PayPal’s crypto holdings rose 56% in Q1 2023 per a recent submission to the U.S. Securities and Exchange Commission (SEC).

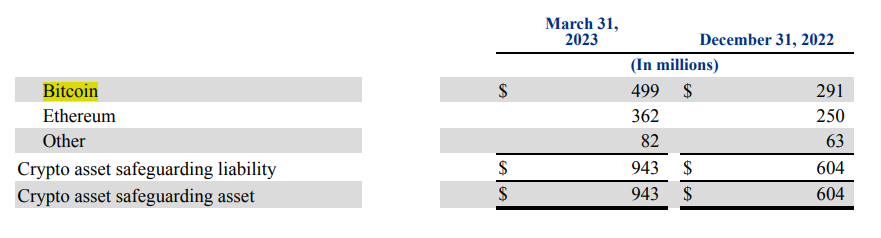

By the end of March 2023, PayPal’s cryptocurrency assets had risen to $943 million, marking a 56% increase compared to the $604 million recorded in the fourth quarter of 2022.

The company also saw an improvement in profitability during this time. Based on generally accepted accounting principles (GAAP), PayPal reported earnings per share of $0.70, a significant increase from the $0.43 registered in the first quarter of 2022.

In contrast, the company’s non-GAAP earnings per share were $1.17, up from $0.88 in the same period the previous year.

PayPal categorizes its cryptocurrency holdings as “protective liabilities,” indicating the intrinsic risks tied to these digital currencies.

In general, the composition of specific cryptocurrencies held by PayPal remained steady in the first quarter of 2023.

PayPal reported the following:

“We offer our customers in select markets the ability to acquire, hold, exchange, send, and receive specific cryptocurrencies and to use the proceeds from crypto sales to cover purchases at checkout. These digital currencies include bitcoin, ethereum, bitcoin cash, and litecoin (collectively referred to as ‘our clients’ crypto assets’).”

PayPal employs third-party services to hold their clients’ assets.

Still, PayPal confirmed that, as of yet, there has been no reported incident or issue with withdrawals:

Source: https://crypto.news/paypals-crypto-holdings-rise-56-to-943m-in-q1-2023/