Making money from cryptocurrency is a contemporary means of earning income that has not yet been mastered by all those who want to make passive profits. The types of earning crypto vary from those that are entirely free, such as airdrops or crypto faucets, to those that involve a substantial contribution of funds, such as mining or stacking, which is impossible without a sizable sum of cryptocurrency. Some are particularly prone to risk, while others are less exposed to it. Find out what types of crypto earning exist further on in the article.

- What is crypto-earning?

- Who pays interest on cryptocurrency investments?

- Will the income from cryptocurrency be taxed?

- What percentage of my portfolio should consist of cryptocurrency?

- Make use of the lower band

- Be aware of the risks

- Avoid scams

- Getting passive income with cryptography

- How to earn crypto in a savings account

- How to earn digital currency as a banker

- Proof-of-Work (PoW) Crypto Mining

- Staking crypto

- Cryptocurrency Debit Cards

- Crypto lending

- Earn crypto in staking pools

- Make money by purchasing cryptocurrency

- Accept cryptocurrency payments

- Cryptocurrency airdrops and giveaways

- Active ways of earning crypto

- Yield Farming

- Earn cryptocurrency with Defi Yield Farming

- Mining

- Mining pools: mining is cheaper, but the remuneration is also lower

- Earn free cryptocurrency by playing games and completing tasks

- Get a salary in crypto coins

- Collectors: complete minor quests to obtain minor rewards

- Earn bitcoins through crypto faucets

- Conclusions regarding ways of earning crypto coins

What is crypto-earning?

To begin with, the basics, let’s first understand what crypto earning is. It’s basically the same as earning fiat money, like buying shares or depositing funds in a bank with an interest, which of course is not the whole list of the means to earn income with conventional money. Now, similar manipulations might be carried out with cryptocurrencies: deposit them and collect interest, buy coins, and sell them when their value increases. Except in the case of cryptocurrencies, there are no banks where you can deposit an amount at interest and no stocks in which you can invest. These services are provided by cryptocurrency exchanges or other special platforms.

There are plenty of other ways of earning cryptocurrency, such as mining, crypto faucets earning, lending, and many others – they will be discussed below. In simpler words, crypto earning is obtaining cryptocurrencies either for free or in a fee-based manner. That is, it may be accomplished from scratch when one already possesses a certain sum of coins as well.

Cryptocurrency is a digital currency that does not possess a material form, with the accounting unit represented by a coin. One curious aspect of almost all cryptocurrencies is the omission of a single center. They operate via what is known as a “blockchain” – a chain of data, each block of which may reside on machines in multiple corners of the globe.

The lack of a unified data center (like a server) as well as the cryptographic protection of transfers turns digital currencies into the safest of assets. Moreover, there are no extra fees to be paid to banks. Particularly if remittances are conducted straight between users.

The digital assets market presents ways to earn cryptocurrency daily. Certain ones are conservative, such as trading on bitcoin fluctuations, the value of which might be roughly 10% per day. Other options offer dramatically higher returns as well as significant risks.

Who pays interest on cryptocurrency investments?

Not only can cryptocurrencies be profitable by increasing their value due to the demand-supply ratio in exchange trading, but they also provide a passive income in the form of interest on deposits. Yet the algorithm for generating this sort of interest has a different nature than the fiat currency deposits. Today two methods of creating digital currency deposits exist – stacking and farming, which may be performed through a cryptocurrency earning platform.

The essence of staking consists in ensuring that the Proof-of-Stake (PoS) network remains operational to support all transactions on the blockchain. Digital coin holders are remunerated for this and earn crypto easy. And the more tokens a holder has, the more likely they may become the creator of a new block. For certain blockchain networks, the entrance threshold would be around 50,000 coins. This sum permits node holders, which is a complete blockchain unit of operation, to collect their percentage of reward – for the network’s use of their nodes. That’s the staking revenue. It should be mentioned that the interest varies from network to network.

Also, there is farming, which is one of the easiest ways to earn crypto on decentralized exchanges by contributing your crypto assets to a liquidity pool. Members build a liquidity pool of some pair of tokens, like bitcoin vs USD, & invest varying amounts of tokens in the pool. According to their share, they obtain remuneration from the trades. Whoever invested more will consequently receive more.

Staking and farming are considerably trickier than bank deposits. To make passive income in this way and earn crypto fast, you have to gradually delve into these technologies.

