Earning rewards for owning monetary and cryptocurrency assets is easy with staking. This is a wonderful new method for many investors to earn a living for holding particular kinds of cryptocurrencies. But if your goal is just to earn not so much money, it’s useful to get at least some useful information about how and why it works the way it does. If you have a portfolio of cryptocurrencies and are not currently staking your tokens, you are wasting your time and not earning additional cash, i.e. money.

Here we try to understand how does staking crypto make money and the way it can increase your earnings.

What is staking?

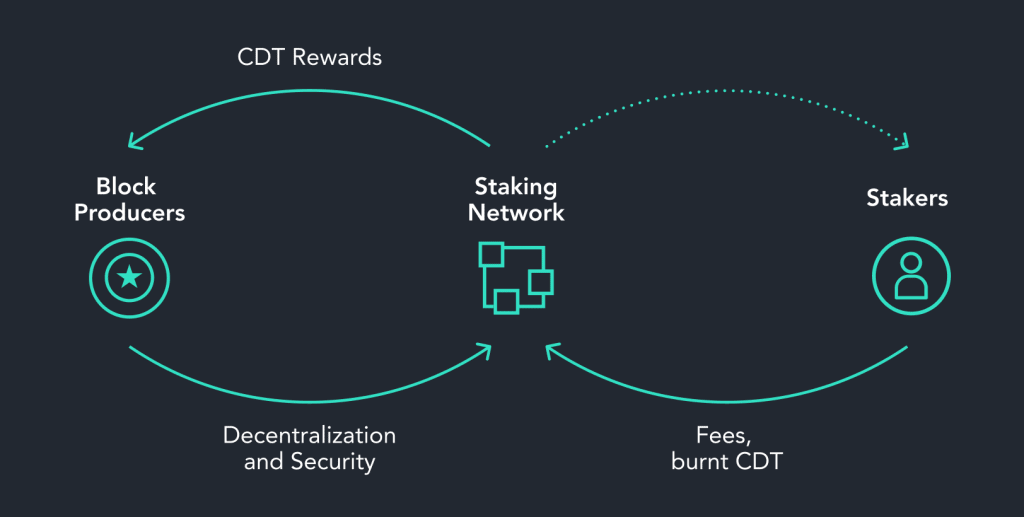

When staking, you basically participate in transaction validation, which is akin to mining. It utilizes a proof-of-stake (PoS) model to enable cryptocurrency owners to stake their coins and ensure the blockchain works. Any person with the minimal required number of digital coins could validate transactions. Because the blockchain puts it to work, staked asset earns reward and become a money source. Therefore, crypto assets holders are making a profit. It’s their passive income. Many coins use the process as a way to verify their transactions.

You can be a nominator or a validator in staking. Validators are nodes, taking care of all the basic tasks to keep the blockchain network running: ensuring security, distributing rewards, providing node statistics, etc. Nominators are token holders who vouch for validators and contribute to the security of the network by economically supporting up to 16 validators of their choice with their tokens (also called “stakes”).

This feature is accessible only for digital currencies running on PoS, such as EOS, Tezos, TRON, and Cosmos. Ethereum (ETH) is the largest altcoin by capitalization, and has just recently upgraded to the PoS algorithm, so if you’re wondering ETH staking is already live. If you stake a certain amount of ether (32 ETH), it will make you a “validator,” which will enable you to partake in the Ethereum 2.0 network.

What is a staking pool?

It takes a significant investment to become a full validator in order to earn the highest rewards and as big money as possible. Hence, solo participation might not be a suitable scenario for newcomers in cryptocurrency trade. Fortunately, a simpler and less expensive participation option exists and is called staking pools.

They allow a team of holders consolidate the funds, usually with the help of a staking service, to boost the likelihood of being rewarded. This kind of merging, or pooling, makes it possible for them to maximize the likelihood of block validation and receiving remuneration. However, in comparison with a single staking, the shared pool produces lower returns, since the reward for validation is divided between members of the team.

Mining vs. staking

As we made it clear above, the concept of staking is closely related to the PoS (Proof of Stake) algorithm, in which the probability of creating a new block in the blockchain is proportional to how many coins a user has. And the wealthier the person is, the more chances they have to get the right to confirm the transaction and claim the credits.

In this way, the PoS mining algorithm is fundamentally different from PoW (Proof Of Work), where the probability of block validation is higher for the miner or group of miners with the highest hashrate (the computing power used). Further, we describe the underlying differences between mining and staking:

- Mining is a process of computing using specialized hardware (GPUs), which consumes a big amount of energy. Staking is a more environmentally friendly process that does not require much energy.

