Strategies of hedging: definition, benefits and risks for traiders

Strategies of hedging: definition, benefits and risks for traiders- What is Slippage?

- How Does Slippage Work?

- Slippage Types

- An Example of Slippage

- Slippage on Stock Market

- Why Does Slippage Happen?

- Slippage and Forex

- What Does Slippage Mean in Cryptocurrency?

- How to Calculate Slippage in Cryptocurrency

- How to Minimize the Effects of Slippage

- Slippage Between Different Networks and Blockchains

- Is Positive Slippage Good?

What is Slippage?

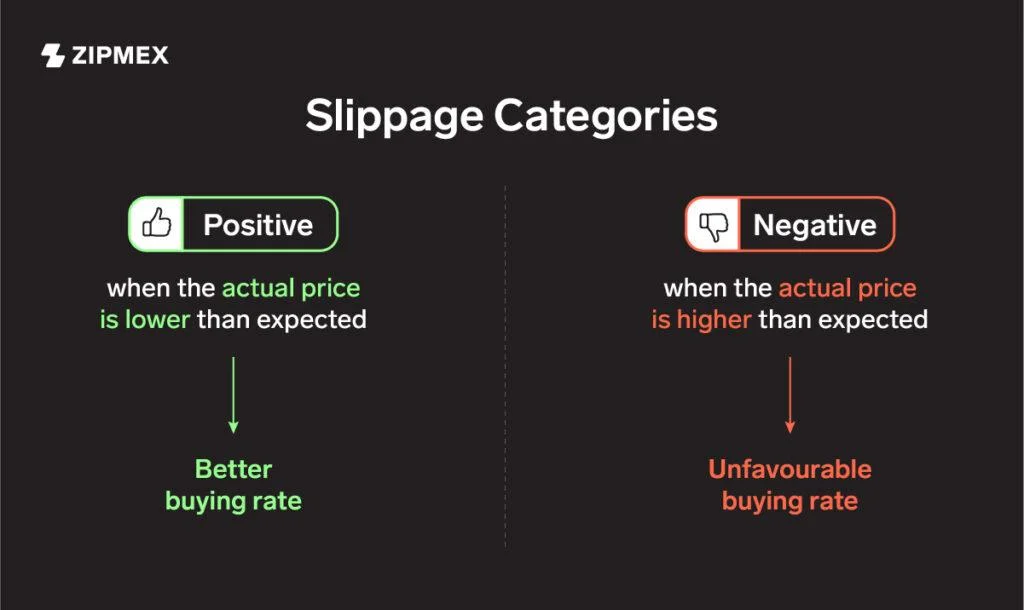

Slippage is an effect when the executing price of a trading order is different from the expected one. The term basically refers to that difference. A slippage can be positive or negative. In the former case, this means a better price than expected (higher for selling or lower for buying). The negative slippage is an opposite situation with price being less desirable. Img1 below shows what slippage is in a demonstrative manner.

Img1 below shows what slippage is in a demonstrative manner.How Does Slippage Work?

If you’re buying or selling an asset, you may see the price being different from the one you expected to see when executing an order. The reasons for that might be different, especially if a market is highly volatile.Slippage Types

There are certain kinds of slippage. You can sort them in two groups:- Positive slippage. This is when the changes are beneficial for a trader.

- Negative slippage. And here is what they call the slippage when the price isn’t good for a trader.