Will the income from cryptocurrency be taxed?

A government may either prohibit cryptocurrency or treat it as a monetary asset, property, or security. Taxation peculiarities are connected with this. The United States, Singapore, Switzerland, and Germany pioneered in 2013 to consider the legal regulation of cryptocurrencies and taxation issues.

For instance, in the U.S., cryptocurrency is legal tender. Since 2022, individuals and legal entities are obliged to disclose income from cryptocurrency transactions. The U.S. IRS explains in detail how to pay taxes. The US considers cryptocurrency to be property. Whether it is taxed depends on the period of investment, and the amount of profit or loss that the user suffered.

Meanwhile, in Germany, cryptocurrencies represent a digital value. It is possible to transfer, store and buy cryptocurrency. Crypto transactions are exempt from VAT and not subject to capital gains tax. If crypto assets are ultimately disposed of within 12 months of purchasing, the profits from the disposition will be subject to an income tax of 45%.

Specific legislation is essential for each nation to handle cryptocurrency transactions and deposits. However, the non-existence of legal frameworks for cryptocurrencies does not necessarily imply that they are illegitimate in a state. In that case, taxes are assessed according to applicable tax regulations or the instructions of tax authorities.

What percentage of my portfolio should consist of cryptocurrency?

Approximately how much of an investor’s financial portfolio should consist of digital currency? It is dependent on multiple elements, among them risk tolerance & level of familiarity with cryptocurrencies.

While some specialists suggest investing one to thirty percent of the portfolio in crypto assets, others even consider investing half of their funds, however, keep in mind it is strictly a matter of personal choice. As mentioned earlier, the share of digital coins in an investor’s portfolio hinges on the degree of awareness about cryptocurrencies and the experience of owning and trading them.

By placing a tiny portion of his/her portfolio into digital currencies, an investor may stand to lose all of his/her funds. Still, the sum of the proceeds may prove to be astronomical. Above all, “never invest in a cryptocurrency more than you can afford to lose. It is still very risky.

Make use of the lower band

To conduct analysis of cryptocurrency rates the algorithms are utilized, implemented in technical analysis indicators, and proved to be highly beneficial in currency and stock markets a long time ago. Such mechanisms aid users to earn in cryptocurrency.

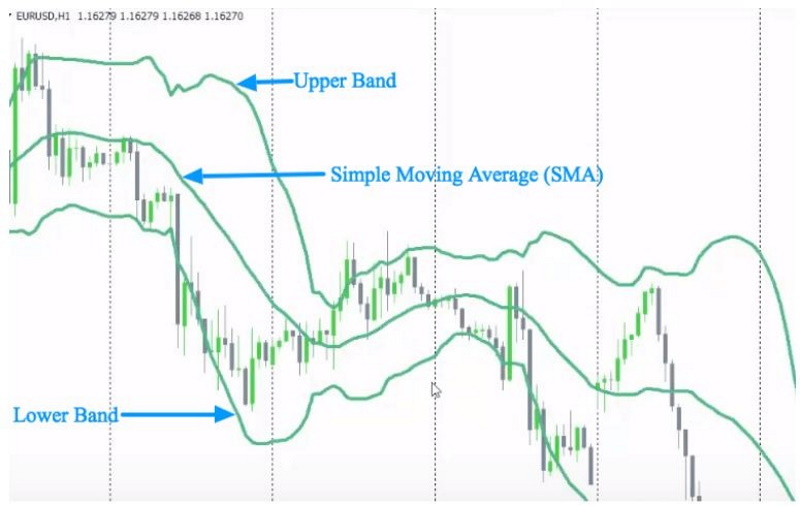

The Bollinger bands, for instance, employ such a strategy as purchasing a crypto-asset when the price goes beyond the bottom band and trading it when it exits the top band, which enables you to earn your coins. The Bollinger bands indicator is favored in the stock and cryptocurrency market, namely in swing trading and medium-term trading. Three simple moving averages (SMAs) are part of it, which can analyze all market data.

The volatility of cryptocurrencies represents its essential characteristic. They respond to events in the market more rapidly than traditional assets. And an indicator that takes volatility into account is useful for traders to make trading decisions and shows the way how to earn crypto coins.