- Mining is Proof-of-Work, which means mining coins by calculating complex mathematical problems.

Staking is Proof-of-Stake, the freezing of a certain percentage of the funds that ensure the validation of transactions in the blockchain.

- The efficiency of mining depends on computing power. The result of staking depends on the number of native tokens involved in the process. Moreover, regular computers no longer provide the necessary levels of processing power to generate coins. Mining is not possible without expensive higher grade equipment designed specifically for mining.

- Mining requires continuous miner engagement in the process, as the system is constantly being updated. If we talk about stakes, however, they are a completely passive endeavor which simply requires the owner to monitor the growth of his or her assets from time to time.

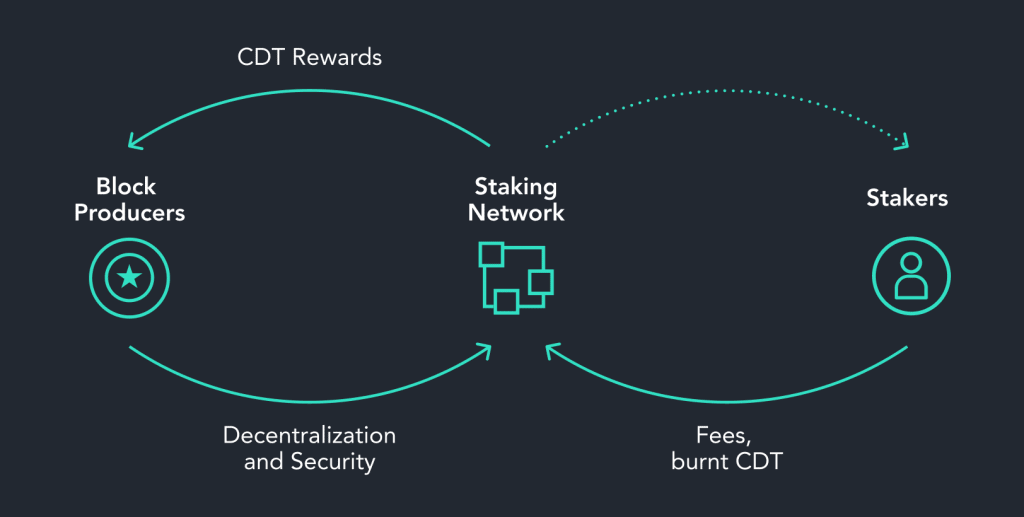

In the picture 2, you can find a schematic presentation of the difference between mining and staking.

So, how to make money staking crypto?

Start staking

In order to yield a crypto staking profit, you would need to buy a substantial amount of coins then freeze them for a set length of time to help maintain the operation of the blockchain. An important point to emphasize is that all the money you deposit into a staking pool are still owned you. There is always an alternative to withdraw your currency, but it normally takes a waiting time (days or weeks), depending on each type of blockchain.

Returns will vary depending on the price of digital currencies. If it does not decline within a year, the profit is guaranteed. For instance, storing Cosmos altcoin gets you 8.27% of the total worth of coins in your wallet per year. Fantom offers 33.59% annually. With one of the finest existing staking coin Tezos your estimated annual interest rate may be anywhere from 6.75 to 10.60%. Rewards are paid out to users every month.

Staking risks

Overall, staking looks like a less risky method of earning funds, since you don’t have to buy physical equipment. Similar to mining, where a high percent of investment in equipment may become non-liquid, staking is often associated with the risk that the price of the staked coin will change.

It is a fairly young sector and there is little consistent information on its profitability, risks, etc. This new sphere definitely holds great potential, but unless it starts generating huge profits, you can hardly expect a large number of people willing to dive right into it.

Choosing a staking platform

When it comes to selecting a platform, do not be seduced by sky-high interest rates, but rather prefer the hypothetical income to the reliability of the platform. Before starting earn by staking, you should carefully read the rules that regulate the procedure of staking on a platform.

Conclusion

If you’re still not sure about how to earn in stacking, let’s conclude. Stacking provides you with the opportunity to get cryptocurrency in exchange for using existing assets to validate the accuracy of transactions on the blockchain network by locking your crypto-assets in a target wallet for a set period of time.

It is a fantastic way to increase your savings in coins that otherwise would be sitting in your wallet or trading account. It is nearly as profitable as the mining or trading of cryptocurrencies. Stakes propose earnings that exceed the amount of money that a savings account can offer.