Crypto assets, such as Bitcoin, Ethereum, and other digital currencies, have become increasingly popular in Japan. Since 2018, the market of cryptocurrency, Japanese and worldwide, has been actively growing. The country, in particular, was the first to legally enshrine the term “crypto-asset,” so exchanges are required to register to start operating. This is largely due to the country’s favorable stance towards cryptocurrencies, as well as its commitment to becoming a leader in the digital assets space. As a result, Japan is home to a vibrant and fast-growing crypto assets market. In this article, we’ll take a look at the most important features of the Japanese crypto industry.

- How to choose the best crypto exchange in Japan

- Fees and commissions

- Trading platforms

- Mobile trading

- How to deposit and withdraw funds on Japanese crypto trading platforms

- Japanese crypto assets

- Is it worth investing in Japanese crypto-assets?

- Customer support

- Liquidity

- Safety

- Reliability and Reputation

- Using Japanese regulator-registered exchanges to buy cryptocurrency

- Types of crypto exchanges in Japan

- TOP 10 Japanese crypto trading platforms

- How to use crypto exchanges in Japan

- How to pay for cryptocurrency in Japan

- The risks related to using crypto exchanges in Japan

- Is it safe to store cryptocurrency in Japanese exchanges?

- Frequently Asked Questions

- What is a crypto exchange?

- What types of digital assets can be traded on a crypto exchange in Japan?

- How can I start trading on a crypto exchange in Japan?

- Are crypto exchanges in Japan regulated?

- What fees do crypto exchanges in Japan charge?

- What security measures do crypto exchanges in Japan have in place?

- Does Japan have any restrictions on crypto trading?

- What is the legal status of cryptocurrencies in Japan?

- Are there any taxes on crypto trading in Japan?

- Are crypto exchanges in Japan insured?

How to choose the best crypto exchange in Japan

Choosing the best crypto exchange in Japan can be a difficult task because there are so many options available. To help you make the best decision, here are some tips to consider when selecting a Japanese crypto exchange:

- Research the exchange’s reputation and fees: Make sure you read reviews from other users to ensure the exchange is trustworthy and has good customer service. Also, compare the fees associated with trading, deposits, and withdrawals to find the most cost-effective exchange.

- Know the regulations: Make sure you understand the legal regulations and guidelines surrounding crypto trading in Japan. This will help you make sure you are using a legitimate exchange and remain compliant with the laws.

- Consider the trading options: Take into account the types of coins and trading options available on the exchange. Make sure the exchange offers the coins you are looking to trade and the trading options you need.

- Security: Security is a very important factor to consider when selecting an exchange. Make sure the exchange uses strong encryption and other security measures to protect your funds.

Fees and commissions

Fees and commissions vary from exchange to exchange, so it’s best to do your research and compare the rates of each exchange you’re considering. Generally, Japanese crypto exchanges charge both a transaction fee and a commission on trades. Transaction fees usually range from 0.1% to 0.3% for each transaction, while commissions are usually around 0.1%. It’s important to note that some exchanges may offer additional fees such as withdrawal fees, deposit fees, and currency conversion fees. Moreover, it’s important to read the fine print and understand the fees associated with each exchange before making a decision.

Trading platforms

There are a variety of Japanese crypto exchanges that offer trading platforms with different features, advantages, and disadvantages.

