Disclaimer: this article is for informational purposes only and does not constitute a solicitation to fund or to speculate in any form – remember that all investments involve risk.

- Types of hedging

- Which investments are used for hedging

- How hedging works

- Hedging with derivatives

- Example of a put option hedge

- Hedging through diversification

- Spread hedging

- To hedge or not to hedge: a little about strategies

- Direct

- Multiple currencies

- Options

- Benefits of hedging

- Risks of hedging

- Is it worth considering hedging for investments?

- FAQ

- What is financial hedging?

- How does hedging work in the stock market?

- What are the methods of hedging?

- Is hedging useful?

- What is a good example of hedging?

Hedging is a strategy (or, more accurately, a set of strategies) that can help protect against potential losses. Read on and we will explain what types of hedging there are, why they are needed, what types of investments can be used in conjunction, what the risks are, and finally, what the benefits are. If there are any.

Types of hedging

Hedging is divided into several types. Things are different from place to place, but usually the classification looks something like this:

- By type of instrument – exchange-traded or over-the-counter (futures contract).

- On the buyer’s or seller’s side – in the first case the buyer insures himself against an increase in the price of goods and deterioration of the terms of the transaction. In the second, the seller insures himself against price decrease.

- By the amount of risks – here hedging is divided into full or partial. It is possible to insure the portfolio for the entire amount at once, or for a smaller amount instead.

- By the time of conclusion – an investor can hedge the assets in his portfolio, sure thing. However, it is also possible to hedge in advance, i.e. before the purchase of the asset to be protected.

Which investments are used for hedging

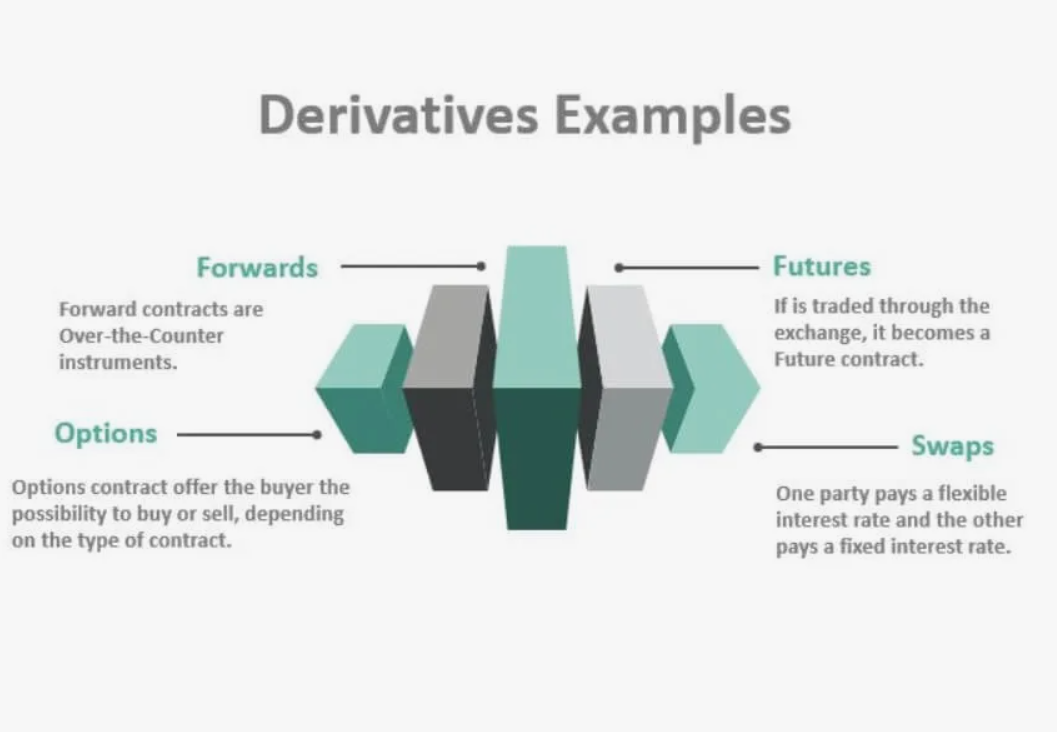

Futures, options, forwards and swaps.

The last two are over-the-counter contracts. They are concluded directly between the parties to the transaction and are therefore less standardized. They can be conducted both without and with the help of an intermediary, by the way.

How hedging works

If one talk about hedging in the perspective of consecutive steps, it will look something like this:

- Establishing a core position – at this stage, the investor fixes a position in some asset. Let’s say a cryptocurrency.

