Among different day trading methods, there’s one that’s definitely one of the most popular. Its name is scalping, and every experienced trader is well aware of the method or tried it for themselves. Our article aims to explain how scalping works in simple terms, provide examples, and cover how it differs from other day trading strategies.

- What’s Scalping?

- The History of Scalping

- The Basics of Scalping

- How Does Scalping Work?

- An Example of Scalping

- How Does Scalping Differ from Other Day Trading Strategies?

- Things to Consider in Scalping

- What Does One Need for Scalping?

- Overall Trading Strategy in Scalping

- Types of Scalping

- Advantages and Disadvantages of Scalping

- Disadvantages

- Advantages

What’s Scalping?

Scalping is a day trading strategy that involves making several small trades throughout the day. The more, the better. The scalpers usually aim to take advantage of market movements, no matter how insignificant they are. “Quantity over quality” can well be a rule in scalping.

The History of Scalping

The word “scalper” isn’t a new one; some mentions date back to the early 1800’s. This is how people called those who bought tickets in bulk only to sell them on the event day at a small profit per ticket.

Scalp trading has existed since the earliest days of trading, although at the time there were other limitations. In modern days, anyone can use this strategy; the market rule and the presence of state-of-the-art market monitoring tools make it possible.

The Basics of Scalping

Scalping works similarly to many other trading strategies. But still, there are basic things you should understand about this technique:

- Traders perform scalping on an intraday basis. This means that you buy an asset after the market opens and sell it before it closes.

- In the majority of cases you hold an asset only for minutes or even seconds. Holding for hours isn’t unheard of but is quite rare.

- Scalpers usually buy normal and sell higher, but shorting an asset is also possible.

- Although there isn’t a high entry bar, it’s better to participate in activities when you have some trading experience. Scalping involves precise timing, understanding several market factors, an ability to monitor even the smallest and quickest changes, and can become a stressful activity. This is why we recommend scalping mainly for experienced day traders.

How Does Scalping Work?

Scalping is pretty straightforward. After the market opens, a trader buys many shares. They do it ideally at its starting price, but can sometimes buy higher, sometimes a bit lower. The goal is to monitor the price movements and manage to sell them quickly.

An Example of Scalping

Let’s take a look at a practical example. A market opens in the morning, and a scalper buys some assets at an opening price. They buy it in bulk, getting 1,000 shares for $5 each. Within a couple of minutes, their price grows to $5.01, which is more than enough to turn in a quick profit—a total of $10. The trader then tries to repeat a circle by buying 100 shares of another asset at $0.8 each. The price goes lower, so the trader decides not to test the luck and sells them at a small loss of 0.79 each.

All of this happens within minutes, and the cycle repeats itself hundreds times per day.

How Does Scalping Differ from Other Day Trading Strategies?

The main difference is that there’s no need to think long-term about scalping. While day trading doesn’t involve holding assets for a long time, planning for hours is still pretty much normal.

But there’s no such thing in scalping: once you see a profitable price movement, you can sell an asset. Sometimes it can happen within a few seconds.

Another difference is that scalpers usually focus on small profits. There’s no need to think big: any profit is good, especially if they’re selling shares in bulk. Another thing to consider is that scalping involves even more focus and closer monitoring of the market: traders must notice even the smallest of movements.

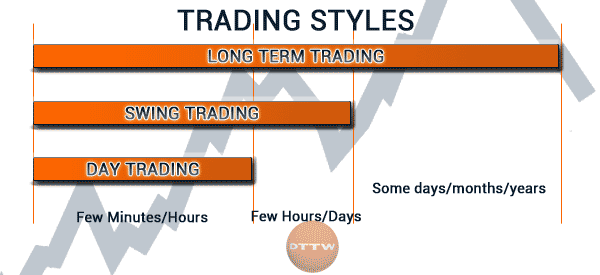

The image1 below shows how fast-paced day-trading can be and that it doesn’t involve that much long term thinking compared to other types of trading. And scalping is even quicker.

Things to Consider in Scalping

Before you try to engage in scalping, there are some things that you have to know and keep in mind.

- You must avoid commissions and fees. Since scalping often involves many transactions and buying/selling in bulk, getting additional fees can lessen your profits.

- Use modern charting tools. Those are the must since you have to be able to notice even the smallest changes. And yes, you have to monitor it constantly.

- Be prepared to spend a whole day in front of a screen. Yes, you can’t clock out in the morning and call it a day. The reason is that scalping involves many transactions to provide you with significant profits.

- Scalping is stressful. Monitoring the market changes during the whole day and being able to make quick decisions and precise movements can take a toll on one’s mental well-being. Make sure that you’re ready for it.

What Does One Need for Scalping?

It isn’t difficult to start scalping but, as we’ve already mentioned in this article, it’s better to start participating in the activity if you have some trading experience. Moreover, there are additional things that make entry more difficult.

- Have direct market access. Yes, your broker should provide it and there must be zero or low fees. Having access to real-time market data is mandatory for successful scalping experience.

- Have significant funds. While it’s possible to start scalping with a low budget, having more money is a must to make it profitable. The reason is that scalpers often buy and sell assets in bulk. And since you’re looking at quantity instead of quality, having more money to spend makes things much easier. It will also be helpful for covering your losses.

- Learn technical analysis and get an understanding of how the market works. While there’s no need to think long-term in scalping, it’s still much easier to participate in the activity when you’re able to analyze the assets, predict the price movements, and understand the market’s trends.

- Use advanced charting tools. We mentioned it before, but we can’t stress it enough: you must use the latest and greatest tools to get all the data in a quick and accessible manner.

Overall Trading Strategy in Scalping

There’s no best strategy for scalping, since the situations can differ significantly. The only aim of scalping is to make profits, no matter how small, quite frequently. This is pretty much straightforward, since it doesn’t require any long-term planning, but can get quite stressful with time.

Types of Scalping

While scalping itself is a kind of day trading, there are subtypes of scalping as well. Let’s take a look at some of them:

- High-frequency scalping. This one involves buying and selling as often as possible. Sometimes this involves using automated algorithms.

- News scalping. This one is simple: read the news to predict the market movements. It’s a normal thing in other day trading strategies, but in scalping it requires quick thinking. It’s especially useful for scalping trading in crypto.

- 1-minute scalping strategy. One of the most popular solutions, this strategy involves using a one-minute chart for market analysis.

- RSI trading strategy. This scalping type involves conducting analysis based on the RSI indicator. It stands for Relative Strength Index, and it shows how quickly the asset’s prices move.

The image 2 below shows an average one-minute chart. This one is a downtrend.

Advantages and Disadvantages of Scalping

As is the case with any other trading strategies, scalping has its strengths and drawbacks. This is to be expected, since it has certain use case scenarios, and isn’t perfect for other situations. Moreover, it can affect a trader in negative ways. Let’s take a look at the advantages and disadvantages of scalping.

Disadvantages

- Limited profits. Scalping doesn’t focus on making big profits, so there’s a certain limit.

- High volatility. Market volatility affects scalpers in even more significant ways compared to many other traders.

- A very stressful activity. This one is obvious: scalping involves constantly monitoring market changes and quick decision making. Moreover, it’s an activity that involves trading for hours, since it doesn’t allow for big profits in small time frames. All of that can affect a trader’s mental state in many negative ways.

Advantages

- Quick profits. This one is obvious: the traders can make a profit very quickly.

- Relatively low risk. Tight stop-loss orders prevent significant losses.

- Flexibility. It’s possible to scalp nearly any asset at any time frame. You can easily find a scalping cryptocurrency strategy, as well as several for scalping regular stocks.

The image 3 below shows some advantages of scalping.