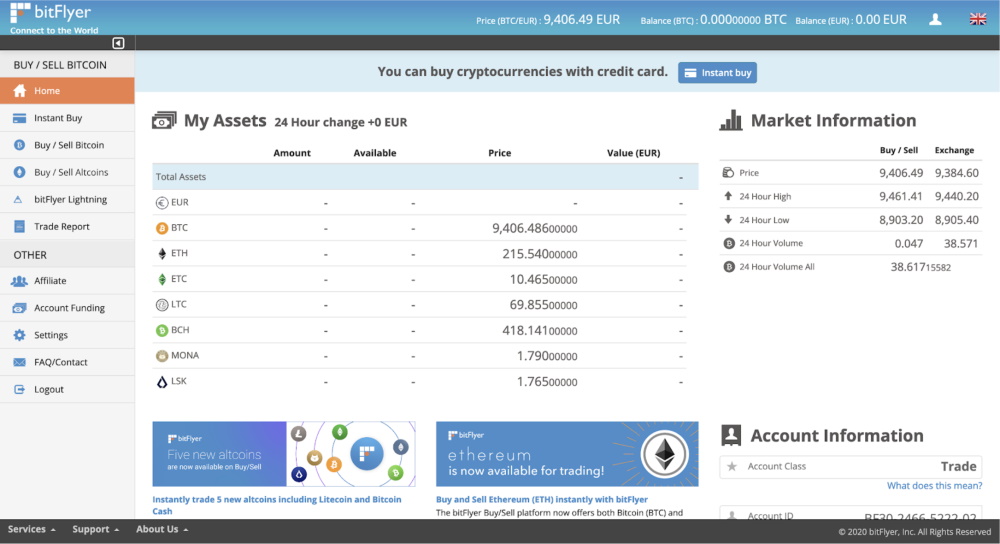

One of the most popular is bitFlyer, which is the largest crypto exchange in Japan. bitFlyer offers a variety of features such as multi-language support, low transaction fees, a wide range of trading options, and advanced order types. The advantages of using bitFlyer include a reliable platform, good customer support, and a secure trading environment. The main disadvantage is that the exchange is only available in Japanese, which can be an issue for non-Japanese traders.

Another popular solution is the Coincheck exchange, which offers a user-friendly platform, a range of Coincheck payment options, and competitive fees. The main advantages of Coincheck are its high liquidity, low trading fees, and wide range of trading pairs. On the other hand, the main disadvantage is its lack of advanced trading tools.

It’s important to choose the right exchange for your individual trading needs, as each has different features and advantages (see below).

Mobile trading

Running mobile crypto trading in Japan is possible but there are some important regulations you should be aware of. The government has established a strict regulatory framework for crypto trading. For example, all crypto exchanges must register with the Financial Services Agency (FSA) and comply with their anti-money laundering (AML) and counter-terrorist financing (CTF) guidelines. You will also need to obtain a license from a local regulator in order to operate a crypto exchange.

How to deposit and withdraw funds on Japanese crypto trading platforms

Depositing and withdrawing funds on Japanese crypto trading platforms can be a bit of a complicated process. However, with the right information and guidance, it can be easy and straightforward. Here is a guide to help you with depositing and withdrawing funds on Japanese crypto trading platforms.

First, you will need to create an account on the trading platform of your choice. Make sure that you set up the account with the proper credentials and that it is secure.

Once you have an account set up, you should check to see if the platform supports the type of crypto you wish to trade. Most Japanese crypto trading platforms support BTC, ETH, and BCH, but some may also support other coins.

Once you’re ready to withdraw your funds, you will need to make sure that you have the correct withdrawal address. You can find the correct address by going to the Withdrawal tab of your platform’s website or app.

F

Japanese crypto assets

Investing in Japanese crypto assets can be a great way to diversify your portfolio and potentially earn some extra income. With the recent advances in blockchain technology, there are now several different types of crypto assets available in Japan. It is important to understand the pros and cons of each asset before investing.

Advantages of investing in Japanese crypto assets include lower fees, faster transaction times, increased security, and potential tax benefits. Additionally, there are many user-friendly platforms available that make it easy to buy, sell, and store crypto assets.

Disadvantages of investing in Japanese crypto assets include the potential for high volatility, illiquidity in certain assets, and the fact that the market is still relatively new and under-regulated. Also, there is still a risk of fraudulent activity in some cases, so it is important to do your research and only invest in assets from trusted sources.

Is it worth investing in Japanese crypto-assets?

This approach has made the country attractive to crypto investors. Advantages of investing in Japanese exchanges:

- Legal market. Every crypto exchange (Japan) has a number of features:

- is used as a means of payment when interacting with unspecified persons;

- can be exchanged for fiat currencies;

- is digitally recorded and can be transferred;

- is not equated with fiat assets.

- Many Japanese banks have begun to adopt blockchain technology. For example, the MoneyTap system, developed with Ripple, helps banking organizations to quickly make transactions with fiat money through online banking.

- High Adoption. Japanese crypto exchange list currently serves more than 3.5 million local citizens. This demonstrates market adoption and makes the country a leader among many nations in the degree of blockchain adoption.

- Loyalty to digital asset ownership by organizations. Companies have no restrictions on cryptocurrency ownership for personal investment transactions as well as for exchange transactions. The only condition is that these services must not be provided to third parties on a commercial basis.

- The process of cryptocurrency mining is not regulated. This kind of activity does not fall under the definition of “exchange services”, so it is not controlled in Japan.

- High limits on declaring transactions. By law, if a citizen or foreign resident plans to exchange more than 273 thousand dollars to or from Japan, he must report this to the Ministry of Finance.

- Ability to inherit crypto-assets. This is an advantage, but one must consider the anonymity of digital assets. This is possible if the private key or password is kept in a known place. Otherwise, it will not be possible to pass the assets to the heirs.

