A “horrendous bearish engulfing” risks defining the weekly close, but all may not be lost, insist Bitcoin price analysts.

On April 23, Bitcoin aimed to reclaim its losses as the 10-day low continued to persist.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

$26,600 becomes popular BTC price target

Information from Cointelegraph Markets Pro and TradingView tracked BTC/USD as it climbed to hover around $27,700 at the time this was written.

With a recovery of approximately 2.5% from the previous day’s low, the pair continued to capture traders’ attention as a potential short-selling opportunity leading up to the week’s end.

“Right now, my target for my short position is $26,600, and since it’s the weekend, it might take a bit longer to reach that level,” Crypto Tony confirmed to his Twitter followers on April 23.

BTC/USD annotated chart. Source: Crypto Tony/Twitter

Reaching that target would set a new low for Bitcoin, which experienced a 10% decline over the week, resulting in an overall negative performance for April.

Analyst Mark Cullen considered the possibility of BTC/USD nearing the April 21 CME futures closing price of $27,310 before the end of the week.

BTC/USD annotated chart. Source: Mark Cullen/Twitter

Another tweet highlighted a surge in spot market selling on Binance, the largest exchange, which could potentially intensify the downward pressure in an otherwise less liquid weekend trading atmosphere.

“Horrendous bearish engulfing” looms

Generally, market participants seemed to agree on BTC price movements, indicating that short-term bearish shifts were not likely to alter the prevailing bullish trend for 2023.

He further mentioned that the weekly chart remained on course to establish a higher low (HL), effectively maintaining the upward trend.

“I don’t see the entire bearish perspective,” he argued.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

“Weekly timeframe we’re seeking for a HL, which seems as a possible case around $26,500-27,000 (perhaps $25,000). Breaking back above $27,800 is probably a strong upwards reaction to $29,000 for #Bitcoin and continuation of the uptrend.”

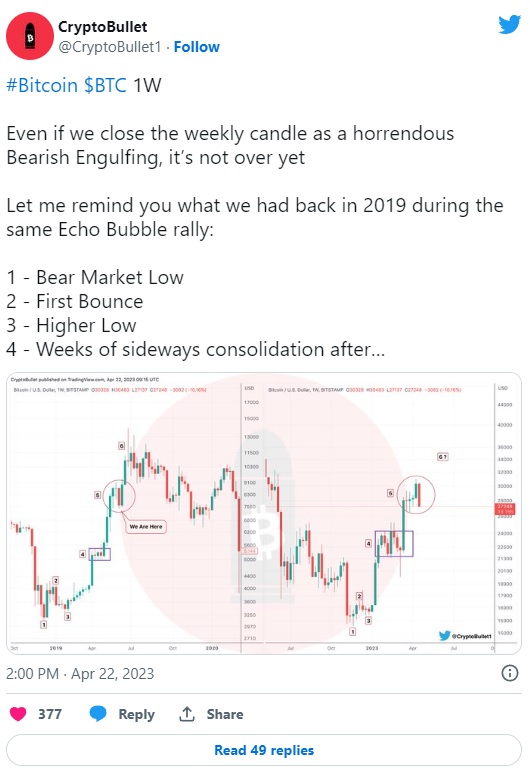

Well-known trader CryptoBullet appeared more apprehensive, though they admitted that a weekly candle overshadowing an entire month’s progress wouldn’t necessarily signal the end of the bull market.