Option exercise is a very sensitive process. Before you start, you need to practice with a professional and not just learn the theory. Below, we describe how to do it.

- Choices when Exercising Stock Options

- Hold on to your Stock Options

- Initiate a transaction with execution and sale to cover costs

- Initiate an execution and sale transaction (cashless settlement)

- How do I sell stock options for cash?

- What is an early exercise of stock options?

- What to consider when selling an asset

- Example of exercising an Incentive Stock Option

Choices when Exercising Stock Options

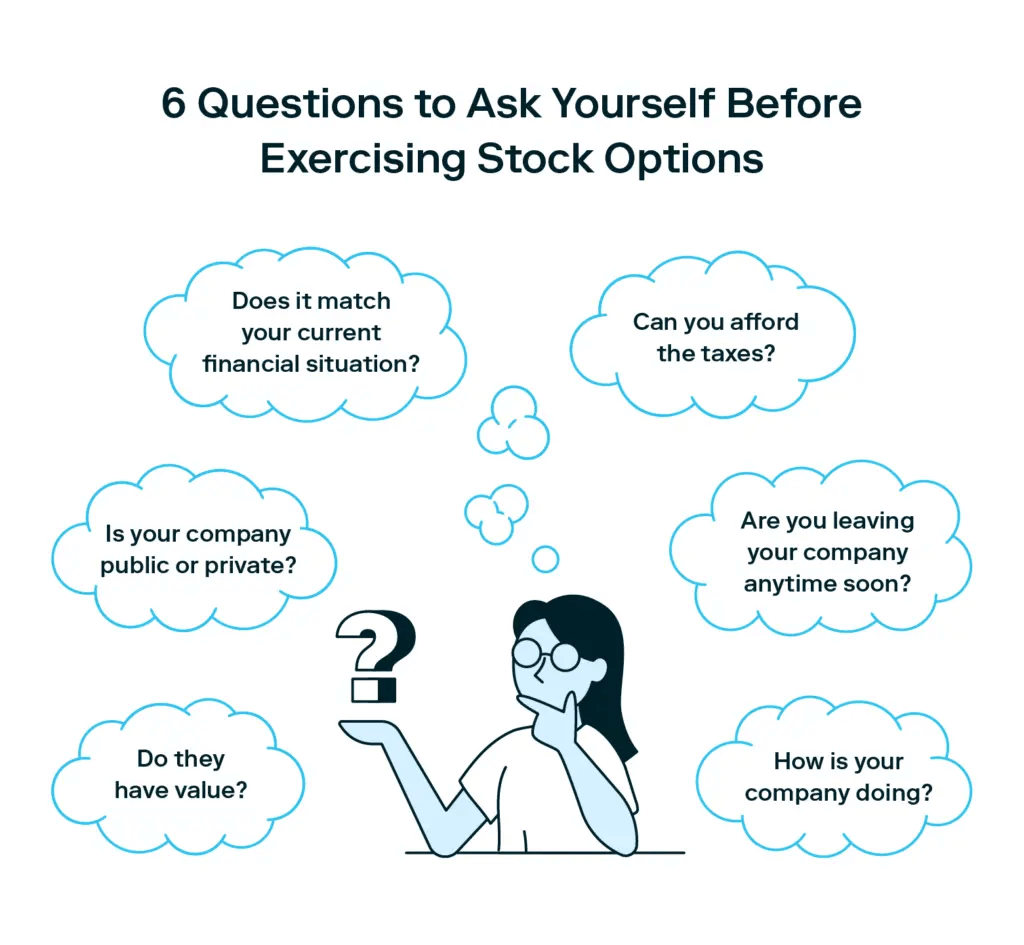

Before deciding to exercise a stock option consult an expert in the field. It is worth listing some aspects when making a choice:

- Identify the underlying asset. Analyze the market. In this way, you will predict the price of the asset and be able to choose the type (put or call).

- Selecting the strike price. This depends on your risk tolerance and its desired value relative to the reward. For example, a conservative investor will choose an asset execution price lower than the stock price, while a trader with a high-risk tolerance will choose a higher one. Accordingly, a put or put execution price above the stock price is considered safer when it is lower.

- Timing Selection. It is required to suggest the change in the stock price over a certain period (day, week, month).

