Strategies of hedging: definition, benefits and risks for traiders

Strategies of hedging: definition, benefits and risks for traiders- How stablecoin staking works

- Delegated

- Fixed

- Flexible

- The difference between lending and staking

- The importance of choosing a reliable platform

- Security

- Returns

- Transparency

- Reputation

- What places are there for staking?

- Crypto.com

- Coinbase

- Curve

- Hi

- Ledger wallets

- Can I stake stablecoins?

- How to do it

- What is the best way to stake stablecoins?

- Is it legal to do so?

- What are the fees?

- Final thoughts: benefits vs. risks

- Benefits

- Relatively high returns

- Stability

- Flexibility

- Risks

- Local troubles with this or that platform

- Possible regulatory introduction

- FAQ

- Is it safe to stake stablecoin?

- How much can one make from it?

- What is staking stablecoins anyway?

Read on to find out exactly what exactly stablecoin staking is, what separates a good investment platform from a bad one, and what the risks of this type of passive income are.

Read on to find out exactly what exactly stablecoin staking is, what separates a good investment platform from a bad one, and what the risks of this type of passive income are.How stablecoin staking works

Practically the same as with regular cryptocurrency. Except that the concept of "staking" is not entirely applicable to stable value assets. But we will talk about that a bit later.Anyways, it is impossible to speak about the mechanisms of this type of investment without mentioning its variations.

Delegated

In some blockchains, token holders can delegate their tokens to other participants in the network, who then use them for stakes. In this approach, both participants share the rewards they receive.Fixed

This type of staking offers a fixed reward in the form of a percentage of income or a certain number of tokens per blockchain. More precisely, for a certain period of time. The advantage of this type is that it allows you to understand in advance how much you will be rewarded in the end.

The advantage of this type is that it allows you to understand in advance how much you will be rewarded in the end.Flexible

Flexible is when users are given the opportunity to manage their assets flexibly and smoothly. What does this mean? It means that it is possible to interact with locked tokens. For example, to take them away without any restrictions or delays.

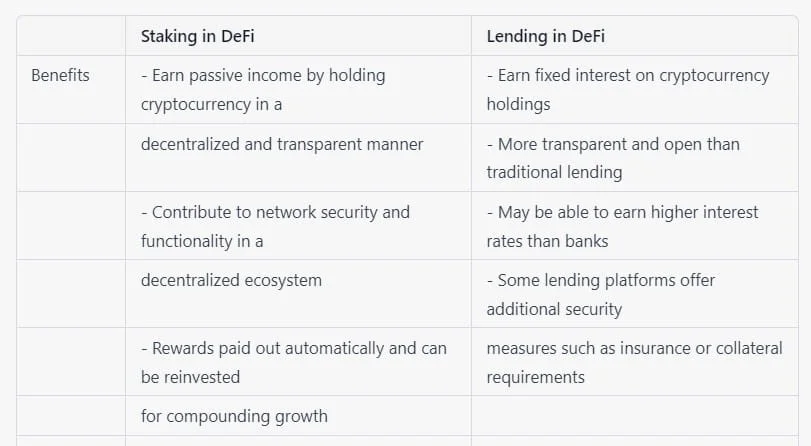

The difference between lending and staking

Lending is a classic form of credit. It is available for all types of assets. It refers to situations where funds are transferred for use. Their security must be guaranteed by an exchange or other platform that actually provides lending services. Staking is a kind of passive version of mining that is only available for certain cryptocurrencies. It also differs from lending in that the funds are not transferred anywhere - they are simply blocked.

Staking is a kind of passive version of mining that is only available for certain cryptocurrencies. It also differs from lending in that the funds are not transferred anywhere - they are simply blocked.The importance of choosing a reliable platform

Choosing the right platform is half the battle. If you manage to pick a reliable place to trade your stables, you can ensure not only top-notch security and a good night's sleep, but also weighty profits for yourself.

Security

Here's the thing: staking means locking coins in for a certain amount of time. Inside of a smart contract. At that point, they can become quite vulnerable. So you definitely want the place where you host them to be known for its excellent security measures that don't end in some complex encryption. You'll also want other users to have a good impression of it, so don't be lazy and check out what others are saying about it.

You'll also want other users to have a good impression of it, so don't be lazy and check out what others are saying about it.Returns

Returns must be just competitive. Yes, you may be in love with high returns, but transparency is more important. Even if you are not satisfied with the returns, you should not immediately turn around, walk away and look for another option.Transparency

Close to security yet it has some distinct differences (otherwise we wouldn't separate them).Transparency is how open the platform is with you. This can come in the form of a detailed explanation of the system of transactions, commissions, rewards.And yes, you should only work with those who have a responsive support team. They ought to be available 24 hours a day, seven days a week. This is critical for staking-related things.

Reputation

We mentioned reputation above. Well, we do feel that this aspect should be put in a separate paragraph as well. The platform you choose for trading should have a solid reputation in the community. Do not be lazy, study the history of its creation, look at reviews and feedback from other users to assess its reliability. As for signs of a reliable place, these are, for example, a long time of operation (several years or more), the absence of any problems with payments and customer focus.

