Bitcoin may be up 7.5% since Friday, but BTC price action is not giving everyone cause for positivity.

Bitcoin aimed to regain the $27,000 mark during the weekly closing on May 14, as fluctuations intensified during non-trading hours.

Bitcoin’s value has increased by over 7% in just two days.

According to information from Cointelegraph Markets Pro and TradingView, the BTC/USD exchange rate soared to $27,200 on Bitstamp, marking its highest level in several days. This uptick represents an approximately 7.5% increase compared to the week’s lowest point during the final Wall Street trading session.

“Patience, as flipping $27.2K is the first serious trigger for continuation upwards. In that case, close to a temporary bottom & potentially new highs to $36-42K still possible.”

Well-known trader Daan Crypto Trades pointed out the possibility of a “gap” forming in the CME Bitcoin futures market when it opens on May 15.

He shared with his Twitter followers, “If BTC maintains its current price level, it will create a CME gap tomorrow. These gaps often get filled, particularly in a range-bound market environment.”

“It’s good to note how during strong trends (up and down), these gaps are more likely to be left open.”

Earlier during the weekend, Cointelegraph highlighted the generally cautious approach taken by market players, including Van de Poppe, who insisted on a bullish re-establishment around the $27,000 level before contemplating long positions.

On another note, Material Indicators, a resource for monitoring the market, reported changes in the liquidity of the Binance order book. They observed the shifting liquidity along with a decrease of approximately $17 million in bid liquidity at the $25,400 level.

Bitcoin enthusiasts encounter a difficult weekly task

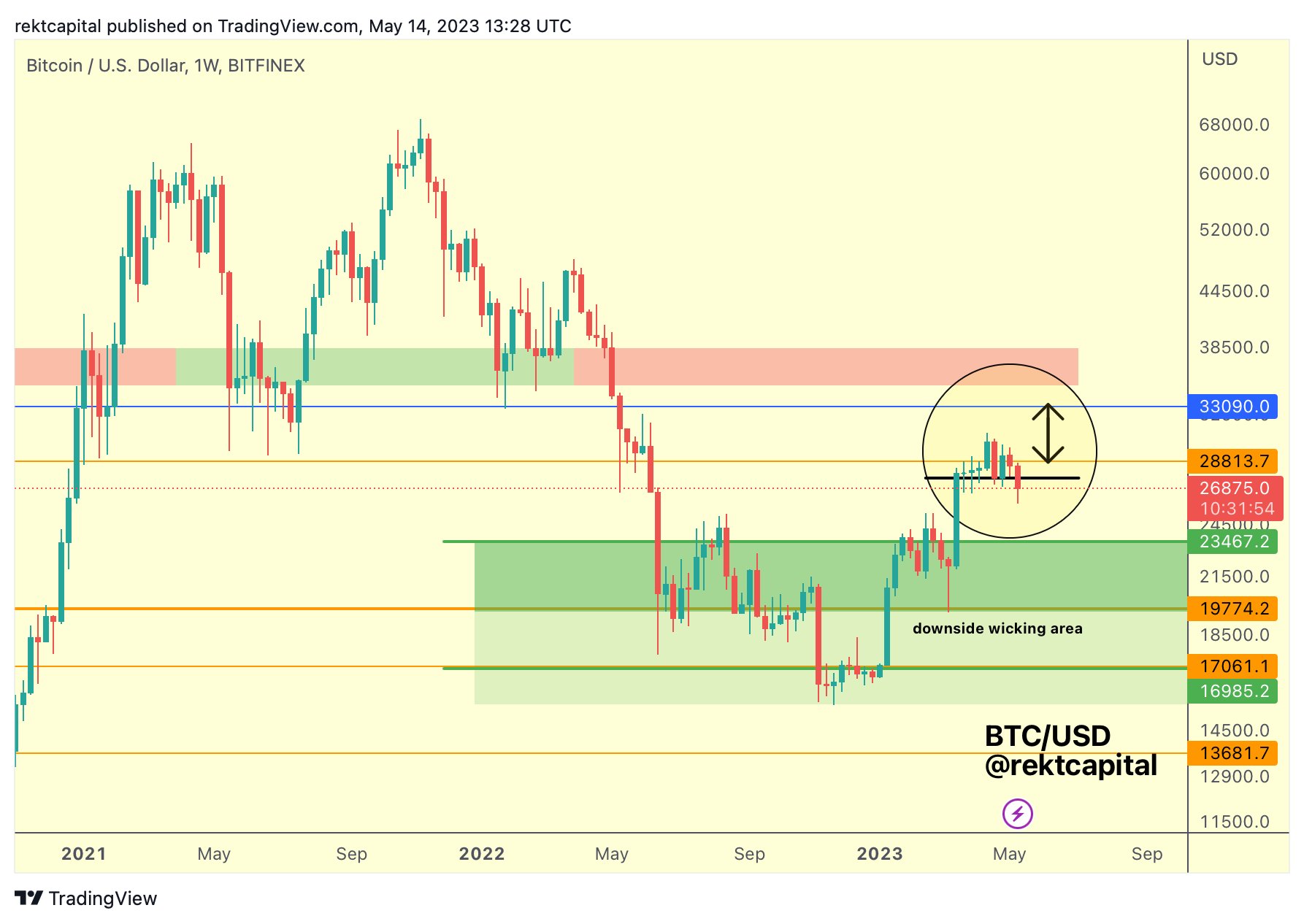

As the week draws to a close, trader and analyst Rekt Capital expressed a less optimistic view about immediate prospects.

In his daily analysis, he cautioned that if Bitcoin closes at $27,550 or below, it could be susceptible to additional losses.

Additional findings argued that Bitcoin was likely not repeating its 2019 recovery so far this year.

Source: https://cointelegraph.com/news/bitcoin-price-hits-27-2k-but-new-analysis-warns-more-losses-likely