- When the expiration time is over, the exchange will automatically calculate the investor’s profit and transfer it to the account.

Inaccurate selection of the strike price will lead to a loss, calculate everything carefully and take into account possible scenarios.

Hold on to your Stock Options

This approach may be appropriate if you believe that the stock will increase in value over time. In such a situation, take advantage of the long-term nature and wait with execution until the market value of the issuer’s shares is higher than the grant price and there is no readiness to realize the assets.

The key advantage is the ability to defer the tax impact until the options are exercised and the perceived increase in share price may increase the profitability of selling them. But keep in mind that stock options have an expiration date, and once they expire, they lose value.

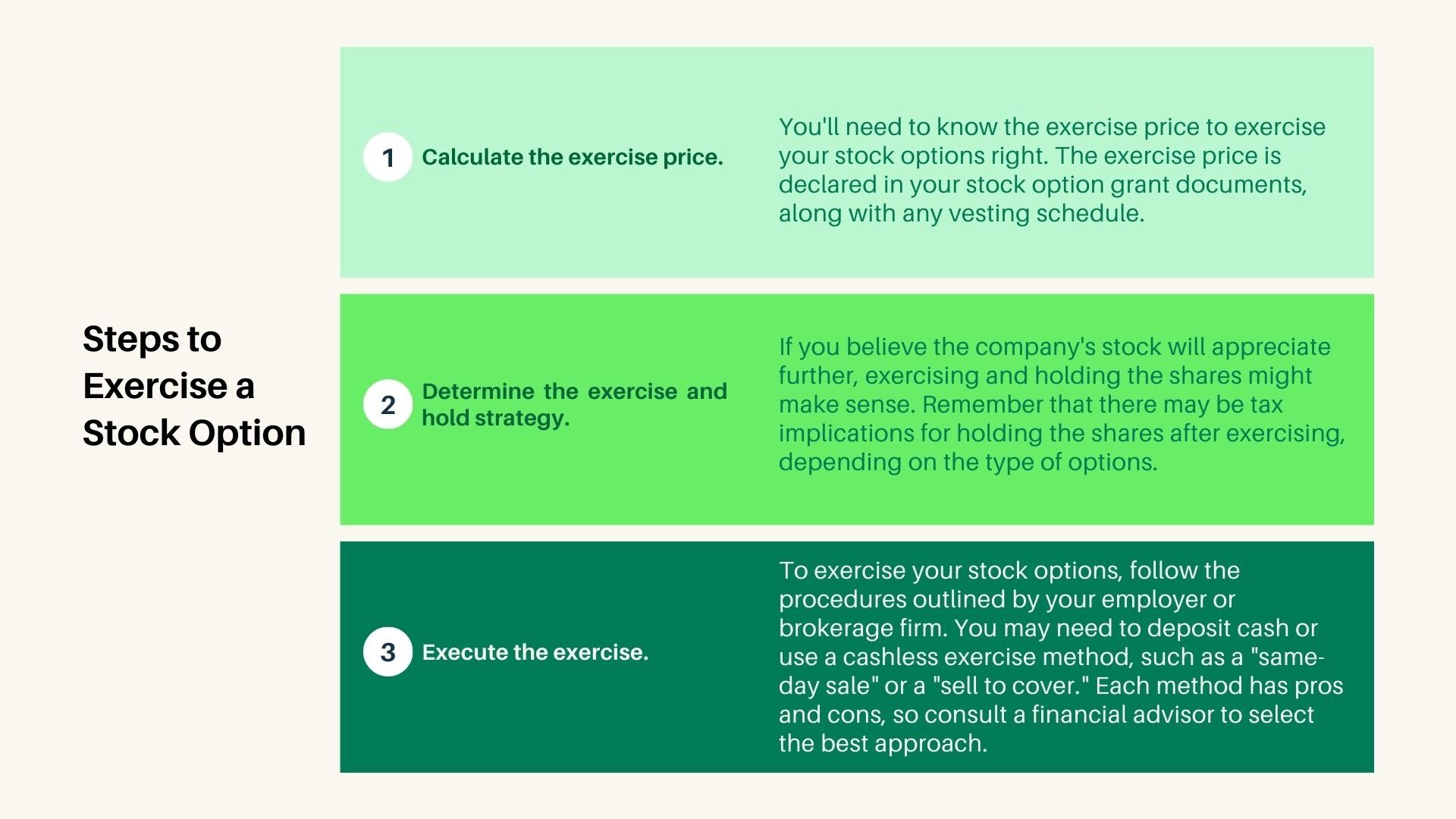

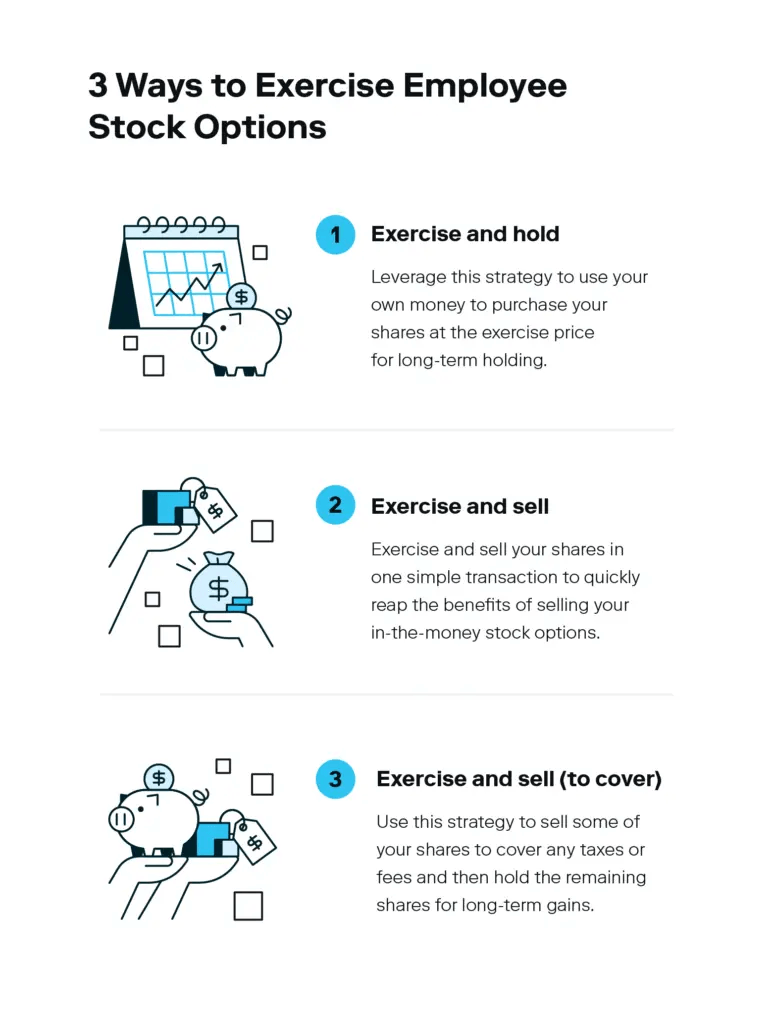

Initiate an “exercise and hold” transaction (cash-for-stock exchange).

Consult a financial expert before initiating such transactions. Initiate such a transaction by exercising an option. This provides an opportunity to purchase securities of a company and then hold them until the value rises to the required value.

Depending on the type of asset, you may need to deposit cash or borrow margin, using your other assets in the account as collateral to pay for the value, brokerage commissions, and any fees and taxes (if margin approval is in place).

Initiate a transaction with execution and sale to cover costs

Such a transaction can be carried out, for example, using stock options. To do this, you need to purchase the company’s securities and then sell as many assets to cover the cost, tax charges, and commissions. In this way, you will receive proceeds equal to the value of the securities, and the remaining amount can be received in cash.

Initiate an execution and sale transaction (cashless settlement)

Another option for this procedure can be an execution and sale transaction (cashless settlement). To do this, use an option to buy securities of the company and sell a certain number of them without using your own cash. Your profit on such a transaction will be the fair market value of the securities less any uncompensated cost and tax deductions, brokerage commissions, and any other fees.

How do I sell stock options for cash?

