It is important to have precision within any observation, especially when it’s about the market price changes. In that case, there is an EMA – one of the indicators which observes the historical picture of the price movement. Let’s take a closer look at its working principles and general differences between it and other technical tools.

Defining EMA

To start with, exponential moving averages are variants of moving average which stands for a deeper analysis and observation of the latest cost changes. It is also known as the exponentially weighted moving average because of this specific feature. The main goal of such observations is to pay much more attention to all previous activity. In comparison, simple moving average (SMA) analyses a whole period equally.

EMA is widely used as an indicator of buying and selling timings. The working principle’s fundamentals are connected to crossovers and divergences which are gathered within the historical average. Most common time-windows for the EMA are presented below:

- 10 days.

- 50 days.

- 200 days.

It is a highly useful tool in specific circumstances.

How to calculate

There is a certain formula for measuring its value:

EMA Today = (Value Today * (Smoothing / 1 + Days)) + EMA Yesterday * (1 – (Smoothing / 1 + Days))

Despite being a highly flexible value, smoothing’s most preferable value is 2. This supports the principles of the information being the latest and having more importance. If the trader decides to raise the number, the quantity of the latest data will be increased which will impact on the EMA increase relatively.

Example

It is a more complicated measurement if we compare EMA to SMA. If the chosen time window contains 20 days, the observer must be patient up until the last day of the simple moving average. Right after receiving the whole structure of the SMA, the 20th becomes the first day of the exponential moving average.

- Firstly, the calculation of the SMA: the sum of all asset’s closing costs, which exist in the time frame, is divided by the exact quantity of observations that occurred. For instance, one observation per day means that the sum will be divided by the exact amount of days it happens within: 20.

- Secondly, the calculation of the smoothing multiplier. The common way to measure the value looks like that: 2 / (Number of observations(In this case it’s 20) + 1). After executing the calculation, the observer will get the 0.0952 which is the value that fits a 20-day MA.

And the last step, measuring the exponential moving average which will have the formula down below:

In addition, there are more options to choose from while operating with the instrument: users can base it not only on the closing valuation, but on open, high, low or even median price.

What does user receive

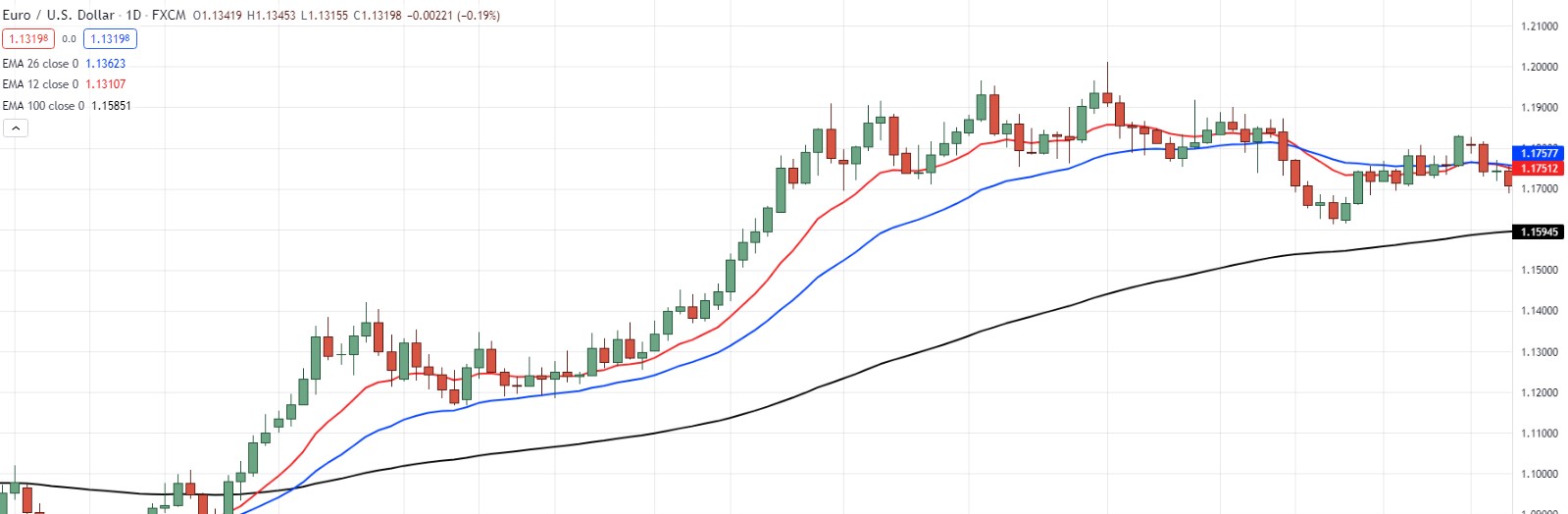

By using the exponential moving averages, specifically 12-day and 26-day EMAs, investors can build the moving average convergence divergence (MACD). Also, there is an opportunity to create the percentage price oscillator (PPO).

On the other hand, there are 50-day and 200-day EMAs which are utilized in a different way: to indicate several major events during long-term tendencies (Reversals, for instance, happen when the asset’s reach and gets across the 200-day MA).

Despite being a very handy technical instrument, an EMA can lead to chaos within the trader’s activity by providing him with false signals, if it’s used incorrectly. Investors which utilize technical analysis praise this tool as very efficient when applied correctly.

That’s why it is important to react on the right timing of the necessary market moves: the most preferable time to act can occur before a MA even identifies the general change in the tendency. Exponential moving average provides the trader with more precision by gathering all the necessary data of the latest price movements and trajectory changes. It is a crucial feature which helps to specify the optimal timing to enter the market.

EMA is a moving average, which means that it is quite better to use within trending markets. It closely follows both uptrend and downtrend: more precise observation which can lead to possible gains by executing the trade in best possible timing which is indicated by the exponential moving average.

Ways to utilize

The efficiency of the EMA utilization reaches its highs when it is united with other instruments. By doing that, traders avoid possible misinterpretations of the signals. It is much more useful for a market player who chooses to trade within fast-moving markets and within a 24-hour time window. For instance, if a trader based his intraday strategy on EMA and it shows the existing upward tendency which is significantly strong, he will commonly trade on the long side.

EMA vs SMA

Those Moving Averages differ in the amount of attention which is paid to the price changing. On the one hand, there is an SMA which observes the price data in a more balanced, equal way.

On the other hand, there is an EMA, whose sensitivity is higher to all existing latest price changes. It is quite common to use both of them simultaneously to have a much clearer perspective on the existing valuation movement and its direction.

Limitations

The principle of EMA’s more intense analysis can be as good as bad, because despite being a recognized technical tool which is stated as a more precise indicator the EMA also can create several false signals.

There is a popular economist opinion that markets are efficient. In general, it means that the market already provides the trader with all available data about the price. This statement may lead to the conclusion: the historical data, which is a fundamental base of the exponential moving average, can’t provide the investor with any possible way because of such level of efficiency.

FAQ

Useful EMA

There are two standard options within long-term and short-term traders. Long-term traders usually operate with 50-day and 200-day EMAs. As for the short-term traders, they prefer 8-day and 20-day exponential moving averages.

EMA or SMA

The EMA applies the higher sensitivity which means that this tool reacts faster to cost movements than the simple moving average. The choice fully depends on the investor’s preferences.

Interpretations of the EMA

Fundamental principles of such observations are gathered around support and resistance: if the instrument shows the increase – it supports price movement. Conversely, the decrease of this tool shows the resistance. Both of them indicate market entry and exit point’s timings.