The Federal Reserve of the United States is planning to implement a new increase in interest rates on March 22nd, offering traders the opportunity to reap profits through a risk-averse approach.

The Fed’s actions of raising the cost of capital can increase the profitability of fixed-income assets, but at the same time, it negatively affects other markets such as:

- stocks;

- real estate;

- commodities;

- and cryptocurrencies.

The Federal Reserve’s meetings have a positive aspect in that they are planned well ahead of time, allowing Bitcoin traders to make necessary preparations. Historically, decisions made by the Fed have resulted in significant intraday volatility in risk assets, but traders can leverage derivatives instruments to maximize their returns as the Fed adjusts interest rates.

A challenge faced by traders is the pressure brought on by the high correlation between Bitcoin and equities.

For instance, the correlation coefficient between Bitcoin and S&P 500 futures has been consistently above 70% since February 7th. While it doesn’t clearly indicate causality, it’s clear that cryptocurrency investors are closely monitoring the movements of traditional markets.

Another advantage of Bitcoin is its low carbon emissions, which could become increasingly attractive as investors come to realize that the Fed has limited options to combat inflation. Further increases in interest rates could result in the U.S. government’s debt repayments becoming unsustainable, potentially surpassing $1 trillion per year.

Risk-tolerant investors may benefit from buying Bitcoin futures contracts to amplify their positions, but they could also face liquidation if there is a sudden drop in price prior to the Fed’s decision on March 22nd. As a result, experienced traders may prefer options trading strategies like the skewed iron condor.

An approach to using call options that balances risk.

By trading multiple call (buy) options for the same expiry date, traders can achieve gains 3 times higher than the potential loss. This options strategy allows a trader to profit from the upside while limiting losses.

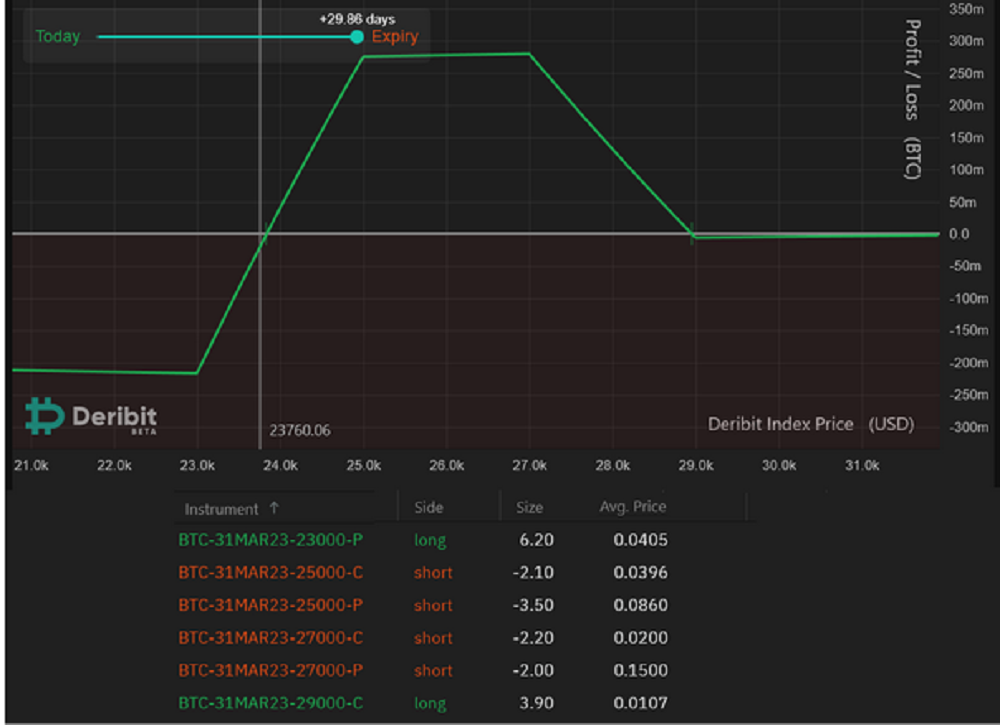

The following shows the projected returns from using Bitcoin options with a March 31st expiration date, but this approach can also be applied to other time frames. Although the costs may differ, the overall efficiency remains unchanged.

To initiate the trade, the investor must buy 6.2 contracts of the $23,000 put (sell) option. Then, the buyer must sell 2.1 contracts of the $25,000 call option and another 2.2 contracts of the $27,000 call option. Next, the investor should sell 3.5 contracts of the $25,000 put (sell) option combined with 2 contracts of the $27,000 put option.

As a final step, the trader must purchase 3.9 contracts of the $29,000 call option to limit losses above the level.

To initiate the trade, the investor must first purchase 6.2 contracts of the $23,000 put (sell) option. Then, the investor must sell 2.1 contracts of the $25,000 call option and another 2.2 contracts of the $27,000 call option. Subsequently, the trader should sell 3.5 contracts of the $25,000 put (sell) option and 2 contracts of the $27,000 put option.

This strategy will generate a profit if Bitcoin is trading between $23,800 and $29,000 on March 31st. The net profits will be at their highest, reaching 0.276 BTC ($6,558 based on current prices), if Bitcoin trades between $25,000 and $27,000. Profits will still be above 0.135 BTC ($3,297 based on current prices) if Bitcoin trades in the range of $24,400 and $27,950.

The cost of opening this skewed iron condor strategy is the maximum potential loss, which is 0.217 BTC or $5,156, and will occur if Bitcoin trades below $23,000 on March 31st. The advantage of this strategy is its wide target profit area, which provides a better risk-to-reward outcome compared to leveraged futures trading, especially given the limited downside.

- Source: https://cointelegraph.com