Let’s name two ways to sell:

- Exercise before expiration. This is available with the American asset type. Contact your broker, for example, when quotes have risen or fallen faster than expected, this way you will lock in your profitability without waiting for expiration. This requires going out for delivery (can be cash).

- Selling to another user. You must submit an application. Specify the price yourself. If you do not find a buyer in this way, the contract will remain with the investor and the broker will close the transaction automatically.

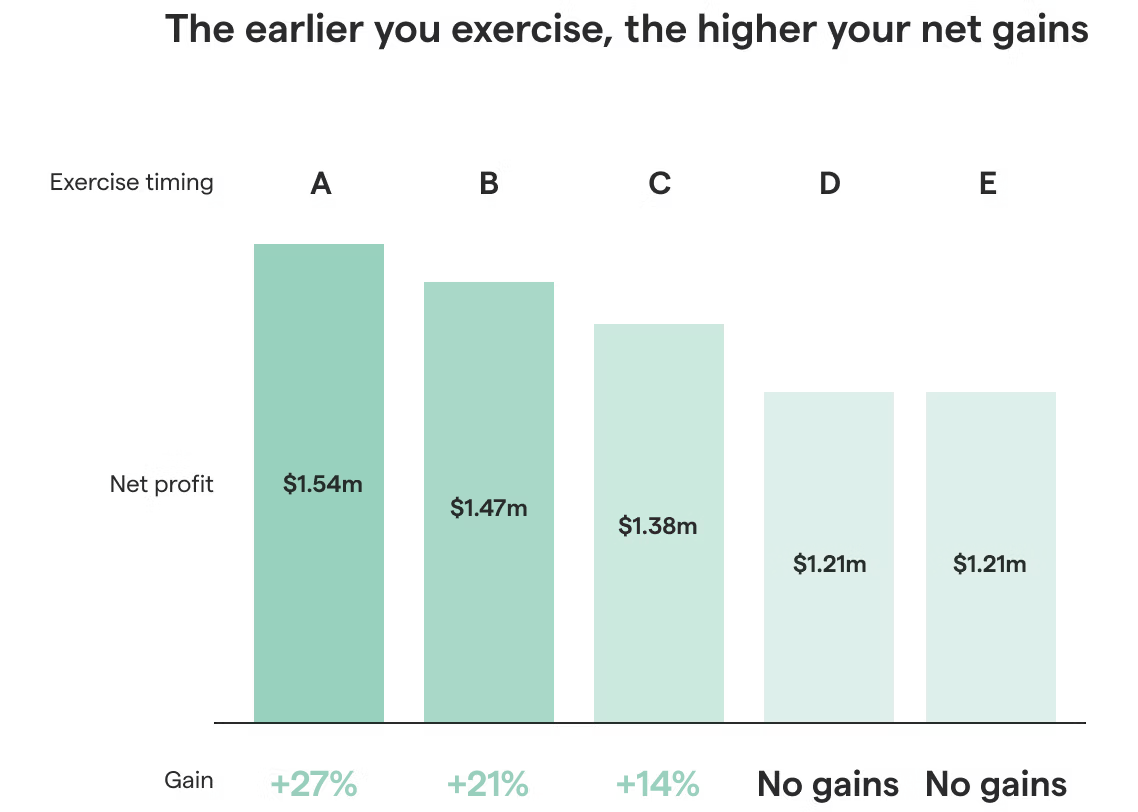

What is an early exercise of stock options?

It is the procedure of buying or realizing the assets of a company in full accordance with the terms of the option contract exercise before the expiration date.

What to consider when selling an asset

The following points should be considered when selling the realization:

- It must be non-public.

- Confirmation of the terms of the option.

- Compliance with the pre-emptive right of the participants in the transaction.

- Assignment of the right under the option.

- Inheritance risks.

Example of exercising an Incentive Stock Option

Suppose a company grants its employee 1,000 shares of stock on December 1, 2024. The employee may exercise the assets or purchase the 1,000 shares after December 1, 2024. After the transfer expires, he can purchase the securities at the exercise price. He can then realize them at their present price. His profit in this situation will be equal to the difference between the strike price and the sale price.

For example, if he waits at least one year after the sale to realize the securities, the gain will be subject to long-term capital gains tax, which has a lower rate than the income tax that everyone is accustomed to.