It is difficult to perform well within the fluctuating market conditions and that’s why it is crucial to have a second – an educated opinion on the matter. Let’s review the registered investment advisors and their principles of work which later will help to decide if it is necessary to get such help.

- Registered investment advisor: Definition

- Regulations

- Those who must register

- Ways to register

- Free from registering

- Charging for service

- RIA Requirements

- Benefits

- List of Services

- FAQ

- What is a Registered investment advisor?

- What are the RIA regulations?

- What are the RIA requirements?

- Where can an advisor register himself?

Registered investment advisor: Definition

As it is stated from the naming, a registered investment advisor (RIA) is the highly-skilled and educated financial expert who is officially registered. The key feature of this kind of advising is a maximum level of priority to the client: all the effort serves for the customer’s goals. As a matter of fact, the advisors provide the investor with individual advice which is fully committed to maximising the profit or reaching the required goal in the first place.

Payment for such services is usually connected to the principles of the Assets under Management (AUM) which means – the fees.

Regulations

Of course, such individuals or organisations operate under certain regulations: the Investment Advisers Act of 1940 together with the securities commission.

Moreover, there is a high level of transparency which is required for having an opportunity to even operate in such a manner.

All-in-all, the list of regulations is fully based on principles: the client is sacred and must be protected and well-informed.

Those who must register

If an individual advisor or a firm desires to provide their services, they are obligated to register themselves with The United States Securities and Exchange Commission (SEC) or with a state securities regulator, depending on the amount of assets, which are under the advisor’s administration, and their value.

In fact, the participants of the RIA firm don’t necessarily need to register because they represent the firm.

There is another key demand: a Series 65 license.

It can be received after passing the Series 65 exam which is under the FINRA administration. Moreover, an IAR must operate under the Series 65 if he has any of the financial certifications below:

- CFP – Certified Financial Planner.

- CFA – Chartered Financial Analyst.

- ChFC – Chartered Financial Consultant.

- PFS – Personal Financial Specialist.

- CIC – Chartered Investment Counselor.

As it can be seen, there is a huge list of the individuals and firms which must go through the registering process, but all the measures are directed towards the quality of services which are provided to the client.

Ways to register

Advisors have several ways to legally fit in the financial system:

- The United States Securities and Exchange Commission (SEC) registration: the main requirement for it is the value of the assets under the advisor’s management which must be higher than $100 million. If the value doesn’t fit and is less than the $100 million – an individual or a firm applies to the state securities regulator. However, there are several cases where it is not the exact amount of worth: the New York requirement spreads to the financial advisors which administrate assets that are estimated at $25 million or more. It is explained by the individual policy of the New York State securities regulator’s inspection. Also, the value between $100 million and $110 million is a transition point: the choice to register depends on the organisation preferring.

- State Registration. The USA has individual laws for each state which are directed to control the financial activity with the securities and their sales. Such laws can also be known as blue-sky laws which are applied to the financial policy by a state security regulator. The organisations or individuals are chosen to register by this organisation to fit the rules of the state they operate with. Moreover, if the financial activity of the registering advisor comes under specific circumstances, he must register in several states. In case of the quantity of 15 and more, the United States Securities and Exchange Commission registration may be the option, even if the AUM has a value below the $100 million bar.

Depending on the activity and the AUM value, the RIA must follow certain financial laws which are decided by the US regulations and the organisations which control the sequence of action. It depends on the multiple features of the RIA services and its portfolio.

Free from registering

Despite strict rules, there are several specific individuals and organisations which are not obligated to become a RIA:

- Banks & Credit unions.

- Insurance & Investment organisations.

- Mutual funds.

- The employers of the investment organisation which became a RIA.

- A person who helps to invest only in the family circle.

One of the key reasons for this is the existence of other regulators for each. For instance, banks, which are observed by federal banking regulators. In the case of the family advising, it is a limited advising and it hasn’t got the level of potential threat.

Charging for service

The list of RIA clients can hold a huge list of people, it all depends on the organisation abilities and the budget. However, payment for the provided services is fixed: it is an annual fee which equals to 3% up to 4% of the total client’s investment. There are several divisions which lay down to the principles of the RIA’s charging for services:

- Performance-based. An investor pays for the quality of the performed investment. The growth in the portfolio performance is the reason to charge for the services.

- Management. It is fully dependent on the portfolio management: if the advisor increases the growth of the portfolio’s value, this fee also can be increased due to the improvement.

- Asset class-based. The amount of fee depends on the class of an asset and the risk which accompanies the investment in it. The common percentage of such fee is approximately 1.5% of the asset’s fees.

It is a well-structured system which is based on general RIA principles of customer service. The quality of the job and the type of assets strongly impact on the outcoming fee.

