If you are interested in a fast profit, monthly options can be replaced with weeklys, but is it worth it? Let’s review all the upsides and drawbacks of such options.

Weekly option’s definition

Weekly options are released every Thursday and expire 8 days after: on the next week’s Friday (3rd Friday is an exception). It works like with monthly ones, but, of course, more often. It gives traders a new wave of opportunities to execute short-term investments. Let’s take look at the compartment:

Features which signify them

They have their own specific features, due to its expiration:

- Commonly smaller premium. It decreases with the amount of time to expire. Moreover, 1st and 2nd Fridays are less profitable than the following 3rd. In addition, people who sell options gain less profit.

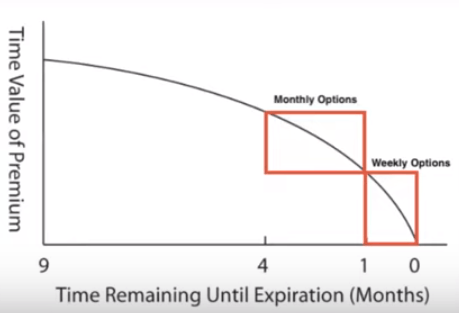

- Higher rate of theta(Θ). It is a time decay which becomes higher when it is closing up to expiration date. Due to this short time period, this parameter is much higher than in case of monthly options. Let’s see the differences in time decay of weeklys and monthly options:

- More sharp cost movements. It is based on higher risks at the time of volatile periods. More specifically, the valuation can move because of movements in the underlying stock’s cost and because of the expected volatility changes. In this case, the delta of short-term options is commonly more impacted by the underlying valuation movements. And that is being followed by a higher gamma – by a higher risk at the volatile time frames.

Working principles

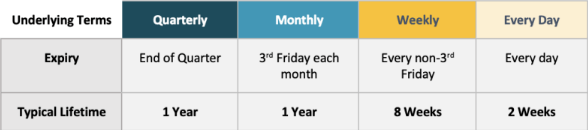

Weekly options are very similar to monthly ones. The main big difference is an expiration date: that’s what influences the result. Weekly ones are flexible with trading strategies and can be used with longer-dated variations. The quantity of received premiums per year is significantly increased because of the amount of options you can operate with during a 365-day period. Here’s the table of the different option’s lifetimes:

Instances

Let’s take a look at the indexes which provide weekly options:

- S&P 500 Index

- CBOE Mini S&P Index Options

- Nanos S&P 500 Index Options

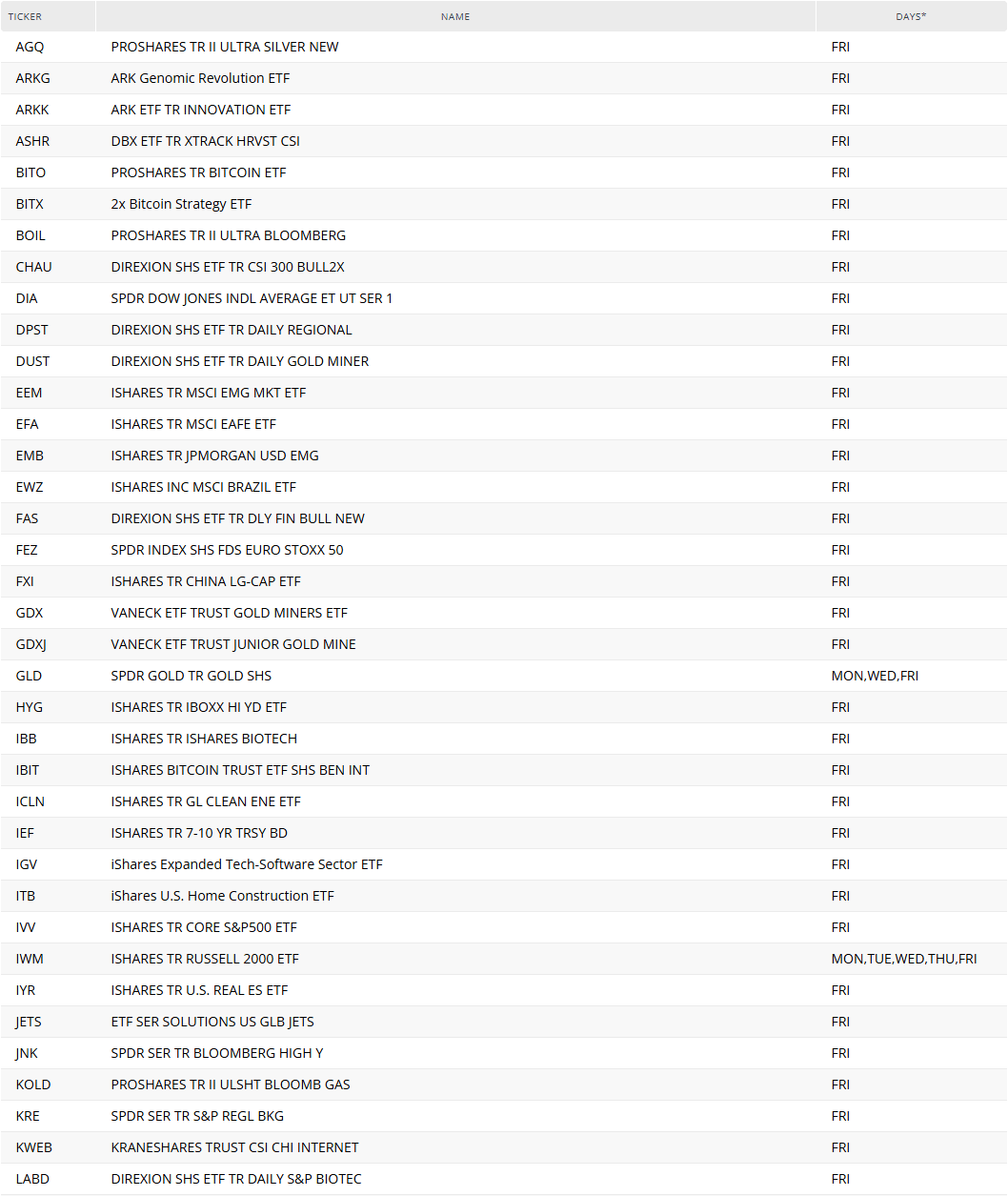

And here’s the examples of available weeklys:

- ARK Genomic Revolution ETF (ARKG).

- DIREXION SHS ETF TR CSI 300 BULL2X (CHAU).

- DIREXION SHS ETF TR DAILY GOLD MINER (DUST).

- SPDR INDEX SHS FDS EURO STOXX 50 (FEZ).

- ISHARES TR U.S. REAL ES ETF (IYR).

- VANECK ETF TRUST OIL SERVICES ETF (OIH).

In addition, here’s a brief part of the huge list of options which are provided by CBOE.

Strategies

Now it’s time to review several ways to have an income with weeklys.

Aiming for a lower premium and higher gamma

Several factors can make a market player decide that a stock’s price can significantly change on the back of an earning report or economical news announcements and e.t.c.

Aiming for a higher theta

Quite the opposite situation happens when an investor assumes that the market has priced in a more significant and huge move off an earnings report or economical announcement. In that case, market players may choose to sell options.

Targeting expiration frequency

There are many examples of market players who operate with covered calls against their own stocks. Here’s where weekly options come into play, because this strategy involves a constant repetitive order within short time periods. By doing so, traders try to compensate for the size of the premium by quantity.

Possible risks

Of course, before using weeklys you need to know the risks:

- Additional volatility which may occur on several occasions. It can be a profitable feature, but also it may result in losses with small changes of the underlying stock.

- More observations which can lead to missing other opportunities. As a result, such monitoring can be useless because some options can be non-profitable in the end.