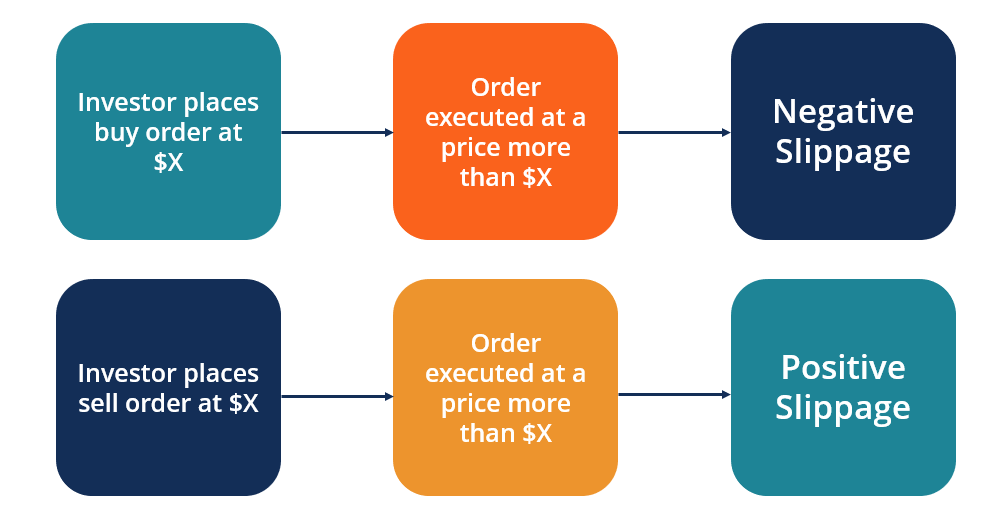

Of course, slippage doesn’t always happen and no slippage is a situation when the price remains unchanged. You can check out Img2 below to see how these two types of slippage differ.

Of course, slippage doesn’t always happen and no slippage is a situation when the price remains unchanged. You can check out Img2 below to see how these two types of slippage differ.An Example of Slippage

Let’s take a look at a practical example. A trader on the stock market sees the price of an asset at $100 per share. The idea is to buy 20 of them at that price and sell them later, when the price gets even higher. The trader places an order but later finds out that it’s executed at $102. This is a negative slippage, since the change isn’t beneficial at all. There’s nothing a trader can do, so they spend $200 more than planned. Img3 below shows how positive and negative slippage work in real scenarios.

Img3 below shows how positive and negative slippage work in real scenarios.Slippage on Stock Market

Slippage can happen on any market with any asset. The stock market is a bit safer in that sense compared to many others: it usually features a more relaxed pace, and the times of high volatility are relatively rare. But they still happen, so watch out for slippage.Why Does Slippage Happen?

Slippage can appear for a variety of reasons. The primary cause is market volatility. The lack of liquidity is another one. Both of them cause a delay between the request and the execution of an order. And the price can change during that delay.Slippage and Forex

Forex isn’t safe from slippage either. This usually happens with less popular currency pairs, since the most common ones usually have enough liquidity to avoid experiencing this effect.Trading with low spreads will be enough in the majority of cases to avoid seeing slippage on forex.

What Does Slippage Mean in Cryptocurrency?

With the cryptocurrency market being incredibly volatile and fast-paced, it’s not surprising to see slippage occur on the crypto exchanges. The mechanism is the same: low liquidity and quick changes result in executing prices not matching the requested ones.How to Calculate Slippage in Cryptocurrency

If you want to find out the slippage percent, then simply follow this formula: (executed price minus expected price) / expected price * 100. The resulting percent reflects slippage. This works for cryptocurrencies as well as for other assets.How to Minimize the Effects of Slippage

Once slippage occurs, there’s nothing you can do. And while there are no 100% methods to prevent it, there are plenty of ways to minimize the risk of such an effect happening. Let’s take a look at some of them.

- Don’t trade during volatile periods. Just avoid trading at times when the market experiences the highest levels of volatility, since it tends to cause slippage.

- Avoid volatile and high-liquidity markets. This tip expands on a previous one, but also recommends trading at low-liquidity markets, since the chances of slippage are low on them.

- Set stop-loss orders. Using such tools can prevent you from losing significant sums. While it’s often helpful, you have to keep in mind that using stop-loss orders doesn’t guarantee that there will be no slippage. The reason is that sometimes the market changes too fast. But it’s still better to use this tool.

- Check for additional slippage tolerance features. There’s a chance that the exchange or trading provider you’re using offers some. Research it and use if it seems to be a beneficial solution.

- Don’t hold your positions during the times when the market is closed. Obviously, this recommendation is difficult to follow, especially if you prefer going long, but the fact remains: some of the most massive price movements happen when the market reopens.

Slippage Between Different Networks and Blockchains

If you’re trading different cryptocurrencies, then the slippage can still occur. Yet again, this depends on the situation on the market, with certain pairs experiencing low liquidity and high volatility. Cryptocurrency exchanges can offer some ways to minimize or eliminate the problem. For example, quite a few decentralized exchanges claim to use certain mechanisms to avoid slippage altogether.

Is Positive Slippage Good?

In fact, yes. The term always refers to the price change that’s beneficial for a trader, no matter the direction of such a movement.Comments

Subscribe

Login

0 Comments