At the same time, Japanese crypto exchanges have many disadvantages:

- The institution must obtain a license to operate in the field of cryptocurrencies;

- Cryptocurrency exchanges are taxed;

- Difficulties arise because of the strict regulation of the exchange of funds;

- Legislation and banks do not consider cryptocurrency to be official money;

- It is impossible to use anonymous coins;

- Local exchanges are difficult to consider safe, even though they have government licenses.

Overall, there are both risks and benefits associated with investing in Japanese crypto assets. It is important to understand all the potential risks before investing and to always do thorough research before making any decisions.

Customer support

Cryptocurrency exchanges in Japan usually communicate with customers only through the ticket system. Customer service is available on weekdays from 10 a.m. to 6 p.m. If there are more requests than the system can handle, it will take longer to respond, but this is not indicated on the website. It is nearly impossible to solve urgent problems, because of which users of exchanges may suffer.

Another problem of the local market — is a poor adaptation to foreign languages. For example, the Coincheck cryptocurrency exchange until recently supported only the Japanese language. At the moment, the platform is available in Indonesian, Chinese, Japanese, and English. Users from other countries will have to use a translator.

Also on the platforms, there are delays in payments and freezing of accounts for unknown reasons. The return of money in this case can be difficult because the support service sometimes delays the proceedings and is not in a hurry to help customers.

Liquidity

Liquidity, or the ability to quickly and easily convert assets into cash, is a crucial factor in any asset market. To assess the liquidity of crypto assets in Japan, one must consider the availability and cost of capital, the liquidity of digital asset exchanges, and the regulatory environment.

Second, Japan is home to a number of digital asset exchanges, each of which offers a variety of trading pairs. These exchanges are very liquid, allowing investors to quickly and easily convert their crypto assets into cash. For example, the Tokyo-based exchange Coincheck (English translation is not always available) offers over 30 different trading pairs, including BTC/JPY, ETH/JPY, and BCH/JPY.

Finally, the Japanese government is supportive of the crypto assets market, providing clarity and certainty for investors. In April 2017, the government officially recognized Bitcoin as a legal form of payment. In June of that year, it also legalized the trading and settlement of crypto assets on exchanges. These measures have helped to ensure that crypto assets in Japan are highly liquid and easily traded.

In general, the liquidity of crypto assets in Japan is excellent, due to the availability of capital, the liquidity of digital asset exchanges, and the supportive regulatory environment. This has helped to make Japan a leader in the digital assets space and a key player in the global crypto market.

Safety

Crypto trading in Japan is generally safe and reliable. Japan is home to some of the most reputable and well-regulated crypto exchanges in the world. To ensure the highest level of safety, traders should always do their due diligence in researching the exchange they’re considering trading on and familiarize themselves with the local regulations surrounding crypto trading. Additionally, traders should always make sure to use secure passwords and two-factor authentication to protect their accounts, and never store large amounts of crypto on an online exchange.

Reliability and Reputation

Japanese crypto exchanges have a good reputation for offering reliable services. Several exchanges have achieved high customer satisfaction ratings, with reports of fast transactions and helpful customer service. For example, BitFlyer, Japan’s largest crypto exchange, has a customer satisfaction rating of 4.3/5 according to TrustPilot reviews. Similarly, Coincheck, another popular Japanese crypto exchange, has a customer satisfaction rating of 4.6/5.

