Moving Average is one of the most popular technical tools which are widely used by traders during the investing. Let’s review and analyse all fundamental features of the instrument and define its utilization.

- Definition

- Working principles

- Types of the tool

- Simple Moving Average (SMA)

- Exponential Moving Average (EMA)

- SMA & EMA: how to understand what is what

- Instance

- Indicator instance

- Interpretation of the MA’s indications

- Ways to utilize

- Moving Average Convergence Divergence (MACD)

- FAQ

- Defining Moving Average

- The best MA to use

- Ways to use

Definition

MA is the part of the technical analysis tools which are meant to indicate asset’s cost movement through the observed period of time (this parameter is adjustable and predetermined by the investor). By following the real valuation changes, MA helps to take a more precise look at the initial readings of the asset’s behaviour. By applying this instrument, the observer mitigates the overall price fluctuations which can occasionally happen during a specific amount of time.

There are two types of MA which can be used within the market observations: Simple Moving Average (SMA) and Exponential Moving Average. There are several individual features of each one which differ one from another. Both of them will be reviewed further down.

Working principles

In general, MAs are widely utilized in determining the existing trend direction and both support and resistance levels which are significantly important: identifying the potential reversals, especially, is crucial. This tool is considered to be a lagging indicator because of its fundamental base: historical valuation changes.

The choice of the time frame depends on the trader’s preference: if he operates in a long-term perspective – the 50-day and the 200-day MAs are the most common choices for such strategies. Short-term investors use a time period which is significantly less: 12-day and 20-day are the most usual options for such traders.

Despite the prediction of the price movement can’t be 100% accurate, it is still quite a useful tool to improve the quality of such predictions. The increase in the moving average means that the uptrend of the security is relevant and the decrease displays the downtrend, vice versa.

Types of the tool

There are two existing variants of this instrument:

- Simple Moving Average (SMA).

- Exponential Moving Average (EMA).

Let’s review them both individually.

Simple Moving Average (SMA)

This variant of MA consists of a set of values which occurred during the existing period of time.

It’s, basically, a sum of all asset prices within such time borders which is divided by the quantity of the included prices. The following formula for the MA calculation:

SMA = (A1 + A2 + … + An) / n

“A” in this equation is the average in period n and “n” strands for the number of time periods.

Exponential Moving Average (EMA)

On the other hand, there is an EMA which differs from a SMA by the amount of attention which is paid to the latest price movements. Also, it is important to calculate the SMA: it wouldn’t be possible to measure the EMA.

Secondly, define the smoothing multiplier for the EMA, which stands for a closer attention to the recent price data. The smoothing multiplier goes along with the previous EMA value which provides traders with the ability to calculate a current number.

Here’s the formula for this indicator:

EMAt = (Vt * (s / 1 + d)) + EMAy * (1 – (s / 1+d))

In this equation, there are several values:

- “EMAt” is a current exponential moving average.

- “Vt” is a current value.

- “EMAy” stands for the previous exponential moving average.

- “s” stands for the smoothing factor.

- “d” is a quantity of days.

This is a specific model of the data analysis which gives more precise information about the most recent price changes.

SMA & EMA: how to understand what is what

The amount of weight on the MA calculation is the key factor when the individual features of each one are questioned. EMA reacts more sensitively to all price movements and changes.

For example, if the asset’s price is rising – both SMA and EMA will rise with it, but the exponential variant of MA will increase its value significantly faster. And, vice versa, in case of the price decrease, EMA will react the same – a much quicker response than SMA has.

Instance

However, both of the MA types are measured in a different way. Let’s take a look at the possible example of the SMA that is created within a 15-day time window.

Each week contains 5 days of the operating time:

- The 1st one: 17,19, 21, 20, 21.

- The 2nd one: 20, 22, 23, 25, 24.

- The 3rd one: 27, 26, 27, 29, 30.

The 10–day MA will determine all closing prices which occurred during the first 10 days of the observed time period. The next step is to drop the earliest cost and add the valuation on the 11th day. The next move will be taking the average.

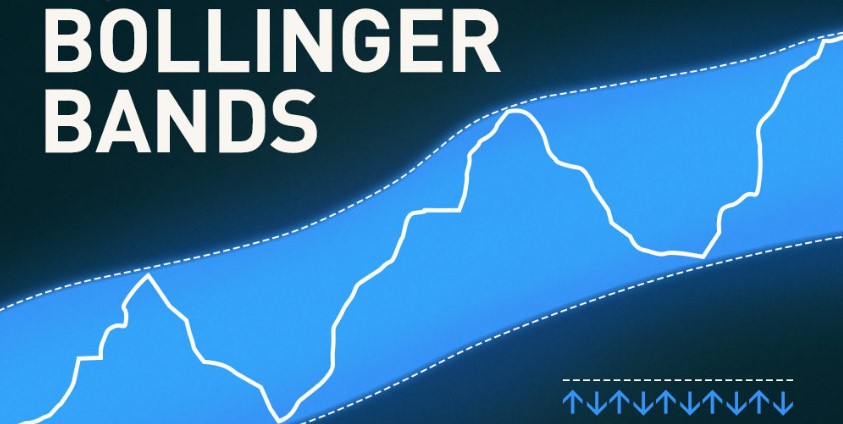

Indicator instance

There is a technical tool which works together with the MAs – a Bollinger Band. It contains two standard deviations which are located away from a SMA. This indicator shows the asset’s both overbought and oversold conditions.

The increase of the SMA and approaching of it to the upper or lower band means that the asset is close to being in an overbought or in an oversold condition, respectively. This technical tool can adapt to the market, because it stands for a statistical measurement of volatility.

Interpretation of the MA’s indications

MA’s readings are especially useful for the traders which desire to take an observation for the asset’s price changes to identify the existing tendency of the market. The rising of this indicator shows that the existing trend of the price has an upward trajectory. And, conversely, the decrease within the readings stands for the valuation downward movement.

Ways to utilize

The most common way to use this tool is analysing and determining the existing price movement patterns. The next step will be gaining profit from that kind of knowledge. By defining the potential reversal points, investors can base their strategy and adapt to the changes of the asset’s price. Both entry and exit points can be detected while using this indicator but it’s crucial to conjunct such a tool with additional ones to improve the data that this tool gives to an observer.

Moving Average Convergence Divergence (MACD)

The other efficient tool in the investor’s hand is the MACD which follows the relationship between two MAs. Here’s the MACD formula below:

12-day EMA – 26-day EMA.

Another significant function which the MACD can perform is the determination of the crossovers.

MACD also defines the intensity of the existing trend. Positive values of the MACD stands for an upward movement: it is described with the short-term average being higher than the long-term one. Conversely, negative values indicate that the price decreases.

FAQ

Defining Moving Average

Moving averages are technical tools to indicate stock price changes through the observed period of time which is customisable.

The best MA to use

It is a choice which strongly depends on the investor’s strategy. Both of the MAs have their beneficial and disadvantageous sides.

Ways to use

It is a technical instrument which is widely used in determining the existing trend of the asset’s price movement. Later on, traders can operate with the data and buy or sell the security.