Ripple Participates in Hong Kong Monetary Authority’s e-HKD Program for Tokenizing Real Estate Assets

Ripple Participates in Hong Kong Monetary Authority’s e-HKD Program for Tokenizing Real Estate Assets- Cointelegraph Markets Pro 2.0 — What’s new?

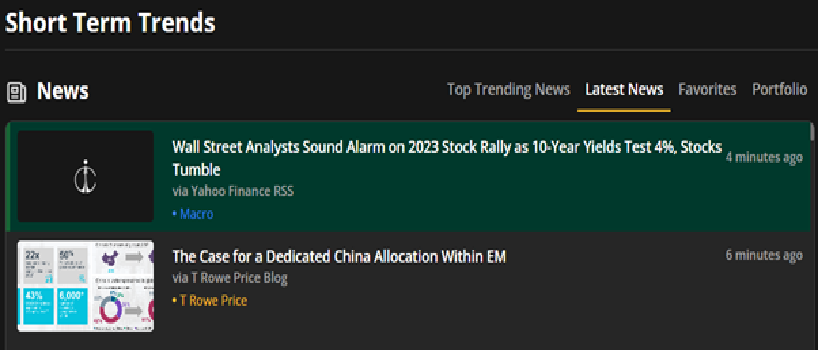

- An updated news section

- Top VORTECS™ Scores

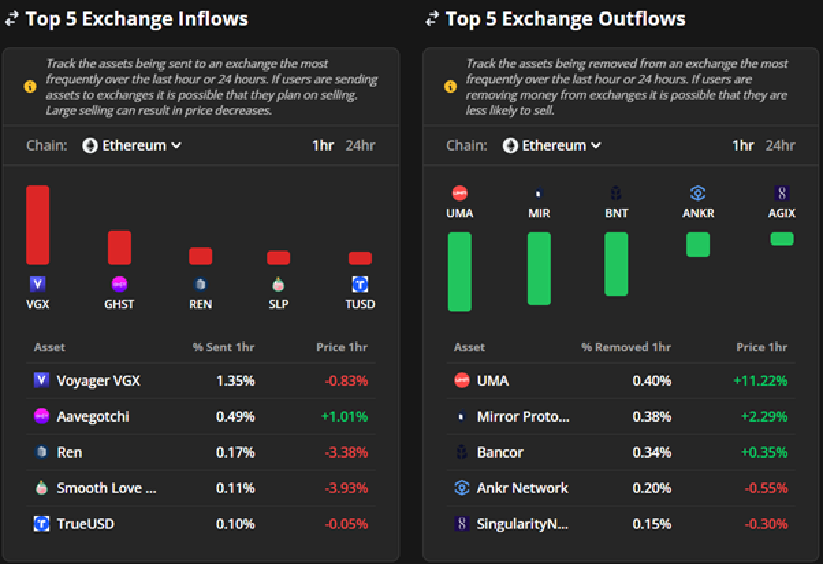

- Top 5 Exchange Inflows and Outflows

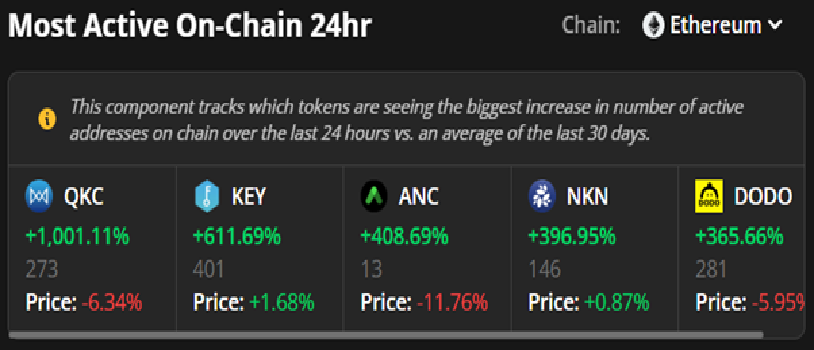

- Most Active On-Chain 24hr

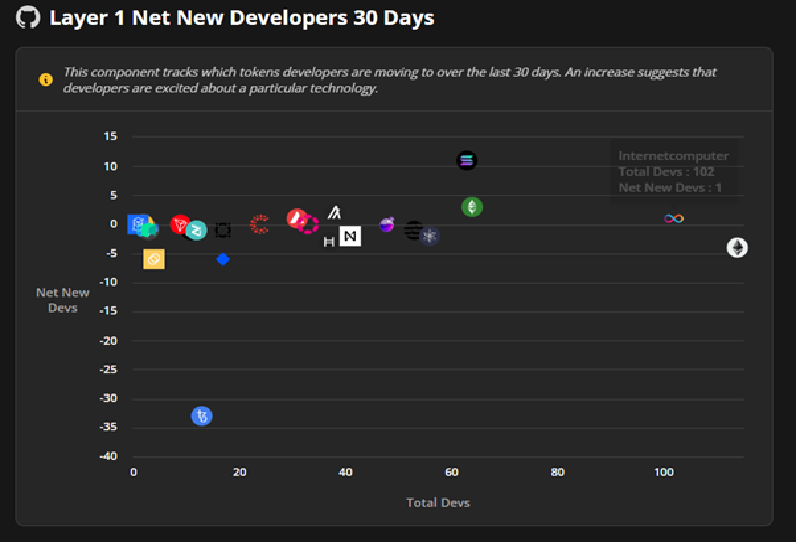

- Net New Developers by Layer 1 Ecosystem in the last 30 days

- Total Value Locked (TVL) Gainers

- Season Indicator

- Join the Cointelegraph Markets Pro trading community

The goal behind the creation of Cointelegraph Markets Pro was to bridge the gap between institutional and retail investors. To accomplish this, the platform offers unique tools like the Newsquakes™ indicator, the VORTECS™ Score, and the Tweet Sentiment indicator.An examination of Cointelegraph Markets Pro's alert performance reveals its outstanding success as an institutional-level platform. Since 2021, the platform has consistently generated an average return of:

- Score-based trading strategies using the platform have produced gains of 2,895%, potentially transforming a $10,000 investment into $289,549.

- Time-based trading strategies have generated gains of 546%, potentially resulting in $54,635 from a $10,000 investment.

- Buy-and-hold breakout strategies have seen gains of 851%, potentially turning $10,000 into $85,179.

Cointelegraph Markets Pro 2.0 — What’s new?

The updated dashboard combines new features with a streamlined design that simplifies the process of receiving and analyzing information for traders. For instance, the dashboard has been divided into two sections: Short Term Trends and Long Term Trends, enabling traders to effortlessly switch between them based on their preferred trading style.

An updated news section

The news section now showcases the most popular trending news and the latest updates. The top trending news is determined by the frequency of tweets about the stories within a 24-hour period. Additionally, users can easily identify the news category by the red lettering beneath the title.Top VORTECS™ Scores