As for signs of a reliable place, these are, for example, a long time of operation (several years or more), the absence of any problems with payments and customer focus.What places are there for staking?

There are many places to stake. It is easy to get confused. But we decided to select the best, most reliable (and most importantly, proven) platforms just for you.Crypto.com

Crypto.com is a very, very famous cryptocurrency exchange that works with a wide range of cryptocurrencies. Not just stablecoins. The main advantage of this site is that the APY here is high. It reaches up to 8.5% (although usually this value is somewhere around 4%-5%).Coinbase

Coinbase is a whole ecosystem that includes the largest centralized cryptocurrency exchange in the United States, a cryptocurrency wallet, an NFT marketplace, a digital asset custody service and other products. However, at the moment we are only interested in the exchange. It is a convenient trading platform for transactions with crypto assets. It ranks third among all exchanges in terms of volume, which is an excellent argument for why it can and should be trusted.

Curve

This is a decentralized exchange with AMM-DEX technology, launched on the Ethereum. This one probably has the lowest commissions of all the places we have listed. They are sometimes less than 1%. The exchange supports stablecoins such as USDC and USDT (the most recent ones), so it can probably be called a universal option.Hi

If Curve is the optimal exchange, then hi is a multi-tool exchange. Hi allows you to store assets as well as stake on the liquidity prover and get sufficient APY, which is in the neighborhood of 10-14%$.Ledger wallets

The most unique contender on this list. Ledger is a leader in the cryptocurrency wallet industry. It has admirers all over the world, and for good reason.When it comes to wallets, there are a lot of them. The optimal model for storing stablecoins is probably Nano. More specifically, the Nano X, because it works with Bluetooth and has a great display overall! Why did we even decide to include a hardware wallet in this list? Well, because it has a sharing feature preinstalled. For example, you can buy new assets in a few simple steps and send them to your Ledger immediately.

Why did we even decide to include a hardware wallet in this list? Well, because it has a sharing feature preinstalled. For example, you can buy new assets in a few simple steps and send them to your Ledger immediately.The percentage varies. From 3% to 7%. This is not a bad indicator.

Can I stake stablecoins?

Sure you can do.иBut there are a few nuances. Stablecoins have no backing as such. Well, that is, if you look at it from a purely theoretical and scientific point of view. Judging from a practical point, there is absolutely no difference between storing a stablecoin and passively earning with it or deliberately blocking any other cryptocurrency.

How to do it

Just find the right place and get started. Familiarize yourself with rules, find out nuances, pros and cons, register, buy your favorite currency and just store it. Come back in a month, two months, or even a year and find yourself richer!

Come back in a month, two months, or even a year and find yourself richer!What is the best way to stake stablecoins?

You have two options here. Well, if you are considering using assets on a PoS algorithm for this very investment purpose. The first option is to buy cryptocurrency and store it in your wallet. The second is to buy a lot of new PoS coins that are not yet listed on any exchange, hoping for a possible increase in price. This should be done on an industrial scale. And you should also realize that if the project fails, all investments are simply lost.When it comes to stablecoins, there are no options. Or rather, there is, but only one. Simply buy these assets and receive income from them over time.

Is it legal to do so?

