Swing trading is an efficient way of gaining profit in the market, but it has several difficulties in execution. Let’s define and break down this method.

How to define swing trading

It is a trading strategy based on cost fluctuations. Traders gain profit from such movements , also known as “swings”. They usually look for this tendency and make a move before the next “swing”: it’s crucial to catch the right particular moment.

Prevalent strategies

Let’s review several way to apply swing trading:

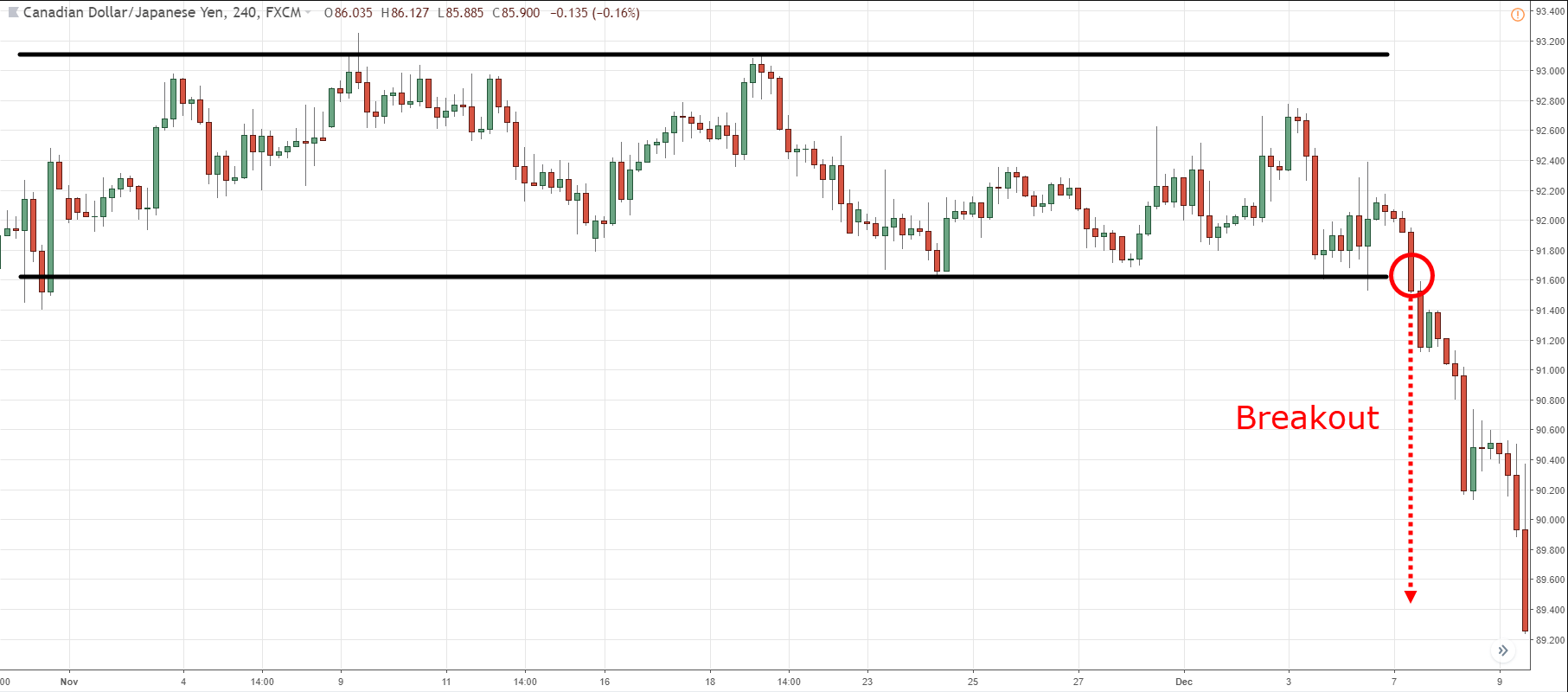

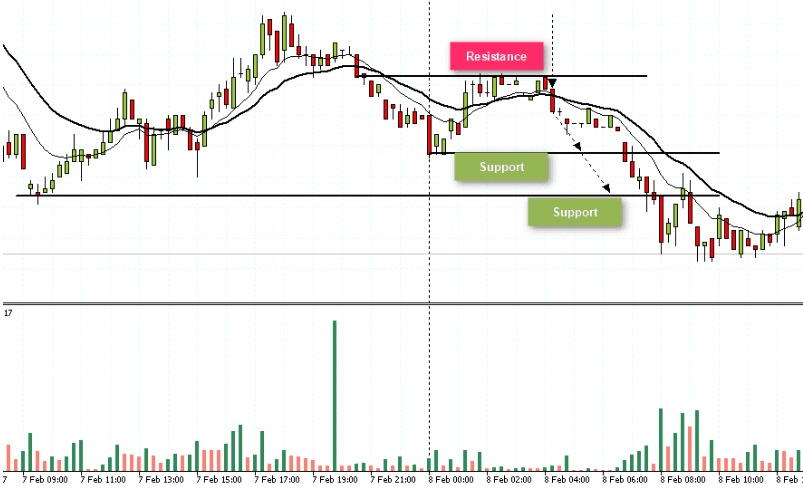

- Breakout trading. It’s based on valuation’s crossing support or resistance levels. People discover such potential changes with the help of technical tools, for instance: volume-weighted moving average (VWMA) which provides traders with knowledge about possible breakouts. In case of potential breakout of the support level people decide to short sell, which prevents them from losses after the valuation downfall. Let’s take a look at the example of breakout:

- Trend trading. It is safer to discover the overall trend and catch the price’s movement than trying to identify the points of start and end of any swing. Here’s where MA’s and relative strength index (RSI) appear to provide traders with the knowledge about current tendency whether it’s bullish (rising) or bearish (decreasing).

Technical indicators & swing trading

Several technical indicators are used within the swing trading:

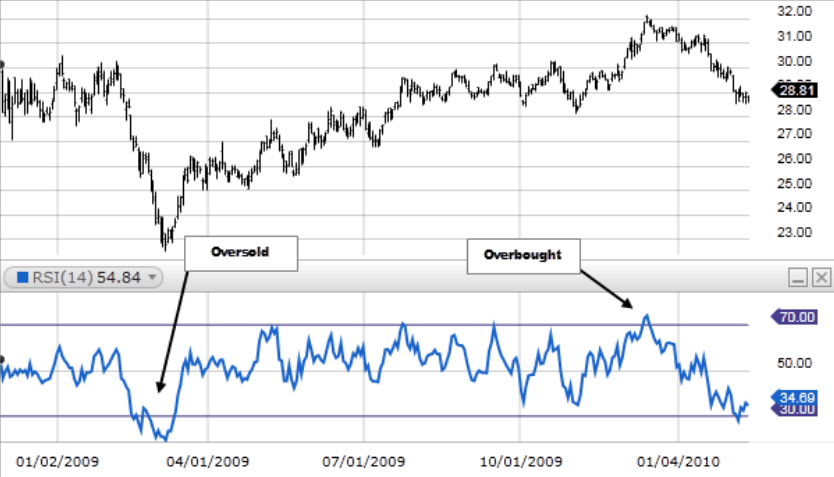

- RSI. It is a momentum oscillator which identifies the possible direction of the market’s momentum. Here’s the example of this tool:

It is usually used to define the status of an asset: overbought or oversold. Its usual operational time window is 14 days. Although, it can be less than two weeks – it is decided by individual features of different strategies.

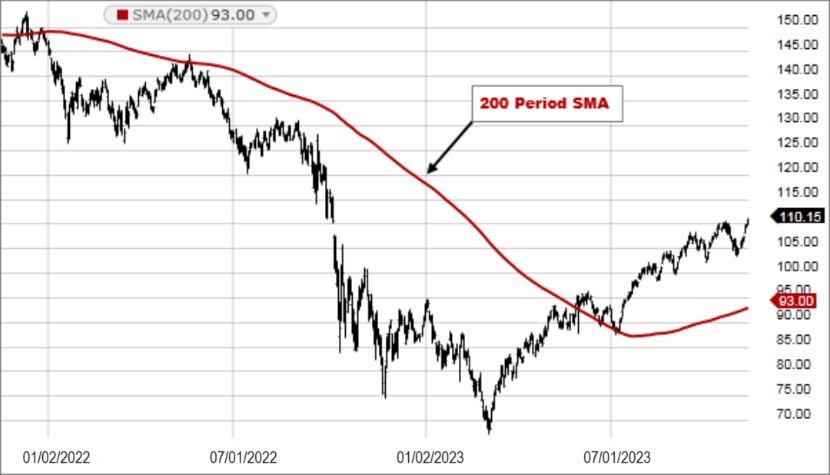

- Simple MA. It is one of the most usable tools of identifying market trends. It’s very adjustable: it can be used for short and long-term strategies in swing trading, respectively. Let’s have a look at the instance of 200 period SMA:

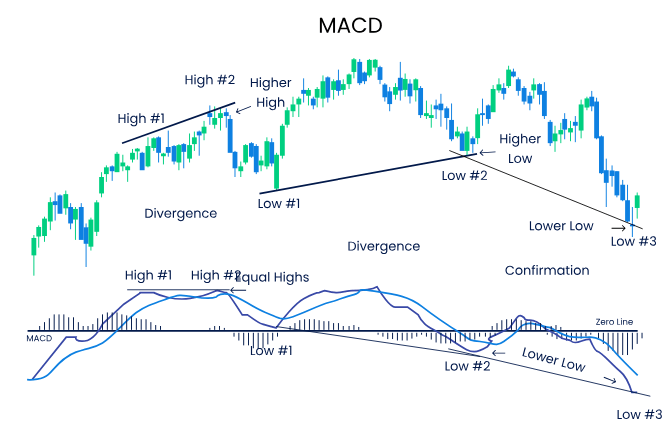

- Moving average convergence divergence (MACD). It also discovers trends, but more precisely. MACD shows the tendency and uncovers the power and momentum of it. Example of a MACD is on the picture below:

Risks

Swing trading is not an exception with risks. There are two main parameters which can be troubled:

- Trading frequency. In case of short-term trades, frequency and risk will be increased, respectively. You need to be experienced and prepared enough to manage this complication. Main advice is to increase the trading volume slowly. It helps with adapting your strategy with potential risks. Do not forget about the price of the transaction itself: the more you trade – the more you pay for it.

- Complexity. It is explained with individual situations which can occur with different trades. It can result in several mistakes and losses which means that you should be more prepared and adapted to a variety of scenarios.

Comparison with day trading

Intraday and swing tradings resemble each other, but they differ in the holding position time. Day traders operate within a 24-hour window, but people who choose to work with swings can wait from days to weeks for a desirable result.

On the other hand, we have intraday traders which operate incredibly faster. The quantity of transactions is larger, as is the fee for it. Their usual method subtract any risk of changes because of news announcements. Take a look at the example of the 15-minute chart which intraday traders operate with:

Frequently, people depend on leverage to increase the overall gain from small valuation fluctuations.

Comparison with long-term position trading

Long-term investors operate with much longer time periods. It results in differences within the overall analysis of the market situation and the range of observable momentum.

For example, in a long-term position trading, people will operate during huge swings, avoiding the transaction when a smaller one happens. But in case of swing trading, market players will gladly take it as an opportunity and execute the move.

Applying swing trading in real-life

Let’s review an instance of Apple’s price increasing period. First of all, preparations:

- Identification of constant levels. When the valuation starts to break such levels it could mean a potential buy timing. In this case, it is around $192.80.

- Now we need to prepare for the stop-loss. In this particular example, it is near $186.50.

- Calculate the risk per share: $192.80 – $186.50 = $6.30. To measure the risk/reward ratio we need to use the following formula:

In this particular case we have a 3% risk.

- If the initial target is to at least double the risk, any valuation from $205.40 and higher is a desirable profit.

Of course, there are different ways of exit in this scenario, but let’s continue on the risk/reward method. Until $216. 30, there were no signs of a huge decrease. When the tendency of overall growth was changed into a small decrease, it is time for selling.

As a result, the received gain from such investments estimated at $23.5 per share.

Benefits & Drawbacks

Let’s take a look at each side of swing trading. First of all, pros:

- It is flexible with your time. This method does not require an every-hour observation.

- Wider stop-loss orders. It decreases the quantity of early exits.

- Slow and stable pace.

Now, let’s review cons:

- The amount of necessary technical knowledge. Traders should be qualified enough to use the intel in the right way, because timing of entry and exit is crucial.

- Individual time horizon. It can lead to gapping in several cases of overnight holding of the position.

- Longer you hold – the more you can lose. Of course, it’s great that you have enough breathing space, but if the investment is executed with leverage – huge losses can occur because of it.

- Emotional resilience. You need to be patient enough in situations when volatility is not on your side.

You should remember about these pros and cons of swing trading.