The upgraded dashboard offers a more comprehensive view of the tokens with the highest VORTECS™ Scores. This numerical value reflects the asset's current sentiment, Twitter activity, trading volume, and price movement in relation to its entire history. A higher score indicates that the current market conditions have a higher likelihood of being bullish for the asset within a 24-hour period.Top 5 Exchange Inflows and Outflows

On the other hand, the Top 5 Exchange Inflow section displays the assets that are being deposited on exchanges the most frequently within a one-hour or 24-hour period. This could suggest that investors are planning to sell, as significant selling activity can lead to price declines.

Most Active On-Chain 24hr

Similar to the tweet and trade sections, these tokens are listed from highest to lowest, from left to right, and their price movement is shown at the bottom, below the number of addresses. An increase in on-chain activity is typically viewed as a bullish sign, indicating that the project is being widely adopted and more users are joining.

Net New Developers by Layer 1 Ecosystem in the last 30 days

The X-axis depicts the total number of developers for the specific blockchain, while the Y-axis displays the net increase in developers over the last 30 days."

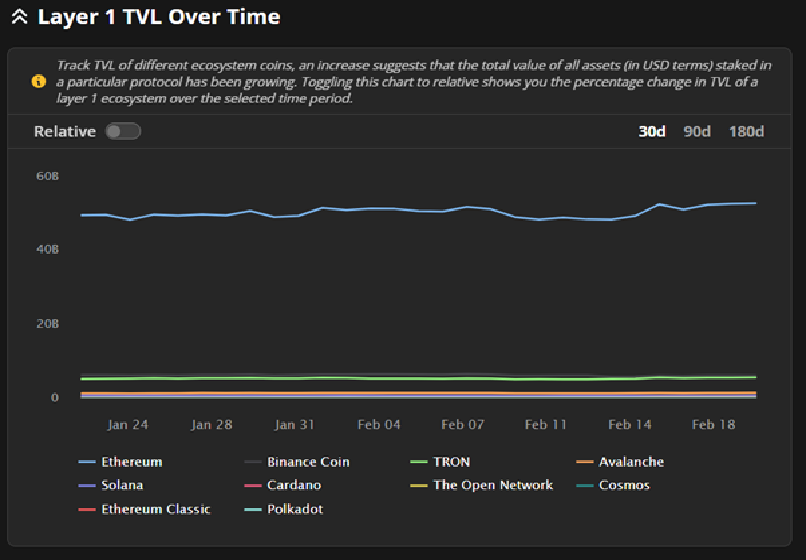

Total Value Locked (TVL) Gainers

Users have the option to view the percent changes by clicking the "Relative" button and filtering the data by time frame (30, 90 or 180 days). They can also choose to hide a specific blockchain by selecting its name in the drop-down menu below.

Season Indicator

Join the Cointelegraph Markets Pro trading community

The latest version of Cointelegraph Markets Pro combines institutional-level tools with a comprehensive library of information for independent analysis. By merging individual research with the recommendations of institutional tools, traders can consistently identify high-probability trades.These latest enhancements make Cointelegraph Markets Pro the most powerful yet. For anyone looking to confidently achieve strong returns, even in a bear market, Cointelegraph Markets Pro is a platform worth considering.

Comments

Subscribe

Login

0 Comments