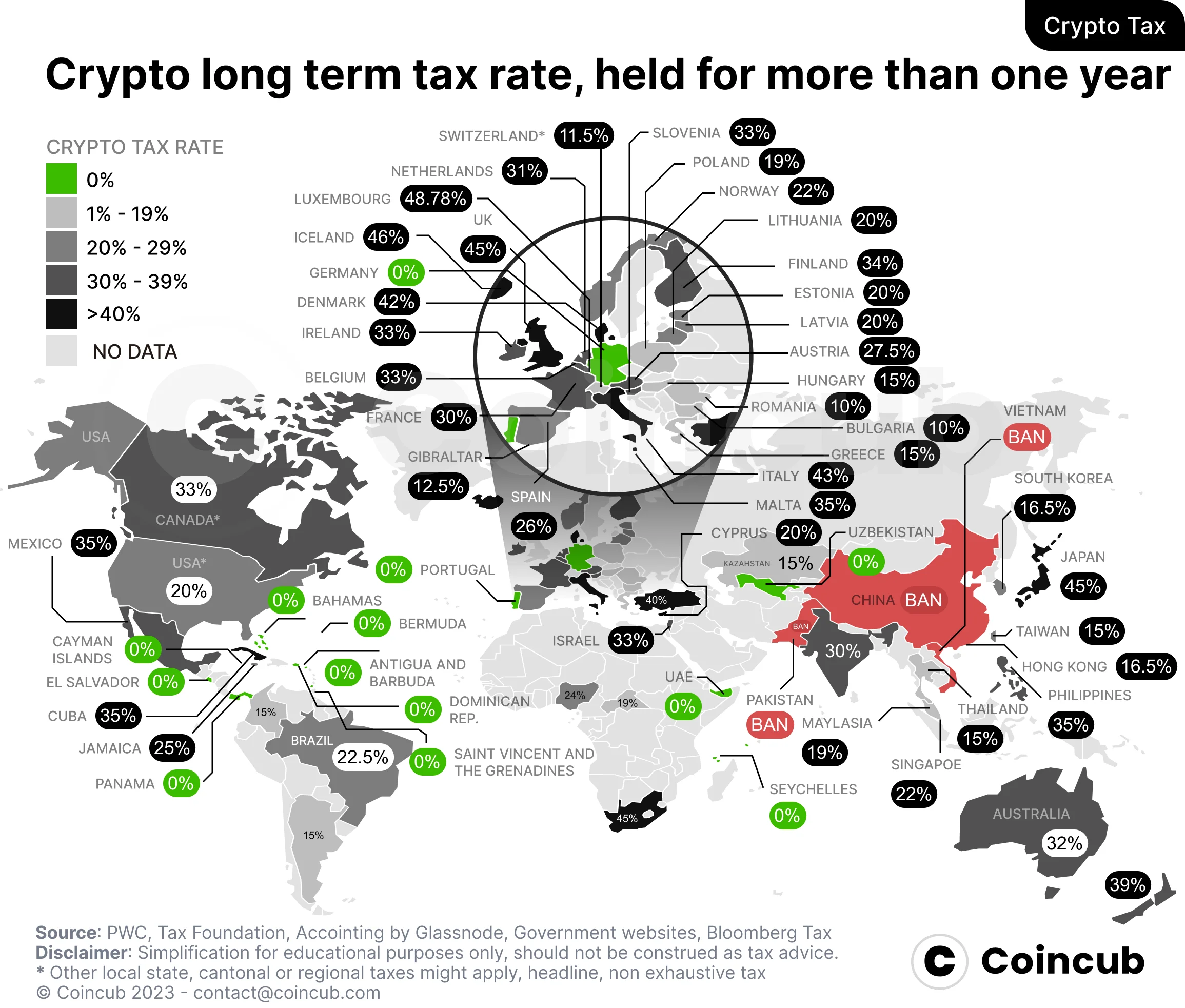

Positive. Stablecoin staking is legal and widely practiced in the crypto market. This is supported by the fact that many reputable platforms such as Binance offer it. But as with any other investment, due diligence is crucial. But this is more about the security aspects. There are also personal aspects related to taxation. We can't know for sure what liability you will face in country X if you don't report your income to the tax authorities, so you should take the time to research this issue and strictly follow local laws.

But as with any other investment, due diligence is crucial. But this is more about the security aspects. There are also personal aspects related to taxation. We can't know for sure what liability you will face in country X if you don't report your income to the tax authorities, so you should take the time to research this issue and strictly follow local laws.What are the fees?

It all depends very, very much on the platform through which you are going to store your money. Usually we are talking about 2-6%, but on some exchanges the commissions can be 10% and even 15%. It also works the other way.Final thoughts: benefits vs. risks

We believe that this material should be summarized as a grammatical weighing of benefits and risks.Benefits

Let's start with the good.Relatively high returns

Investing in stablecoins offers higher returns (of course, when compared to savings accounts or other low-risk investments).Stability

Because stablecoins are pegged to fiat currency, they offer predictability of value. It's as simple as that.And yes, and this asset class is also far less volatile than other cryptocurrencies for the same reason.Flexibility

This plus seems to us to be quite controversial. Not because it will not help. No, not at all. It just not unique, but we have to mention it anyway. Stablecoins are a very flexible investment. You can engage in staking wherever you have the opportunity to do so.

Risks

Now let's move on to the "risks". These are also can be called "downsides".Local troubles with this or that platform

The most important risk associated with stablecoin investing is third party problems. That is, on the platform you have chosen as your investment environment. The risks can be quite high: from a simple malfunction, when the exchange site is attacked by hackers and you are not able to control the processes, to a deliberate deception on the part of the administration.Possible regulatory introduction

Places that allow staking may well be subject to regulatory scrutiny. Changes in legislation may affect the investment process and its returns. While writing this article and researching competitors, we came across some very interesting statistics about countries that are friendly (or not really) to cryptocurrencies. You can read the useful table from Coincub and get an idea of how things are with taxation in different countries:

While writing this article and researching competitors, we came across some very interesting statistics about countries that are friendly (or not really) to cryptocurrencies. You can read the useful table from Coincub and get an idea of how things are with taxation in different countries:FAQ

Is it safe to stake stablecoin?

Yes, but it's only really safe if you do it on a reputable platform with a good reputation. It's perfectly legal from a legal perspective, but you should still familiarize yourself with your local tax laws.How much can one make from it?

A tough question yet a good one! It all depends on how much you are ready and willing to dive into the process. If you don't mind transferring a thousand or two USD into stablecoins and start storing them, why not? You will make a good enough profit from it.What is staking stablecoins anyway?

Stablecoin staking is buying the cryptocurrency you are interested in (USDT, BUSD, TUSD, USDC and others) and then holding it on some exchange or even in a wallet with a certain percentage. Kinda long term investment.Comments

Subscribe

Login

0 Comments