Utilization of Fibonacci Sequences in the Cryptocurrency Market

Utilization of Fibonacci Sequences in the Cryptocurrency Market Cryptocurrency Liquidity providers are market participants who ensure the availability and willingness to buy or sell cryptocurrency assets at specific prices.

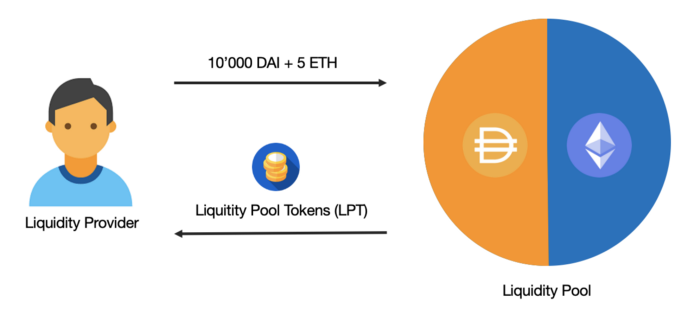

Cryptocurrency Liquidity providers are market participants who ensure the availability and willingness to buy or sell cryptocurrency assets at specific prices.They can be individuals or companies. They usually have significant resources and access to a large number of cryptocurrency assets. Also, they use automated systems and algorithms to provide buy and sell quotes in the market.

Liquidity providers have an interest in generating income from their activities. They may receive commissions or spreads between the buying and selling prices of assets. In addition, they can engage in arbitrage strategies, capitalizing on price differences across platforms.

Comments

Subscribe

Login

0 Comments