Using Japanese regulator-registered exchanges to buy cryptocurrency

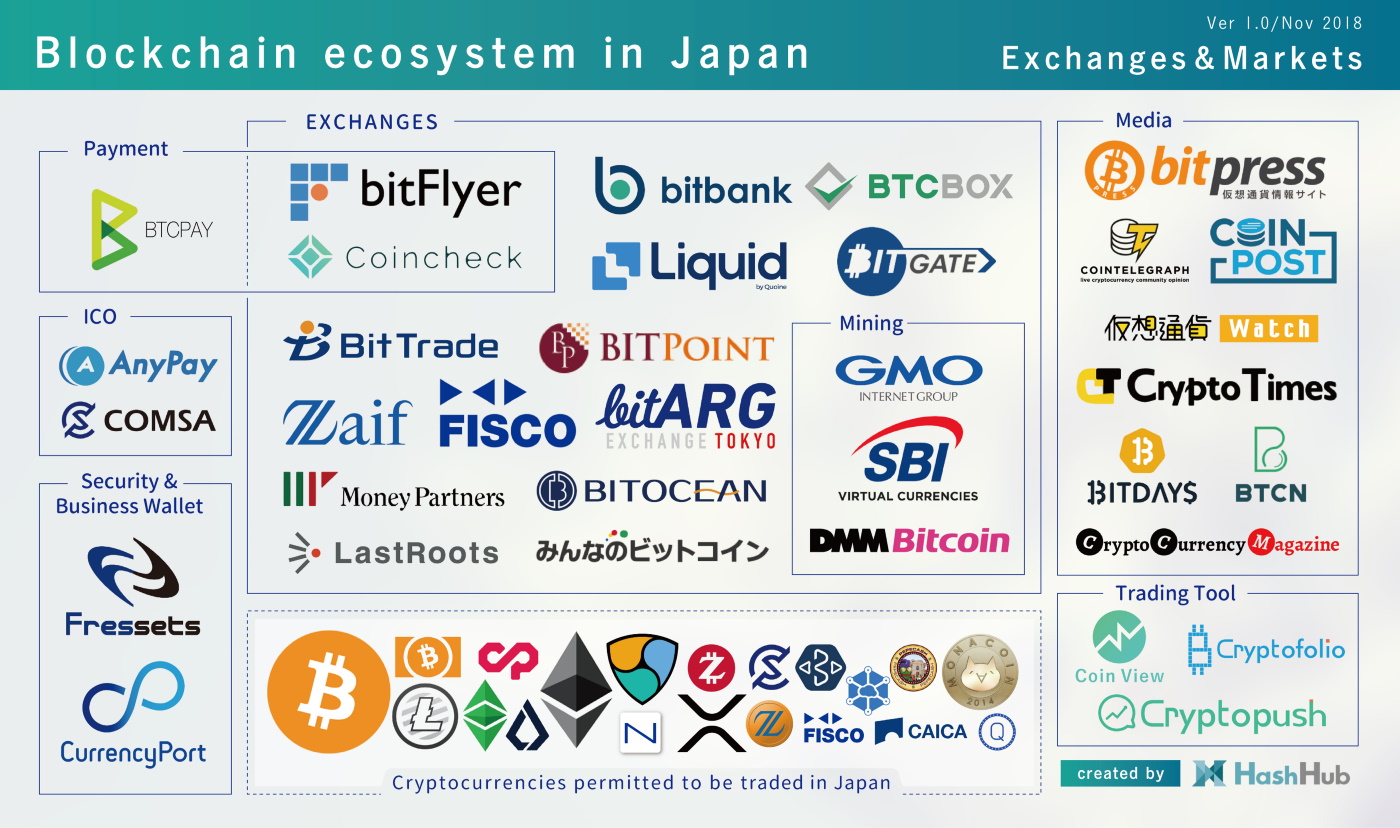

Among the list of the TOP Japanese cryptocurrency exchanges registered by the regulator are:

- bitFlyer;

- Liquid;

- Coincheck;

- Zaif.

The main advantage of working with these platforms is the license of the regulator provides protection of transactions and clients’ data on the exchange. However, it is worth considering other nuances of working with such platforms:

| Exchange | Pros | Cons |

| bitFlyer |

|

|

| Liquid |

|

|

| Coincheck |

|

|

| Zaif | The main advantage is the high security of the exchange (the project was created under the guidance of financial and technical consultants). |

|

As a result, crypto available in Japan can be a great investment vehicle. It is a large market, recognized at the national level. With the right exchange, the investment will pay off. However, you have to understand that Japan is a more conservative country compared to the United States. Investing in the local market has many limitations and problems, including security concerns.