Be aware of the risks

Notwithstanding its innumerable strengths, digital money possesses several downsides. These are of course inherent to all financial markets, however, in the instance of cryptocurrencies, the associated hazards are twice as great given their distinctive properties. Before exploring the best way to earn crypto online, it is imperative to examine the dangers involved. The following are some notable examples of the risks that may await an investor.

- Cyberattacks. Hacker attacks are occurring more frequently, and fraudulent methods are escalating in sophistication. The Bitcoin wallets and huge sums that circulate in the trading platforms have become particularly tempting for hijackers. Digital currency exchanges have been compromised more than once, leading to many closures due to bankruptcy;

- Lack of guarantees for reimbursement of losses. The client’s assets are practically possessed and controlled by the exchange. The exchange merely grants access to these assets when logged in. Thus, the owner fully confides his or her bitcoin wallet to a third party, relying on the security measures it takes to protect the money;

- The collapse of the virtual money market. There is no guarantee of the success and longevity of cryptocurrencies. They are accepted on the same level as fiat money, on the one hand, while on the other, they are not liable to any kind of control. The value of digital coins naturally fluctuates in value over time, although no assurance can be given that booming growth will not at a certain point be replaced by an equally booming downturn;

- Volatility means unsteadiness. Digital coins have the potential to be a high-yield tool that allows earning crypto, though it is only feasible for savvy investors. Erratic rate surges are caused in part by the limited issuance of bitcoins. Once trading businesses start embracing bitcoin as payment, its price is likely to plummet;

- There is both an advantage and a disadvantage. Given that no governing body exists, no one can sustain the bottom price of digital currency. If the majority of investors decide to abandon bitcoin, there is a huge danger that the exchange rate crashes;

- Secret code loss. The code loss entails losing everything that is contained in the wallet. This may occur if the PC hard drive crashes or the USB flash drive, where the password is located, is corrupted. Restoring the code, getting the money back, and moreover producing coins earn is unreachable;

- User Transaction Mistake. Entering a single character incorrectly or sending it to the wrong address also results in losses. The transaction couldn’t be undone, so the transferred sum is not refundable;

- Initial Coin Offering (ICO). Anyone who has invested in an ICO must be prepared to lose their money, considering that these schemes are closely associated with the fraud. ICOs are perilous projects that do not warrant a repayment of the investment, so each member must be conscious of the level of danger and be prepared to lose the investments made. Successful projects are practically nonexistent, but the quantity of people willing to contribute money is not diminishing.

Avoid scams

Sadly, instances of cheating are not uncommon. The most common schemes of crypto scammers include:

- Counterfeit websites. Generally, they promise a guaranteed easiest crypto to earn provided you are constantly investing;

- Pyramid schemes. It is virtually the same scheme, except the illusion of profit is established through paying off new investors with the funds of the previous ones;

- Phony billionaires. Scammers pose as wealthy individuals, claiming to boost investments, and proposing the fastest way to earn crypto, whereas, in reality, they seize the funds for themselves;

- Fake Online Dating. Among the most common forms of fraud in the United States. Through online correspondence, cybercriminals encourage people to initiate investments in fake exchanges, asserting that these are legit ways to earn cryptocurrency.

Regretfully, the theft of coins from wallets is extremely widespread. In other words, even without trying to earn crypto currency, there is a probability of losing funds. The most common methods are:

- ransomware;

- viruses;

- fake links (spoofing);

- phishing (illegal personal information disclosure).

Digital money keepers should be extra vigilant when seeking ways to earn crypto. They should attempt to remain one step ahead of the malicious software: make sure to use solid anti-virus protection, verify all e-mail addresses, and do not click on suspicious links.

Getting passive income with cryptography

Cryptography is a type of encryption employed to protect cryptocurrency transactions. Different ways to earn crypto also exist thanks to cryptography. The birth of cryptocurrency has spawned several opportunities and possibilities for utilization. Among the most significant opportunities created by crypto is the emergence of an online economy that enables individuals to make a living, or at minimum, generate a considerable income through the activities associated with the entire system.

How to earn crypto in a savings account

Lately, large crypto exchanges launched a new product: cryptocurrency savings accounts. These yield up to 40% p.a. in cryptocurrency and might constitute an interesting alternative to a bank deposit. However, the associated downside of such crypto deposits comes with high risks due to price volatility, especially if you want to earn alt coins through investments.

