout strategy, where a trader buys a stock just above the previous high in anticipation of continued momentum and profit growth.

Limit orders are often used in the false breakout strategy. It may seem that it would be better to use the stops or even market orders instead, but this is not quite true. The fact is that the market often falls into the zones where numerous stop losses accumulate. If you try to enter a position using the markets, you may simply not have time enough time. Therefore, using a limit order is the most reasonable solution.

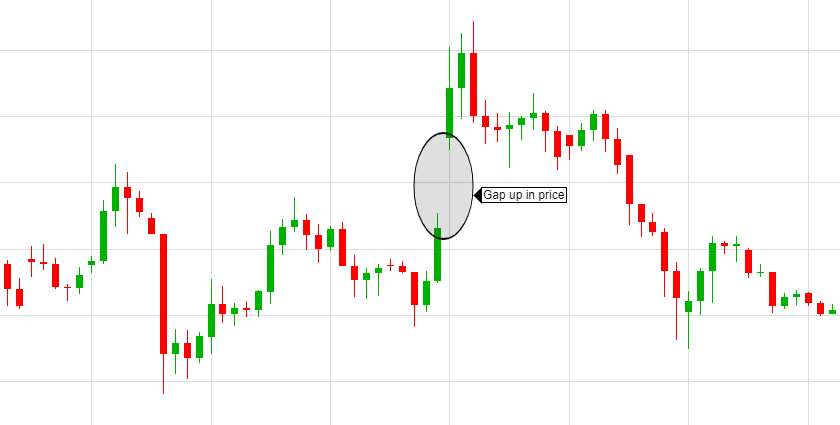

What is a Price Gap?

A price gap is a ripped thing in the price chart. Most often it occurs due to non-trading time between sessions, when new information arrives but the markets are closed and participants cannot quickly incorporate it into quotes. The opening price of the next session is significantly different from the closing price of the previous day and a gap is formed on the chart.

This is how it works. And this is what it looks like:

What to do with them? Well, you have three choices:

- Do nothing.

- Protect yourself with orders.

- Try to make money with them.

The first point is clear. However, we are not the kind of people who let things go, and therefore we will try to avoid losing money in this unavoidable ambiguous period.

Standard stop-loss and limit orders will not help you protect yourself here – unlike the put option, which gives you the right (but not the obligation) to sell stocks at a predetermined price. In other words, a put option guarantees that you will be able to close your position at a certain price no matter what. Yes, you still have to pay a certain sum for it, but it is much better than stop-loss and limit options, which may simply not work: the former will just sell at a much lower price if company positions are reopened, and the latter may not sell at all while the asset continues to lose value.

Order Comparative Table

Below is a table with the specifications of the main orders. We can say that it somewhat summarizes the content of this article.

| The question | Market | Limit | Stop |

| According to what principle does it work | With a single click, an order is sent to the broker and the broker executes it | Remains active on the exchange server until the desired quote appears | Remains active on the exchange server until the price reaches a specified value |

| Should you expect and fear a slippage? | YES | Not really | Not really |

| What is the likelihood of order fulfillment? | Almost 100% | High, but not guaranteed. Approximately 80% | High, but still not guaranteed. On average about 70% |

So Which order is Best?

It all depends on your goal. If you just want to buy something and do it as quickly as possible, then the markets are your ideal option. To be on the safe side, you can use limit and stop orders. As mentioned above, orders can also be used within different strategies.

Understanding the different types of orders is important for informed and efficient trading. Whether you want to use stop, limit or market orders to profit comfortably and safely, you should always be extremely careful and try to gather as much information as possible from different sources. For example, from our website.

If you liked this article – write in the comments. We would also be happy if you suggest a topic you are interested in so that we can revise our content plan and write something extremely relevant and useful for you.