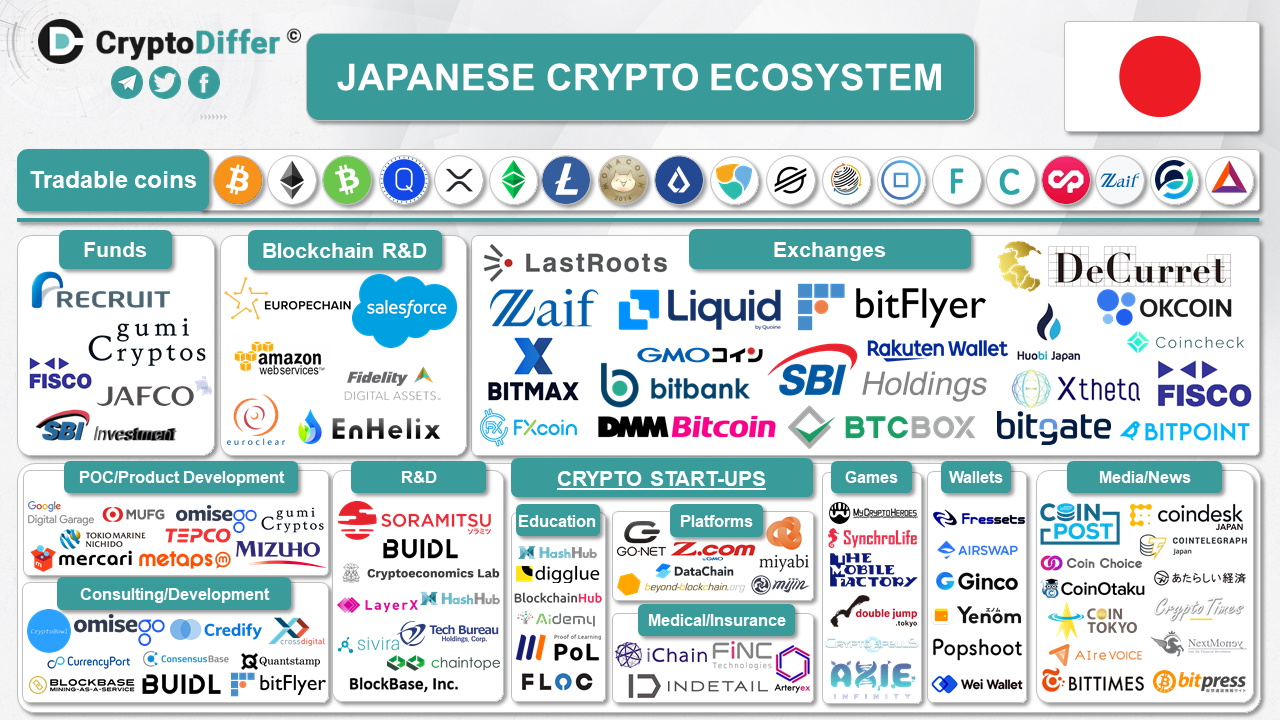

Types of crypto exchanges in Japan

There are a few different types of crypto exchanges that are available in Japan. The most popular type of exchange is the centralized exchange, which allows users to trade cryptocurrencies with each other, often through the use of smart contracts. These exchanges typically require users to register and provide personal information, as well as a valid form of payment. Another type of exchange that is popular in Japan is the decentralized exchange, which is a peer-to-peer trading platform. These exchanges are not subject to the same regulations as centralized exchanges, and users can trade directly with each other without the need for a third party.

TOP 10 Japanese crypto trading platforms

There are a few Japanese crypto trading platforms that you may be interested in. As mentioned above, one of the most popular ones is bitFlyer, which allows users to buy and sell Bitcoin and other cryptocurrencies. Other Japanese platforms include Quoine, BitTrade, and Zaif. All of these platforms offer a wide range of services, including a secure wallet, real-time market data, and access to multiple currency pairs. They are all highly regulated and compliant with Japanese laws and regulations.

Here is a list of 10 of the best Japanese crypto trading platforms:

- BitFlyer – A top exchange with a wide range of Japan cryptocurrency coins.

- Coincheck – A popular trading platform with a wide selection of coins, including new Japanese crypto coins.

- Quoinex – A top exchange with a variety of coins.

- Zaif – A top exchange for trading a variety of cryptocurrencies.

- Bitbank – A popular trading platform for trading a variety of coins.

- BTCBOX – A prominent exchange with a wide selection of coins.

- FISCO Cryptocurrency Exchange – A top exchange for trading a variety of coins.

- GMO Coin – A popular exchange for trading a variety of coins.

- Huobi Japan – A top exchange for trading a variety of crypto coins (Japan).

- Liquid Exchange – A top exchange for trading a variety of coins.

For detailed information, please explore tables 1, 2, and 3.

Table 1. Japanese exchanges list.

| Exchange | Features | Available cryptocurrencies | Deposit and withdrawal fees, relatively |

| BitFlyer | One of the most popular cryptocurrency exchanges in Japan launched in 2014. It is used by both individuals and large investors. It offers a user-friendly interface, fast transaction processing, and various deposit/withdrawal methods. | Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Ethereum Classic, Lisk, Monacoin, Factom, Zcash, Augur | 0% / 0,0008 BTC |

| Coincheck | An exchange specializing in cryptocurrencies, established in 2012. Known for being one of the first cryptocurrency exchanges in Japan. | Bitcoin, Ethereum, Ethereum Classic, Litecoin, Bitcoin Cash, NEM, Lisk, Factom, Monacoin, Augur | 0% / 0,001 BTC |

| Quoinex | The exchange specializes in cryptocurrencies and was created in 2014. It provides trading platforms for novice and experienced investors. The exchange has a variety of deposit and withdrawal methods, including bank transfers and online payments. It also offers services for exchanging cryptocurrencies for fiat currencies. | Bitcoin, Ethereum, Bitcoin Cash, Ethereum Classic, Litecoin, EOS, BCH ABC, XRP, LTC, BSV | 0% / 0,001 BTC |