Crypto platforms are consistently elaborating new alternatives to the traditional ways of how to earn cryptocurrency. In parallel to trading and staking, savings accounts are steadily gaining prominence in crypto. The bottom line is straightforward: if you keep cryptocurrency in anticipation of a long-term rate boost, it can generate additional passive income by depositing it.

It is worth noting that crypto deposits are unlike staking. Proper staking implies that the token holder delegates its right to validate transactions to one of the network’s existing validators, in return obtaining a portion of its remuneration, thus helping its holder earn coins online. For savings accounts, the crypto platform essentially relies on the invested funds to issue loans.

How to earn digital currency as a banker

Lending is a mode of investment in the Defi sector that enables income generation through P2P lending, which is similar to the banking method. Lenders and borrowers here earn digital currency by interacting via blockchain. The borrower obtains a loan in cryptocurrency with interest while leaving a deposit, also in crypto.

This is mostly about 150% of the loan amount. Meantime, a smart contract guarantees that the lender will return its investment with interest, earning crypto even if the currency plummets in value or the borrower fails to return the loan.

Proof-of-Work (PoW) Crypto Mining

For mining, Proof-of-Work was introduced along with Bitcoin and is widely employed to unravel a mining block utilizing dedicated hardware. To put it simply PoW is a process that allows accessing any abstract resource by solving a certain problem.

The essence of PoW is pretty straightforward: a miner completes a complex cryptographic task via its equipment and submits the solution result to the system, which matches the result with a verification template. If the answers are the same, the miner gets a reward in a form of coins to earn for the work done.

Nevertheless, with the increased complexity of unraveling the block, miners combine into pools, collecting the power of their equipment and unraveling the block faster. In so doing, the size of the bounty is distributed in proportion to the power involved among all the miners who have solved that block. If you have an understanding of mining it is one of the best ways to earn crypto.

Staking crypto

Staking is yet another form of how to earn crypto online, which consists of holding funds in a cryptocurrency wallet to back up all transactions on the blockchain. Fundamentally, it consists of locking a certain amount of cryptocurrency into a wallet to receive rewards.

Cryptocurrency Debit Cards

Like a normal debit or credit card, crypto debit cards permit everyday transactions through BTC, ETH, XRP, and other altcoins. Depositing your cryptocurrency debit card with the digital currency of your preference is frequently accomplished through a mobile app or website. Next, you are free to do some shopping. A lot of cryptocurrency debit cards feature lavish spending limits as well as small transaction fees.

Certain cards even propose perks, such as waiting room access at the airport, along with cashback for transactions, and after all, the best way to get crypto is to get some of your money back for your purchase. It’s gratifying to get the thing you want at a discount. So it’s worth taking a closer look to see which card is right for you.

Crypto lending

As stated earlier, cryptocurrency lending is just one of the best ways to earn cryptocurrency. Although cryptocurrency lending is oftentimes compared to traditional savings or interest-bearing savings accounts, however, it is crucial to admit that these are substantially newer and riskier platforms in comparison to traditional banks with a high regulatory level.

Digital lending instruments may be extremely beneficial, unlocking new investment and trading scenarios. However, it is critical to remain cautious of suspicious loan possibilities, in particular those that seem to propose cryptocurrency loans with no collateral requirements. Most likely, there is some kind of trick behind it, so you might end up losing everything.

Earn crypto in staking pools

A staking pool is a means for multiple crypto-asset holders to aggregate their tokens representing another way how to get more cryptocurrency, thereby empowering the staking pool operator with validator status and rewarding all interested parties with the easiest way to earn cryptocurrency for sharing their computational resources.

Public stacking pools are ideally suited for those individual investors who wish to be engaged in stacking without having to place a huge sum of crypto tokens necessary to qualify as a validator on the blockchain network or to create a private stacking pool.

How do you earn crypto by staking? Users may choose to contribute to a staking pool a fraction of the number of tokens needed to become a validator in the PoS blockchain because the staking pool is one of the fastest ways to earn cryptocurrency rewards daily, weekly, or quarterly, depending on the amount of cryptocurrency delivered.

Stacking pools are remunerated in proportion to the invested tokens, although the amount supplied is only a fraction of what it takes to achieve validator status on the blockchain. A stacking pool is a system that allows anyone to generate passive income while keeping their tokens for long-term growth.