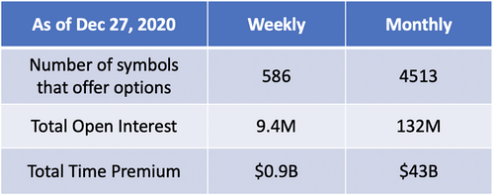

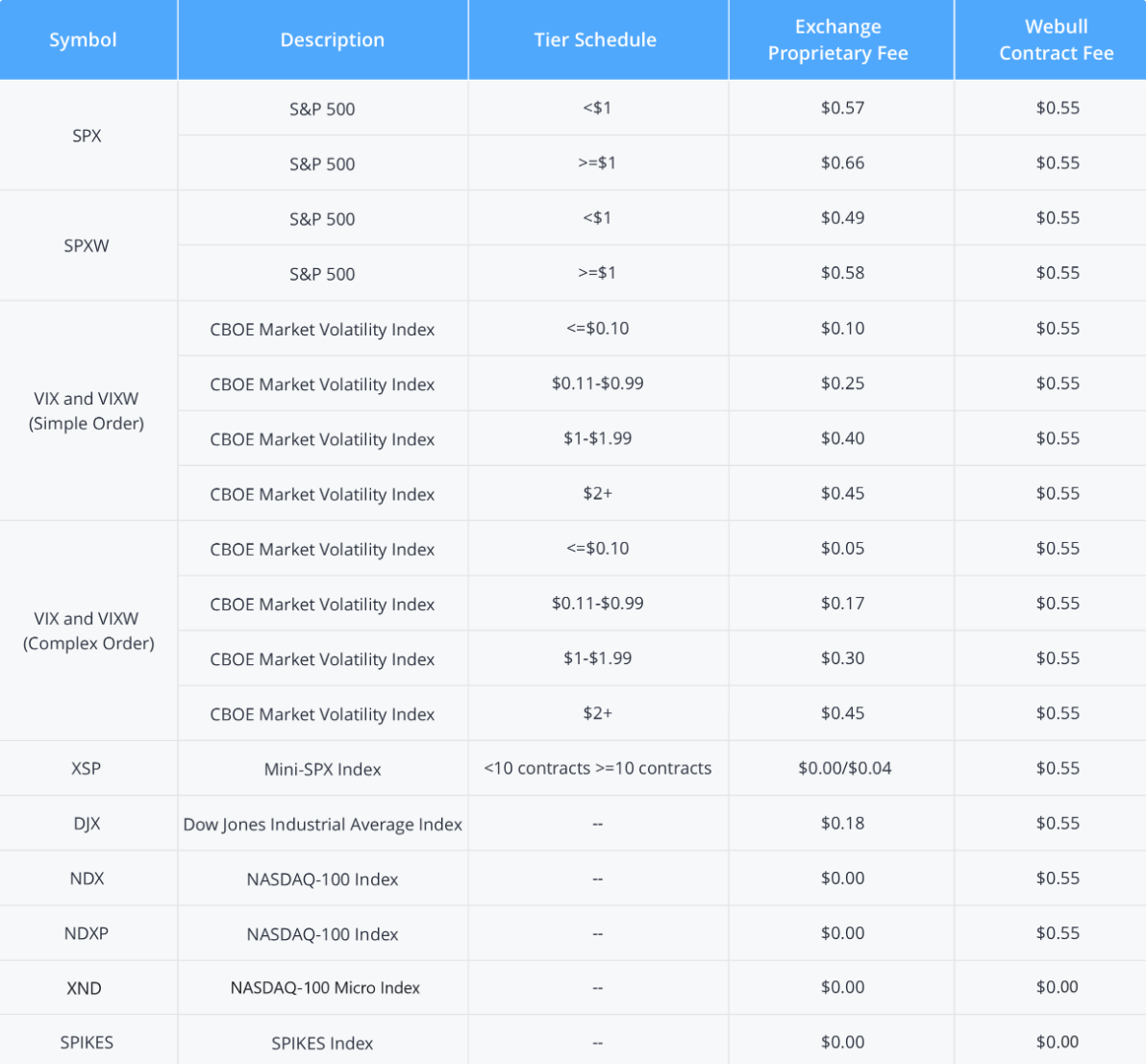

- Risk of losing too much on transaction fees. Such a large quantity of deals can outweigh the profit you can gain from them. Take a look at the table below to understand how much can you lose during the transactions:

- Incompatibility with trading strategy or a portfolio. You should consider if the chosen option will be suitable for your own approach.

Pros & cons

Weekly can be as good as bad. Let’s review both sides of the same coin.

Firstly, benefits:

- Several opportunities to make a short-term bet on a specific option which can be profitable due to the expected sharp cost jumps.

- Reduced potential losses. If you don’t bet too much and lose premium for an option – it would be a smaller loss, because it is a shorter time period.

- Constantly high bid-ask spreads. It is provided with open interest and the weeklys volume. However, monthly options have higher bid-ask spreads.

Now, let’s review the drawbacks:

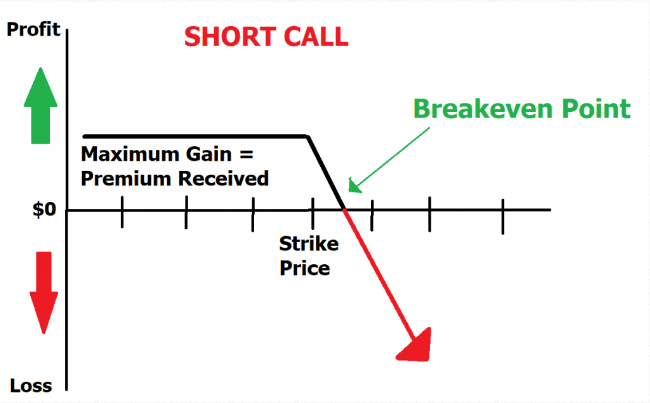

- Small amount of time to adapt the strikes or to get the awaited changes of the underlying stock. Here’s the visualization of such strike within the short call option:

- Several strikes can have significantly wide spreads due to the open interest and the volume of weeklys. It doesn’t end well with a short-term bet.

FAQ

Put option

It is a contract which gives you the right to sell an asset until a certain date comes which is included within the contract together with the cost of such a deal. It is not necessary to sell such an option, but it is available.

Call option

Conversely, it is the opposite contract which implies the ability to buy an asset. The date and the valuation of buying are agreed upon by the contract.

What happens after the expiration

Basically, this is an end for the option. The expiration date is the last day of its existence before eradication. But there is a difference between American and European options. First ones can be carried out on and before the exact date, but in case of European ones – only on the expiration date.