| Huobi Japan | Huobi Japan is an official partner of the major Chinese exchange Huobi, offering transactions of crypto currency, Japan trading, as well as cashiering services, and a marketplace for interaction with various crypto projects. Several convenient deposit/withdrawal methods are available. | Bitcoin, Ethereum, Ripple, Bitcoin Cash, Litecoin, EOS, Cardano, IOTA, MonaCoin, NEM | 0% / 0,0005 BTC |

| Zaif | Established in 2014 and specializes in the exchange of cryptocurrencies. It offers trading platforms for investors of different experience levels. A variety of deposit and withdrawal methods are available, including bank transfers and transfers via online payment systems. It also offers a service of exchanging cryptocurrencies for fiat currencies. | Bitcoin, Ethereum, MonaCoin, Nem, Bitcoin Cash, Ripple, Ethereum Classic | 0% / 0,001 BTC |

| Bitbank | Offers cryptocurrency exchange services, as well as marketing and consulting services for crypto projects. | Bitcoin, Ethereum, Ripple, Litecoin, Bitcoin Cash, MonaCoin, NEM, Cardano, IOTA, EOS | 0% / 0,001 BTC |

| BTCBOX | Founded in 2014, it offers trading platforms for both novice and experienced investors. The exchange offers a variety of deposit/withdrawal methods, including bank transfers and online payment systems. It also offers services for exchanging cryptocurrencies for fiat currencies. | Bitcoin, Ethereum, Litecoin, MonaCoin, Ripple, Ethereum Classic, Factom, Augur, Lisk, Zcash | 0% / 0,001 BTC |

| FISCO Cryptocurrency Exchange | An exchange created by FISCO that specializes in cryptocurrency trading and also offers cashiering services for crypto projects. It provides convenient deposit/withdrawal methods, including bank transfers. | Bitcoin, Ethereum, Litecoin | 0% / 0,1% |

| GMO Coin | An exchange that specializes in cryptocurrencies and was created by GMO Internet. It offers cryptocurrency trading services, as well as cryptocurrency mining and storage services. The exchange has a user-friendly trading platform and various deposit/withdrawal methods, including bank transfers. | Bitcoin, Ethereum, Litecoin | 0% / 0,1% |

| Liquid Exchange | An exchange specializing in cryptocurrencies, founded by Quoine. It offers cryptocurrency trading services, as well as cashiering services, and a marketplace for interaction with various crypto projects. It has a user-friendly trading platform and various deposit/withdrawal methods, including bank transfers. | Bitcoin, Ethereum, Litecoin | 0% / 0,1% |

| Binance Japan | The national division of the world’s largest cryptocurrency exchange Binance. | More than 100 currencies, including Bitcoin, Ethereum, XRP, Binance Coin, etc. | Usually, 0% / usually 0.0005 BTC |

| DMM Bitcoin | Owned by the large Japanese company DMM Group | Bitcoin, Ethereum, Litecoin, Ripple | 0% / 0.001 BTC |

| Fisco Cryptocurrency Exchange | Japanese cryptocurrency exchange focusing on security | Bitcoin, Ethereum, XRP, Bitcoin Cash, Litecoin, Monacoin, Nem, Augur | 0% / 0.0005 BTC |

| Bitpoint Japan | Owned by the large Japanese financial company Remixpoint | Bitcoin, Ethereum, Ripple, Bitcoin Cash, Litecoin, Monacoin, Nem | 0% / 0.001 BTC |

| SBI Virtual Currencies | Owned by the large Japanese financial company SBI Holdings | Bitcoin, Ethereum, Ripple | 0% / 0.001 BTC |

| BitTrade | It was created in 2018 after a crowd sale. The main feature of this exchange is its narrow specialization. | Bitcoin, Ethereum, Ripple, Litecoin, Bitcoin Cash | 0% / 0.001 BTC |

| Bitgate | BitGate is a mobile cryptocurrency storage app that is easy to use, secure, fast and compliant. | Bitcoin, Ethereum, Ripple | 0% / 0.001 BTC |

| Xtheta Corporation | Xtheta is a provider of virtual currency transfer, buying, selling, and exchanging services. | Bitcoin, Ethereum, Ripple | 0% / 0.001 BTC |

| Tokyo Bitcoin Exchange | A bitcoin exchange based in Shibuya, Tokyo, Japan. Launched in 2010, it handled more than 70% of all bitcoin transactions worldwide by early 2014. | Bitcoin | 0% / 0.001 BTC |

| Mr. Exchange | Mr. Exchange (formerly Mr. Ripple) is a Japanese cryptocurrency exchange. There are many cryptocurrency exchanges in Japan, but another very popular Japanese cryptocurrency exchange is Bitbank. | Bitcoin, Ethereum, Ripple | 0% / 0.001 BTC |

| E-Coin | E-Coin, managed by Wallet Capital Group Inc. has been successfully operating in the cryptocurrency market for more than a year. The domain of the service was registered back in 2009. | Bitcoin, Ethereum | 0% / 0.001 BTC |

| Kripto Japan | A platform offering the ability to trade digital assets and exchange virtual currencies. | Bitcoin, Ethereum, Ripple | 0% / 0.001 BTC |