RIA Requirements

However, it is not that simple to get the registration and fit in the financial system legally. There are several general requirements for getting the necessary license:

- Registration with The United States Securities and Exchange Commission (SEC). If an organisation or an individual reaches the AUM value requirement, it can be approved by the SEC. In case of having less worth, the advisor can register with the state securities regulators.

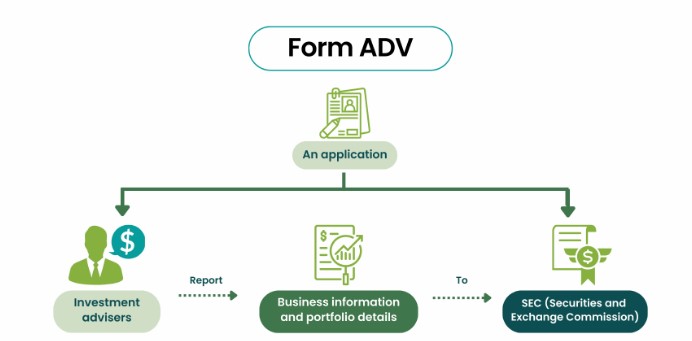

- Form ADV. It contains multiple requirements: the list of RIA ownership, clients, strategies and e.t.c (Part 1), an information about the amount of fees, the advisors and their educational background (Part 2A) and an information about financial experts who will engage with the clients (Part 2B).

- Disclosure. The transparency of the actions is mandatory to ensure that if there is any possible risk or conflict of interest – the client will be informed and prepared before the potential transaction.

- Compliance Officer (CCO). Every RIA has to control the quality and legal aspect of their services. That’s why it is obligated to have a Compliance Officer who will observe and analyse the RIA’s actions. The CCO’s job also involves the creation of the policies within the firm which must be strictly followed to avoid any possible law violation.

- Fiduciary Duty. Each RIA must follow the main principle of advising: the client must be satisfied and well-informed. Any potential risk must be listed by the organisation.

- Keeping the records. Again, the transparency of the advising company is the key feature of the service. RIA is also obligated to have the records of any activities which, of course, includes the financial data. If any inspection occurs, the company will be ready to provide the information.

Benefits

Despite multiple requirements, being a RIA has several beneficial sides:

- More freedom to operate with. For instance, if the Exempt Reporting Advisers depend on the venture capital fund exemption. They have their limitations: the private fund registration is allowed only if the AUM value is below $150 million. All the restrictions and regulations which are applied to the RIA works specifically in conjunction with new opportunities.

- It is tempting for the investors. Even if the investor has a huge funding or a high level of knowledge, he may not have the necessary amount of time to perform all the transactions by himself. It means that the RIA has a lot more to offer by analyzing the initial plans of the client and adapting their strategy to the current market state and its regulations, based on the state you operate within, the asset class and e.t.c.

A registered investment advisor can significantly improve the portfolio of clients and has the fees charging policy which does not require a constant change.

List of Services

There is a variety of services which are provided by RIAs:

- Financial planning. Advisors work in conjunction with the investor to choose the strategy by analyzing the market and all possible influencing factors which may be involved.

- Retirement planning. If the client chooses to quit investing, RIAs also help them to create a beneficial and safe exit strategy.

- Estate planning. Clients can get the help from the RIA in managing the existing Estate which means the increase of its value, decrease of the taxes and e.t.c.

- Wealth management. Advisors can assist the investor’s portfolio quality by increasing its diversification with several different classes of assets and by analyzing the current state of the portfolio.

- Investment management: asset allocation, monitoring and e.t.c.

- Insurance. These organisations can provide the client with insurance that is required specifically for the investor’s need.

However, it is not the whole list of services which can be provided by a RIA. There are more ways to make the investor’s life more comfortable and an advisor can ensure that the client is safe and gaining profit from the investments.

FAQ

What is a Registered investment advisor?

A registered investment advisor (RIA) is the highly-skilled and educated financial expert who is officially registered. It can be an organisation or an individual which helps the investor to improve the existing strategies and make profits in a much safer and more elaborate way.

What are the RIA regulations?

Such individuals or organisations operate under certain regulations: the Investment Advisers Act of 1940 together with the securities commission. Also, a high level of transparency and the principle of the client’s importance are required.

What are the RIA requirements?

There are several regulations for the RIA: registration with The United States Securities and Exchange Commission (SEC), Form ADV, Disclosure, Compliance Officer (CCO), Fiduciary Duty and Keeping the Records.

Where can an advisor register himself?

There are two ways to register: The United States Securities and Exchange Commission (SEC) registration and State Registration.