Make money by purchasing cryptocurrency

Probably you asked yourself the question “How do I earn crypto by buying it?” After all, there are traditional currencies trading, it is likely equally possible to earn digital coins in this way. This is indeed true.

Several specialized cryptocurrency exchanges are in place. If you want to earn in this way, you have to:

- Sign up for an account and create an account on one of the exchanges;

- Deposit funds to the account;

- Purchase bitcoins or other currencies at a cheap rate and dispose of them at a higher one.

It is sufficient to input a modest value into a deposit to get started. Various forms of cryptocurrencies are traded on exchanges. Thus, investors are entitled to determine the best option for them. Purchasing a large number of lots at a low price, the investor may resell them when quotations rise.

Accept cryptocurrency payments

If you are running a brick-and-mortar store or selling your merchandise at a local market, you may want to transform your smartphone or tablet into a cryptocurrency wallet. There’s another option: purchase a POS terminal that supports cryptocurrency payments.

Receiving cryptocurrencies as a means of payment is now quite simple, either online or in person. There are a handful of companies in this segment that now are competing for the customer by introducing easy-to-use approaches that enable businesses around the globe to adopt cryptocurrency payments on websites as well as in conventional real-world outlets.

Owners of companies that have decided to embrace digital assets as a form of payment can count on solid profits, as such news is actively circulated through word-of-mouth and news among members of the cryptocurrency community.

Cryptocurrency airdrops and giveaways

Airdrop or distribution of cryptocurrencies is another way to earn crypto online. It is a free allocation of currencies to members for performing certain actions aimed at popularizing projects.

Typically, the user is encouraged to follow a Telegram feed, Twitter, or other social networks, make retweet, give likes to a video, and so on. Projects are then willing to compensate users with a particular amount of their tokens in return for their activities, which later may be sold and generate income.

You may ask where can I earn crypto through an airdrop. To obtain these coins, you have to follow the news of the crypto world, and read posts in the crypto community to find announcements regarding the initiation of airdrops.

Active ways of earning crypto

While there are passive ways to get cryptocurrency, there are also activities that require engaged participation in the process. The following are examples of such methods.

Yield Farming

During the past few years, yield farming has gained popularity as a trendy new idea. It is a kind of making a profit by keeping cryptocurrency assets. Essentially, it is the act of retaining your crypto assets while receiving remuneration for doing so.

Earn cryptocurrency with Defi Yield Farming

Defi Yield Farming stands for one of the ways to earn cryptocurrency online, generating income in the Defi sector through different investment and reinvestment strategies. Yield farming could be extremely lucrative with yields ranging from 10% to 50%. However, the risks involved here are also high, due to the characteristics of the Defi sector itself.

How can you earn cryptocurrency in Yield Farming? You grant funds to the DeFi project, thereby providing it with liquidity, at the same time you additionally obtain or farm project tokens besides standard fees. Such tokens possess value, the value of which may increase over time, therefore increasing the yield on your investment.

Where to earn cryptocurrency by farming? DeFi farming projects, as well as decentralized finance in general, operate on all sorts of blockchains. Although most DeFi projects and yield farmers are found within the Ethereum blockchain, other projects in other blockchains are now popping up every day.

Mining

Mining refers to the extraction of electronic currencies by means of dedicated equipment. Each digital currency utilizes a separate crypto-encryption algorithm. The objective of any miner is to decrypt it, transforming a bunch of coincidental pieces of data into organized information. Subsequently, it is this information that will be recorded in the blockchain.

Mining pools: mining is cheaper, but the remuneration is also lower

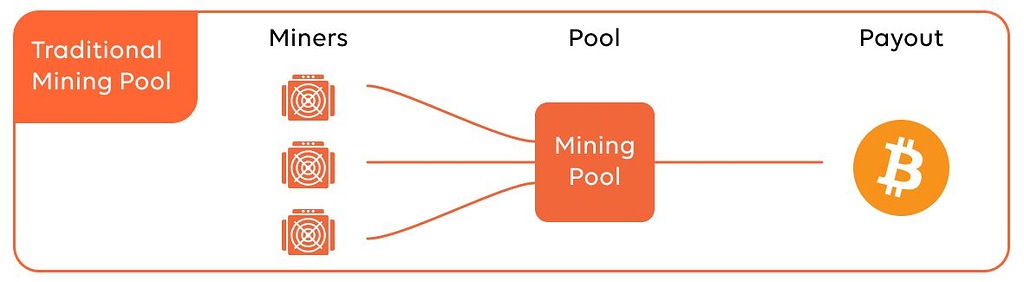

Mining describes the extraction of Bitcoin, Ethereum, or another digital coin that exploits the computing power of the user’s PC, thereby becoming a miner, as discussed above. Nevertheless, the explosive increase in the number of individuals participating in mining brought about the fact that solo mining even with the help of high-powered graphic cards and special ASIC processors is becoming less and less efficient.