- Identifying risks – the next step would be risk management. For example, in the case of a cryptocurrency, the risk here is a possible price drop (this essentially applies to any altcoin and token, not just the Bitcoin or whatsoever).

- Creating an opposite position – then comes the very hedging stage, in the process of which the opposite position is engaged.

Hedging with derivatives

Let’s go from a distance here. Options are financial instruments (derivatives) based on the price of an underlying asset. In general, they are divided into two types:

- Put – gives the right to sell an asset at a certain price at a certain time.

- Call – gives the right to buy an asset at a certain price at a certain time.

We will work with the first one.

Example of a put option hedge

So, as an underlying asset we will use a share that is now worth 100 dollars. The premium for it is five dollars.

The buyer of the put option will make a profit if the price falls below $95, the only limit = $0 per share. He will also have a break-even point at the $95 level. And if the stock starts trading above $95, he will make a loss. However, this loss will be limited to five dollars (remember: the premium).

As for the seller of the put option, he will incur a loss if the price falls below $95. The greater the drop, the greater the loss. The break-even point in this case is recognized as $95. He will make a profit of $5 if the stock starts trading above $100.

In other words, hedging with a put option works like this: the parties agree that the buyer of the option may (yet is not obligated to) sell the underlying asset at a predetermined price, regardless of future quotes.

Hedging through diversification

Hedging through diversification will simply not work. Just because these are two completely different approaches, which can still also be combined.

The point is that hedging is insurance against losses that may be caused by changes in the value of an asset in the future. In other words: to fix the cost of purchase or sale.

Spread hedging

Spread hedging is a limited risk strategy used by options traders. Conservative in nature, spread hedging sacrifice some of the upside potential in order to reduce the risk of loss though.

When one talk about spread hedging, he or she usually mean a strategy that uses a combination of buying a call option and selling a call option to take both sides of the market. Despite the relative simplicity of the theory, option spreads can be quite complex and tricky to execute.

To hedge or not to hedge: a little about strategies

And here we move smoothly to strategies.

Truth be told, there are a lot of them. In fact, everything is limited just by the investor’s imagination. Yet we will analyze the most popular ones.

Direct

The most common type. It ‘appears’ when a trader already has a long position on a certain currency pair, and then simultaneously takes a short position on the same asset.

Multiple currencies

Organizations that are looking to make a profit resort to this type of hedging. The way it works is that a company (a person, perhaps) selects two positively related currency pairs and then takes opposite positions in them. One compensates for the other.

Options

We have already said a lot about options. And the strategy involving them is detailed above. One just need to remember that there is a thing like this.

Benefits of hedging

Hedging not only allows one to reduce potential losses, but also opens up the possibility of profiting. Profiting in the face of unfavorable market fluctuations, to be said. Well, yes, even diversification can be profitable, but it is not guaranteed.

And the fact is that hedging works with instruments that have a perfect inverse correlation to the underlying assets (short positions, futures contracts with leverage), thus offering a real opportunity not only to protect but also to increase capital.

Risks of hedging

But there’s a fly in the ointment. After all, hedging is still a complex and often inaccessible instrument for beginners. In general, it is best suited for speculators, not ordinary investors: interaction requires active position management, deep technical analysis and understanding of how to use orders – for example, a stop loss one.

By the way, we have an article dedicated to orders. You can find it here.

Is it worth considering hedging for investments?

That is for you to decide. Some may find such techniques too complicated. Some may not be willing to sacrifice their expected profits. That’s fine. But understanding the basics of hedging can still be helpful.

Let’s just say it’s harder to find a company that doesn’t hedge than the other way around.

FAQ

What is financial hedging?

Financial hedging involves usage of instruments or market techniques to reduce the risk of price fluctuations (unfavorable ones).

How does hedging work in the stock market?

On the stock exchange, hedging works in such a way that an investor protects his entire portfolio from market risk at once, rather than individual positions.

What are the methods of hedging?

One can insure the entire transaction. Or one can protect only one or several assets. One also can resort to it immediately after the transaction, or before it. There are a lot of options, really.

Is hedging useful?

Absolutely. But one should realize that it must be used by professional investors and not by amateurs and beginners.

What is a good example of hedging?

A simple (and good) example of hedging is as follows: an investor has some shares of a company whose price starts to decline. To protect himself, he perform short trading with the same shares on another account. As a result, he receives a loss on the long position and a profit on the short one.