Table 2. Japanese and worldwide exchanges comparison.

| Exchange | Headquarters country | Foundation year | Exchange type | Trading is allowed |

| bitFlyer | Japan | 2014 | Centralized | Yes |

| Coinmama | Israel | 2013 | Centralized | Yes |

| Coincheck | Japan | 2012 | Centralized | Yes |

| Crypto.com | Hong Kong | 2016 | Centralized | Yes |

| CoinSmart | Canada | 2018 | Centralized | Yes |

| Liquid | Japan | 2014 | Centralized | Yes |

| PayBis | UK | 2014 | Centralized | Yes |

| Coinbase | USA | 2012 | Centralized | Yes |

| OKCoin | USA | 2013 | Centralized | Yes |

Table 3. Exchanges info.

| Exchange | Access from the USA | Payment methods | Contacts | |

| Deposit | Withdrawal | |||

| bitFlyer | Yes | Wire transfer, credit card | Wire transfer | https://www.bitflyer.com/en-us/ https://www.bitflyer.com/en-us/support/ |

| Coinmama | Yes | Credit card | Wire transfer, credit card | https://www.coinmama.com/ https://www.coinmama.com/support |

| Coincheck | Yes | Wire transfer | Wire transfer | https://coincheck.com/ https://faq.coincheck.com/ |

| Crypto.com | Yes | Wire transfer deposits, credit and debit cards, online payment services. | Wire transfer, credit and debit cards | https://www.crypto.com/ https://www.crypto.com/support |

| Coinsmart | Yes | Wire transfer, credit and debit cards, online payment services. | Wire transfer, credit and debit cards | https://coinsmart.com/ https://coinsmart.com/support |

| Liquid | Yes | Wire transfer, credit and debit cards, online payment services. | Wire transfer, credit and debit cards | https://www.liquid.com/ https://www.liquid.com/support/ |

| PayBis | Yes | Wire transfer, credit and debit cards, online payment services. | Wire transfer, credit and debit cards | https://paybis.com/ https://paybis.com/support/ |

| Coinbase | Yes | Wire transfer, credit and debit cards, online payment services. | Wire transfer, credit and debit cards | https://www.coinbase.com/ https://support.coinbase.com/ |

| OKCoin | Yes | Wire transfer, credit and debit cards | Wire transfer | https://www.okcoin.com/ https://www.okcoin.com/support/ |

How to use crypto exchanges in Japan

Japanese crypto trading platforms are becoming increasingly popular and offer a wide range of services and support options. Here are some tips and guidance to help you get the most out of your experience.

- Familiarize yourself with the platform. Take some time to get to know the platform, including the user interface and the different features available. This will make it easier to navigate and understand when you’re ready to start trading.

- Read the FAQs. Most platforms have an FAQ section that provides answers to common questions about the platform and its features. This can be a great resource for getting up to speed quickly and understanding how the platform works.

- Utilize customer support. Many platforms provide customer support via phone, email, or live chat. If you ever have a question or problem with the platform, don’t hesitate to reach out to the customer support team.

- Be aware of fees. Different platforms have different fee structures, so be sure to read up on the fees associated with trading on the platform before you start trading.

- Make use of tutorials and guides. Many platforms provide helpful tutorials and guides on how to use the platform and understand its different features. This can be a great way to get up to speed quickly and start trading with confidence.

In addition, by following the tips and guidance below, you can make the most of your experience with Japanese crypto trading platforms:

- First, it’s important to understand the laws and regulations in Japan when it comes to crypto trading. Make sure you are aware of the legal requirements of trading digital currencies in Japan before you start.

- Next, you’ll need to find a secure, reliable trading platform that meets your needs. Do your research and make sure the platform has good customer service and a user-friendly interface.

- Once you’ve chosen your platform, you’ll need to create an account and fund it. Many trading platforms require a KYC (Know Your Customer) process to verify your identity. This is to ensure your security and protect you from fraud.

