Despite all the existing monitoring activities throughout the world, there are several projects that aim to be separated from the constant tracking: the Orchid network is one of them. Let’s take a look at the project and review its native token – OXT.

- Defining the Orchid (OXT)

- Story of foundation

- Exceptional features of the asset

- Security measures

- OXT existing amount of supply

- Trading data

- Daily trading volume

- Highs and lows

- The market cap

- Fully Diluted Valuation (FDV)

- Comparing OXT to its peers

- Places to buy the asset

- Current price of OXT on the exchanges

- Future plans on the Orchid’s network

- Picking the Wallet

Defining the Orchid (OXT)

OXT was released as the native token of the VPN which is based on crypto. It was integrated to the p2p privacy network to ensure that the participant avoids any gas fees and potential overload of the Ethereum blockchain.

The prior goal of the initial project is to provide users with a payment model which has no freedom restrictions whatsoever: every involved provider gives the bandwidth that can be bought with no limitations. The feature is achieved by probabilistic nanopayments. They are directly connected to the network’s native token.

Moreover, the network demands payments only during the usage: there is no strict order to pay the price each month or disburse annual fees.

Story of foundation

The original founders of the project were doing several financial and crypto activities, but were gathered with the same thought – the existing all-consuming control of people by authorities. There were four of them:

- Steven Waterhouse, the CEO of the project. An acknowledged investor who made significant investments to the most popular businesses. He, also, took a significant part in the creation of the Pantera Capital – a venture company which directly connected to his significant investments. The official sources explain that the Waterhouse’s desire to avoid any freedom restrictions began to form after him suffering from a SIM-swap attack.

- Jay Freeman, the founder of Cydia, which is a modified variant of App Store. The key difference of his app is the ability to use it with jailbroken Apple devices which is restricted within the original application. Estimated 30,000,000 such devices use Freeman’s product.

- Brian J. Fox, the creator of the first interactive banking online system of the Wells Fargo bank in 1995.

- Gustav Simonsson, one of the key participants of Ethereum’s security fundamentals who aided the initial launch of the platform.

Together, they’ve launched the Orchid network in December 2019 which initial goal is to be a non-restricted peer-to-peer platform where the user can participate with no limitations and constant monitoring by the centralized authorities.

Exceptional features of the asset

One of the key features that Orchid provides is the symbiosis between the blockchain and virtual private network: by executing probabilistic nanopayments, which are available with OXT, participants can avoid being acknowledged because of the network’s independence. It is provided by the VPN which is fully free from centralized servers.

Thirdly, the project provides users with Orchid credits which are meant for users who are less enthusiastic with crypto and wish to use fiat currency. In that case, Orchid native token is obliged to be used only within the network.

Security measures

There are several risks which are associated with the usage of the network, but the prior one is the data loss from OXT which can occur due to the fraudulent attack. The platform itself contains significantly stronger structure than the weak links which are, for the most part, contained by the participant itself. The Orchid’s smart contracts hold an incredibly small amount of data which significantly complicates the attempt of data’s harvest.

The other possibility to lose the data lies in the third-party participation: for instance, an exchange, which can occur due to the constant observing of the person’s transactions to define the identity of the trader himself.

OXT existing amount of supply

Orchid native tokens have a total supply of 1 billion assets. The token burning is available within the network which provides the crypto with a deflation. However, the inflation does not participate in the asset’s supply state.

The existing supply is given to several instances:

- 511,3 million assets are contained within the project treasury to participate in the network’s growth and other activities.

- 173 million of OXT were given to investors. It is obliged to the Simple Agreement for Future Tokens (SAFT).

- 44,9 million Orchid native tokens were given for SAFT 2a.

- 33,8 million went to the participants of the SAFT 2b.

The rest of the supply is going to be given to four dev teams, separately.

Trading data

Let’s take a look at different intel of the asset’s valuation behaviour together with its trading volume.

Daily trading volume

Current trading volume of the token is $4,126,196.99 on the last day. As it stands, such levels of this rate demonstrate the existing increase of the asset’s participation within the trades: the 2.60% growth of the previous 24-hour time window.

Highs and lows

As it stands, the Orchid native token has been valued as $1.02 per each asset: it is the all-time high. Conversely, $0.04666 is the lowest price of the token which ever existed. By overlooking these statements, current OXT cost is almost twice higher than the all-time low and significantly lower than the all-time high of the asset.

The market cap

To this date, the market capitalization of the Orchid (OXT) is $70,107,930.54 which was calculated by the following formula: price of the single asset * the circulating supply. The data must be collected within the same time period to have a maximum level of accuracy (982,294,556.8 OXT are circulating at the moment).

Fully Diluted Valuation (FDV)

FDV is a value of the potential market capitalization maximum level, but on several occasions – it can take a lot of time to define this value because of the launching schedule. In case of the Orchid (OXT), it is, currently, unknown what the limit is going to be, but at the time, it is assumed to be 1 billion tokens: it is the current total supply. With all the calculations complete, $71,300,687.67 is the current FDV.

Comparing OXT to its peers

All along, the statistics show that the OXT is underperforming the global cryptocurrency market in the last 24-hour window: 4.44% market cap loss compared to the 2.25% loss.

Places to buy the asset

Despite being a part of a strong ecosystem, the asset can be used in the trading on several centralized exchanges:

- MEXC.

- Binance.

- HTX.

There are more to choose from: these are just the most popular variants, but the trading on the major exchange is quite tricky with all assets, especially when it comes to the data harvest.

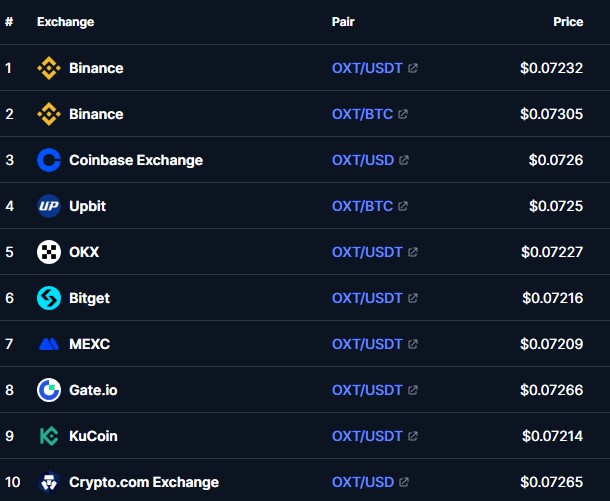

Current price of OXT on the exchanges

Here’s the list of the latest price updates of the Orchid (OXT) on different platforms:

Future plans on the Orchid’s network

The project is developing an idea of digital citizenship by creating the framework which will be based on gathering together a bandwidth, storage and a distributed market for computation.

Picking the Wallet

There are several existing options for the OXT’s containing. Here’s the hardware variants:

- Ledger Nano X.

- Ledger Nano S.

- Ledger Stax.

There are two more extensions:

- MetaMask.

- Enkrypt.

In addition, these are the other existing options, worth mentioning: GUARDA, Atomic Wallet, Trust Wallet, MyCrypto.

It’s difficult to say which one is the best to pick, because the choice of the wallet highly depends on the personal preferences.