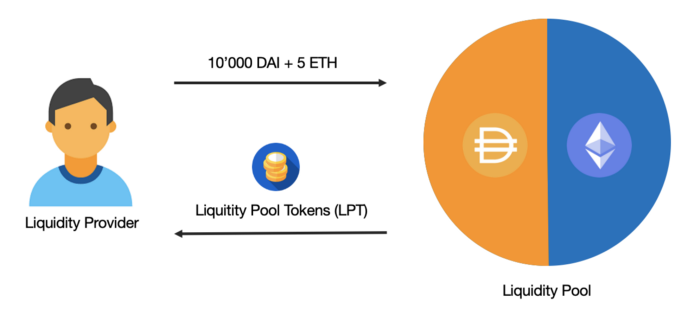

Cryptocurrency Liquidity providers are market participants who ensure the availability and willingness to buy or sell cryptocurrency assets at specific prices.

They can be individuals or companies. They usually have significant resources and access to a large number of cryptocurrency assets. Also, they use automated systems and algorithms to provide buy and sell quotes in the market.

The role of liquidity providers is to create supply and demand in the market, ensuring that trading continues uninterrupted. They are ready to buy assets from sellers and sell them to buyers at set prices and volumes. This contributes to market liquidity, allows for quick transactions, and reduces the impact of individual transactions on asset prices.

Liquidity providers have an interest in generating income from their activities. They may receive commissions or spreads between the buying and selling prices of assets. In addition, they can engage in arbitrage strategies, capitalizing on price differences across platforms.

The presence of cryptocurrency liquidity providers is important for the efficient functioning of the market. They help set prices, reduce volatility, and ensure that cryptocurrency assets are available to traders and investors.

Top news

Comments

Subscribe

Login

0 Comments

Oldest