- Finally, you’ll need to familiarize yourself with the tools and features of the platform. Read the user guide and take advantage of any tutorials or customer support resources that are available. Practice on a demo account until you feel comfortable trading with real money.

Using a crypto exchange in Japan is a relatively straightforward process. To get started, here are the steps you will need to take:

- Research the different crypto exchanges available in Japan. Check out reviews and ratings from other users to get a good understanding of the different platforms available.

- Choose the exchange that best meets your needs and create an account. Most exchanges will require some form of verification for identity and residency.

- Once your account is verified, you will need to fund it with fiat currency. Most exchanges will accept bank transfers or credit/debit cards for deposits.

- Once your account is funded, you can start trading crypto. Make sure to read the terms and conditions of the exchange before you start trading.

- When you are ready to withdraw your funds, you will need to complete a withdrawal request. You can withdraw to a bank account or other supported wallet.

How to pay for cryptocurrency in Japan

The most popular options are bank transfers and credit/debit cards. Bank transfers are usually the most convenient and cost-effective option, as they typically have lower transaction fees than other methods. Credit/debit cards can also be used, but you may be charged extra fees depending on your card issuer. Some exchanges in Japan offer alternative payment methods such as cash deposits, PayPal, and wire transfers. Be sure to check with the specific exchange for details. Remember to always be mindful of the current regulations and laws governing cryptocurrency transactions in Japan.

The risks related to using crypto exchanges in Japan

The use of cryptocurrency exchanges in Japan carries with it a number of risks, and it is important to be aware of these in order to protect yourself and your assets.

Firstly, the risk of hacking is a major concern. Cryptocurrency exchanges are often targeted by hackers, and if you store your cryptocurrency on an exchange, it is possible for it to be stolen. It is important to regularly check the security of your exchange and to take measures such as using two-factor authentication to protect your account.

Secondly, there is a risk of exchange failure. Although exchanges are generally reliable, it is possible for them to become insolvent, meaning that your funds may be lost if you have not withdrawn them in time. It is important to do your research before selecting an exchange and to diversify your assets across different exchanges.

Finally, there is the risk of regulatory changes. Japan has implemented a number of regulations regarding cryptocurrency exchanges, and these can change at any time. It is important to keep up to date with the latest regulations and to ensure that your exchange is compliant.

Is it safe to store cryptocurrency in Japanese exchanges?

When it comes to storing cryptocurrency, the security of the exchange is paramount. With the increasing popularity of digital currencies, it is important to ensure that users are safe when storing their assets. In Japan, there are a number of cryptocurrency exchanges that offer secure storage of digital currencies.

It is important to understand the legal landscape in Japan when it comes to cryptocurrency. Japanese exchanges must meet certain security requirements in order to be considered safe for storing cryptocurrency. They also must use advanced security protocols such as two-factor authentication and a secure wallet system to protect user assets, as well as have a valid system for monitoring transactions to detect any suspicious activity. Finally, exchanges should use a cold storage system to store the majority of user assets, as this is the safest way to store digital currencies.

Frequently Asked Questions

What is a crypto exchange?

A crypto exchange is a platform that allows its users to buy, sell, and trade different types of digital assets, such as cryptocurrencies.

What types of digital assets can be traded on a crypto exchange in Japan?

Crypto exchanges in Japan typically offer a wide range of digital assets from major cryptocurrencies like Bitcoin and Ethereum to other altcoins and tokens.

How can I start trading on a crypto exchange in Japan?

To start trading on a crypto exchange in Japan, you will need to create an account and fund it with the desired asset. You can then place orders to buy or sell digital assets.

Are crypto exchanges in Japan regulated?

Yes, crypto exchanges in Japan are regulated by the Financial Services Agency (FSA). All exchanges must be licensed and follow strict rules to ensure a secure and fair trading environment.

What fees do crypto exchanges in Japan charge?

Crypto exchanges in Japan typically charge fees for deposits, withdrawals, and trades. The fees may vary depending on the exchange and the asset being traded.

What security measures do crypto exchanges in Japan have in place?

Crypto exchanges in Japan usually have robust security measures in place, such as two-factor authentication, cold storage, and data encryption.

Does Japan have any restrictions on crypto trading?

Yes, the Japanese government has imposed certain restrictions on crypto trading, such as limiting leverage and banning anonymous trading.

What is the legal status of cryptocurrencies in Japan?

Cryptocurrencies are legally recognized as a form of property in Japan. They are not recognized as legal tender, but they are subject to taxation.

Are there any taxes on crypto trading in Japan?

Yes, crypto trading is subject to capital gains tax in Japan.

Are crypto exchanges in Japan insured?

Yes, some services of crypto, Japan exchanges as an example, are insured against theft and other losses.