Therefore, yet another way how to earn more cryptocurrency online has emerged, which is represented by special associations of miners, which are referred to as pools. A mining pool is the joint production of cryptocurrencies. Miners unite to build a block jointly, i.e. they operate in a “pool”. With the development of bitcoin, its mining process got significantly complicated. The mining pools are commonly associated with bitcoin, however, they are also applicable to all cryptocurrencies on the Proof-of-Work (PoW) protocol.

Earn free cryptocurrency by playing games and completing tasks

How do you earn cryptocurrency by conducting easy assignments, such as taking surveys and watching videos? Faucets of crypto assets may provide such an opportunity. They are specialized ad platforms through which a member may perform simple Paid to Click activities. Assignments may be quite diverse, for example:

- watch an ad video from the beginning to the end;

- type in a CAPTCHA;

- follow the link of the advertiser;

- take a survey or fill out a questionnaire;

- play a game;

- install an application.

For the accurate completion of activities, there is a reward paid in satoshi, which the user may withdraw to his/her bitcoin wallet. Users may register simultaneously on several faucets so as to expand the number of tasks they receive and thereby boost the number of their earnings.

Do Crypto games respond to an inquiry about how to earn crypto without buying it? Yes, they also let you make free coins by having fun after a long day at work. Crypto games are blockchain-based games. Players have the ability to utilize interchangeable or non-interchangeable in other words unique tokens in the game world. The blockchain game genres can range from strategy, RPGs, racing, simulation, sports, and more.

Get a salary in crypto coins

Proposing to receive compensation for work in virtual currency assets nowadays appears to a lot of people to be a reckless and perhaps even insane idea. Most individuals simply have no comprehension of what bitcoin is, where it can be spent, and how it should be deposited.

Meanwhile, the payroll option in cryptocurrency is being offered by many employers. The highest-paying positions with pay in bitcoin are offered in the following sectors:

- cryptocurrency trading;

- mining;

- cryptoeconomics;

- research in digital currencies.

Paying for your services in cryptocurrency is a perfect opportunity to remain independent and to receive a salary anonymously. Nowadays exchanging any coins into real cash is simple, plenty of exchangers and exchange offices are in operation. Besides, you can capture a fortunate moment, when the rate is rising and obtain a little bit more.

Collectors: complete minor quests to obtain minor rewards

Crypto faucets are also called collectors. There are plenty of crypto-collectors you can find, so a user has to thoroughly consider what he or she should use.

When thinking about using a Crypto Faucet, here are some things you should consider:

- Withdrawal time;

- Withdrawal methods;

- Minimal withdrawal limit

Earn bitcoins through crypto faucets

The ways of earning on crypto faucets have been listed above. With them, it is indeed achievable to earn free crypto if you are persistent enough & possess the spare time to do all the small tasks. Those are really basic and do not demand much effort, though if you desire to accrue a genuine sum & cash it out to your crypto wallet, you should make sure to have the spare time and energy to make earning on crypto faucets a reality.

Be cautious of online services that appear questionable and promise too much. If you are willing to experiment with faucets, choose trustworthy, long-established brands. By getting a bit of free cryptocurrency now and then, a considerable amount can be accumulated provided you utilize the faucets appropriately and frequently, especially when the current market value of the tokens you collect rises.

Conclusions regarding ways of earning crypto coins

Arguably, the best way to earn cryptocurrency online is the one that works for you and not for some of your friends or people on the internet, even if they are cryptocurrency pros. That is probably the only true statement, that there are no easy ways to earn crypto, therefore be willing to dedicate yourself and a certain amount of your finances, maybe not a big one. Learning how to make cryptocurrency online is definitely never too late, moreover, it is necessary for successful free cryptocurrency earning.